This article is also available in Spanish.

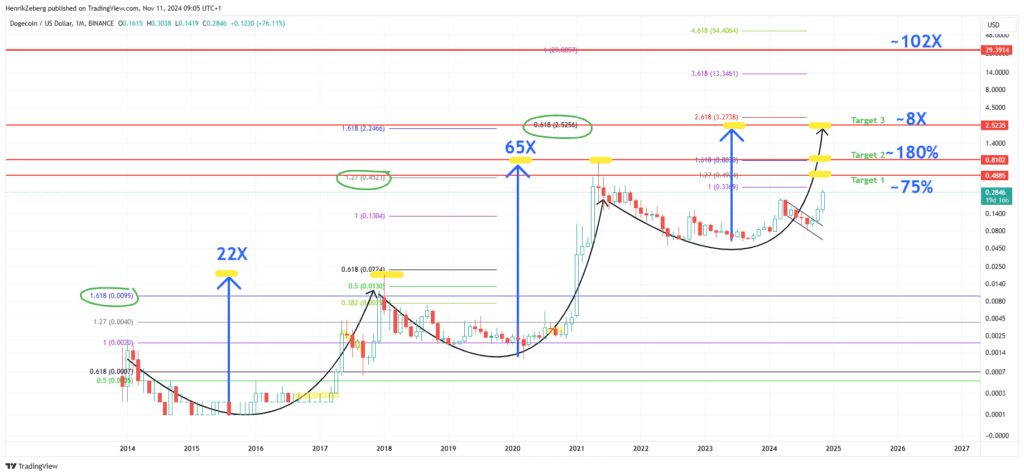

Henrik Zeberg, a prominent macroeconomist known for his expertise in business cycles and chief macroeconomist at Swissblock, published a technical analysis of the price of Dogecoin upon popular demand. In the monthly DOGE/USD chart, Zeberg highlights potential future prices based on Fibonacci extensions and a specific chart pattern known as the “Rounding Bottom.”

Will Dogecoin price reach $29?

Zeberg’s technical approach relies heavily on Dogecoin’s historical performance, suggesting that its price could follow an upward trajectory reflected in previous cycles. In his analysis, he points out: “DOGE seems to develop a Rounding Bottom structure with each cycle. We observe how each cycle produced higher and higher levels until the Euphoria phase.

The bottom round is a proven chart pattern, often seen in financial markets, that signals a significant reversal or shift from a downtrend to an uptrend. The pattern can be recognized by its gradual, rounded rise from a low point, resembling the shape of a bowl or saucer. This trend indicates a phase of slow and steady accumulation among buyers, followed by a gradual increase in prices and demand.

Related reading

The formation of a Rounding Bottom begins when an asset hits a new low, then slowly begins to recover, with buyers gradually entering the market, wary of the downtrend but beginning to gain confidence as prices stabilize. As the asset’s price increases, it reflects increased buying pressure and decreased selling pressure, suggesting a change in market sentiment from bearish to bullish.

To confirm a Rounding Bottom, the price must cross the resistance level that initially led to the formation of the pattern, often marked by the highest point on the curve before the price of the asset begins to decline. For Dogecoin price, this is the price level around $0.49 that Zeberg identifies as the first price target.

The breakout should usually be accompanied by an increase in volume and can signal a long-term uptrend. If DOGE manages to break this resistance in the coming days, the future could be extremely bullish.

Related reading

Zeberg used Fibonacci levels to provide specific future price targets for Dogecoin. Fibonacci extension levels specifically marked on the chart for Dogecoin include the 1.27 Fib ($0.4924) which Zeberg labels as Target 1 with a potential gain of 75%.

The next price target for Dogecoin price is the 1.618 Fib at $0.08030, referred to as Target 2 with a predicted 180% increase by Zeberg. The 2.618 Fib at $3.2738 is marked as Target 3, a stretch target representing an 8x increase.

Additionally, the 3.618 Fib levels at $13.3641 and 4.618 at $54.4064 are also marked, although not explicitly linked to immediate targets, indicating very optimistic long-term possibilities if the market enters another phase of recovery. euphoria similar to past cycles.

When discussing these goals, Zeberg warns: “Could we see an even crazier development? Nothing is certain, but the setup looks like a repeat of what we saw in previous phases. This statement refers to Zeberg’s primary target for this bull run, which is between the 3.618 and 4.618 Fibonacci levels at $29, assuming the entire market remains in a mania phase for an extended period of time. In this scenario, Dogecoin would realize a gain of 10,200%.

At press time, DOGE was trading at $0.41.

Featured image created with DALL.E, chart from TradingView.com