Crypto markets will be watching several US economic events this week and preparing for volatility. Meanwhile, Bitcoin (BTC) remains well above the $67,000 threshold amid continued range movement, as crypto markets await strong catalysts to enable further upside.

Meanwhile, the countdown to the US election continues. The volatility inspired by certain macroeconomic data, coupled with that caused by US election expectations, could harm the portfolios of traders and investors. This calls for caution and suitable trading strategies.

Four US economic data with crypto implication

As US economic events and data continue to have crypto implications, traders and investors should monitor these reports this week.

Third quarter GDP

The Department of Commerce’s Census Bureau will release the third quarter (Q3) gross domestic product (GDP) report on Wednesday, October 30. The median forecast is 3.2% after GDP of 3.0% in the second quarter. Still, based on a generally reliable Atlanta Fed model, the economy likely grew at an annualized rate of 3.3%.

If that happens, it will be almost twice as high as the July median forecast at the start of the quarter. At the same time, a slowdown in GDP growth would suggest a potential economic slowdown, influencing investor confidence. This change in sentiment could lead to increased interest in Bitcoin and crypto in general as alternative investments.

Learn more: How to protect yourself from inflation using cryptocurrency

Non-farm payroll

Nonfarm payrolls (NFP) figures, released on the first Friday of each month, are a highlight of this week’s U.S. economic events calendar. They measure the employment situation in the United States, reporting the number of jobs created compared to the previous month, excluding agricultural employees, government employees, private household employees and NGO employees .

The US Department of Labor will release its October report, expected on Friday, November 1 and likely to cause significant movements in the financial market. First of all, the job market should still have been hit hard by hurricanes Helen and Milton. Disasters are estimated to have eliminated up to 40,000 jobs in October.

In this context, Reuters says that economists estimate that non-farm job creation increased by 125,000 this month, following a rise of 254,000 in September. The unemployment rate would also be unchanged at 4.1%.

A weaker-than-expected report could raise concerns about economic stability, prompting investors to seek alternative investment opportunities such as cryptocurrencies. On the other hand, a positive report showing strong job growth could boost consumer spending, thereby fueling economic expansion and increasing demand for digital assets.

Mega-Cap Profits

Key mega-cap profits are also on the watchlist among US economic events with crypto implications this week. More specifically, the reports will be published after market close (AMC) according to the following schedule:

- Tuesday October 29: Alphabet (GOOGL), AMC

- Wednesday October 30: Microsoft (MSFT), Meta (META), AMC

- Thursday October 31: Amazon (AMZN), Apple (AAPL), AMC

Notably, other companies will also be reported including Visa (V), Starbucks (SBUX), Merck (MRK), AMD.and Intel (INTC). However, the highlight will be the five above, as focusing on the asset class that is large – or mega-cap growth – remains the biggest area of focus at the moment.

US elections

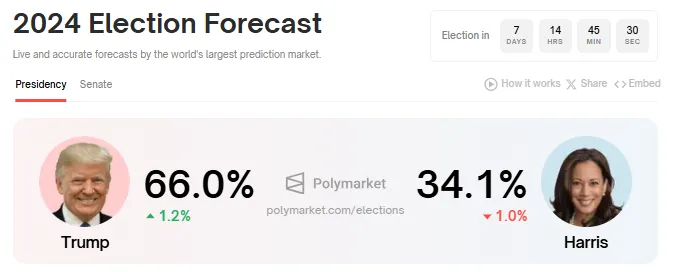

It is also worth mentioning that these events come just days before the US elections, reinforcing expectations of increased volatility. According to the countdown to the American elections, Americans are just over a week away from the election of their 47 elected officials.th president.

Polymarket data shows Republican candidate Donald Trump in the lead popular betting measures, with 66%, against Kamala Harris, the Democrat ticket holder, with 34.1%. Recently, Polymarket explained that the prediction market remains non-partisan.

Learn more: How can blockchain be used to vote in 2024?

As crypto gradually becomes a political concern in the United States, given the digital assets’ large cohort of voters, traders and investors can also expect volatility as this countdown continues .

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.