Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Ethereum has experienced significant volatility in recent days, largely trained by degenerating geopolitical tensions in the Middle East. After having broken down from the fork that had been held since early May, ETH fell strongly at $ 2,100, which stimulates generalized concerns among investors. The rupture was largely attributed to the reaction of the market to the American attack on Iranian nuclear installations, which intensified the conflict between Israel and Iran.

Related reading

However, the markets quickly responded to positive developments. Ethereum rebounded strongly above the level of $ 2,400 following the reports that Iran and Israel had accepted a cease-fire, temporarily softening the feeling of global risk. This rescue gathering has brought new optimism to the Ethereum market, in particular in the midst of signs of institutional trust.

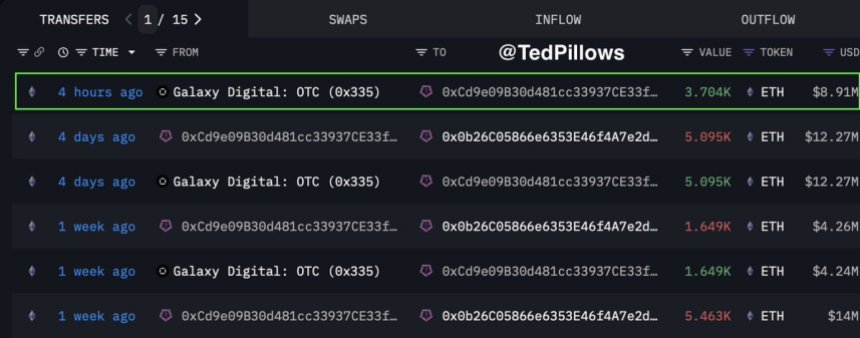

According to data shared by the best TED Orex analysts, a large whale or an institutional entity bought another 8.91 million dollars of ETH, pursuing an aggressive accumulation sequence. In the past three weeks, this same entity has bought $ 422 million from Ethereum, reporting a strong conviction despite recent stress on the market. This wave of accumulation suggests that long -term players can consider the current price zone as a key opportunity, strengthening the idea that Ethereum could build a base for its next major movement once wider conditions stabilize.

Ethereum increases as a ceasefire lights market optimism

Ethereum increased by more than 14% following a ceasefire agreement between Israel and Iran, offering an essential rescue rally after weeks of geopolitical tension and uncertainty. The news has sparked a vague bullish momentum across the market, eTH strongly bouncing recent stockings almost $ 2,100 to negotiate firmly above the $ 2,400 mark. The Bulls, who had lost control in the middle of the sale of panic, now show signs of strength while the market is preparing for its next decisive movement.

Despite this rebound, prudence remains. The wider macroeconomic environment continues to tighten, with increasing concerns concerning a potential American recession, high cash yields and a sustained colony of the Federal Reserve. These factors could weigh on risk assets in the coming weeks, putting the Ethereum rally to the test. Nevertheless, optimism is built, in particular around the possibility of the long -awaited season – that which, according to many, will be led by Ethereum.

Adding fuel to this story is the growing trend in the accumulation of whales. According to information shared by analyst TED OREADS, a whale or a major institutional entity has just acquired another 8.91 million dollars of ETH. This purchase adds $ 422 million from Ethereum accumulated in the past three weeks.

These aggressive purchases suggest that the big players are positioning themselves for an important decision, probably expecting Ethereum to be at the forefront of the next market cycle. While the ETH consolidates above key levels, the accumulation tendency could act as a fundamental force supporting higher prices, especially if macro and geopolitical risks stabilize.

Related reading

ETH recovers $ 2,400 after a sharp rebound

Ethereum recovered the level of $ 2,400 after a quick rebound in ventilation close to $ 2,100. The recent candle structure on the 3-day graph shows a strong downward wick, followed by a recovery, reflecting the impact of geopolitical developments, in particular the ceasefire between Iran and Israel. This rebound prevented a deeper sale and brought Ethereum over a key psychological level.

Looking at the graphic, ETH remains under pressure from the mobile averages of 100 days and 200 days, currently acting as resistance around areas of $ 2,638 and $ 2,779. The price has also recently broken a short-term descending trend line and is now trying to consolidate above. This suggests the potential of a trend reversal if the bulls can support the momentum and pass through the average mobile cluster.

Related reading

The volume remains moderate but shows signs of recovery, signaling an early interest back after the fight against fear. A break and a closure above the fork of $ 2,600 would probably open the path to reset the $ 2,800 area, which was a major supply area in previous months.

Dall-e star image, tradingview graphic