Rough 24 hours on the cryptography market, and it is not only the figures. More than half a billion dollars aneantized in liquidations – $ 555 million, to be exact. It doesn’t even count on Friday evening when things really started to fall.

Most of these liquidations? Long positions. No surprise there. The logic was simple: everything increased, so it should continue to increase. Buy the dip, right? Well, not quite.

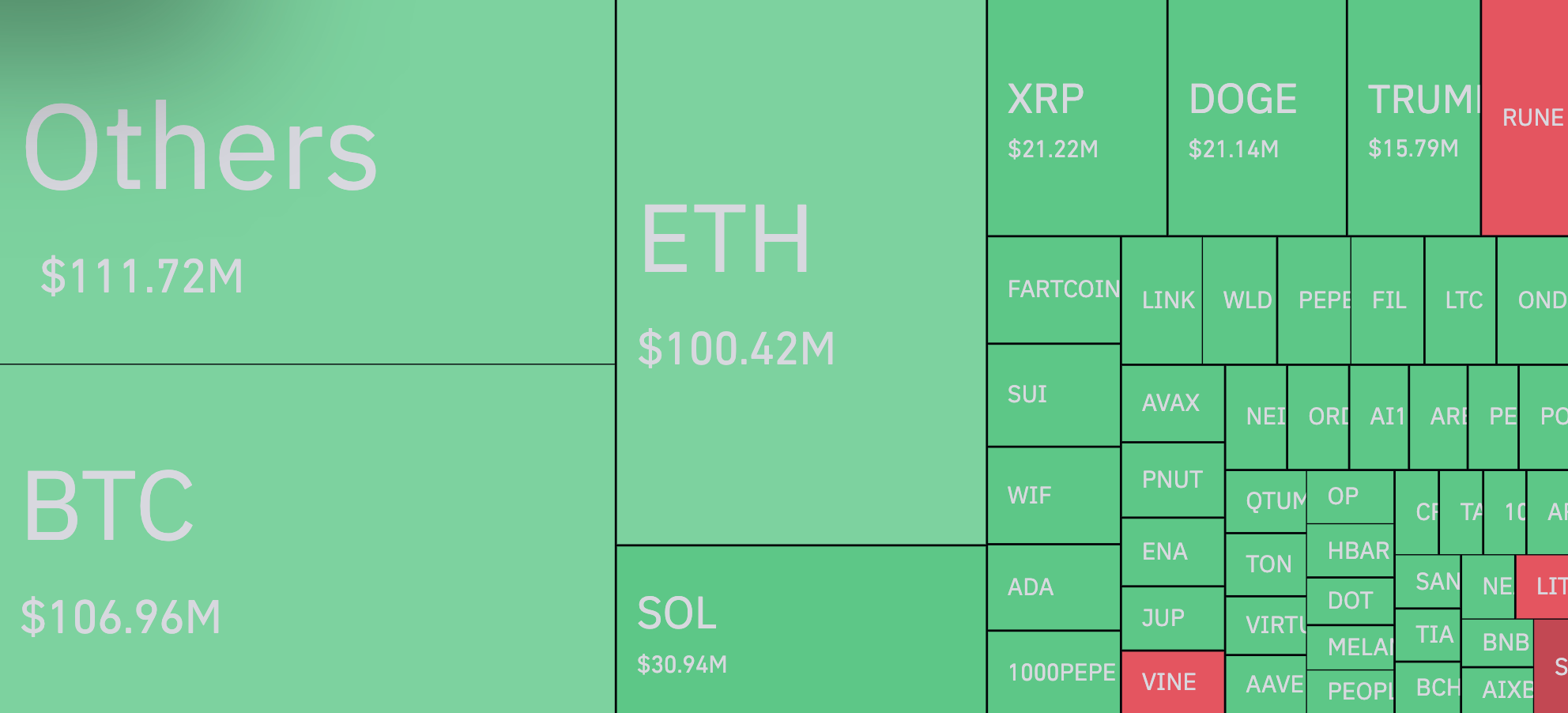

Bitcoin spot traders could be used to this rate, but the future tell a different story. Co -cup data present it – out of these $ 555 million in liquidations, only $ 68 million was short positions. The rest? Long caught off guard. Bitcoin Futures alone saw $ 105 million liquidated, with 90.4% of those that are long.

But surprisingly, Bitcoin (BTC) was not the biggest loser here. The “other” category, where smaller cryptocurrencies fall, have taken an even more difficult blow.

Now the traders look at what will happen next. The stock market opens on Monday, and it is likely to set the tone. Traditional finance has not yet reacted, which means that more turbulence could be ahead of the crypto. Liquidations may not be completed.

“Great strategy”

And then there is Peter Brandt, a name that has weight in trading circles. Veteran since the 1970s, he rang at the right time with a remark that flowed from sarcasm.

He called this a “great strategy” to short -circuit the winners and let the losers run – an obvious reversal of conventional wisdom. No serious trader works this way, which makes her comment less a tip and more a sharp criticism of the recent behavior of the market.

Cryptographic space is in reaction mode, adapting to a market that refuses to behave predictably. One thing is clear: the next few days will say a lot about the fact that it is only a upheaval – or the beginning of something bigger.