Join our Telegram Channel to stay up to date on breakup news coverage

In 2024, blockchain networks saw substantial revenue from transaction fees, with Ethereum leading the way, followed by Tron and Bitcoin. Combined transaction fee profits on Layer 1 and Layer 2 blocks exceeded $6.89 billion, with Ethereum significantly accounting for $2.48 billion in gas fee revenue.

Ethereum’s fee income saw variability throughout the year, with monthly profit ranging between $62.82 million and $606.77 million. This positive outlook has investors looking for affordable tokens, especially the Best Cheap Cryptos to Buy Now Under $1.

6 Best Cheap Cryptos to Buy Now Under $1

Solana has made significant progress in decentralized finance (DEFI), illustrating its ability to improve network operations and expand its ecosystem. The global network celebrated a key achievement by verifying 10 million users, indicating substantial progress in its expansion. Starknet (STRK) is trading at $0.3718, up 4.28% in the last 24 hours.

In 2024, the Internet Computer Protocol (ICP) introduced significant improvements to its network nervous system (NNS) governance framework. Meme Index ($memex) reached a notable fundraising goal, raising over $2.7 million in its first month of presale. The cryptocurrency community rejoices in the recent news as the old President Trump forgave Ross Ulbricht, the founder of Silk Road.

1. Solana (Sol)

Solana has recently demonstrated notable progress in decentralized finance (DEFI), showcasing its ability to improve network functionality and expand its ecosystem. These developments highlight its growing role in the sector and suggest the potential for sustained growth in the future.

Solana’s collaboration with platforms like Jupiter has significantly improved decentralized exchange aggregation and introduced advanced perpetual trading tools. These innovations contribute to network performance by improving transaction yields and encouraging greater adoption of Defi solutions.

Additionally, the total network value locked (TVL) saw a substantial increase, increasing by $3.5 billion in three days. This growth is part of a broader recovery trend, with Solana’s TVL reaching $10 billion, largely supported by stablecoins. These numbers indicate its ability to attract capital and maintain liquidity in Defi markets, further strengthening its ecosystem.

The next billion dollar companies are being built on Solana.

It’s time to go into founder mode – here are the resources you need to grow your crypto startup from 0 to 100 🧵 pic.twitter.com/n7gnhelkce

– Solana (@solana) January 21, 2025

At the same time, the Solana network saw a 300% increase in transaction activity, which positively impacted validator profits and pushed transaction fees to record levels. This increase in activity is supported by the network’s stablecoin cap reaching $9 billion, reflecting increased usage and adoption across various applications.

2. WorldCoin (WLD)

The global network has reached a milestone with 10 million verified users, marking a significant milestone in its growth. Additionally, the World Foundation’s inclusion in the next Optimism Security Council cohort highlights its growing engagement within the Optimism Governance ecosystem.

This development suggests an increasing role for the organization in shaping decisions through the Council and its responsibilities as stewards of optimism. Recent sentiment analysis for WorldCoin indicates a bearish trend despite the Fear and Greed Index reflecting a level of 75, signaling market greed.

World Foundation has joined the next @Optimism Security Council cohort!

We are incredibly grateful for the trust placed in us by the community and look forward to participating in @Optimismgov More actively through the Council and our future work as delegates of optimism.

– World Foundation (@worldcoinfnd) January 16, 2025

Notably, 16 of the last 30 days (53%) saw green days, where daily closing prices exceeded opening prices, which may suggest positive movements in the near term. The token also demonstrates high liquidity relative to its market capitalization, indicating ease of trading and robust activity.

3. Cortex (CTXC)

Cortex (CTXC) is trading at $0.244892, having marginally declined by 0.16% over the past 24 hours. The sentiment around the CTXC price prediction is bearish, although the Fear and Greed Index indicates a level of 75, suggesting greed in the market. The coin shows high liquidity, with a 24-hour volume/market cap ratio of 0.7223. It is available for trading on Binance, and its annual inflation rate is 1.36%.

Despite the recent negative trends, analysts expect Cortex to eventually reverse this pattern in October 2025. The forecasted trading range for the month is between $0.206969 and 0.368577, with an average price of approximately $0.242651.

Here’s what we worked on last month #Opml, #Zkrollupand full node development. 🛠

🧵👇

– Cortex Labs (@ctxcblockchain) January 5, 2025

This represents a potential increase of 10.23% from the previous month, providing investors with a significant return on investment (ROI) of approximately 50.51%. This prediction suggests possible stabilization or growth in CTXC value, making it an interesting time for investors.

4. Starknet (STRK)

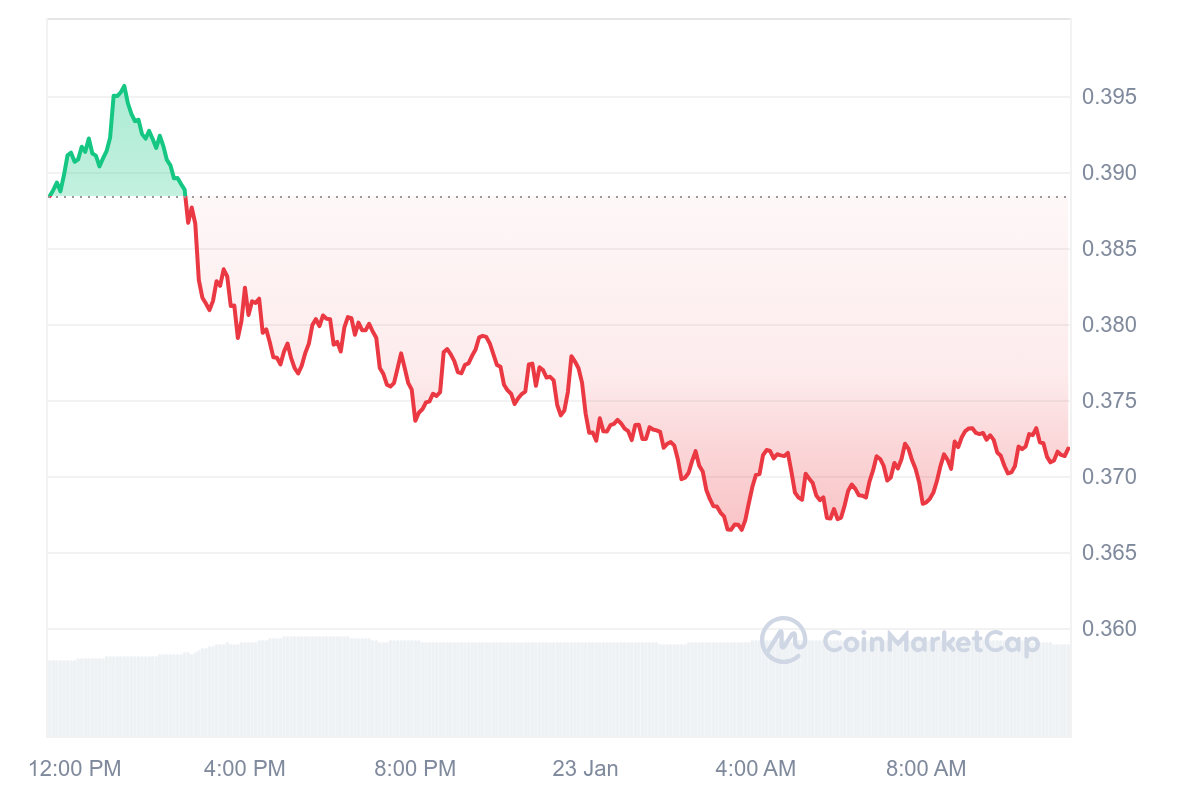

Starknet (STRK) has a price of $0.3718, reflecting an increase of 4.28% from the last day. Its market capitalization stands at $899.44 million, marking an increase of 4.30%, while the 24-hour trading volume is $96.02 million, representing 10.67% of its capitalization stock market. The fully diluted valuation (FDV) is estimated at $3.71 billion. Despite these numbers, Starknet sentiment remains bearish. However, the Fear & Greed Index indicates a high level of market greed at 75, which could influence investor behavior.

Projections suggest that Starknet could continue the positive trend seen last month in October 2025. The forecast trading range is estimated between $0.6695 and $0.8918, with an average price of $0.7308.

Appchains encourages building not only on the security of Ethereum, but also leveraging the scalability, readability, and speed of Starknet.

The era of “D” Appchains is inevitable.

– Starknet-ecosystem.com ✨ (@Starkneco) January 22, 2025

The market trend is expected to remain positive until November 2025, with an expected price increase of $0.9623. The forecast places the trading range between $0.8807 and $1.0168, building on momentum from October.

5. Internet Computer (ICP)

In 2024, the Internet Computer Protocol (ICP) implemented notable updates to its Network Nervous System (NNS) governance model. These changes aimed to improve participation and decision-making within the decentralized system.

Key governance updates included the introduction of new incentives to encourage active participation. These rewards encourage greater engagement, potentially leading to more representative and dynamic governance outcomes. Along with this, the organization of the proposal has been improved, simplifying the presentation of information to make voting more accessible and user-friendly.

On the market side, ICP performance reflects stable activity. ICP is priced at $9.18, showing an increase of 3.06% over the past day. The token has a market capitalization of $4.4 billion, with a 24-hour trading volume of $198.63 million, representing a robust 20.48% growth in daily activity. The high volume to market capital ratio of 0.0585 suggests strong liquidity for its market size, a positive indicator for traders and investors.

6. Index Meme ($memex)

Meme Index ($Memex) reached a milestone by raising over $2.7 million in its first month of presale. The MEME coin market has solidified its place in the crypto ecosystem, with a market capitalization of approximately $119 billion as of early 2025. However, selecting the next high-growth MEME coin remains a challenge for investors.

Meme Index introduces a new approach with dynamic indexes and curated meme currency baskets, allowing investors to diversify risks while potentially maximizing returns. The platform’s token, $memex, is essential for accessing these indices, which cater to varying risk levels from moderate to highly volatile.

Currently, $memex is priced at $0.0154693, making it an attractive investment for early adopters. With prices expected to rise soon, now is an opportune time to invest. The structure of the Meme Index ensures that the failure of one token does not significantly affect the entire index, providing a more robust investment strategy.

The Meme Index provides four indexes tailored to investors’ risk tolerance: Meme Titan for established tokens, Moonmoon for high-growth potential, Median Hood for mid-tier growth, and Meme Frenzy for high risk/reward scenarios. As a $memex holder, you can influence which tokens are included through community governance, keeping the indices dynamic.

To join the presale, visit Meme Index Website and connect your wallet. $Memex can be purchased with various cryptocurrencies or a bank card. After purchase, holders can access an 856% APY, potentially doubling their investment in 31 days. Audits from CoinSult and Solidproof confirm the security of the platform.

Visit the Meme Index Presale

Learn more

NEW SAME COIN ICO – Wall Street Pepe

- Audited by coinsult

- Early Access Presale Round

- PRIVATE ALPHA TRADIE FOR THE ARMY $WEPE

- Staking Pool – High Dynamic APY

Join our Telegram Channel to stay up to date on breakup news coverage