Bitcoin hit an all-time high of nearly $80,000 on Sunday, fueled by renewed optimism within the crypto community following the re-election of Donald Trump as president of the United States.

This support has fueled the bullish momentum of Bitcoin, whose rally seems unstoppable for the moment.

Bitcoin’s Latest ATH Leads to $400 Million Market Liquidation

On November 10, Bitcoin hit an all-time high of $79,600, surpassing its previous all-time high (ATH) by over $77,000, according to data from BeInCrypto. Although it fell slightly to $79,326 at press time, the price of the leading digital asset still saw a notable increase of over 3% in the past 24 hours.

“Bitcoin at $79,000, new ATH. My friends, this is only the beginning. It’s time to be right and sit tight. No rash actions are necessary, HODLing does the work for you,” said Bitcoin investor Tuur Demeester.

Analysts attribute much of this growth to optimism surrounding Trump’s return to power. Many believe his administration could take a pro-entry approach to crypto regulation, adding further momentum. Trump himself has shown support for crypto, attending several industry events including the Bitcoin2024 conference, and has pledged to foster a pro-crypto environment.

Likewise, recent drops in global interest rates have also fueled Bitcoin’s recent price action. The U.S. Federal Reserve and the Bank of England recently cut rates by 25 basis points, a move that typically boosts liquidity while weakening the dollar. These conditions historically favor risky assets like Bitcoin, making it an attractive option for investors amid relaxed monetary policy.

At the same time, Bitcoin’s new price record also had a positive impact on the broader crypto market, with several leading assets riding the wave. Over the past 24 hours, Ethereum rose 5.4%, Solana rose 3.2%, and Dogecoin saw an 11% jump.

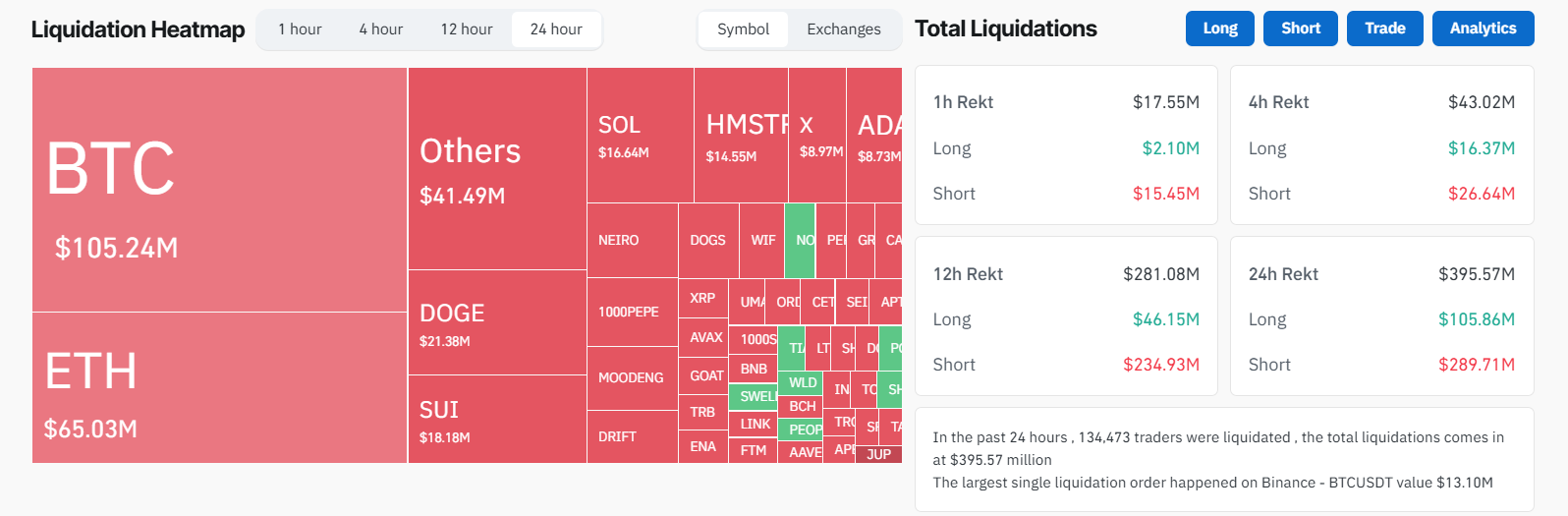

Yet, this bullish market performance has led to significant losses for traders speculating on the prices of these digital assets. According to Coinglass data, more than 132,000 traders were liquidated for almost $400 million during the market’s uptrend.

Short sellers – who were betting on a market decline – saw the biggest losses, totaling about $288.46 million. Long traders suffered smaller setbacks, with total losses of around $105.6 million. Bitcoin traders accounted for about 30% of the liquidations, or $105 million, followed by Ethereum traders, with $65 million.

Among exchanges, Binance saw the highest liquidation volume, accounting for 46.76% of the total, or approximately $180 million. Other exchanges, such as OKX and Bybit, also recorded significant losses, with $79.6 million and $65.4 million, respectively.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.