US Senator Cynthia Lummis has proposed a national strategic reserve of Bitcoin by selling some of the Federal Reserve’s gold, rather than buying it from the government budget.

Cynthia Lummis, a Republican senator, plans to make President-elect Donald Trump’s master plan for Bitcoin a reality. Lummis mentioned, in an interview with Bloomberg, that some of the Federal Reserve’s gold could be sold to buy more Bitcoin, rather than buying from the federal government’s budget.

“We already have the financial assets in the form of gold certificates to convert into Bitcoin,” Lummis said.

Following his bill, the largest cryptocurrency by market capitalization would be held for no less than two decades. The appreciation in value would help reduce the national debt, which stands at approximately $36 trillion.

However, the Trump administration also aims to maintain ownership of 200,000 Bitcoins. Most of the time, all cryptocurrencies owned by the US government are assets seized in several court cases.

On Polymarket, the world’s largest prediction market, the crypto community lacks confidence in Trump’s plan as the poll shows only a 30% chance.

Nonetheless, the US Congress saw a large number of pro-crypto lawmakers winning seats, indicating that the crypto bill would easily pass in the future.

Trump commits to the Bitcoin community

President-elect Donald Trump once pledged to the crypto community to create a strategic national Bitcoin reserve during the last conference in Nashville. He also mentioned that the United States will be the crypto capital of the world as he takes the oath of office in mid-January.

Trump also mentioned that he would fire Securities and Exchange Commission (SEC) Chairman Gary Gensler on his first day in office. At that point, he will appoint another person as president who is more supportive of digital assets.

He also promises the crypto community to pardon Silk Road founder Ross Ulbricht, who is serving a 40-year prison sentence without the possibility of parole.

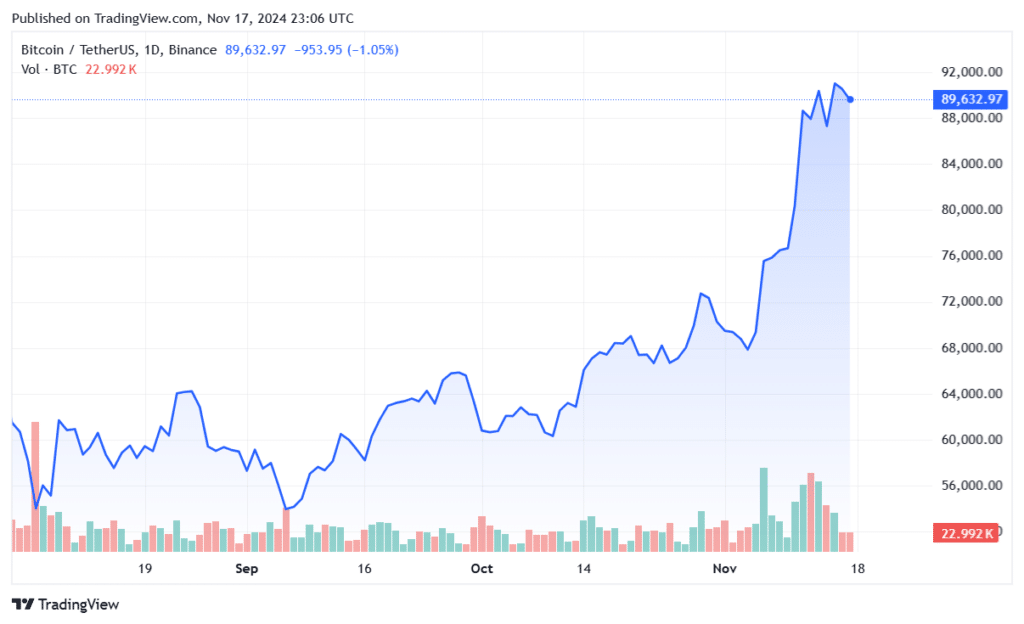

Recently, the price movement jumped almost 12% in the last 7 days and traded at $89.632 on November 18. The world’s largest cryptocurrency also hit new all-time high prices, as high as $93,477 on November 13. increased to $1.7 trillion.

Following Trump’s victory in the November 5 US election, which boosted the crypto market’s confidence in better regulation and mass adoptions.