This article is also available in Spanish.

The price of Bitcoin has continued its momentum over the past week, hitting successive all-time highs in less than five days. While Donald Trump’s success in the US election may have sparked the recent rally, the growth of the premier cryptocurrency – and the general crypto market – appears to have taken on a life of its own.

Interestingly, the market is wondering where the next market peak will be, with some experts and commentators believing that the BTC price rally has ended. However, a leading on-chain analytics firm said that Bitcoin price still has room for some upward movement.

Four reasons why $100,000 is possible for Bitcoin price: CryptoQuant

In its latest weekly report, CryptoQuant revealed that Bitcoin, the world’s largest cryptocurrency by market capitalization, is not yet overvalued despite its recent positive momentum. According to the blockchain platform, the market leader could soon reach the coveted $100,000 price level.

Related reading

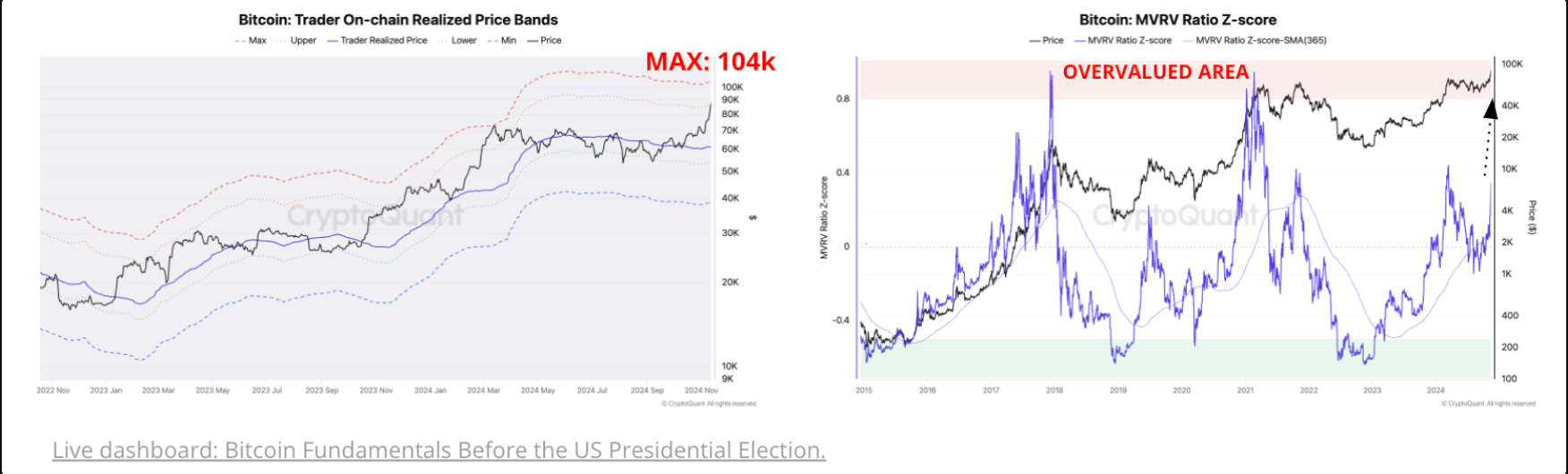

The rationale for this projection relies on valuable metrics, such as the MVRV (market value to realized value) ratio. As its name suggests, this indicator measures the relationship between the market value and the realized value of a cryptocurrency. As such, MVRV helps gauge the ups and downs of the Bitcoin market.

CryptoQuant noted that Bitcoin is not yet overvalued at current price levels, as the MVRV metric is still outside the overvalued region. This ultimately means that the bullish price action is not overheated and the Bitcoin price could still work in favor of higher prices.

Additionally, the maximum band made by the on-chain trader indicates $100,000 as the next target for Bitcoin price. According to CryptoQuant, the last time the maximum band reached its current level was in March 2024, when the leading cryptocurrency first surpassed the $70,000 level.

Another on-chain observation that supports the continued rise in Bitcoin prices is the growth in demand. CryptoQuant highlighted that investor demand in the United States has returned since the presidential election, with Coinbase Premium remaining positive in recent days.

Finally, liquidity in the crypto market has continued to increase over the past few weeks as stablecoins hit exchanges. As a reminder, more than $3.2 billion in USDT has flowed into exchanges since the US election, signaling the potential for a sustained rise in Bitcoin prices.

Be careful

However, CryptoQuant issued a warning in its report, saying that some selling action could follow the recent price rally. While some Bitcoin miners have started dumping their assets for profit, the blockchain company also noted that Bitcoin sales seen so far are still insignificant but could soon increase rapidly.

Related reading

At the time of writing, the Bitcoin price stands at around $91,270, reflecting a 4% increase over the past 24 hours. According to CoinGecko, the flagship cryptocurrency is up more than 19% in the past week.

Featured image from iStock, chart from TradingView