- NEAR was trading at $5.79 at press time, gaining 12% in seven days with a daily trading volume of $712 million and a market cap of $7 billion.

- Futures open interest fell 5% while TVL reached $260 million, signaling stable ecosystem activity despite volatility.

NEAR Protocol (NEAR) gained 12.33% over the last seven days, trading at $5.79 with a 24-hour volume of $712.5 million.

Despite a 0.97% decline over the past 24 hours, the price range remained between $5.54 and $5.99, showing consolidation after recent bullish momentum.

The NEAR protocol’s circulating supply of 1.2 billion tokens values its market capitalization at $7.05 billion, placing it among the best-performing assets.

The asset’s recent rally follows a historical pattern of cyclical price action, with the price previously reaching highs near $7.50 to $8.00 and finding support near $3.00 to $3.50.

Analyst Michaël van de Poppe note that a break above key resistance could lead to further gains, with traders identifying potential accumulation zones around $4.25 to $5.00 for the next leg up.

Source:

Consolidation and upside potential?

The daily chart for NEAR/USDT showed slight bearish pressure as the price retreated from resistance near $6.00 to its press time level.

Meanwhile, the relative strength index (RSI) was at 61.45, indicating that the asset remained in bullish territory but was showing signs of weakening.

Source: TradingView

The MACD indicator reflects a bullish crossover, with the MACD line above the signal line and positive histogram bars. However, the decrease in histogram size suggests reduced momentum, which aligns with the recent pullback.

Analysts suggested that holding the $5.50 support zone was key for buyers to maintain bullish momentum, while a move below this level could trigger further consolidation.

Futures market activity shows slight decline

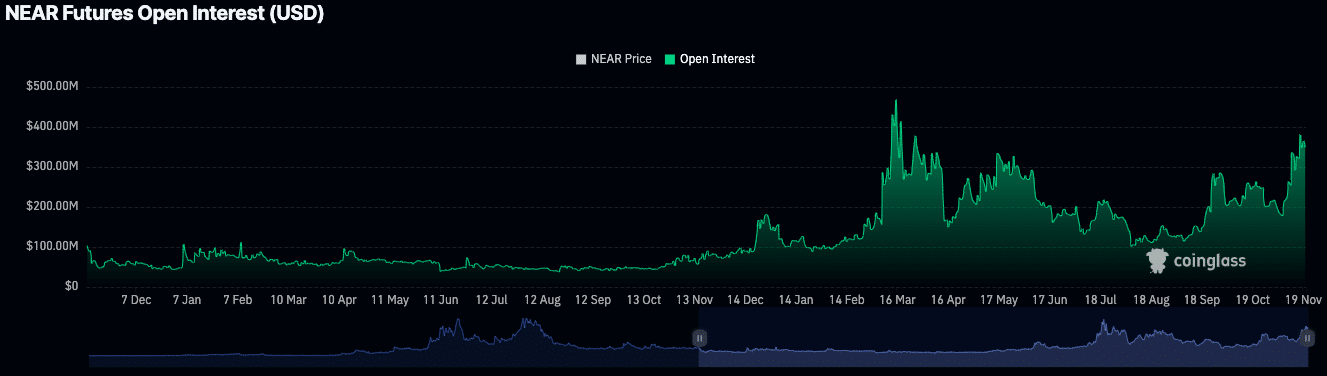

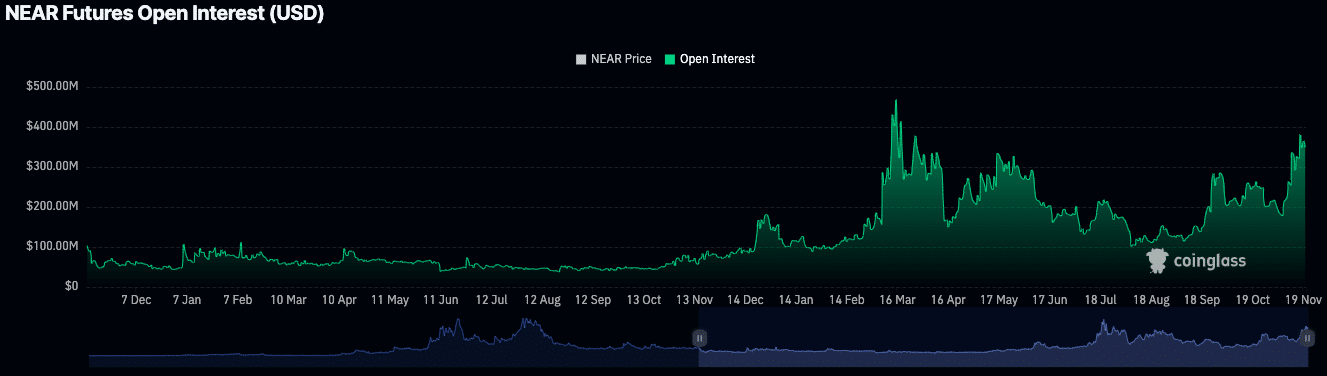

The NEAR Protocol futures market showed a 5.03% drop in open interest, at $345.50 million at press time, according to coin mechanism.

The slight decline follows increased market activity earlier this month, indicating a potential slowdown in speculative interest.

Source: Coinglass

Trading volume also decreased by 19.30% to $597.67 million, but open interest remained higher than previous months.

This suggests that traders remain engaged in the asset, even if short-term profit-taking reduces activity.

Constant growth of the ecosystem

On-chain data from DeFiLlama showed The total value locked (TVL) of NEAR stands at $260.05 million, with a stable market cap reaching $677.77 million.

Read Near Protocol (NEAR) Price Prediction 2024-2025

Over the past 24 hours, the platform generated $23,430 in fees and revenue, highlighting the continued activity within the ecosystem.

These measures demonstrate continued development of the NEAR protocol’s decentralized financial infrastructure.