- BONK lost almost 30% after hitting a new record high.

- Whales took the lead in taking profits and liquidating their long positions; will recovery be delayed?

MemecoinCorporations were the biggest weekly losers over the past week as large- and mid-cap altcoins took center stage amid new altcoin season calls. Good (BONK) was among the biggest losers as profit-taking intensified after hitting a new high of $0.000062.

At the time of writing, BONK was down 29% from its new all-time high. While this may be a broader trend of capital turnover, here are the key levels that bulls could follow.

BONK Withdrawal Assessment

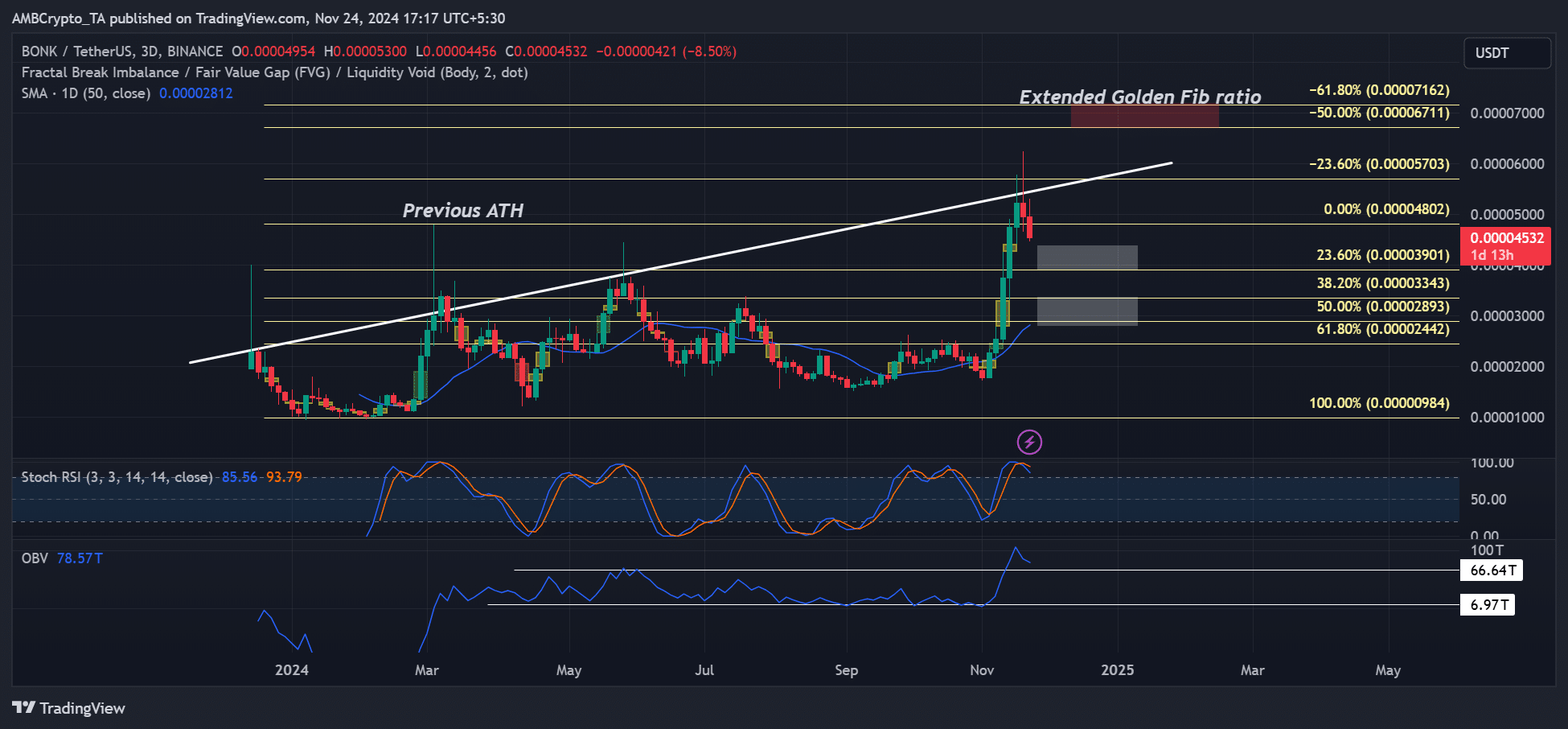

Source: BONKUSDT, TradingView

Although the new ATH is slightly below the extended Fibonacci Golden Ratio (around -61.8%), the level can be breached as the next upside target in the event of a recovery after the pullback.

That said, the uptrend has left key price imbalances in two white zones (FVG fair value gaps). The immediate level of price imbalance was above 23.60% Fibonacci, while the second was at 50% Fibonacci.

The latter also coincided with the 50-day SMA (Simple Moving Average), suggesting it could be stronger support if the pullback falls below $0.000039. So, if the bullish momentum continues, these could constitute key re-entry points for the bulls.

Given the high and oversold stochastic RSI, BONK could still be poised for further pullback if short sellers extend their profit-taking.

Demand has fallen

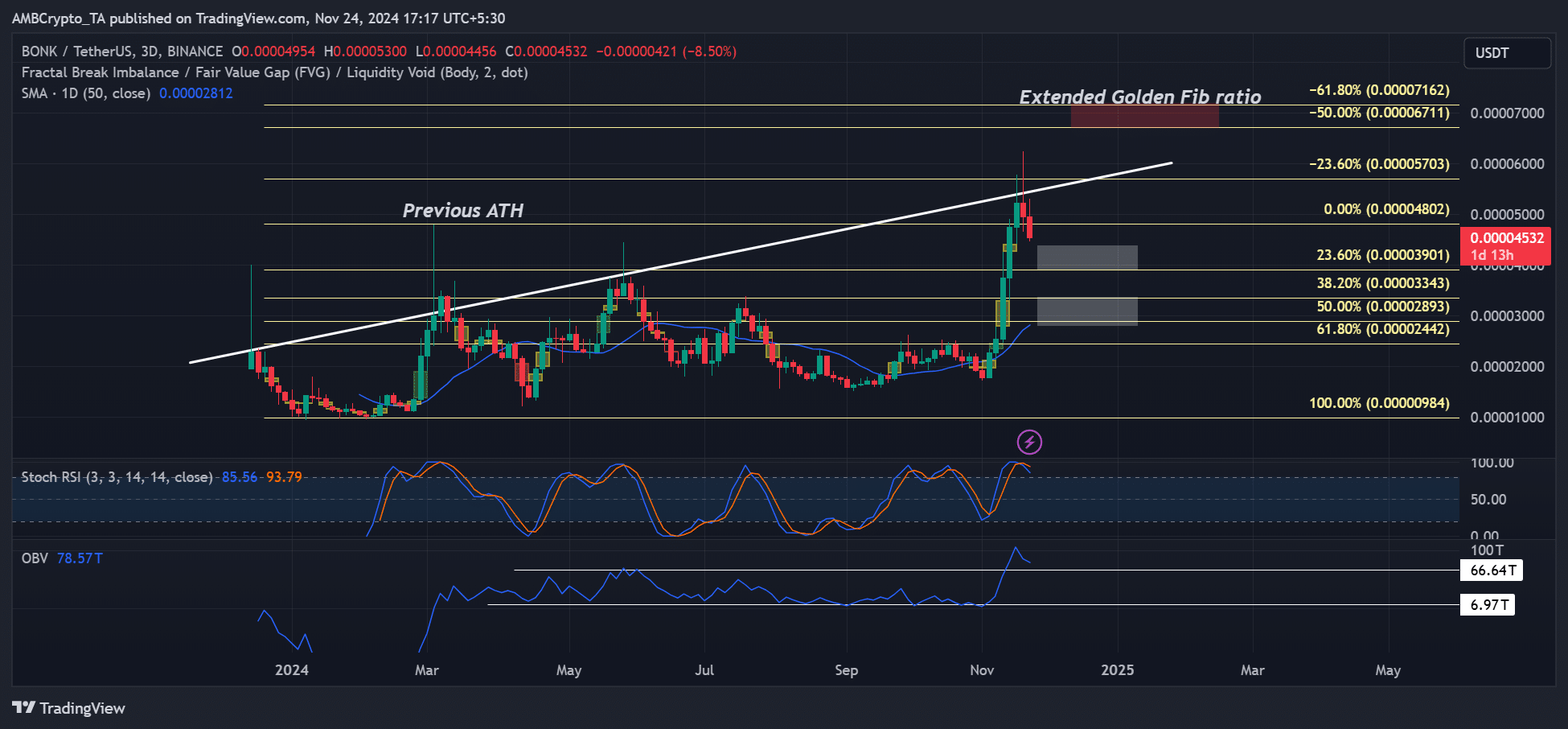

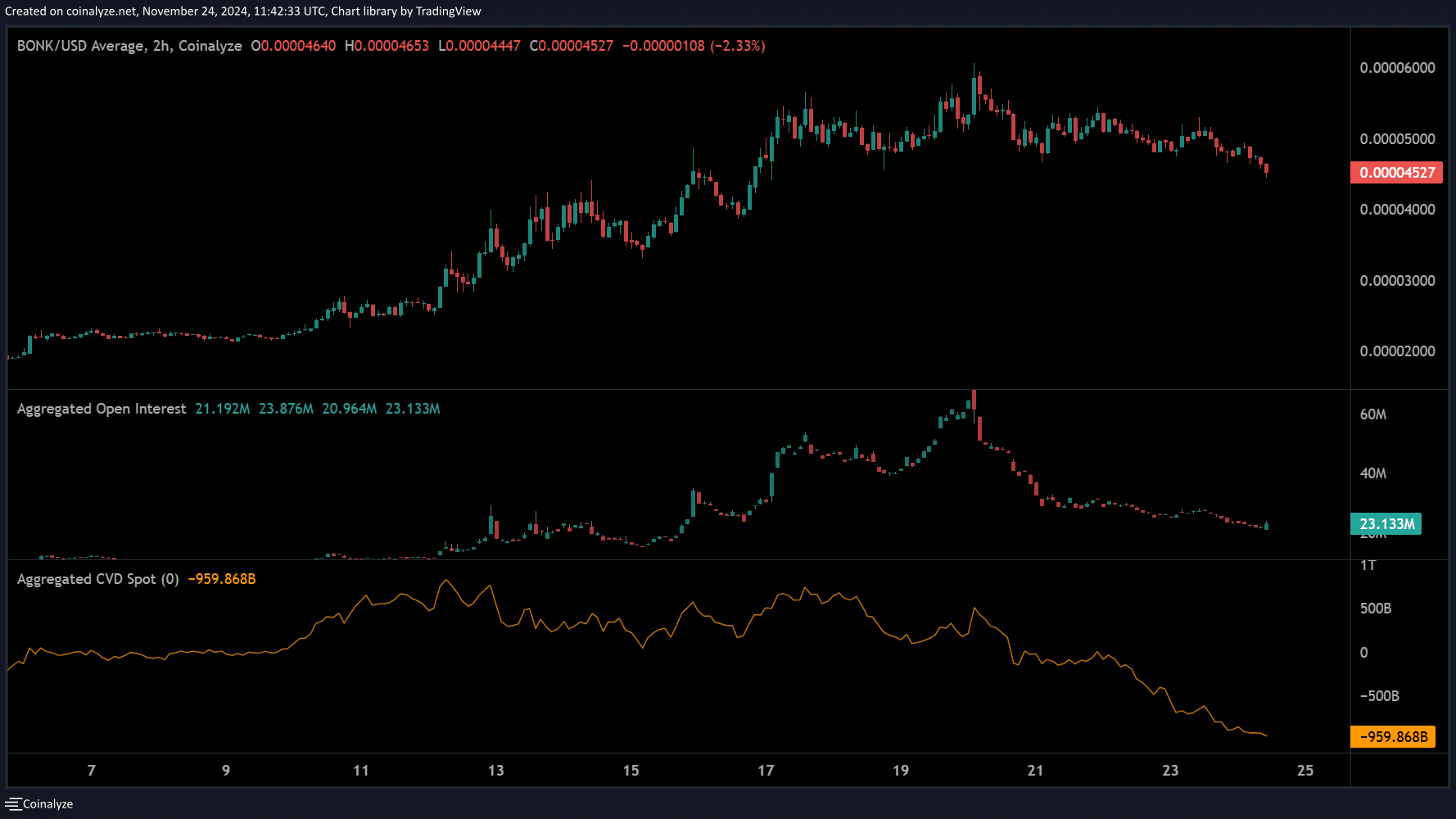

Source: Coinalyse

During the first half of November, demand from the spot market (increase in cumulative spot volume delta – CVD) spurred the rise, which was then taken up by the futures market (increase in open interest) .

However, demand in the futures and spot markets has fallen, as shown by the southward movement on OI and spot CVD.

This could further complicate a strong recovery unless the coin narrative regains its dominance again.

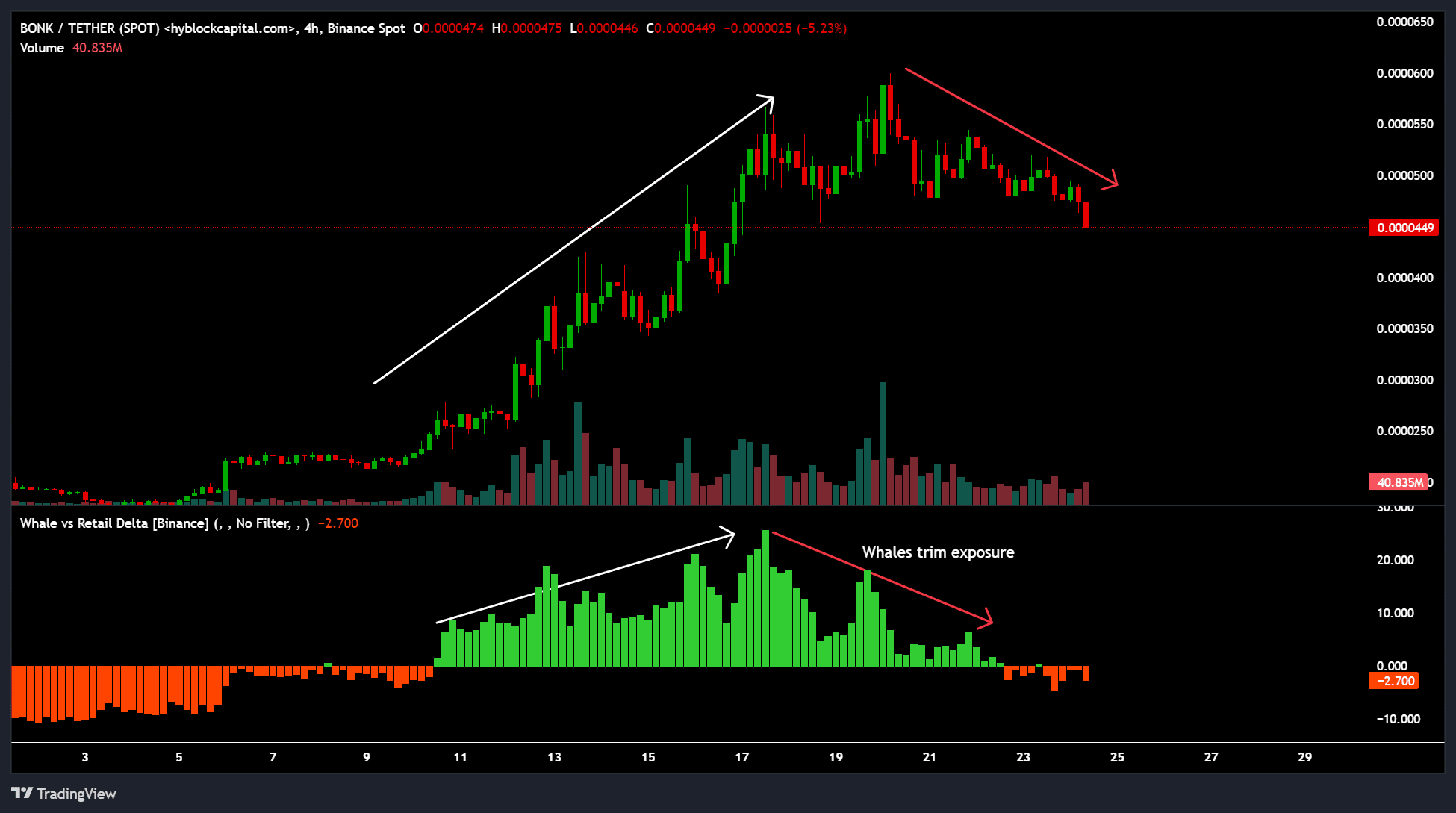

Source: Hyblock

Another bearish indicator was the reduction in whale risks. Whales on the Binance exchange have been steadily offsetting their long positions since mid-November, as shown by the negative reading of Whale vs. RetailDelta.

Read Bonk (BONK) Price Prediction 2024-2025

Historically, the reduction of large players has led to price stabilization or consolidation. This could hit BONK in the short term.

For a likely price reversal, traders can monitor critical levels as well as the potential re-entry of whales, which could signal a likely recovery for BONK.