- ENS has a strongly bullish outlook for the coming weeks.

- On-chain metrics signaled increased market activity and demand.

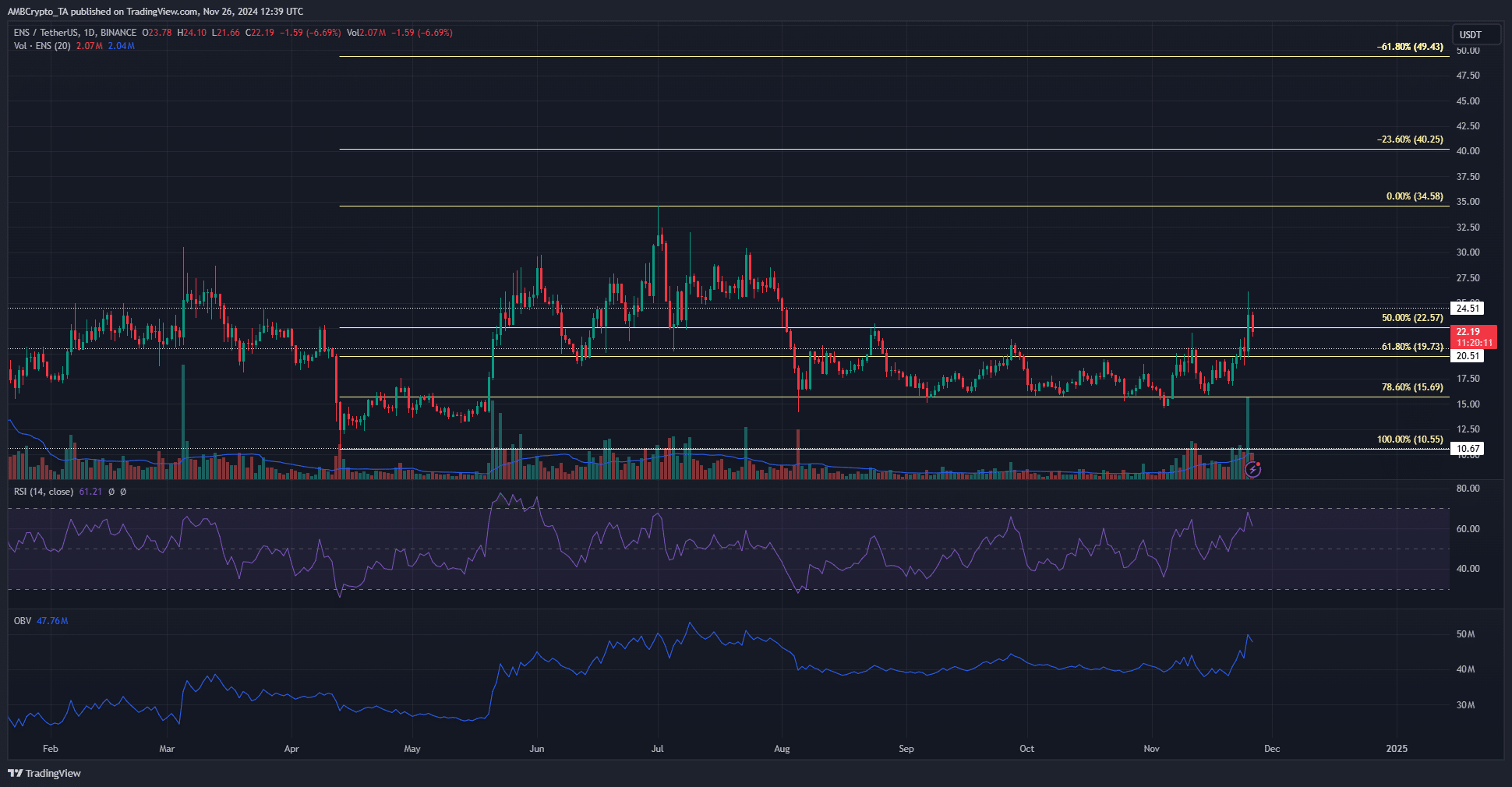

Ethereum Name Service (ENS) reversed its long-term downtrend and broke out a group of resistance levels around the $20-$22 region that had been challenging the bulls since early August.

Network activity also told an encouraging story.

That said, the possibility of a price decline is present. However, it is expected that the Ethereum Name Service token may rise further.

There will be significant releases in the coming months which could harm the supply-demand equation.

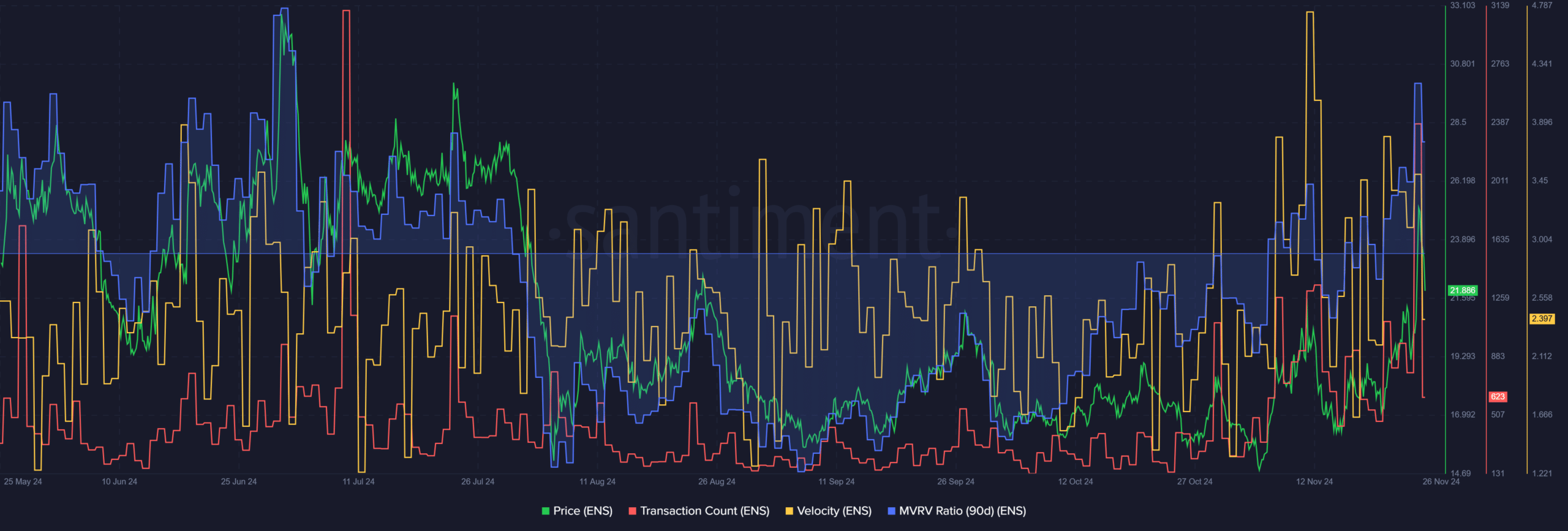

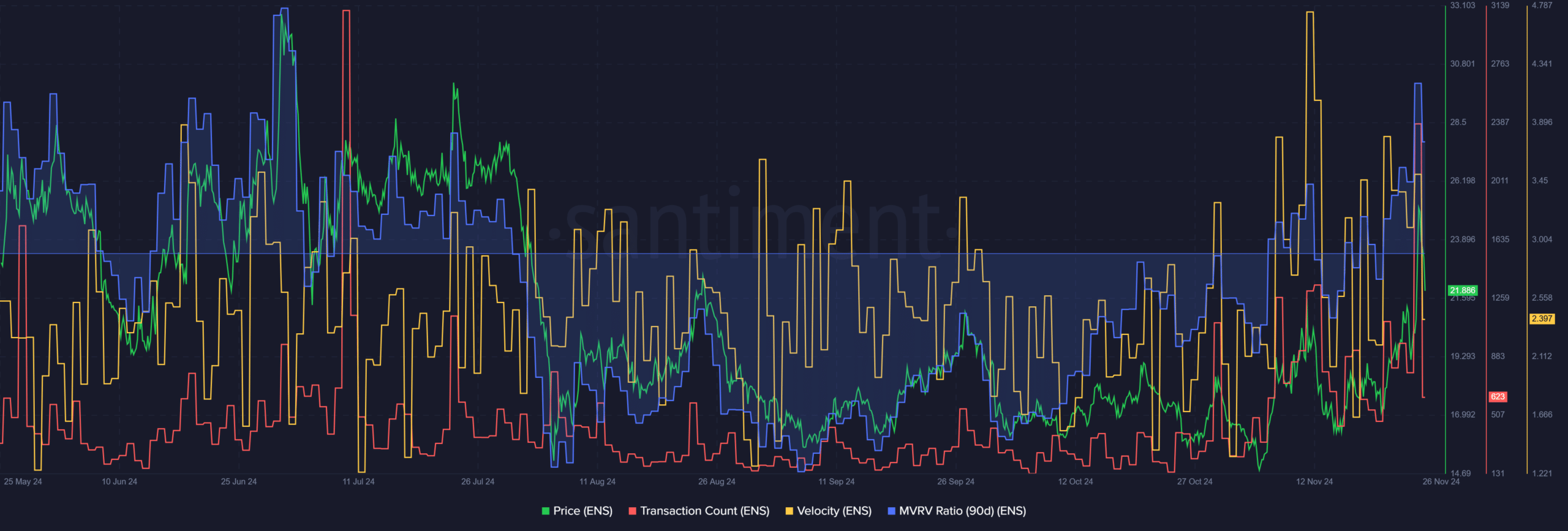

ENS Measurements Signal Positive Market Sentiment

Source: Santiment

The 90-day MVRV was positive after recent strong gains. This opened up the possibility of profiteering activities and lower prices. However, the number and speed of transactions were more optimistic.

Their upward trajectory since the end of October is a sign of increased market activity. Transaction count measures unique transactions made on the network during a day.

An increase in this measure is a sign of increased market participation.

Velocity measures how often a token changes hands. The increase in price, speed and number of transactions means that the token is traded more frequently and supports the idea of a healthy and active market.

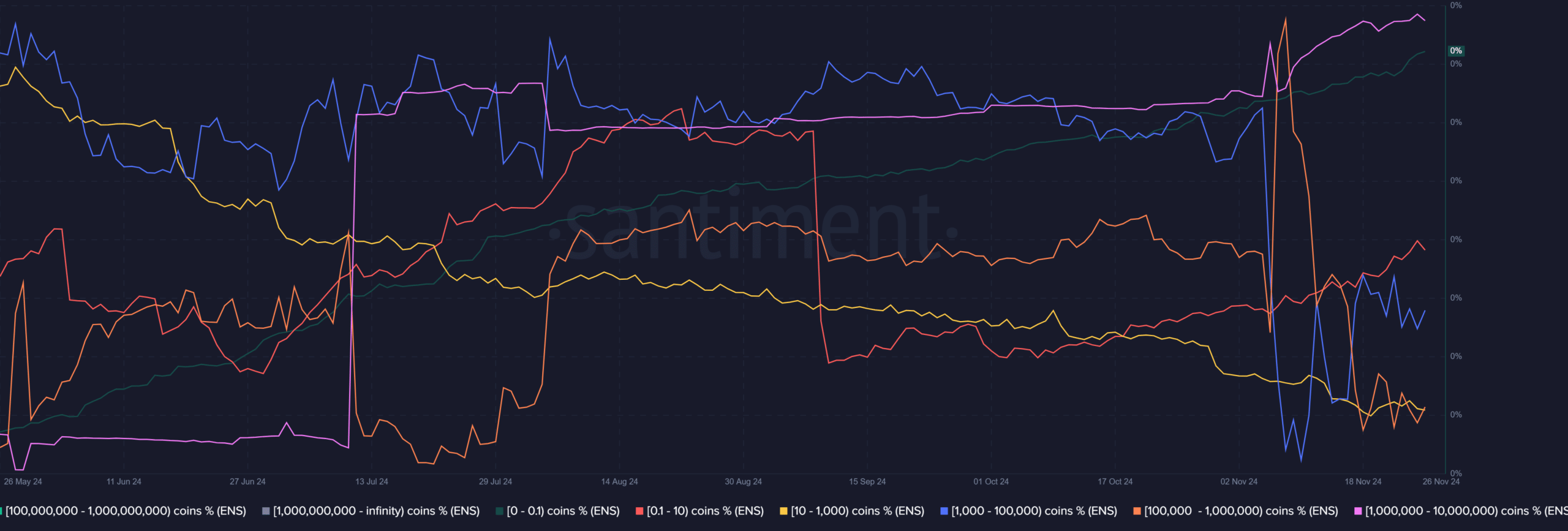

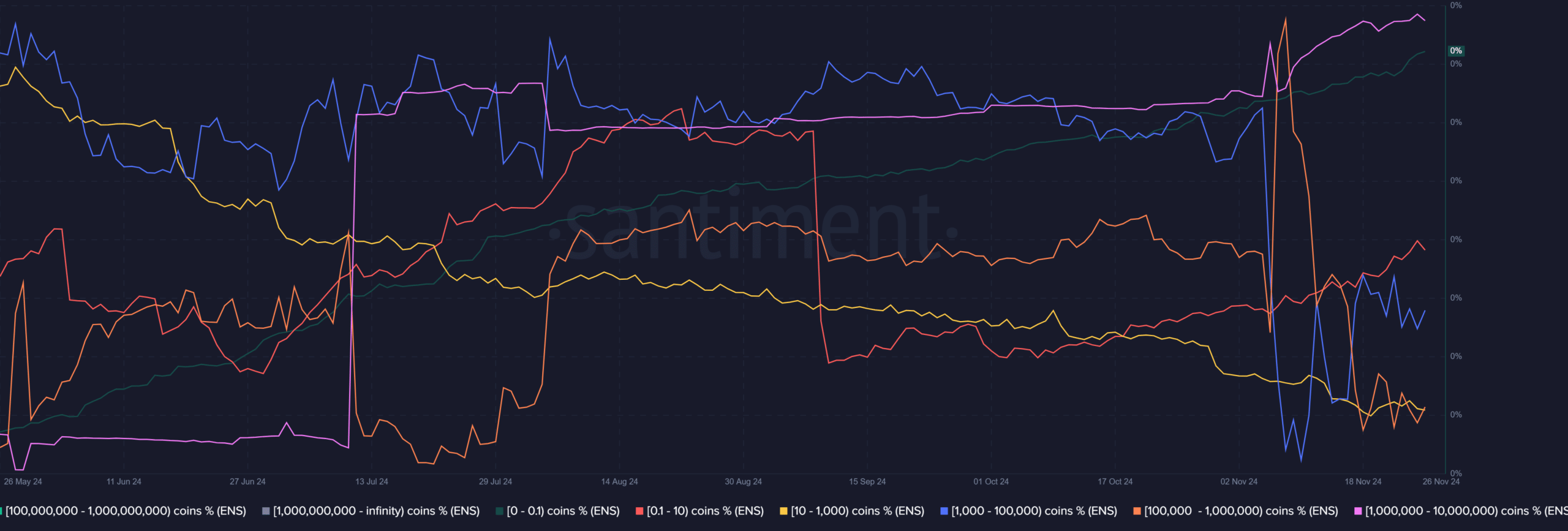

Source: Santiment

Breaking down the supply by address balance showed that the 1,000 to 1,000,000 ENS balance addresses lost some of their holdings starting in October.

The first cohort started to climb, showing some accumulation.

Shrimp addresses under 10 ENS were also piling up. More importantly, large whales with 1 million ENS or more saw their share of the pie increase, a sign that whales were also buying these tokens.

Will this whale activity increase the chances of a rally?

Source: ENS/USDT on TradingView

Read Ethereum Name Service (ENS) Price Forecast 2024-25

The move past $22 meant that ENS bulls had clean air above them. Volatility due to Bitcoin (BTC) could push ENS below the $20 mark, but it is likely to recover soon even in this scenario.

The 78.6% level at $15.7 has been diligently defended since early August. A recovery from this level means that the $34.5 and further north extension levels will be the next targets in the coming weeks.