Ethereum co-founder Jeffrey Wilcke transferred $75.2 million from Ether to Kraken, raising speculation about a potential market correction.

On-chain data showed that Wilcke sent 20,000 Ether (ETH) to centralized crypto exchange Kraken, located in California. The motivation for Wilcke’s decision was unknown, but a foreign exchange deposit usually signals a proposed sale.

Community members pointed out that Wilcke’s past transactions sometimes preceded Ethereum’s price decline.

For example, on January 6, 2021, the price of Ethereum fell after Wilcke deposited 15,000 ETH. Similarly, on February 11 and 14, 2024, its movements of 4,300 ETH and 10,000 ETH, respectively, were followed by price drops. Despite the recent transaction, Wilcke still holds 106,006 ETH, valued at over $384 million, according to LookOnChain.

Ethereum executives and organizations selling ETH or making exchange deposits have historically drawn public anger. Earlier this year, the foundation sold 4,266 ETH, worth over $12 million, sparking backlash from users accusing it of profiting from the reserves.

Users criticized the nonprofit for allegedly profiting from its Ether reserves. The co-creator of ETH, Vitalik Buterin, clarified that the foundation liquidates part of its assets to finance initiatives and finance its operations.

Indeed, the foundation’s annual report revealed that most of its money went toward supporting the Ether ecosystem or rewarding projects focused on advancing the larger decentralized financial blockchain.

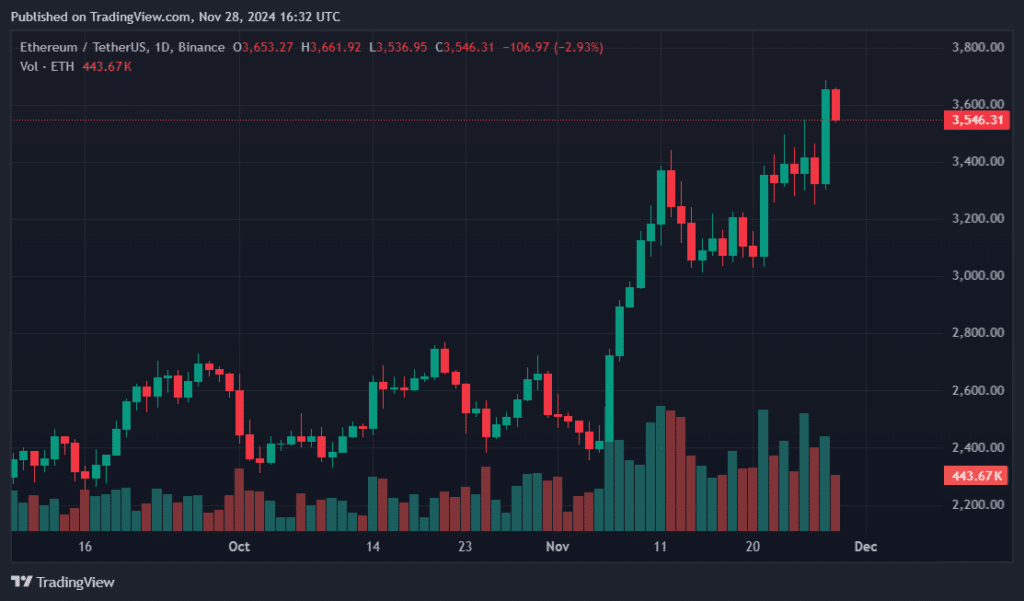

The price of Ether saw a slight increase, like other cryptocurrencies, after the US general election on November 6. As the total crypto market reached $3.4 trillion, ETH reached $3,550. The token was down around 28% from its previous all-time high of $4,878.