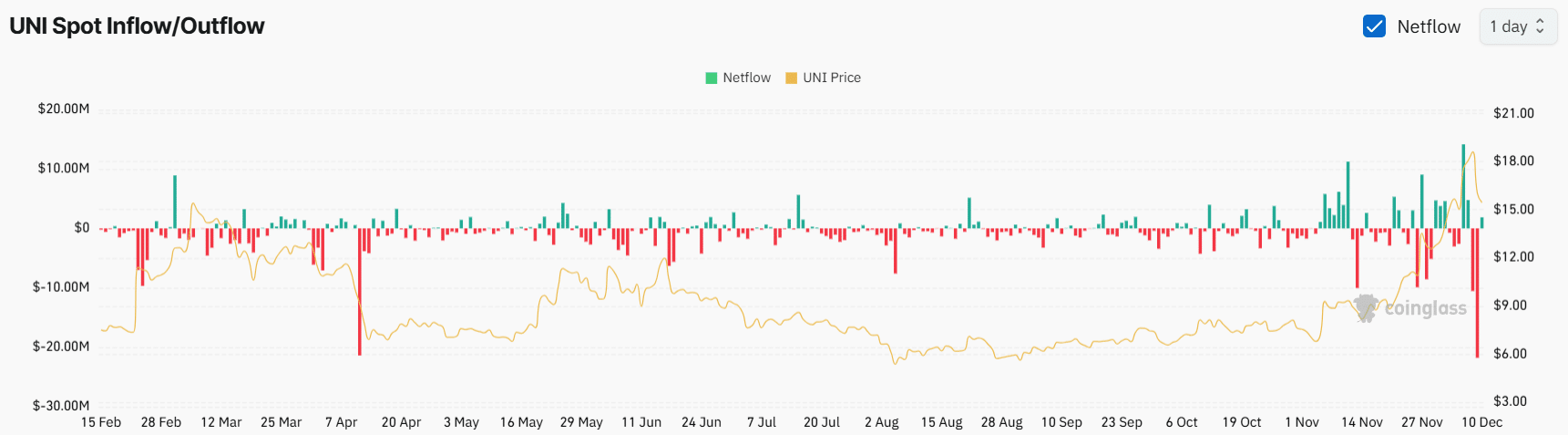

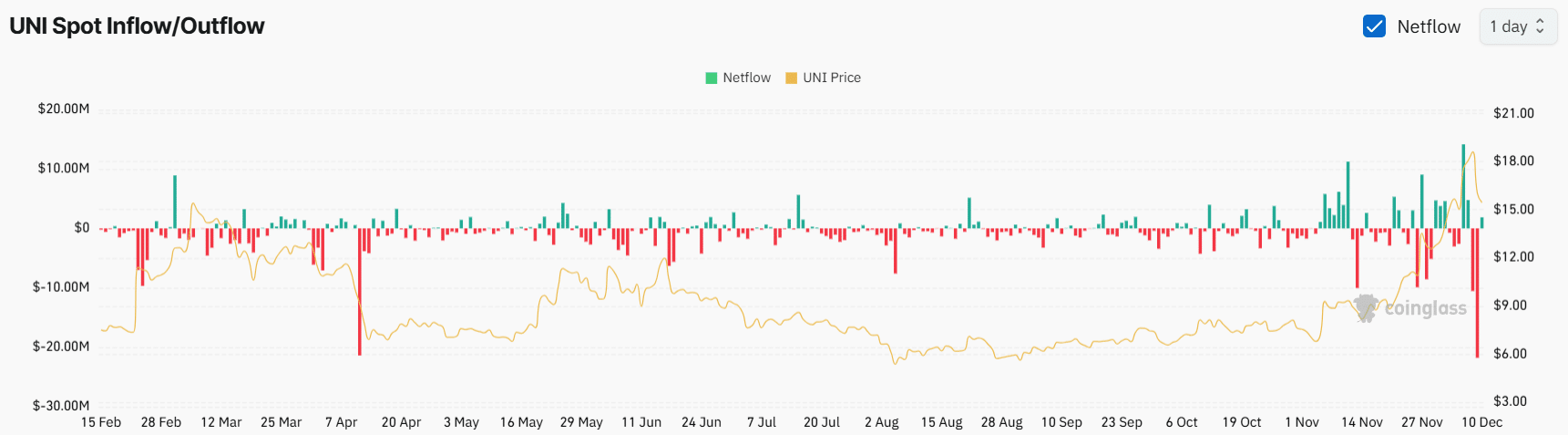

- The exchanges saw $3.5 million in UNI inflows.

- UNI could decline by 20% to the $11.10 level if it closes a daily candle below the $14.60 level.

Uniswap (UNI) appeared to be in trouble at press time as whale interest in the token appeared to fade.

This notable shift in investor interest follows broader sentiment in the cryptocurrency market, which was entering a correction phase.

Whale sells $16.73 million worth of UNI tokens

On December 10, whale transaction tracker Lookonchain noted that professional trading company Cumberland sold 989,520 UNI tokens worth $16.73 million.

These substantial tokens were offloaded to various centralized exchanges including Binance, Coinbase, OKX, and Robinhood.

Additionally, Cumberland began dumping its holdings as the UNI price fell 10%. This fall during the short-term price correction has sparked fear among investors and traders.

At press time, UNI was trading near $15.65 after a price drop of over 11% in the past 24 hours.

AMBCrypto’s review of Coinglass data revealed that other whales and institutional investors have begun moving their portfolios to exchanges, potentially for sales purposes.

Also, according to the Spot Inflow/Outflow, exchanges recorded a modest $3.5 million in asset inflows.

Source: Coinglass

In the context of cryptocurrencies, “inflow” refers to the transfer of assets from wallets to exchanges, which generally indicates a potential sell-off and portends a future decline in prices.

However, the amount of asset inflows into the stock exchanges over the past three days has been significantly lower than the outflows.

This suggests a strong possibility that these long-term holders will support UNI over the long term, which could prevent further price declines.

UNI Technical Analysis and Key Levels

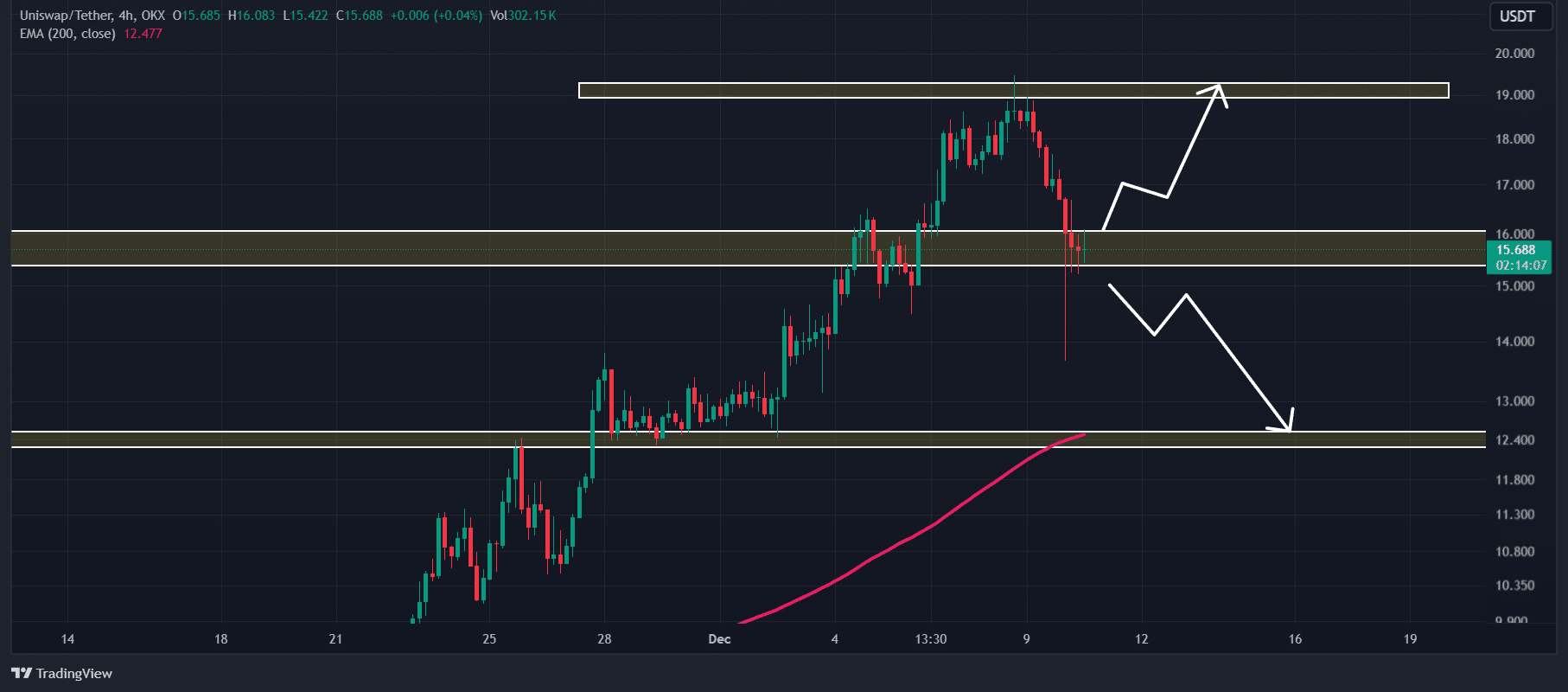

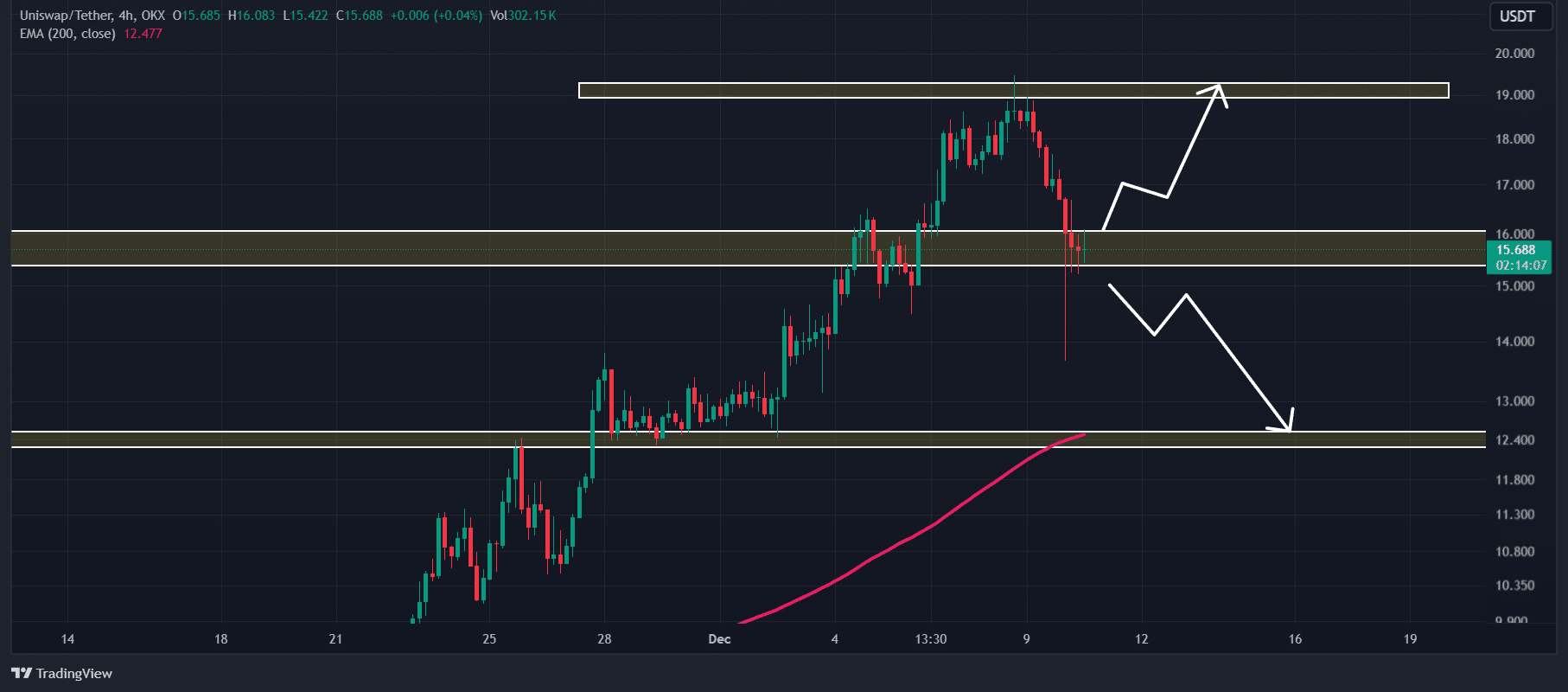

According to technical analysis by AMBCrypto, UNI reached a crucial support level of $15.30 following the recent price decline. This level has created a make-or-break scenario for the altcoin.

Source: TradingView

Based on recent price action, UNI is currently facing two possibilities: it could either rebound or experience a further decline.

Read Uniswap (UNI) Price Forecast 2024-2025

If the altcoin holds above the $15.50 level, there is a strong possibility that it could surge by 30% to reach the $20.50 level in the near future.

Conversely, if UNI fails to hold this support level and closes a daily candle below $14.60, there is a high chance that it will decline by 20%, potentially reaching the 11 level, $10 in the next few days.