- Most market indicators looked bearish on Bitcoin.

- In the event of a trend reversal, BTC could move towards $100,000 again.

While Bitcoin (BTC) Struggling below $96,000, the coin’s trading activity has also seen a massive decline. Therefore, AMBCrypto planned to investigate further whether this latest development would have a continued negative impact on the price of the royal coin.

Bitcoin transfers have reached an all-time high!

Woominkyu, an analyst and author at CryptoQuant, recently published a analysis highlighting a notable development. According to the analysis, BTC exchange-to-exchange transactions have decreased significantly.

The analysis mentions: “Notable spikes in trading volume align with significant price changes. In particular, peaks in foreign exchange transactions marked in the red circles precede or coincide with sharp price movements.

The first peak highlighted in 2017 corresponds to the historic Bitcoin price surge, while the second peak around 2021 corresponds to another significant price movement.

Recently, trading volume has declined significantly, indicating lower trading activity than in previous years.

Where is BTC going?

Will this drop in exchange-to-exchange transactions hurt the coin’s price in the near term? Let’s find out.

According to our analysis of CryptoQuant data, Bitcoin net deposits on exchanges were below the past seven-day average, suggesting increased selling pressure. The coin’s aSORP was also red, indicating that more investors were selling at a profit. In the midst of a bull market, this can suggest a market top.

BTC Binary CDD highlighted that long-term holder movements over the past seven days were above average. If these movements were intended for selling, it could have a negative impact.

Source: CryptoQuant

However, Glassnode data revealed a different story. The platform’s Accumulation Trend Score indicator showed a value above 0.93 at the time of publication.

A value closer to one indicates strong buying pressure on BTC, which is a positive signal because high buying activity usually leads to price increases.

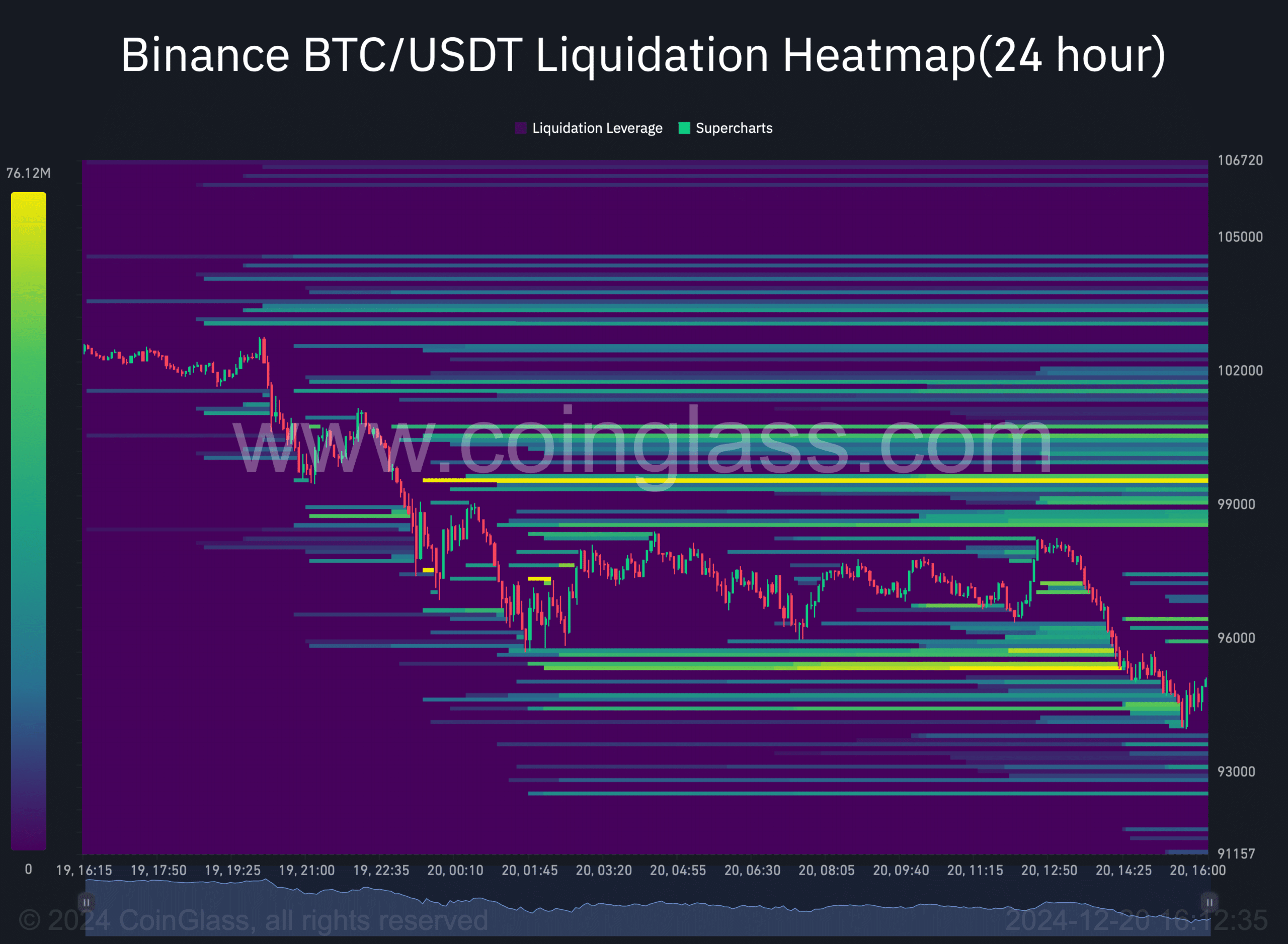

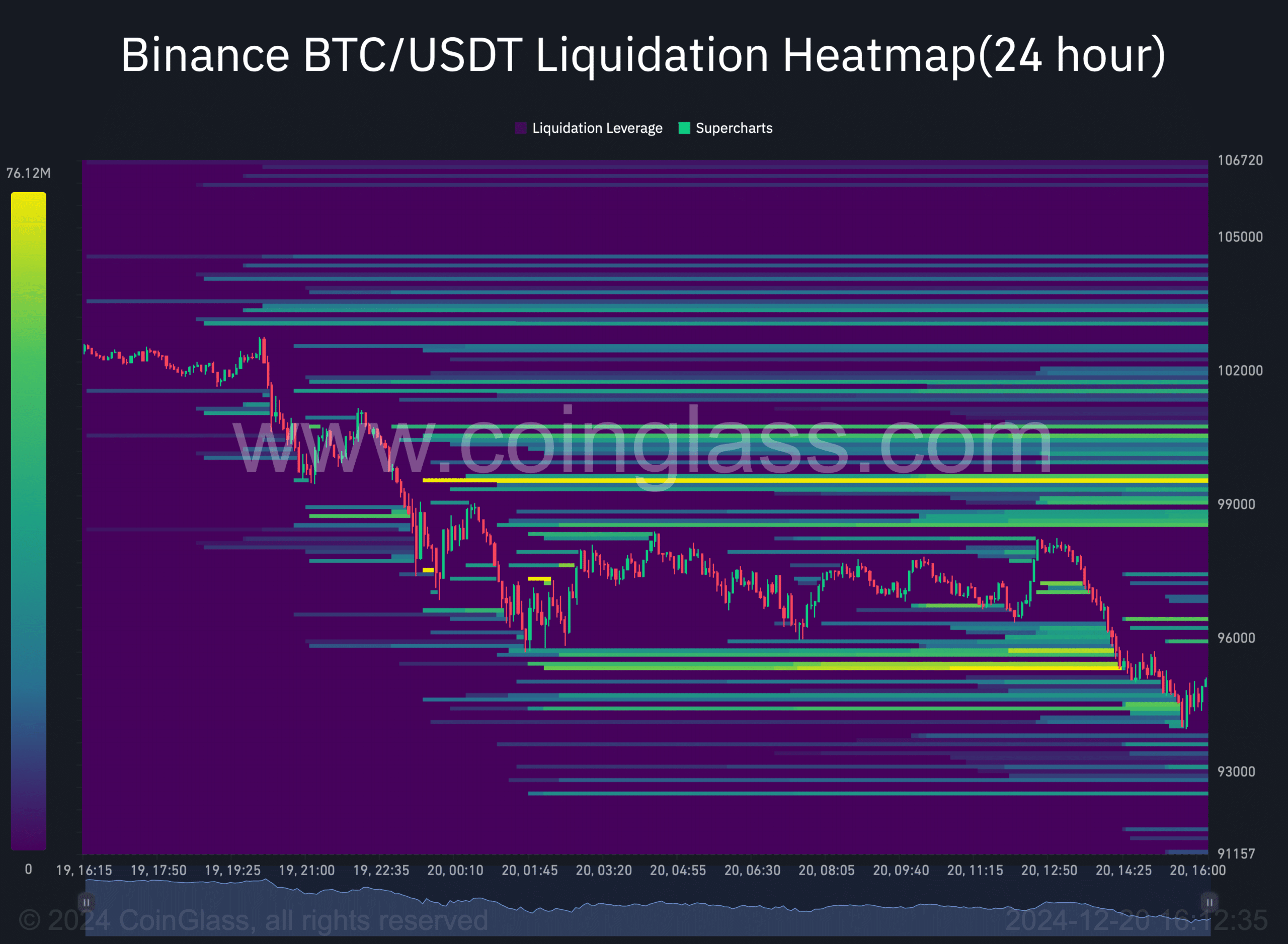

Nonetheless, Coinglass data highlighted another bearish move. BTC’s Long/Short ratio recorded a sharp decline over a 4-hour time frame.

This meant that there were more short positions in the market than long positions, which could depress the price of the coin in the short term. If the price decline continues, BTC could fall to $91,000.

Read Bitcoin (BTC) Price Prediction 2024-2025

However, if the bulls initiate a trend reversal, BTC could potentially touch back the $99.5K to $100K mark, as suggested by the King Coin liquidation heatmap.

Source: Coinglass