- Whale accumulation and technical indicators suggest that LINK could rebound from its critical support of $21.

- Increasing transactions, active addresses, and declining reserves build confidence in LINK’s upside potential.

Chain link (LINK) is making waves in the crypto market, with nine new wallets withdrawing 362,380 LINK worth $8.19 million from Binance in just 48 hours. This significant whale activity highlights growing interest in LINK’s potential, sparking speculation of a price breakout.

At press time, Chainlink was trading at $21.87, reflecting a 4.62% decline over the past 24 hours. However, these movements portend an imminent change in dynamics that could reshape its trajectory.

A key resistance level could define LINK’s next move

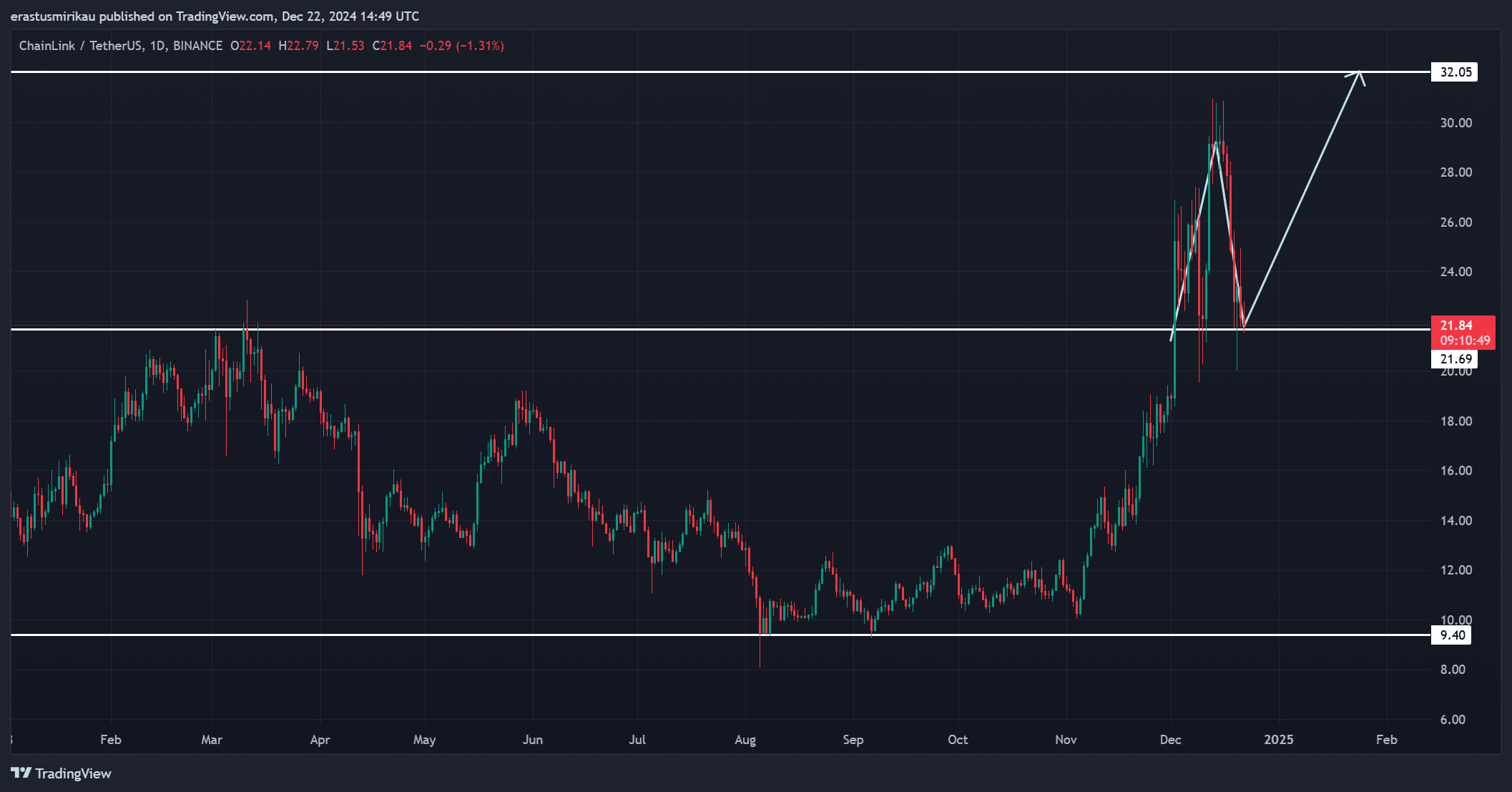

Technical analysis shows that Chainlink is facing a critical moment. After climbing to $32 in November, LINK has returned to its current level near $21, sitting within an important support zone. This level has the potential to serve as a launching pad for another bullish attempt towards $32.

However, if it fails to hold, Chainlink could fall further, testing lower support levels. Therefore, traders should closely monitor these price levels when setting LINK’s immediate outlook.

Source: TradingView

LINK’s Growing Transactions Suggest Brewing Business

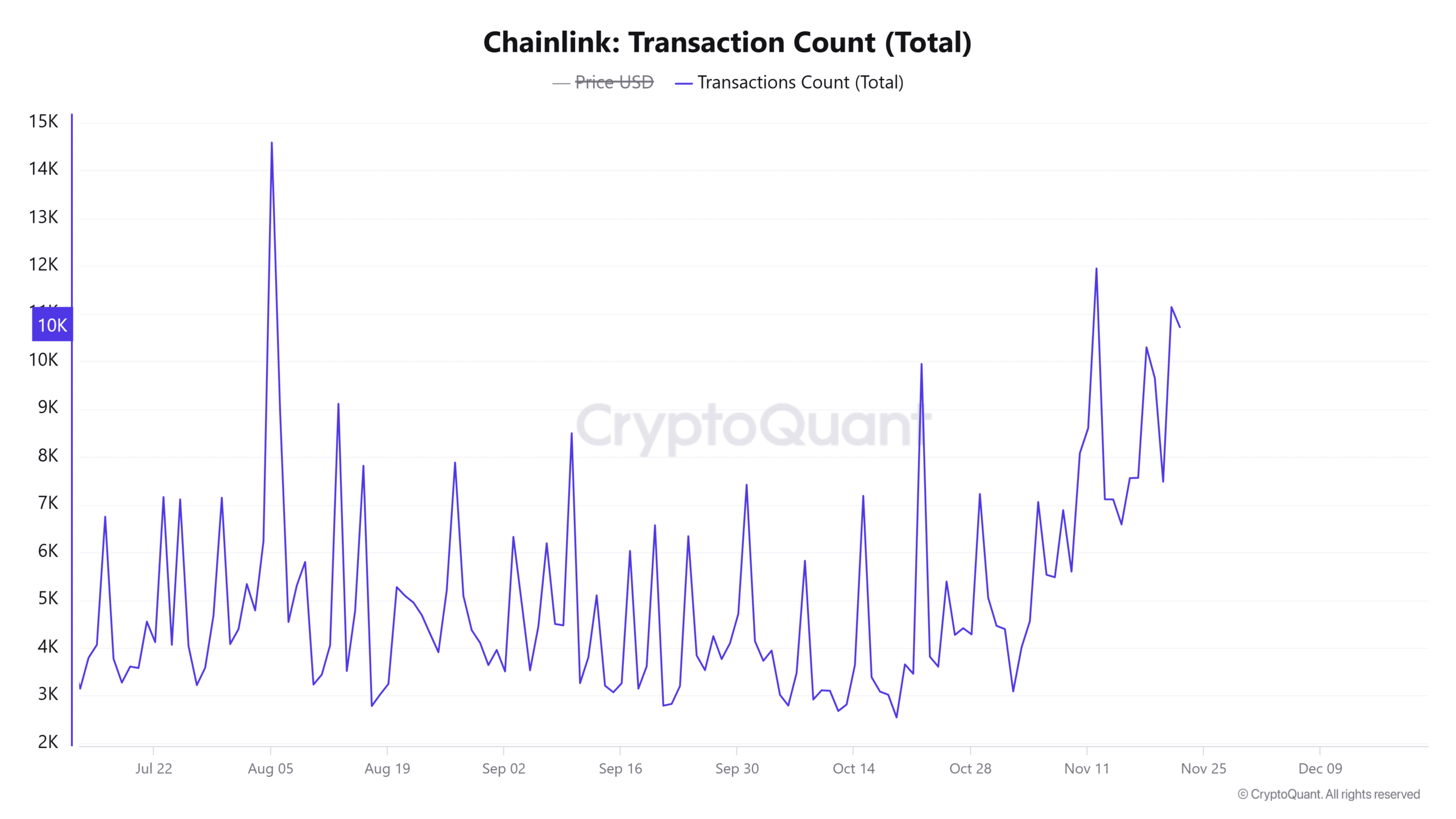

The number of transactions for Chainlink increased by 0.76% in the last 24 hours, climbing to 10,000. This increase in activity indicates increased on-chain movement and renewed interest among market participants.

Additionally, such an increase is often correlated with price volatility, suggesting that Chainlink could be preparing for a significant move. Therefore, this metric highlights the market’s anticipation of LINK’s next price action.

Source: CryptoQuant

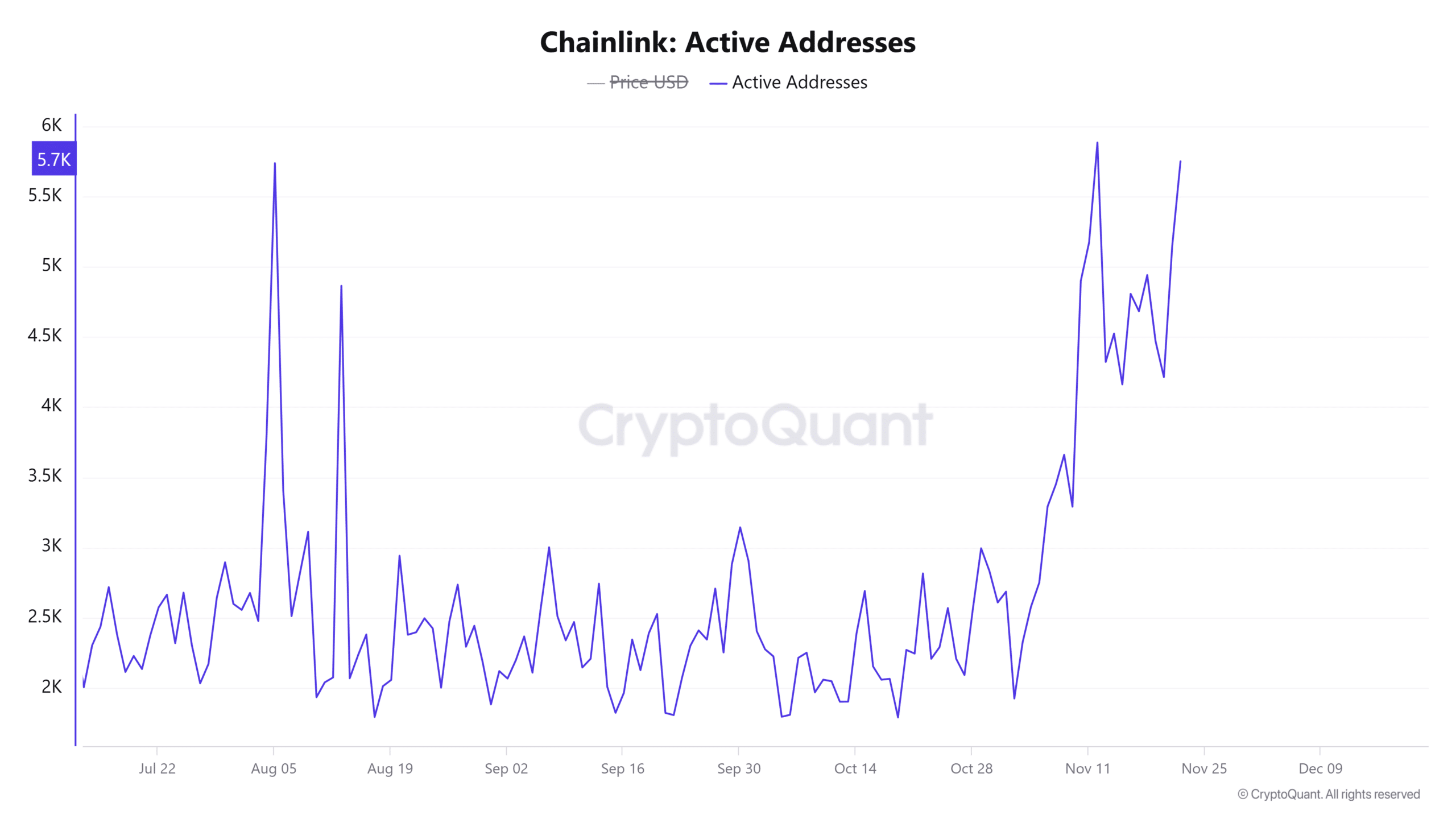

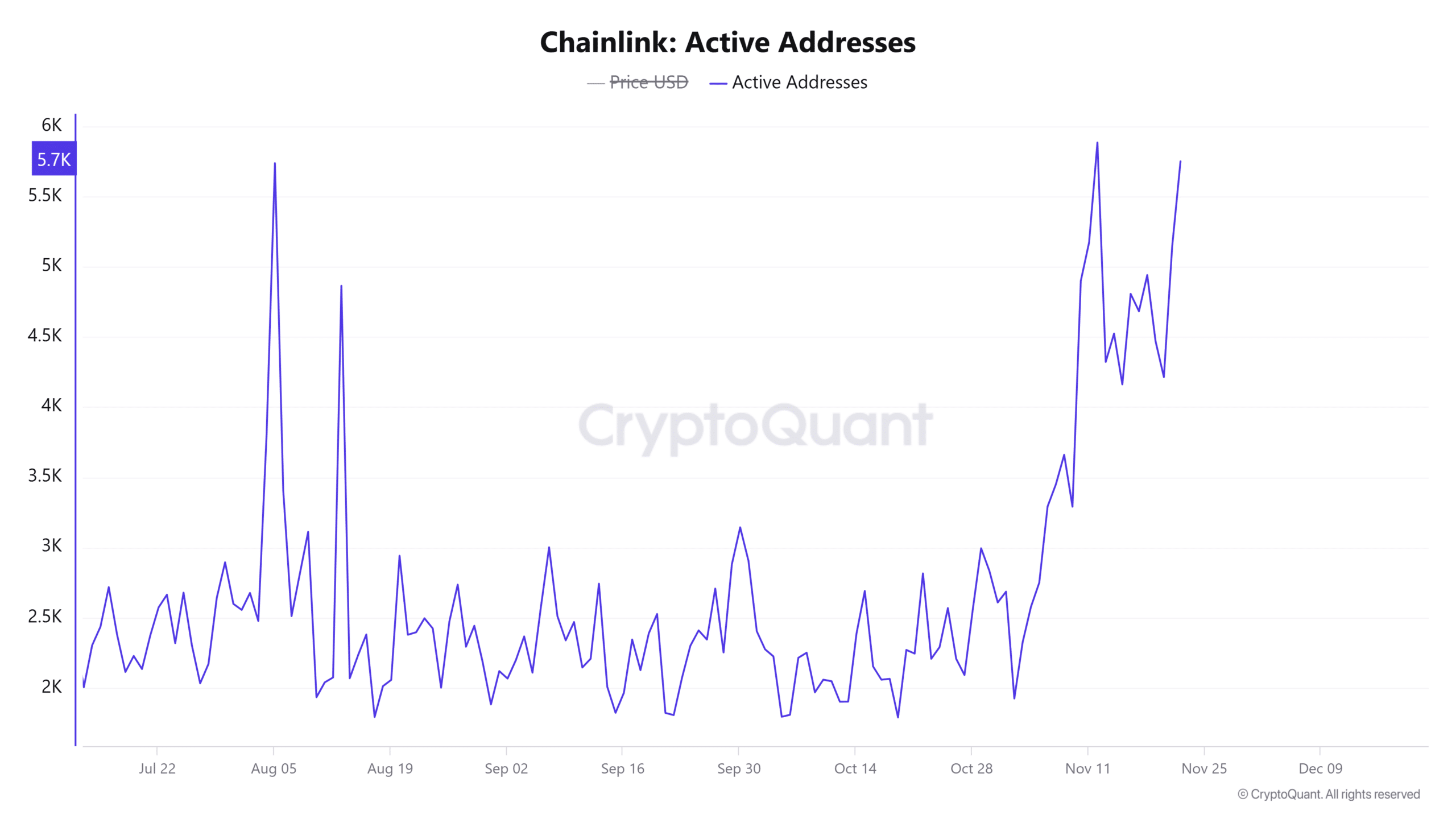

Increase in active addresses reflects network trust

Active addresses also increased by 0.83% over the past day, reaching 5.7K. This increase aligns with the accumulation of whales, signaling stronger engagement within Chainlink’s network.

Additionally, increases in active addresses often indicate growing adoption, reinforcing bullish sentiment. Therefore, this data supports the idea that the LINK network is poised to grow further.

Source: CryptoQuant

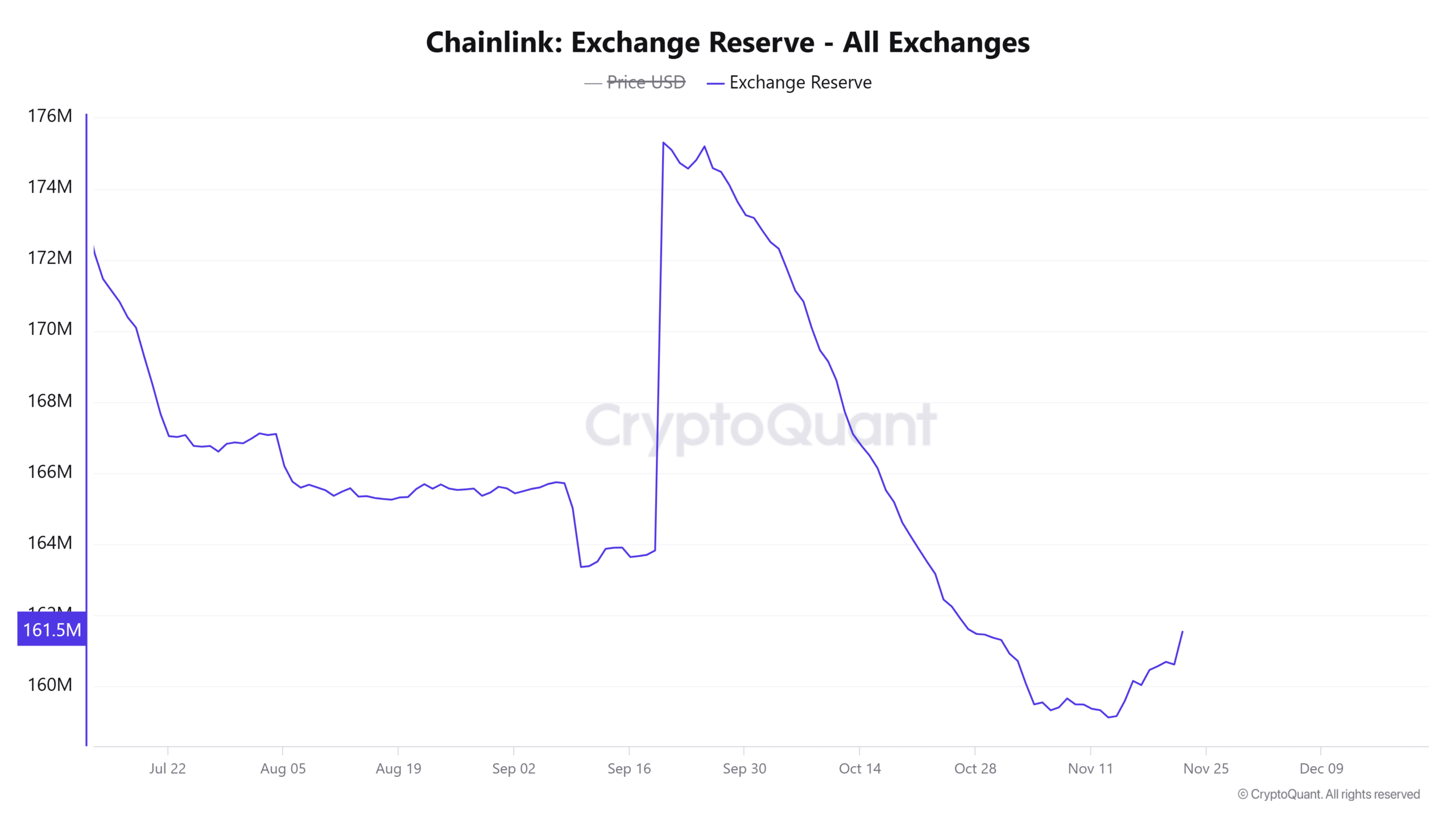

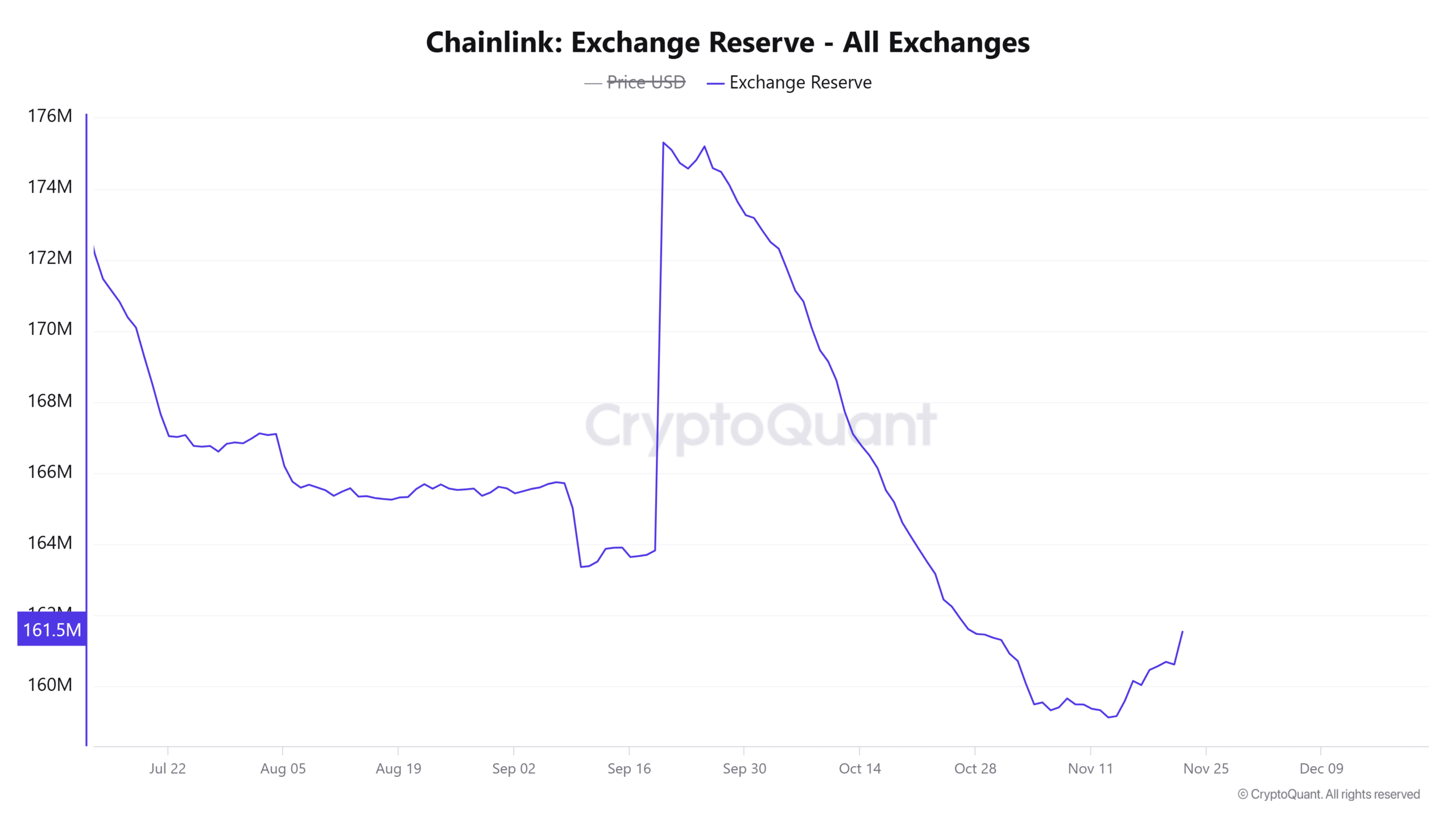

The drop in foreign exchange reserves could limit selling pressure

Chainlink’s exchange reserves fell 0.26% to 161.5 million in the last 24 hours. This decline suggests a reduction in selling pressure as holders remove tokens from exchanges, potentially to hold them for the long term.

Additionally, the combination of whale accumulation and dwindling supplies strengthens the argument for a bullish breakout.

Source: CryptoQuant

Is your wallet green? Check out the LINK Profit Calculator

LINK’s recent whale activity, combined with increased transactions, active addresses, and declining foreign exchange reserves, strongly suggests a bullish outlook.

Therefore, Chainlink looks set to reclaim its $32 resistance in the near future, provided it maintains its critical support at $21.87.