- Peter Schiff proposed the launch of USA Coin.

- This fits with his continued criticism of Bitcoin.

Peter Schiff, a staunch critic of Bitcoin and staunch defender of gold, has once again focused on the cryptocurrency. In a recent social media post, Schiff proposed the idea of a U.S.-issued digital currency called an “American coin” as an alternative to Bitcoin.

He suggested that US coins could cap their supply at 21 million, like Bitcoin. However, it would have an “enhanced blockchain” to make it viable for payments.

Although Schiff’s skepticism is well-documented, this new suggestion has reignited the debate over the viability of Bitcoin compared to government-backed digital currencies.

Bitcoin coin vs USA – Schiff’s proposal

Schiff argues that Bitcoin’s scalability and use as a medium of exchange are its fundamental weaknesses. He says the U.S. coin could overcome these challenges by improving the functionality of the blockchain and leveraging the trust of a government-issued currency.

However, this suggestion has drawn criticism from Bitcoin supporters who emphasize decentralization as Bitcoin’s main strength.

Bitcoin is designed to operate without central control. The design ensures that no entity, government or otherwise, can manipulate its procurement or policies.

In contrast, U.S. coins, issued by the U.S. government, would be inherently centralized. This centralization could limit its appeal to those who value Bitcoin for its resistance to censorship and inflation.

Historic performance of BTC in the face of criticism from Schiff

To understand Schiff’s continued skepticism, it is crucial to review his history of Bitcoin predictions. Over the years, Schiff has repeatedly predicted the demise of Bitcoin, but the cryptocurrency continues to defy his expectations.

A look at Bitcoin’s historical performance tells a different story.

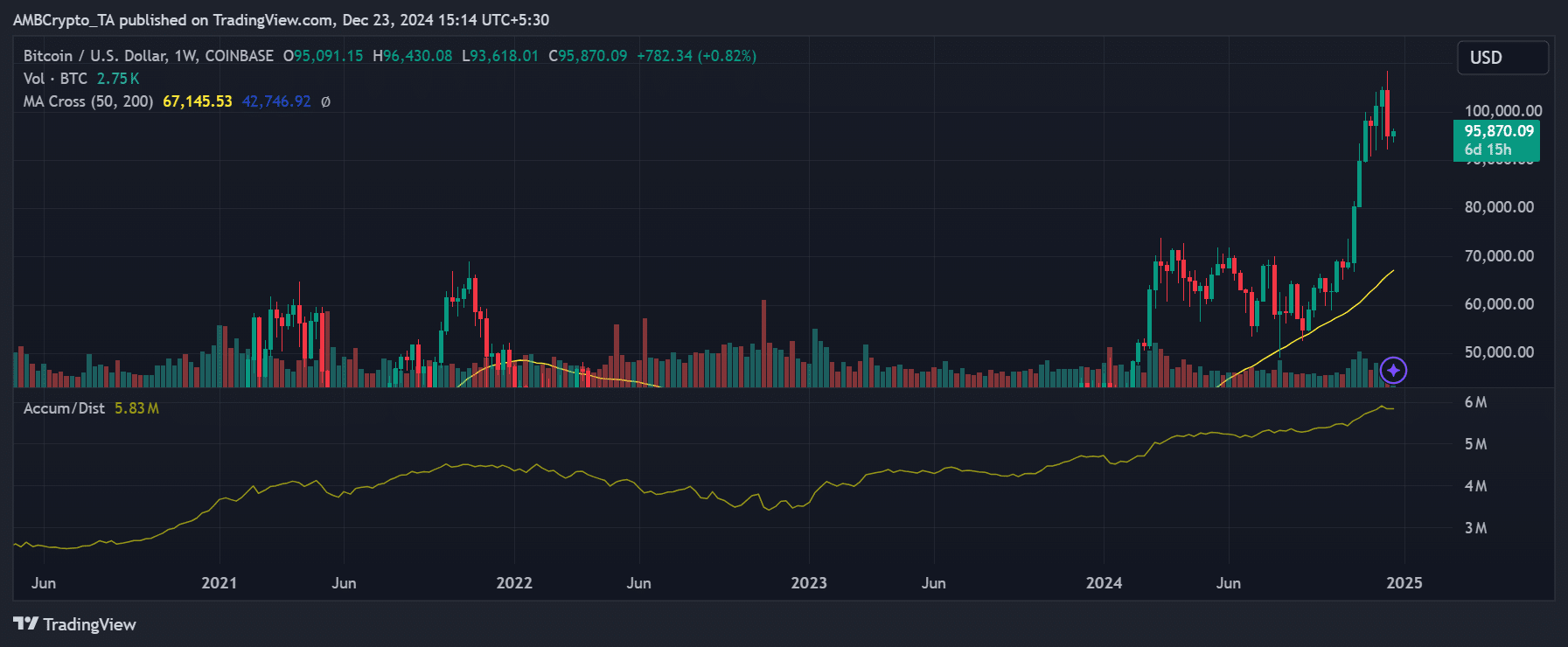

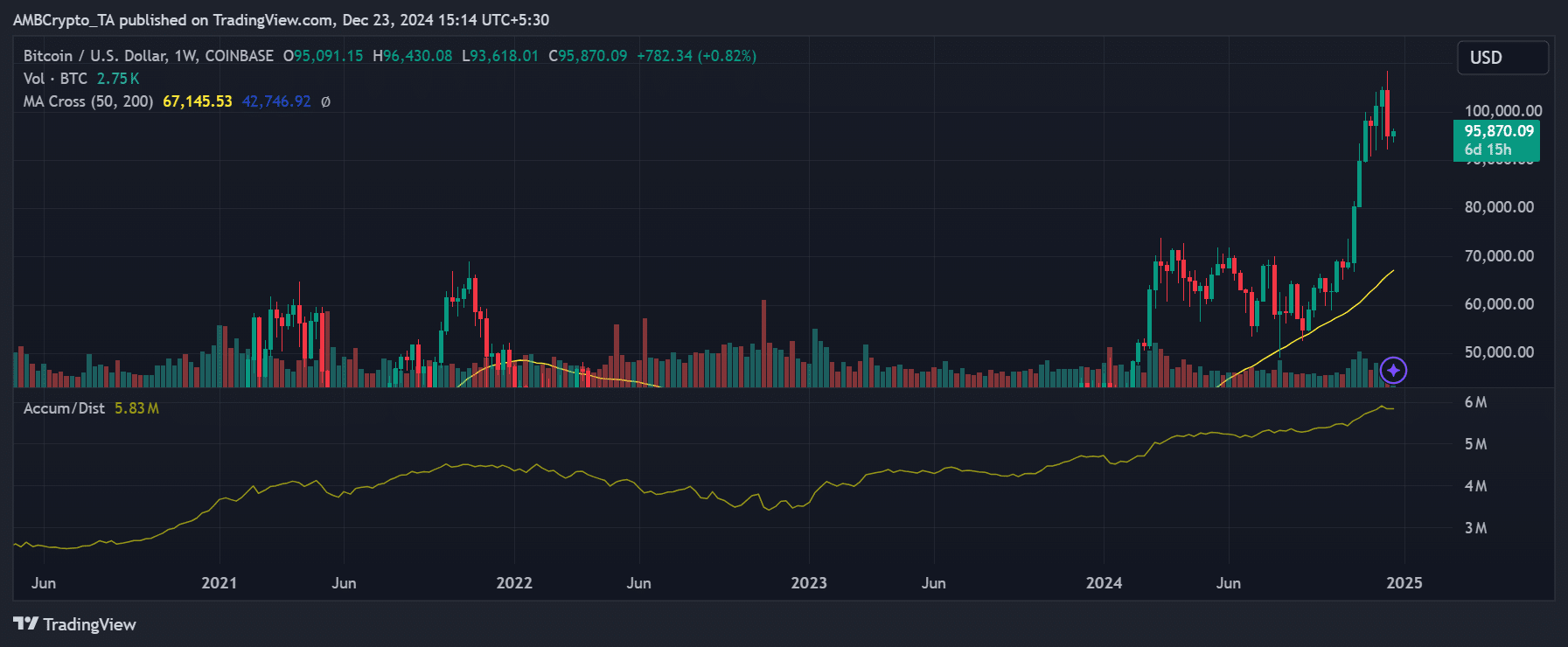

Source: TradingView

Bitcoin has gone from being worth pennies in its early days to its current price of around $95,000. Despite periods of significant volatility, its long-term growth trajectory has made it one of the best-performing assets of the past decade.

Schiff’s predictions that Bitcoin would collapse during its previous price increases (e.g., to $1,000 in 2013 or $20,000 in 2017) did not materialize, further fueling debates between his supporters and the cryptography advocates.

The implications of a government-issued digital currency

If the United States created a digital currency like the US coin, it would likely function more like a central bank digital currency (CBDC) than a decentralized cryptocurrency.

CBDCs are designed to work within existing financial systems, potentially providing faster and more secure transactions. However, they lack the basic features that make Bitcoin unique.

Schiff’s suggestion, while hypothetical, reflects a broader trend of governments exploring digital currencies to maintain control. Whether American coins could “make everyone rich,” as Schiff claims, remains highly speculative.

Although his skepticism towards Bitcoin has not yet been validated, his comments draw attention to the growing interest in government-backed digital assets. Only time can answer the question of whether the US coin or any other centralized digital asset can compete with Bitcoin.