- CRV jumped 7.33% in the last 24 hours.

- Curve Dao defies market predictions amid increased accumulation.

While Bitcoin (BTC) and other altcoins have seen some slowdowns, Curve DAO (CRV) is charting its own path.

After hitting a low of $0.687, Curve Dao gained on its price charts for three consecutive days.

Over the past few days, the altcoin managed to reach a high of $0.93. At the time of writing, Curve Dao was trading at $0.836. This represents an increase of 7.33% in 24 hours. Prior to these gains, CRV was on a downward trajectory, down 22.94% on the weekly charts.

With the trend reversal seemingly inevitable, the question that arises is whether CRV can continue to defy the downtrend seen in crypto markets and continue the uptrend.

What CRV cards indicate

According to AMBCrypto analysis, Curve Dao is building upward momentum amid increased accumulation from retail traders and whales.

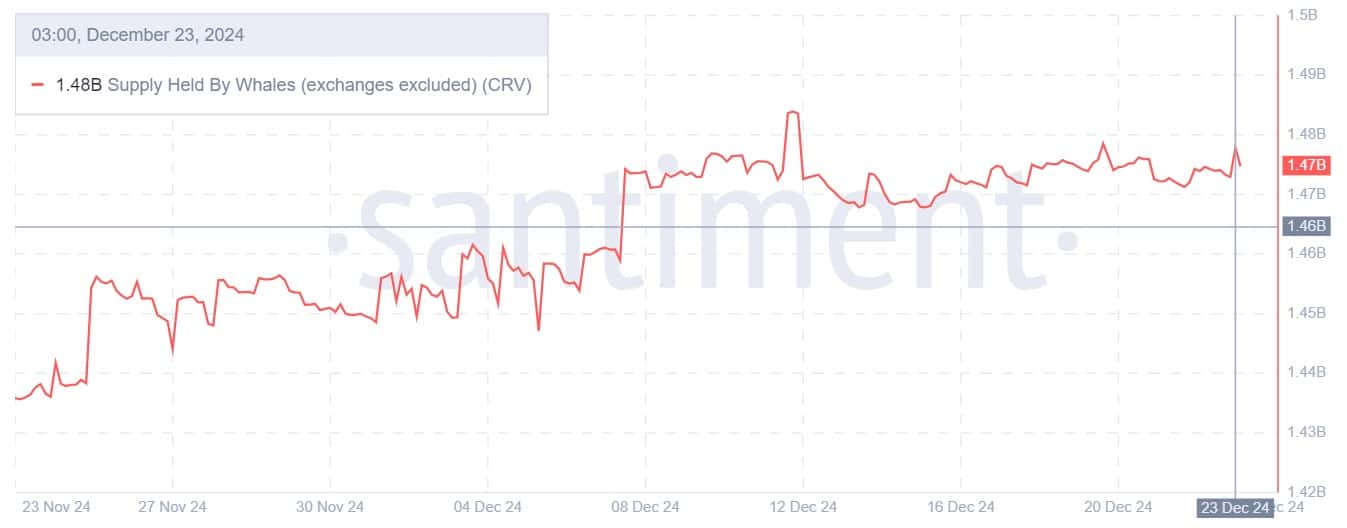

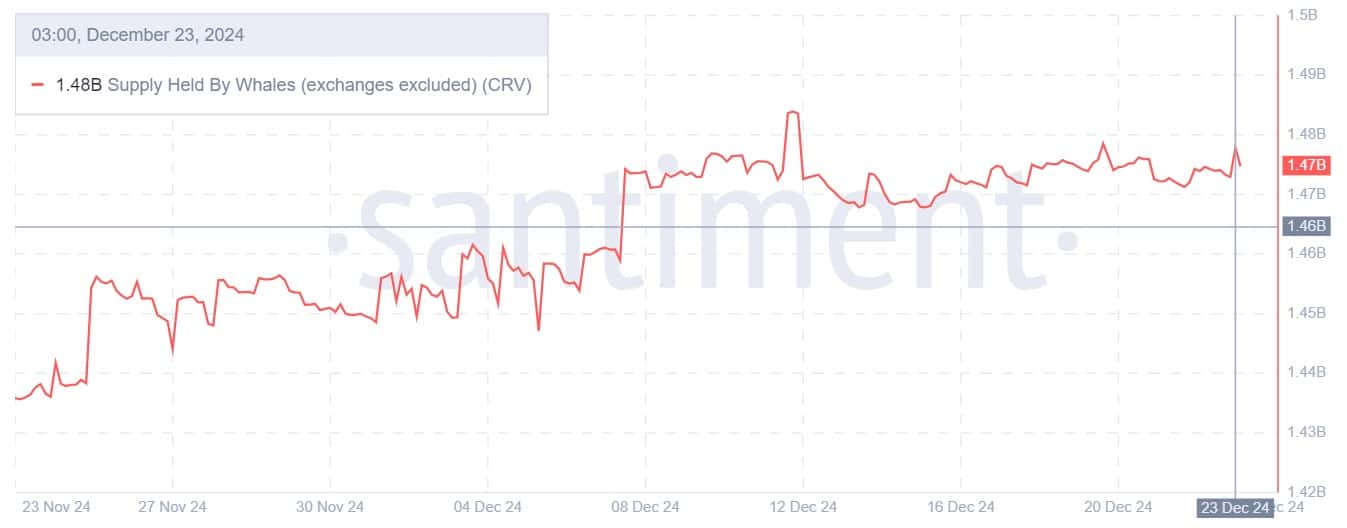

Source: Santiment

To begin with, we see this increased accumulation among large holders with the increase in supply held by whales, from 1.44 billion to 1.48 billion.

Thus, whales have purchased 400 million tokens in recent weeks. When whales turn to accumulation, it shows their confidence in the market and anticipates rising prices in the near future.

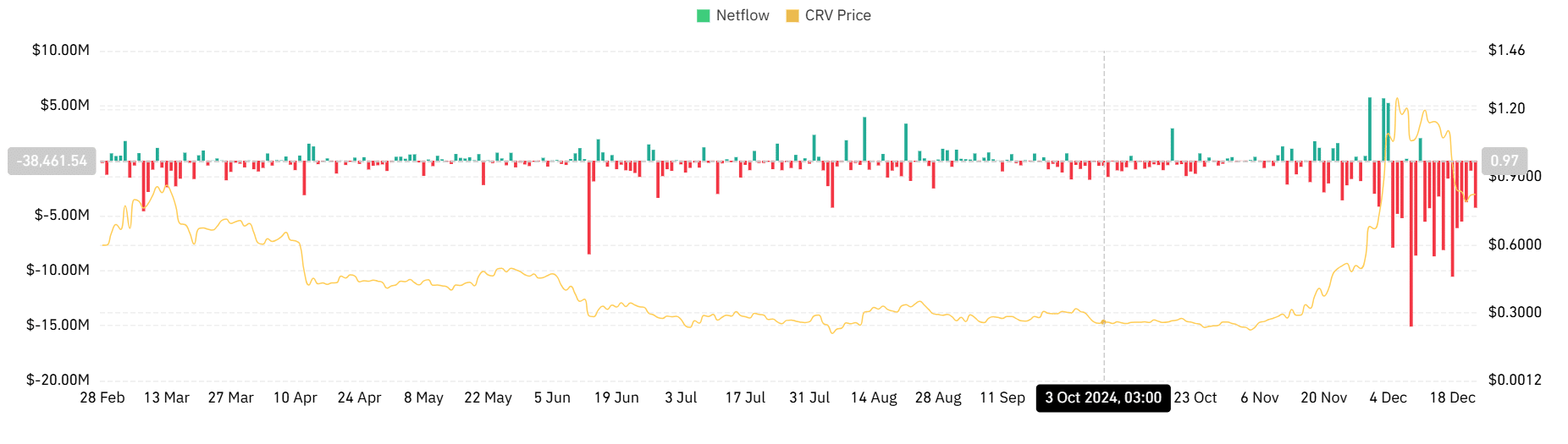

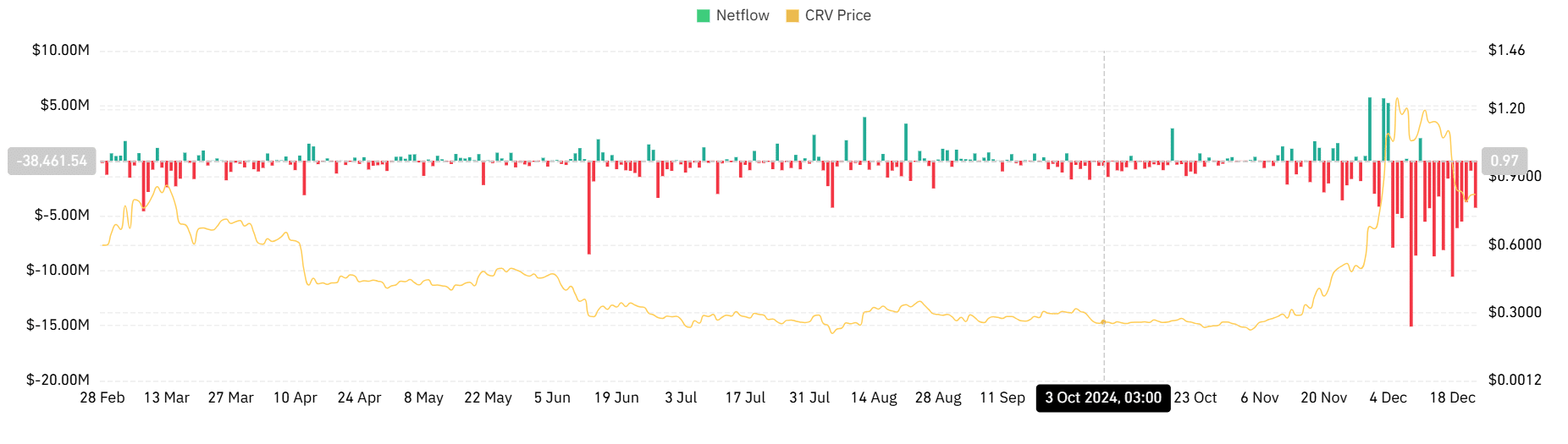

Source: Coinglass

Additionally, Curve’s Spot net flow remained negative over the past week, indicating that investors are actively accumulating CRV. A negative net cash flow implies that most traders are withdrawing their assets from exchanges to private wallets or cold storage.

This often signals accumulation and a long-term bullish outlook. When traders remove assets from exchanges, it reduces supply for immediate supply.

Source: Tradingview

This bullish outlook is also highlighted by the bullish crossover of CRV on its Stoch RSI. The crossover indicates that recent prices are approaching the highs, indicating increasing bullish momentum.

This further signals a potential reversal of the downtrend to the upside.

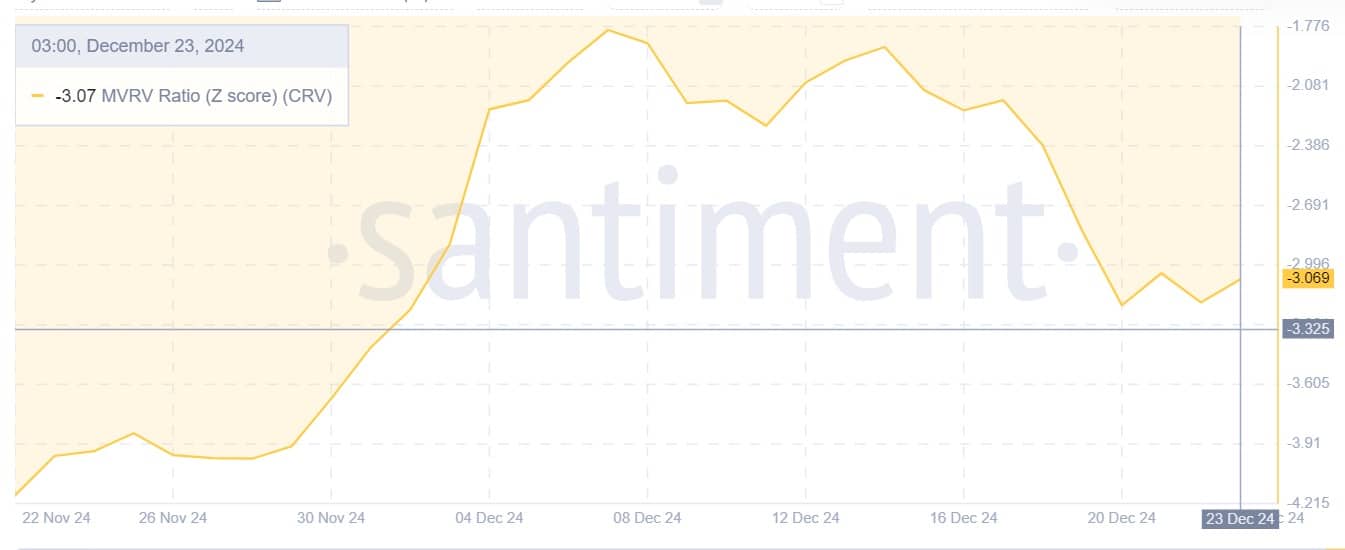

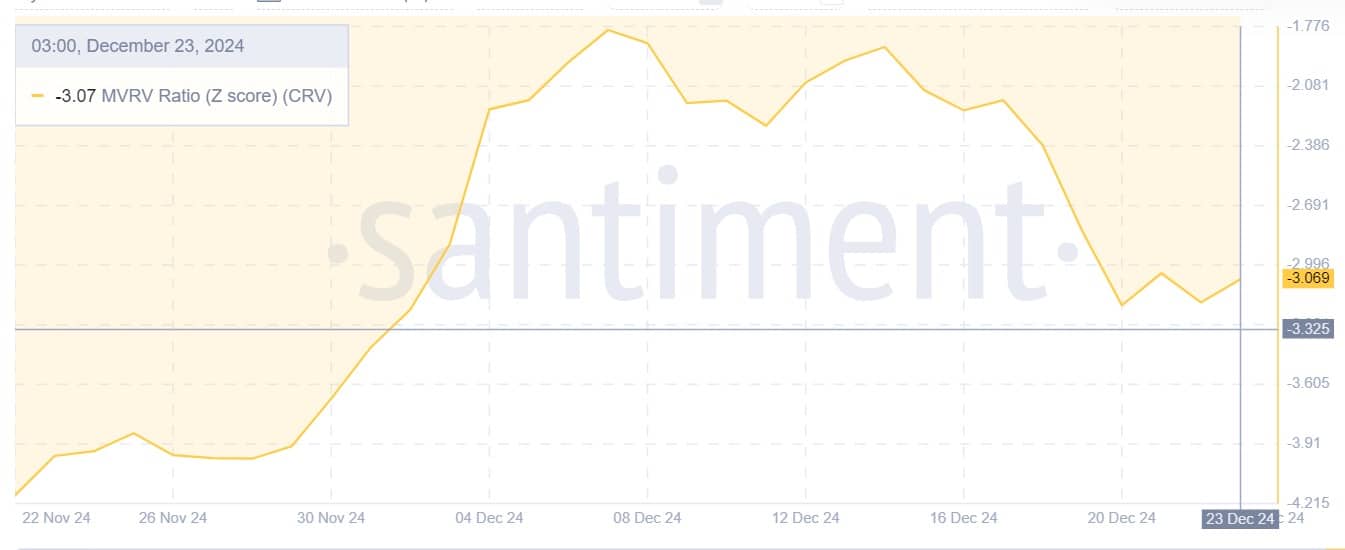

Source: Santiment

Finally, CRV’s MVRV score ratio indicates that the asset is currently undervalued. With a negative value of -3.07, this signals short-term bearish sentiment. Although bearish, undervaluation provides a buying opportunity as investors buy the dip.

Is your wallet green? Consult the CRV profit calculator

Will the upward trend continue?

Simply put, Curve Dao is currently opposing the downtrend due to increased accumulation as buyers enter the market to buy the dip. With retail traders and whales showing optimism, it appears that CRV is about to reverse and the uptrend may continue.

If these conditions prevail, CRV could record more gains on its price charts and reclaim the $1.1 resistance level. However, if the bears outweigh the rises again, CRV risks falling to $0.69.