The rise of digital identity management has transformed the way we interact online, but it also poses challenges around security, privacy and trust. Blockchain technology appears to be the cornerstone of these solutions, offering decentralized, transparent and secure frameworks for identity management.

We speak with Sebastian Rodriguez, Chief Product Officer at Privado ID, who describes the role of blockchain in digital identity solutions.

Self-sovereign identity: a user-centric model

Self-Sovereign Identities (SSI) allow users to control their data and ensure its privacy. By decentralizing data management, blockchain eliminates the need for centralized institutions, creating systems where trust is embedded in the technology itself.

The self-sovereign identity model is at the heart of blockchain-based digital identity systems. Unlike traditional systems, in which organizations store and control user data, SSI puts users at the center.

Blockchain acts as a verifiable repository for credentials, allowing users to manage their identity securely. Rodriguez explains that this approach provides key benefits such as credential revocation, key rotation, and trust registries.

“Blockchain is one of many components at play in self-sovereign identity solutions. These types of solutions place the user at the center of their data exchange and are based on consent. This is what really helps improve the security and privacy of the user, being the true owner of their data,” Rodriguez said in an interview with BeInCrypto.

Privado ID leverages advanced cryptographic techniques, including Zero-Knowledge Proofs, to ensure data confidentiality.

This ensures that users can verify their credentials without exposing sensitive information. Combined with smart contracts, this method enables trustless identity verification processes, eliminating dependence on central authorities.

The primary function of blockchain in identity systems is to anchor trust. It provides a public, immutable record of credentials issued by trusted organizations, such as governments or financial institutions.

This allows users to verify the authenticity of credentials while allowing issuers to revoke them if necessary. According to Juniper Research, automation of identity and money laundering checks, combined with blockchain to verify digital identity, can save up to 50% of banks’ existing costs within a few years .

By separating data storage from verification processes, blockchain ensures security while maintaining flexibility for cross-platform use. This model is particularly effective in sectors like finance, healthcare and governance, where trust and compliance are paramount.

Challenges of blockchain-based identity systems

Despite their promise, blockchain-based digital identity systems face critical adoption limitations. One challenge is ensuring accessibility for non-crypto-native users. Rodriguez emphasizes the importance of hiding complex blockchain processes from users.

“In general, it is better to hide blockchain from end users if we are aiming for mass adoption beyond the crypto community – we are competing with the ease of use of Google and Apple. Convenience has won the battle against privacy time and time again – to win this battle we must accept that user experience is key,” Rodriguez said.

To overcome these obstacles, Privado ID uses a “light blockchain” approach. This method minimizes user interactions with the blockchain, focusing on seamless integration between networks. Interoperability between chains is another essential feature.

“Our system verifies credentials without requiring blockchain transactions, making it chain-agnostic,” Rodriguez said.

Reusable Know Your Customer (KYC) credentials are changing financial services. Users complete KYC verification once, storing credentials in decentralized tokens for use across multiple platforms.

This reduces costs for institutions while improving user privacy. Additionally, blockchain-based age verification systems are being adopted in online services and games, ensuring compliance without revealing sensitive user data.

The Future of Blockchain in Digital Identity

The evolution of digital identities is poised to redefine online trust and security. Rodriguez believes blockchain will play a central role in this transformation.

“Identity is bigger than blockchain – and its evolution in the coming years will impact every aspect of our digital lives. We’ve lived without a strong, reliable identity for years, using our social accounts as a proxy for our identity — but there’s a reason you can’t use an email address to vote or buy a house. AI will push the boundaries of our trust and sense of belonging to the point where trusted identities will become indispensable. In 10 years, we will remember the current state of the Internet as a ‘wild’ time, the same way we remember the ’90s as a ‘naive’ year,” Rodriguez said.

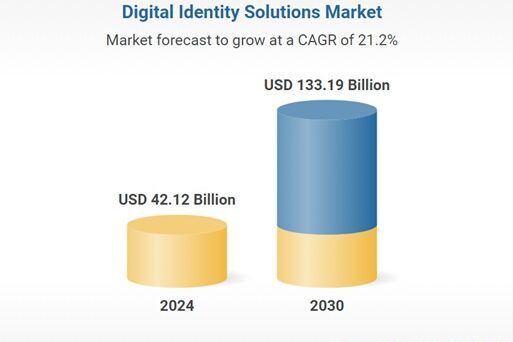

The global digital identity solutions market size is expected to grow from $42 billion in 2024 to $133 billion by 2030.

As digital identity systems evolve, they must balance privacy, security, and ease of use. Rodriguez emphasizes that user experience will be key to widespread adoption.

Blockchain’s ability to ensure transparency and security while respecting user privacy positions it as a revolutionary player in digital identity. With more innovations underway, blockchain-based identity systems are poised to transform the way we interact and transact online.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and views of industry experts and individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify the information independently and consult a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.