The US Internal Revenue Service (IRS) is setting its sights on decentralized finance (DeFi) with a game-changing tax rule that could reshape the landscape of decentralized platforms. Starting in 2027, DeFi brokers will be required to collect detailed data on user transactions, including names, addresses and trading activities, by issuing tax forms similar to those used in traditional financial markets.

The move stems from the Infrastructure Investment and Jobs Act of 2021 and aims to combat crypto tax evasion by creating parity between digital assets and traditional tax reporting standards.

The rule faces strong opposition from crypto industry leaders and legal experts, who point to significant challenges for decentralized platforms operating without centralized entities.

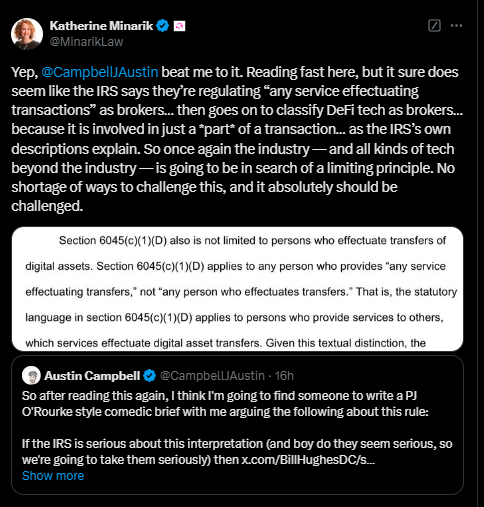

Uniswap’s Chief Legal Officer, Katherine Minarik, and CEO, Hayden Adams, have sharply criticized the IRS’ approach.

Adams hopes the rule will be overturned via the Congressional Review Act, highlighting the practical impossibility of applying traditional broker-dealer standards to decentralized ecosystems.

Bill Hughes, a legal expert at Consensys, described the rule as “all cost, no benefit,” warning of compliance burdens that could stifle innovation without tangible gains for regulators or investors.

For cryptocurrency investors, the new IRS rule promises increased transparency, which could make tax reporting for digital assets more standardized. However, making such things mandatory is considered by many to be unethical in crypto, as crypto is all about financial freedom.

DeFi platforms, which typically operate without centralized entities, could face increasing compliance costs as they attempt to adapt to these new requirements. Many small platforms, already operating on thin margins, may struggle to meet IRS demands. This could push some to relocate to crypto-friendly jurisdictions, while others could be forced to close their doors entirely.

The changes could also introduce volatility into the market as the DeFi space adapts to the stricter regulatory landscape. Investors may experience temporary disruption as platforms implement new systems to comply with the rules or seek ways to circumvent them.

Also read: New Congress, new opportunities for crypto legislation in 2025