- Endaoment sold 3,690 Ethereum tokens worth $12.47 million.

- ETH continues to consolidate while market indicators suggest a potential breakout.

Since hitting $4,109 two weeks ago, Ethereum (ETH) has struggled to maintain an uptrend. During this period, the altcoin has been trading in a consolidation range.

These market conditions have largely been associated with increased selling pressure from various entities and individuals.

Endaoment sells 3,690 ETH for $12.47 million

According to SpotOnChain, large Ethereum holders are actively selling. One of the latest entities to sell its stakes is Endaoment, a charitable fund on Ethereum.

Based on Spotonchain’s observations, Endaoment sold 3,690 ETH tokens worth $12.47 million. This is the entity’s first transaction in 10 months and its largest ever.

Notably, a significant sell-off by a large holder like Endaoment may raise concerns about selling pressure and potentially bearish sentiment in the near term. However, the fact that the sale is for a charitable cause could alleviate negative perceptions, as it is not a speculative sale by a trader.

Impact on ETH Price Charts

Despite increased selling from large holders, Ethereum continued to hold within the consolidation range between $3,500 and $3,300.

At the time of writing, ETH was trading at $3,429, marking a moderate increase of 0.21% on the daily charts and an extension of this uptrend by 2.45% on the weekly charts.

These gains indicate that Ethereum bulls are trying to take over the market and push prices up, while bears are still trying to push prices down.

According to AMBCrypto analysis, the Ethereum market remains optimistic and investors are still hoping for a price recovery.

Source: TradingView

This market sentiment is evidenced by a rising RSI and MACD. The Relative Strength Index (RSI) made a bullish crossover 2 days ago, signaling an increase in buying pressure as buyers begin to dominate. The RSI rose to 47 at press time from 42.

Likewise, the MACD line is approaching a bullish crossover, further confirming the strengthening momentum to the upside.

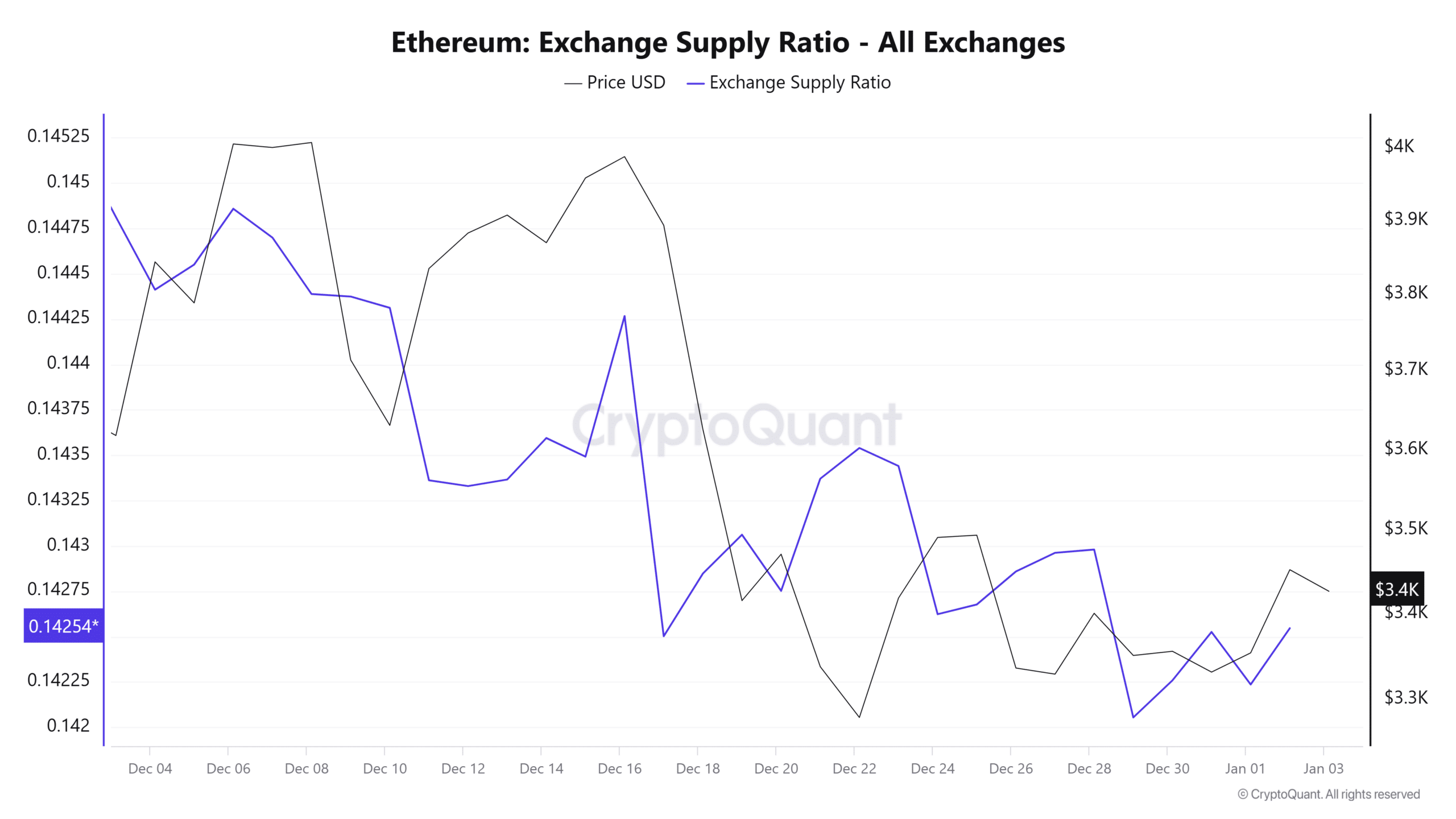

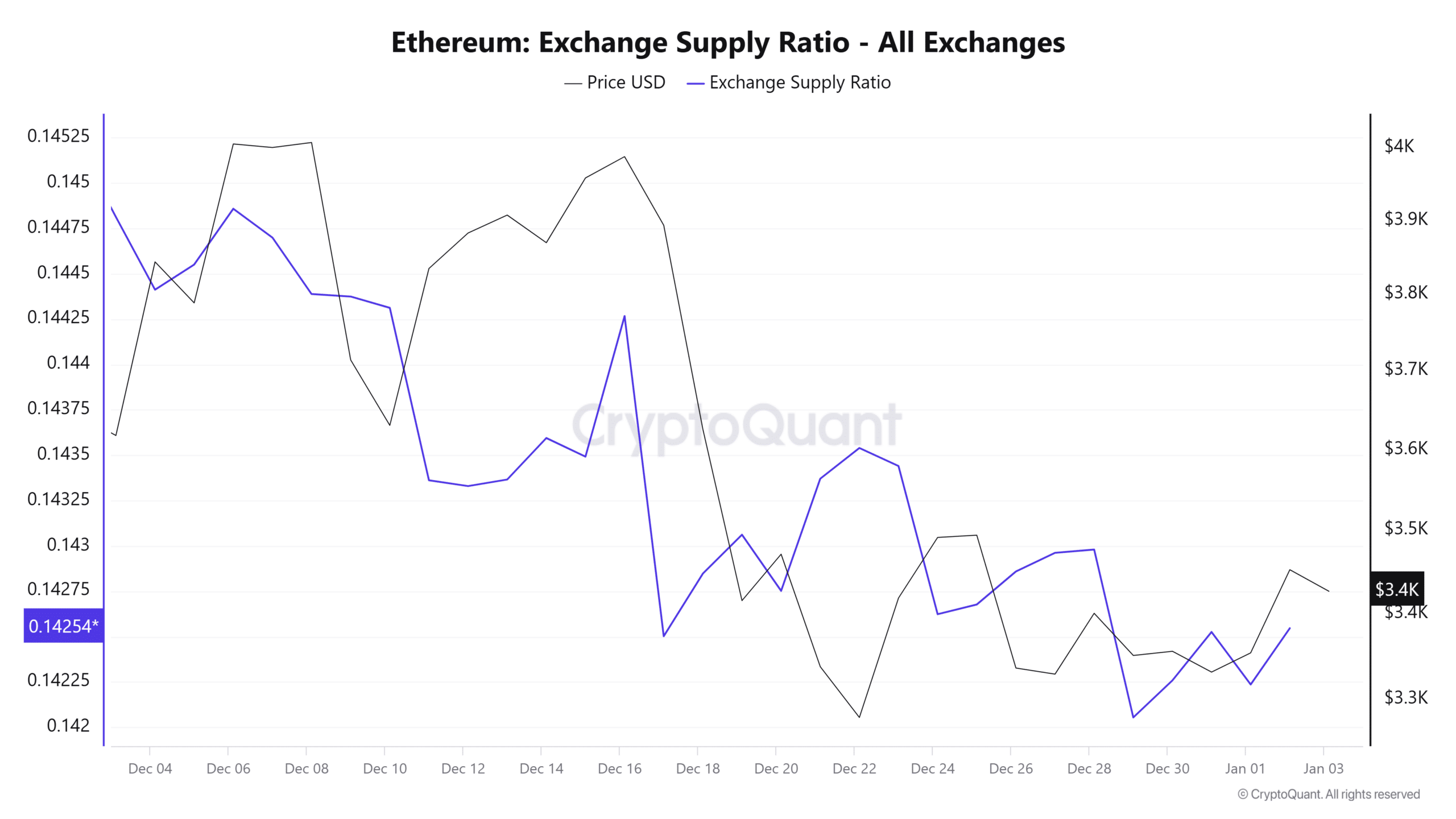

Source: CryptoQuant

Looking further, Ethereum’s exchange supply ratio has declined over the past month. This indicates that ETH outflows from exchanges have exceeded inflows.

This therefore reflects optimism since more investors are accumulating than sellers.

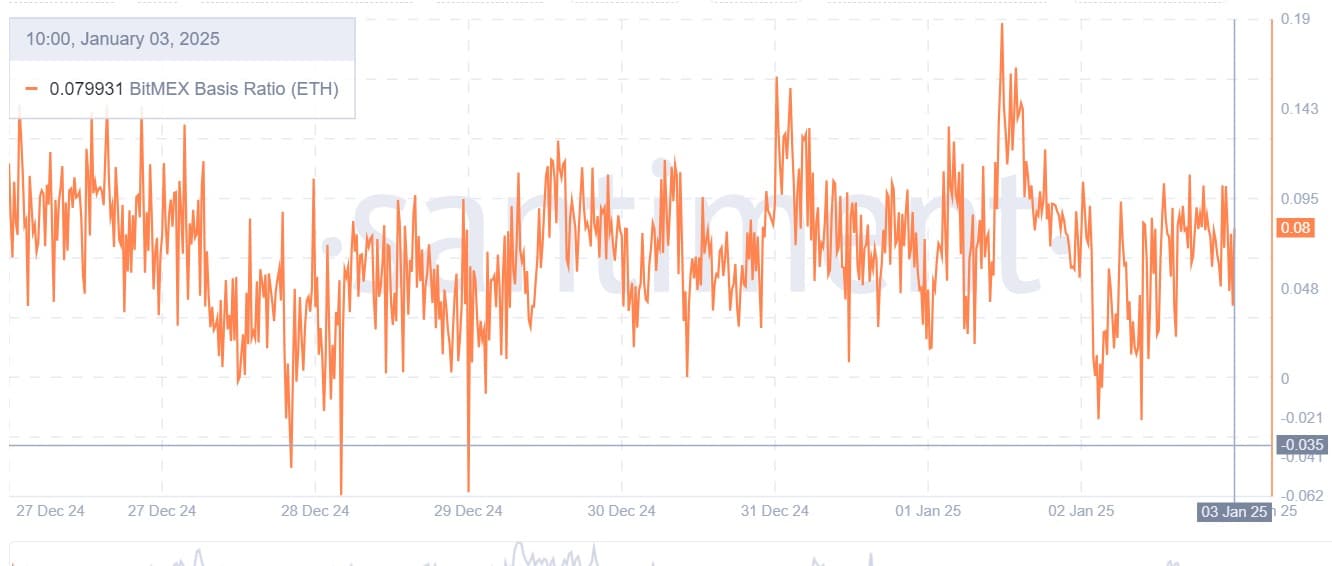

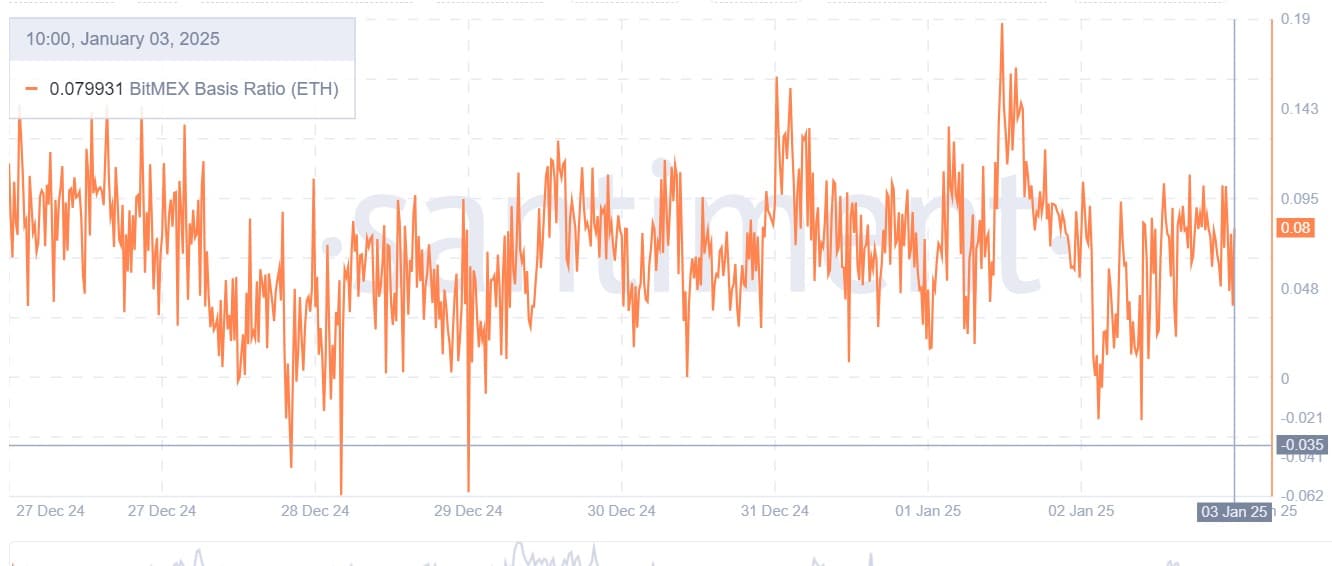

Source: Santiment

Finally, Ethereum’s Bitmex Basis Ratio has remained positive since the start of the year.

A positive basis ratio suggests that traders in the futures market are willing to pay a premium for their contracts. This reflects the optimism of the market, which expects prices to increase.

What future for Ethereum?

In conclusion, Ethereum appears stuck in a consolidation range as bulls and bears fight for market control. Therefore, even though sellers like Endaoment are active, buyers are also actively accumulating.

Read Ethereum (ETH) Price Forecast 2025-2026

If these market conditions continue, Ethereum will continue to trade between $3,300 and $3,500.

However, if bulls regain control, ETH will surpass $3,500 and find the next significant resistance around $3,700. Therefore, if sellers dominate, the altcoin will fall to $3,305.