- The cryptocurrency sector’s valuation surpassed $3.4 trillion on Friday, after increasing by $253 billion in the first three days of 2025.

- The crypto market rebound has been linked to positive speculation about Trump’s upcoming inauguration.

- The bullish moves of Michael Saylor and Elon Musk also accelerated the market recovery.

Bitcoin Market Updates: Michael Saylor’s Buying Frenzy Sparks 8% Rally

Michael Saylor, CEO of Microstrategy, announced another BTC purchase worth $209 million. Since then, the price of Bitcoin has surged 8% to hit the $98,000 mark on Friday.

- Bitcoin ETFs saw outflows of $242 million on Thursday.

- Total Bitcoin liquidations reached $222 million on Friday, with short traders’ positions of $114 million closed, accounting for x percentage of losses.

Altcoin Market Updates: Solana, Cardano and Ethereum Dominate as Investors Turn to L1 Tokens

Recent crypto market movements highlight growing investor interest in layer 1 tokens amid a positive start to 2025.

- Solana (SOL): After a brief decline to $175 in late December 2024, Solana rebounded above $200 on Friday, currently trading around $216.

- Cardano (ADA): Cardano price surged more than 30% in early January 2025, crossing the $1 mark and reaching around $1.11.

- Ethereum (ETH): Ethereum’s price rally has been relatively muted, currently trading around $3,604, an increase of 4.7% from the previous close.

Chart of the Day: Elon Musk’s Profile Photos Spark Memecoin Market Rally

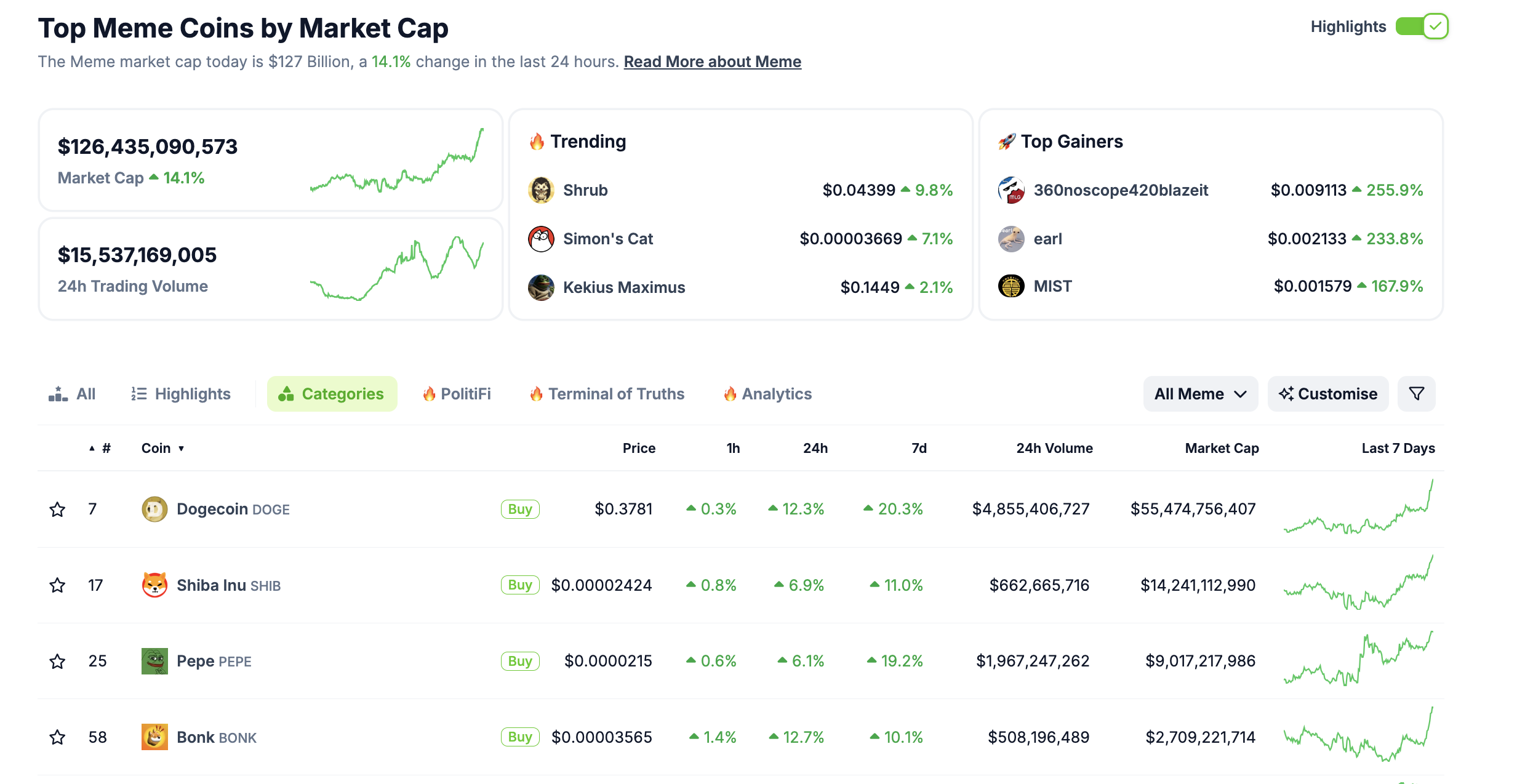

Elon Musk’s recent activity on X (formerly Twitter) has once again triggered volatility in the memecoin markets this week.

On December 31, 2024, Musk changed his profile name to “Kekius Maximus” and updated his avatar to feature the “Pepe the Frog” meme of PEPE in gladiator armor.

Memecoin Sector Performance | Source: Coingecko

Memecoin Sector Performance | Source: Coingecko

According to Coingecko data, this triggered a dramatic 900% increase in the price of memecoin “Kekius Maximus”, while PEPE’s 20% gains also saw it emerge among the top 30 performing crypto assets ranked this week .

The impact of Musk’s profile update extended beyond the memecoin “Kekius Maximus.”

Other mega-cap memecoins like Dogecoin (DOGE), BONK, and a16z also saw notable gains.

Crypto News Updates:

- Telegram launches NFT conversion for digital gifts

Telegram has unveiled a revolutionary feature that allows users to convert digital gifts into non-fungible tokens (NFTs).

These NFTs can be stored on a blockchain and traded on popular NFT marketplaces, providing a new layer of interactivity and monetization for the platform’s user base.

With this feature, Telegram users can personalize the characteristics of each NFT, adding uniqueness and rareness, making digital gifts more attractive and personalized.

By integrating NFTs, Telegram is not only capitalizing on the popularity of digital collectibles but also positioning itself at the forefront of Web3 innovation.

The move could potentially accelerate the adoption of blockchain technology within mainstream platforms, as companies explore innovative ways to improve user experience and expand monetization opportunities.

- Binance Receives Regulatory Approval in Brazil

Binance has reached an important milestone by obtaining regulatory approval in Brazil, further strengthening its commitment to global compliance and market expansion.

This approval allows Binance to further consolidate its presence in one of the largest crypto markets in Latin America, improving accessibility for Brazilian users and businesses.

The move aligns with the exchange’s broader strategy to establish operations in regions with growing crypto adoption, following similar successes in Argentina, India, Kazakhstan and Indonesia.

In addition to its growing global footprint, Binance continues to emphasize its robust compliance measures, including anti-money laundering (AML) and anti-terrorist financing (CFT) protocols.

The exchange has also established a specialist unit to help law enforcement combat crypto-related crimes, demonstrating its proactive approach to regulation.

- MARA CEO Predicts $200,000 Bitcoin by 2025, Highlights Institutional Growth

Fred Thiel, CEO of MARA Holdings, expressed confidence in Bitcoin’s long-term growth trajectory, predicting that it could reach $200,000 by 2025.

Speaking in a recent interview on FOX Business, Thiel emphasized the importance of consistent investment strategies for retail investors, citing Bitcoin’s historical annual appreciation rates of between 29% and 50%.

He also highlighted the growing role of institutional actors in strengthening the resilience and legitimacy of the Bitcoin market, highlighting its growing integration into traditional financial systems.

Thiel further noted that favorable regulatory developments under a potentially more crypto-friendly US administration could catalyze Bitcoin’s growth.

Additionally, he outlined MARA’s strategic initiatives to expand its Bitcoin holdings and mining operations, reinforcing the company’s commitment to exploiting Bitcoin’s long-term potential.

According to Thiel, these factors collectively position Bitcoin as a transformative asset class capable of generating substantial returns over the coming years.

- FTX begins process of repaying $16 billion from creditors

The FTX domain has officially launched its repayment plan, more than two years after the stock market crash in November 2022.

Convenience class creditors with claims less than $50,000 are given priority and receive 119% of their authorized claims within 60 days, amounting to $1.2 billion.

Larger claims exceeding $50,000 will be distributed over time from a pool of $10.5 billion.

BitGo and Kraken have been designated as platforms to facilitate upfront payments for eligible customers.

According to the court ruling, creditors must complete KYC verification, submit tax forms and integrate distribution platforms to qualify for upfront payments.

Analysts predict that around $2.4 billion could re-enter the crypto market from these refunds, although restrictions on certain applicants and entities may limit reinvestment.

This development marks a crucial step in resolving FTX’s financial obligations and closing one of the largest crypto business collapses in history.