- A whale sold 19,001 AAVE tokens worth $6.5 million.

- AAVE decreased by 1.71% in the last 24 hours.

Over the past two days, Aave (AAVE) fell from a high of $361 to $335. The decline comes as big operators have turned to profit-taking, trying to maximize the New Year’s pump.

According to SpotOnChain, a whale sold 19,001 Aave tokens worth $6.5 million through Binance. Through this sale, this whale made a huge profit of $4.93 million.

This is the first sale since the whale began accumulating the altcoin in 2024. The whale withdrew 89,109 tokens worth $7.36 million in June. After the recent deposit, the whale still holds 70,108 AAVE tokens worth $23.65 million.

When whales start selling, it either shows their lack of confidence in the market or an attempt to maximize profits after a price rise.

Such selling activity is generally likely to cause selling pressure, as investors might view the selling as bearish sentiment, leading to lower sales.

Impact on price charts?

As expected, the increase in selling activity hurt AAVE’s price charts. In fact, at the time of writing, AAVE was trading at $339.

This represents a decline of 1.71% on the daily charts. Before the decline, the altcoin was on an upward trajectory, rising 19.34% monthly.

Source: TradingView

Although the altcoin fell on its price charts as the whale started selling, it seems that all market participants have turned bearish and expect prices to fall.

This is evidenced by the bearish crossover of the relative strength index (RSI) that appeared over the last 24 hours. This confirms that sellers have entered the market and still dominate.

Additionally, the Chaikin Money Flow (CMF) is negative at -0.02, once again confirming the strong selling pressure.

Source: In the block

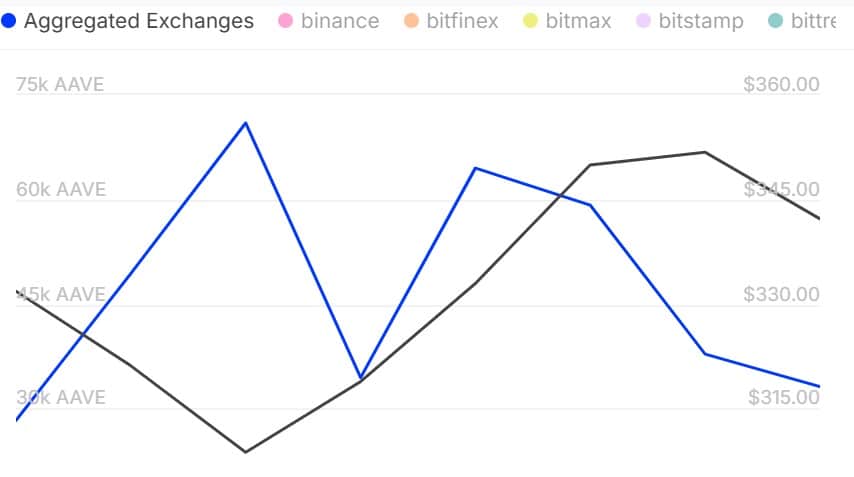

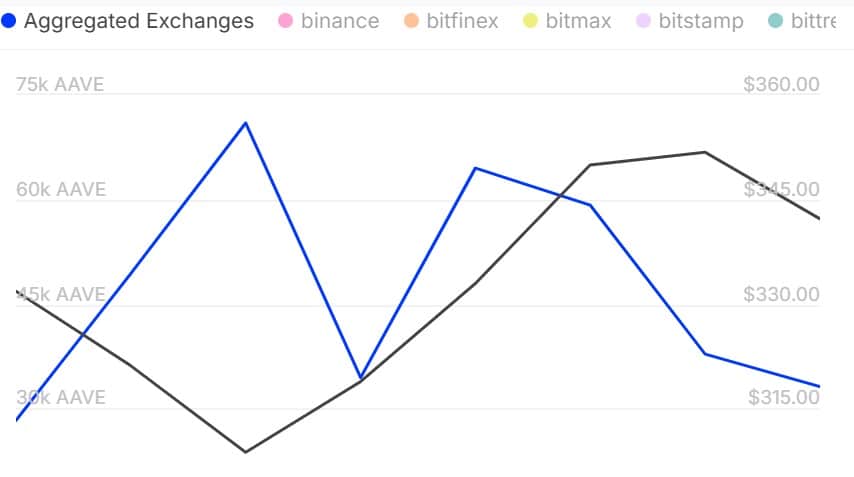

Looking further, we can see this downward trend through the decline in on-chain release volume. According to IntoTheBlock, release volume increased from 59.22k to 33.19k.

This shows that more and more investors are keeping their AAVE tokens on exchanges.

Source: In the block

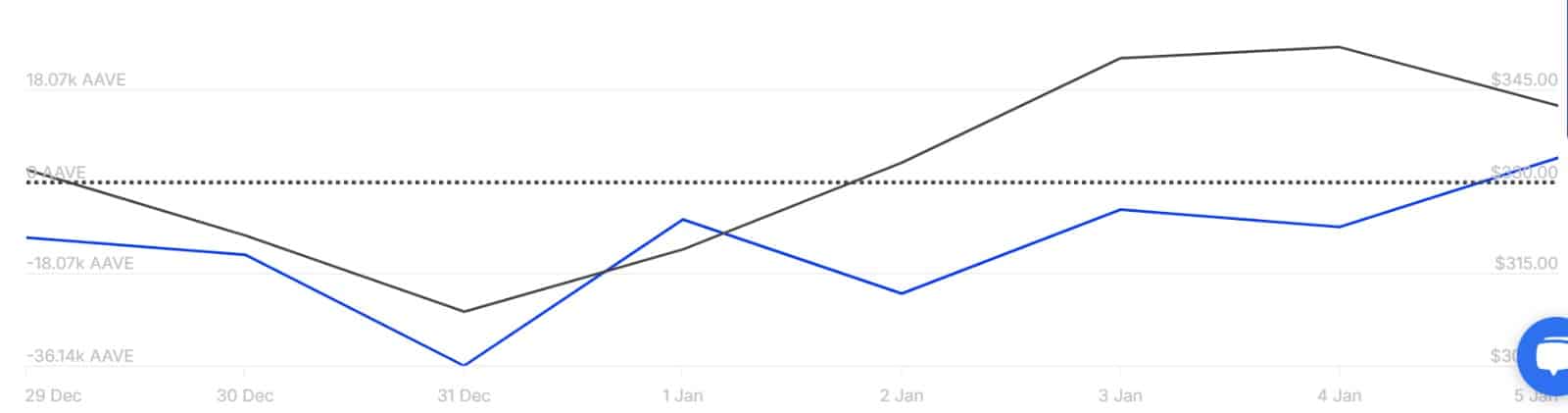

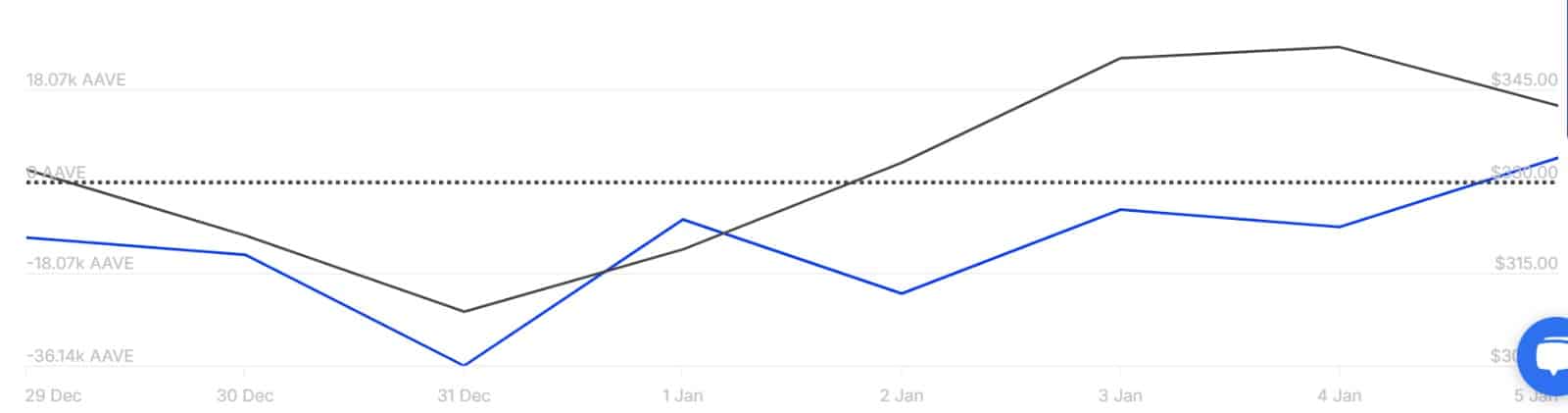

This phenomenon is also highlighted by the increase in net flows which went from -22.02k to 4.57k. This shows that more investors are moving their tokens to exchanges than those accumulating them. Such trends suggest that investors are pessimistic and expect prices to fall.

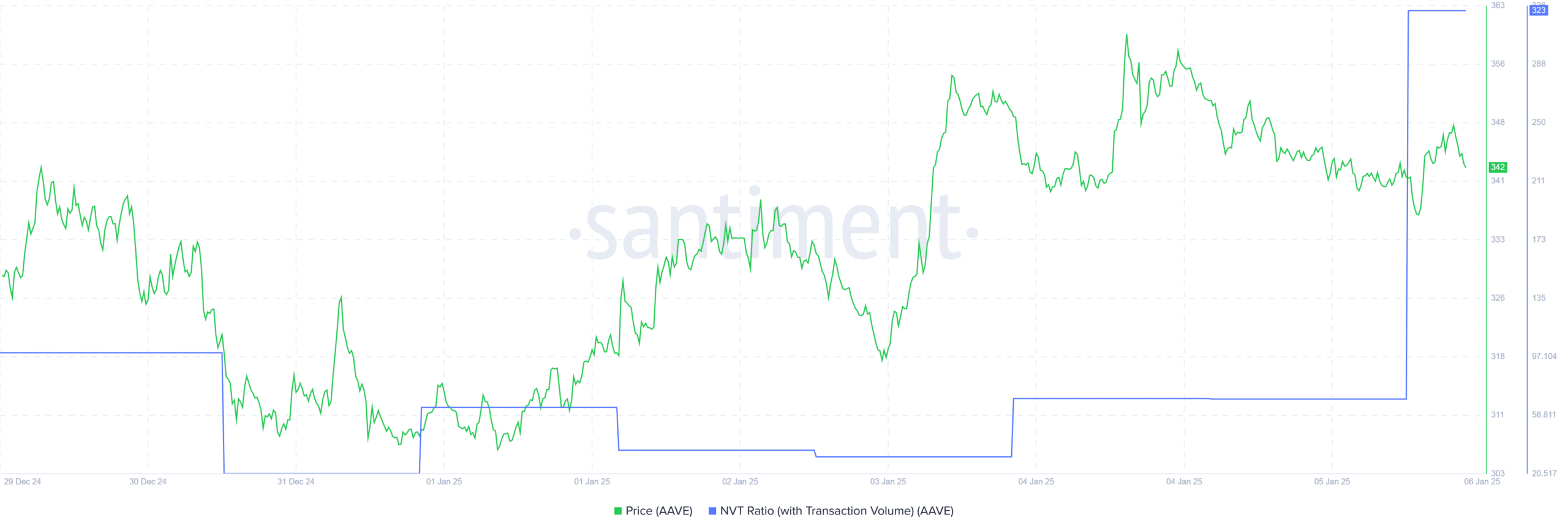

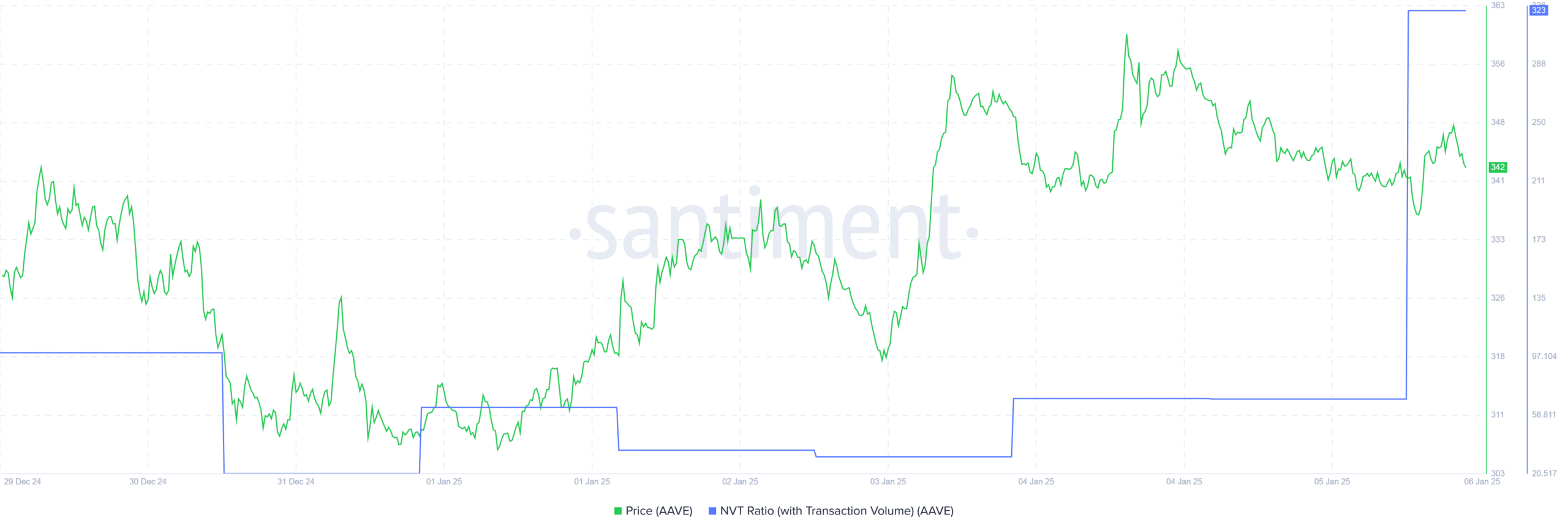

Source: Santiment

Finally, AAVE’s NVT ratio with trading volume has reached extreme levels (323), which is associated with a potential market correction. This increase indicates that the number of active users of the network has decreased relative to its market capitalization.

Historically, a high NVT ratio often precedes market corrections because there is a mismatch between prices and market fundamentals.

Read Aave (AAVE) Price Prediction 2025-2026

In conclusion, although whale selling is associated with increased selling pressure, this is not an isolated case as investor sentiment has turned negative, but only in the short term.

If these market conditions continue, AAVE could fall to $324. If buyers re-enter the market, a reversal could see the altcoin reclaim $354.