Join our Telegram channel to stay up to date with the latest news

BitMEX co-founder Arthur Hayes predicts that Bitcoin and the rest of the crypto market will peak in March this year before experiencing a sharp correction.

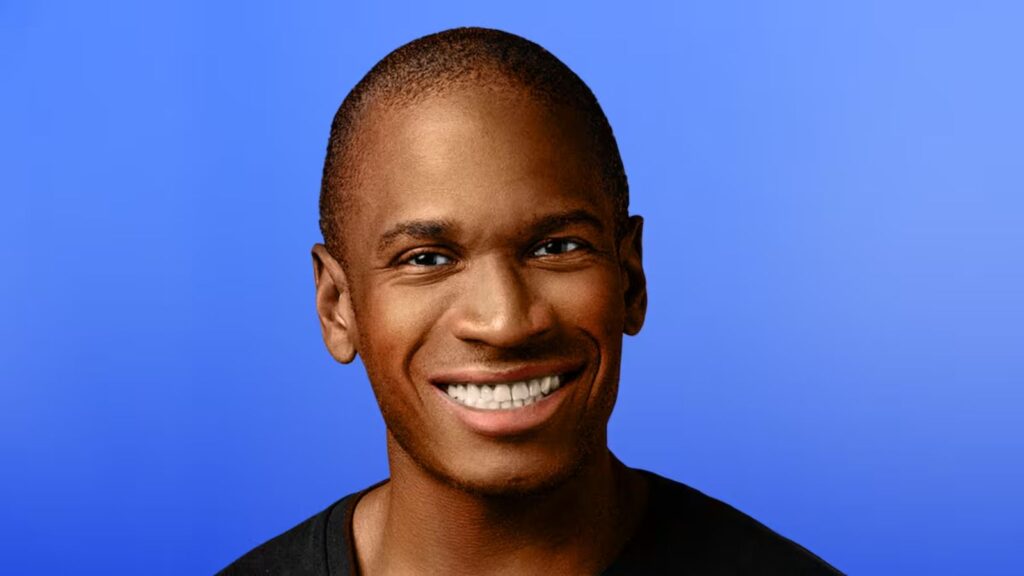

In a January 7 blog postHayes said his prediction was based on how he thought the U.S. dollar’s liquidity environment would play out in the first quarter of 2025, as Donald Trump prepares to enter the White House for his second term.

Arthur Hayes says other sources of liquidity will offset Fed quantitative tightening

According to HayesUS dollar liquidity will continue to fuel optimism in the crypto market. However, he warned that recent policy changes from the US Federal Reserve and the Treasury Department will likely influence the price trajectory of BTC in the coming months.

Hayes estimates that the Federal Reserve will continue quantitative tightening through the middle of the year, at a rate of about $60 billion per month. If this happens, it will reduce the overall liquidity of the financial system, according to the BitMEX founder. Hayes said, however, that he was not too perturbed by the potential strain on liquidity levels towards the middle of the year.

“Sasa” is an essay where I explain and I think #crypto reaches its maximum in mid-March, then corrects severely. In the meantime, it’s time to dance. pic.twitter.com/LKQ24GMtpq

-Arthur Hayes (@CryptoHayes) January 6, 2025

Indeed, he believes that other sources of liquidity will partly alleviate these concerns. He added that the Treasury would likely inject liquidity into the market, if necessary, through its Treasury General Account (TGA), by spending funds rather than issuing debt.

Collectively, Hayes forecasts an injection of $612 billion into US dollar liquidity markets by the end of March this year.

The Trump Bump phase could end after the first quarter of 2025

With the dollar’s possible liquidity crisis, Hayes believes the Trump buzz will begin to fade after the first quarter of 2025. He subsequently anticipates a broader and severe correction in the crypto market as fiscal support and monetary will begin to decline.

There is also the upcoming tax season in mid-April which will likely contribute to the liquidity crunch and hit investors. feelingHayes warned.

Related articles:

Newest ICO Coin – Wall Street Pepe

- Audited by Coinsult

- Early Access Presale Cycle

- Private Trading Alpha for the Army $WEPE

- Staking Pool – High Dynamic APY

Join our Telegram channel to stay up to date with the latest news