The total market capitalization of the cryptocurrency space has fallen by more than $60 billion in the past 24 hours due to a combination of factors, including reduced expectations of lower interest rates in the Federal Reserve and a potential massive sale of BTC from the US government.

Stock markets began falling earlier in the week after U.S. job openings rose more than expected in November, a potential sign of a tightening labor market. At the same time, Treasury yields rose significantly, with the 10-year U.S. Treasury interest rate jumping about 5 basis points to now stand at 4.693%.

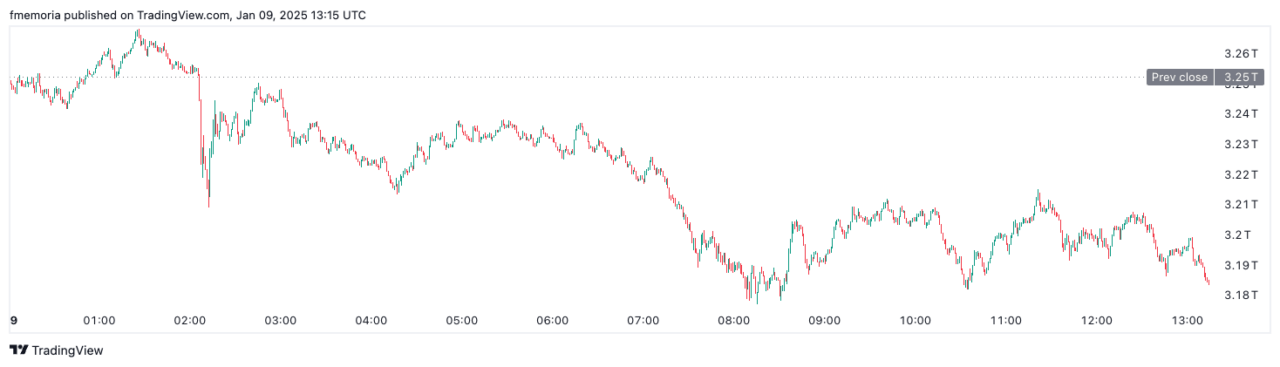

The crypto market sell-off has caused the price of bitcoin to plummet to $93,000, while ether is now trading at $3,280, with both cryptocurrencies having lost more than 2% of their value in recent 24 hours. The crypto market as a whole has lost a similar amount of value to now reach a total market cap of $3.18 trillion.

The drop also came when the U.S. government was allowed to sell 69,370 bitcoins worth about $6.5 billion seized from the now-defunct Silk Road darknet marketplace.

As reported DB News and confirmed by court documents, Chief U.S. District Judge Richard Seebord denied a motion to block the forfeiture of the seized Bitcoin, allowing the U.S. Department of Justice to proceed with the sale of $6.5 billion in Bitcoin .

This potential sale could take place just before President-elect Donald Trump takes office and makes the upcoming political theater intriguing, given his pro-crypto stance and proposals, such as establishing a strategic reserve of Bitcoin using the seized funds.

Ki Young Ju, CEO of CryptoQuant, highlighted that last year, a staggering $379 billion entered the cryptocurrency market, indicating an inflow of around $1 billion per day. He further suggested that the $6.5 billion sale could be absorbed within a week.

Blockchain data reveals that the wallet associated with the seized funds has not yet transferred any of its coins.

Featured image via Pexels.