- This upward movement indicates increased market interest in AIXBT, likely influenced by the whale’s investment.

- Despite this, the token’s MVRV has yet to reach extreme levels often associated with market highs, suggesting that the rally could extend if buying momentum remains robust.

A recent acquisition of 3.47 million aixbt by Virtuals (AIXBT) tokens, valued at approximately $1.96 million, has attracted the attention of the cryptocurrency community.

This purchase by a prominent investor highlights the growing interest in AIXBT and suggests potential implications for its market dynamics.

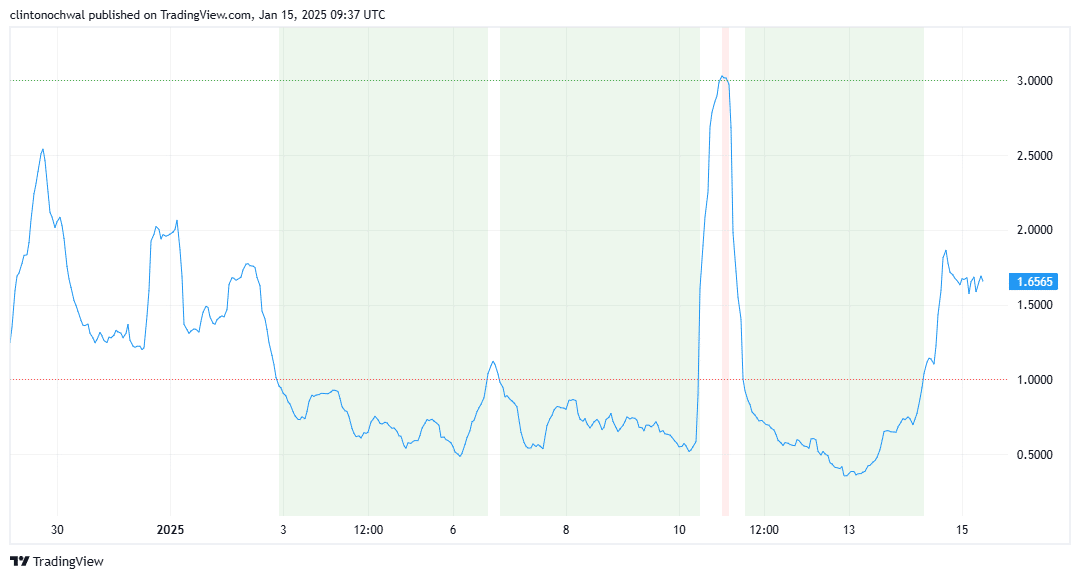

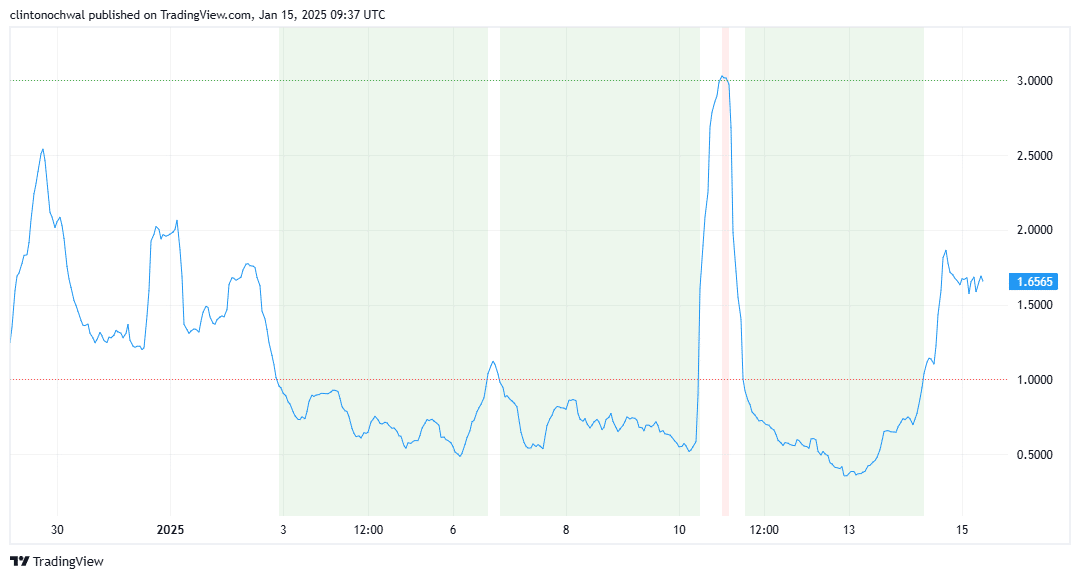

Price Action Analysis

Following the Whale acquisition, the price of AIXBT experienced notable volatility. The token’s value rose from an intraday low of $0.5503 to a high of $0.7456, reflecting increased buying pressure.

This upward movement indicates increased market interest, likely influenced by the whale’s investment.

However, such rapid appreciation may attract short-term traders looking for quick profits, which could lead to increased volatility. If buying pressure persists, AIXBT may test higher resistance levels. Traders should remain cautious of potential corrections.

How has social volume increased?

AIXBT’s social engagement increased after the whale purchase, as traders and enthusiasts discussed the market implications.

According to social analytics platforms, mentions of AIXBT increased by more than 150% in 24 hours. This sharp increase in social volume often correlates with increased interest from retailers, which could lead to near-term price increases as investors respond to community buzz.

Prominent cryptocurrency influencers have amplified discussions about AIXBT, attracting new participants to the token. This growing attention has increased its visibility among traders looking for opportunities in trending assets.

Analysis of active addresses

A slight increase in the number of active addresses interacting with AIXBT was observed, suggesting an increase in user engagement and transaction activity.

This rise may indicate growing adoption or speculative trading following the purchase of the whale.

A sustained increase in the number of active addresses often reflects a healthy network with high user participation. If the trend continues, this could demonstrate long-term confidence in AIXBT. Conversely, a decline could suggest reduced interest or profit-taking by short-term investors.

Market value versus realized value indicates…

Recent whale activity has pushed AIXBT’s MVRV into overvalued territory, surpassing the critical threshold of 1.2. This indicates that the token’s market capitalization far exceeds the average price at which current holders acquired their tokens.

Source: TradingView

High MVRV levels suggest that many investors are holding unrealized profits, potentially increasing the likelihood of selling pressure. AIXBT’s current MVRV hints at a possible price correction as traders realize gains, particularly if overall market sentiment turns cautious.

Despite this, the token’s MVRV has yet to reach extreme levels often associated with market highs. This suggests that the rally could extend if buying momentum remains robust.

If MVRV begins to decline as prices stabilize, this could signal a healthier consolidation phase.

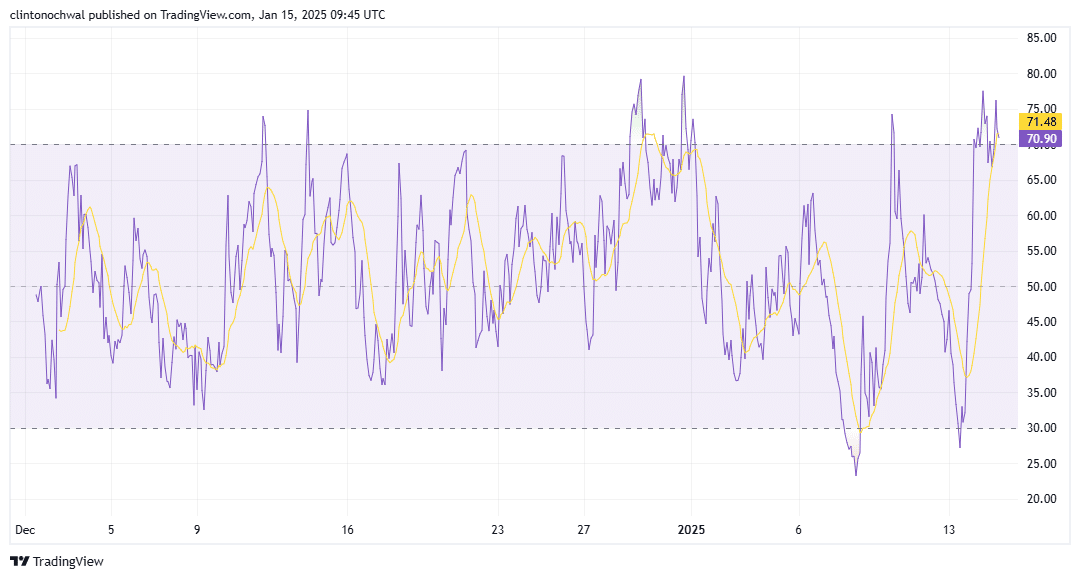

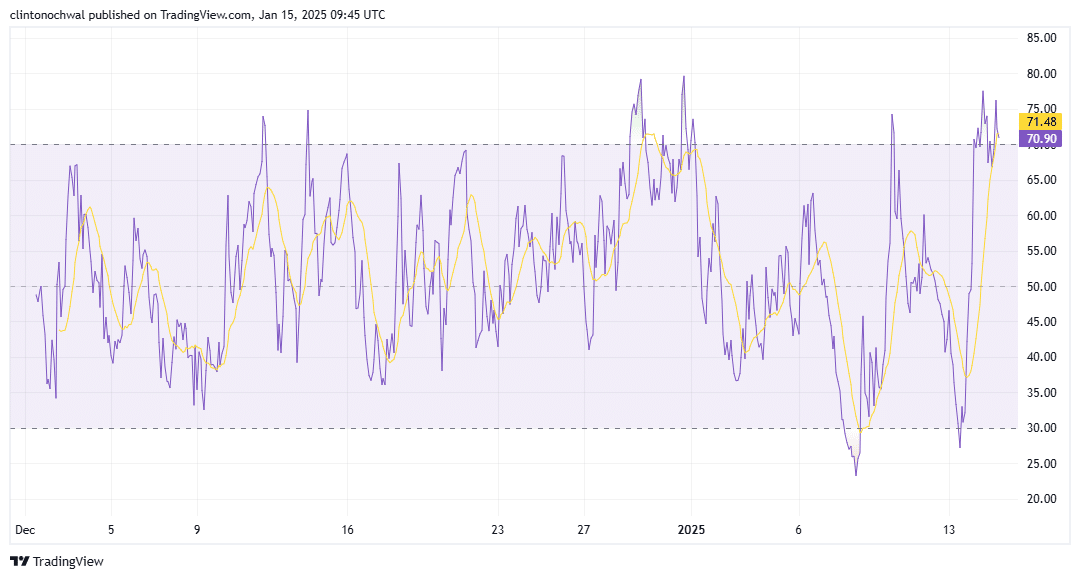

The RSI in the overbought region suggests…

AIXBT’s Relative Strength Index (RSI) has entered overbought territory, surpassing the 70 mark. This suggests that the token may be overvalued in the near term, which could lead to a price correction.

Source: TradingView

An RSI above 70 is often associated with buying momentum, but it can also precede a reversal as traders begin to take profits. If the RSI begins to decline, it could signal a weakening of the current uptrend.

Read aixbt price prediction by Virtuals (AIXBT) 2025-2026

In conclusion, the whale’s substantial investment in AIXBT has introduced significant momentum to the token market.

Although the immediate impact has been positive, with prices rising and interest increasing, traders must remain vigilant.