- Large holders, commonly known as whales, have started dumping their ENA tokens amid declining confidence in the asset.

- The last 24 hours have seen a significant increase in the number of active addresses, suggesting increased sales activity among traders.

Ethena (ENA) has struggled over the past month, recording a 22.58% drop in value due to prevailing bearish sentiment.

Despite these challenges, the token saw a brief resurgence over the past 24 hours. Its price rose by 10.66% and trading volume by 53.77%, indicating a change in sentiment.

However, continued selling pressure from investors has limited ENA’s rebound potential, leaving the asset vulnerable to further declines.

Whales persist in selling ENA, prolonging pressure

AMBCrypto reported that a major investor, holding between 0.1% and 1% of ENA’s total supply, recently sold $6.46 million worth of tokens. This sale triggered a price drop of 9.84%.

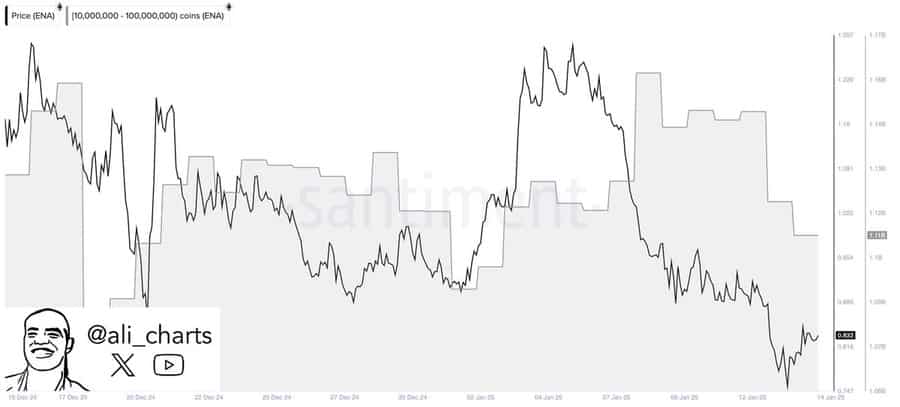

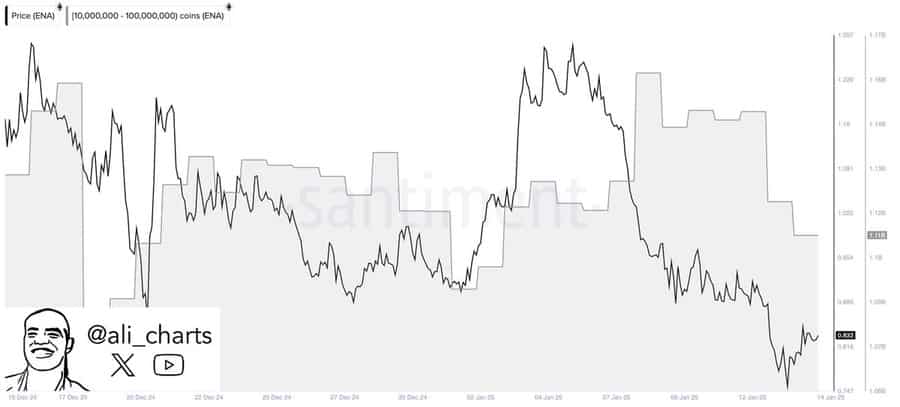

This trend has continued over the past 24 hours, according to Santiment data, with groups of large investors dumping over 50 million ENA tokens.

Santiment identified these large investors as addresses holding between 10 and 100 million ENA.

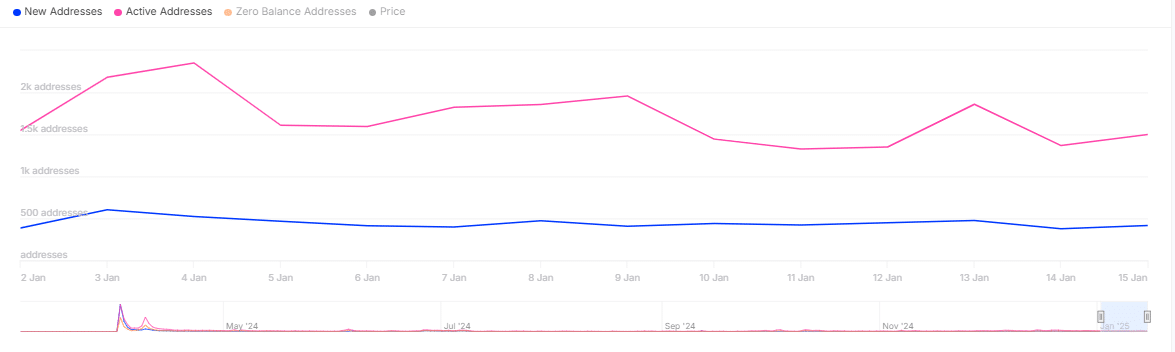

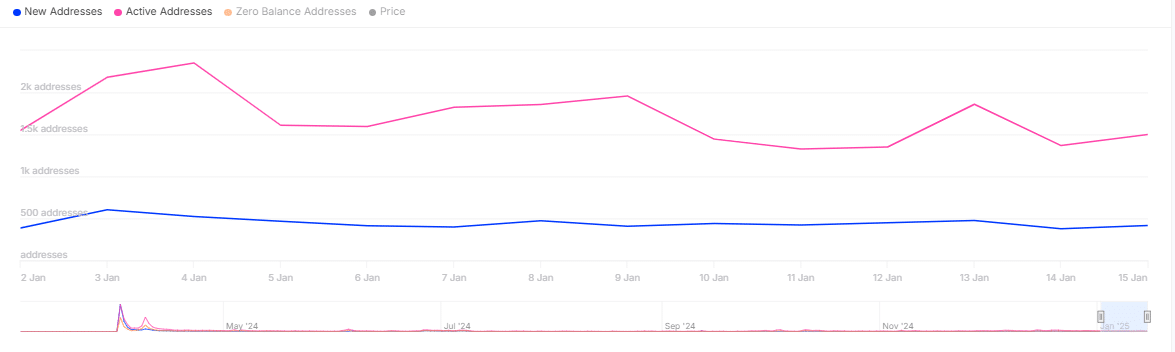

Source: Santiment

Mass sales from these cohorts often lead to further price declines, stifling the asset’s potential for upward momentum.

AMBCrypto looked at additional data to better understand the situation.

Whales Drive ENA Selling as New Entrants Exit

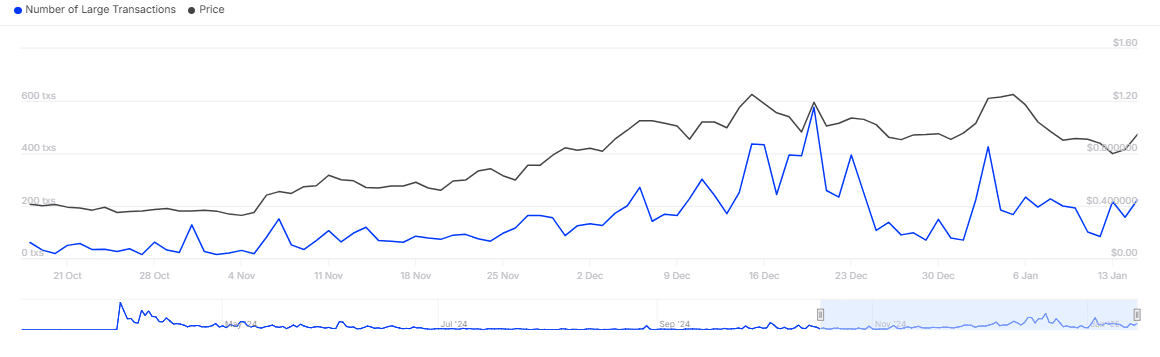

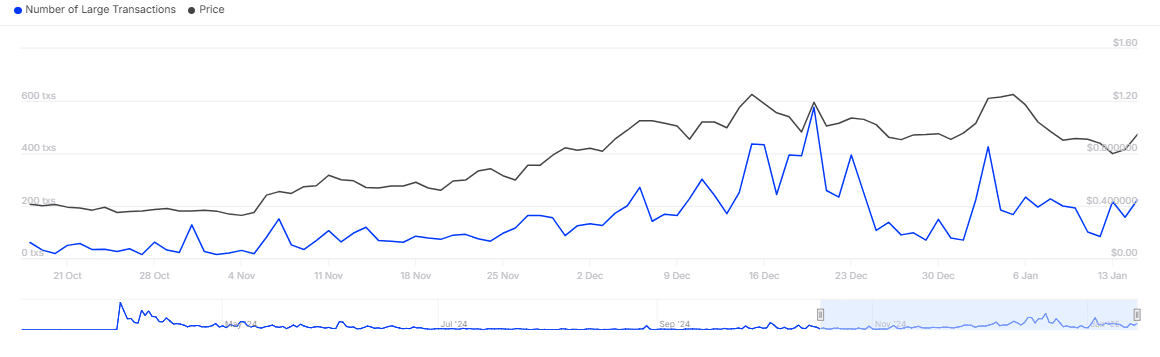

Whale-driven sales intensified, with 224 transactions recorded, the highest number in the past week, according to data from IntoTheBlock.

A total of 50.64 million ENA, valued at $47.9 million, were unloaded during this bearish wave involving large investors and market players.

Source: In the block

The number of active addresses notably increased over the last 24 hours, but it remains 19.27% lower than the previous week.

This indicates that a new cohort of large investors may be driving the sell-off, contributing significantly to the overall total of 1,500 active addresses, as retail players increasingly join the trend.

Source: In the block

Additionally, with active addresses dropping over the past week and new addresses dropping by 11.81%, market sentiment appears firmly on the bearish side.

Further decline could be on the horizon

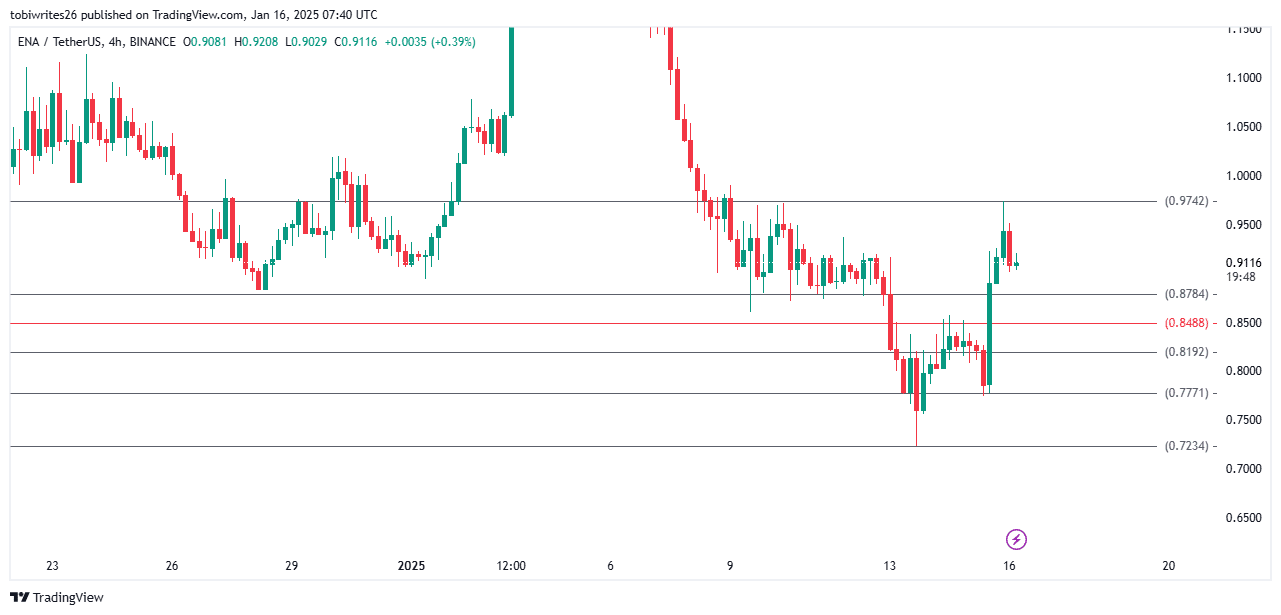

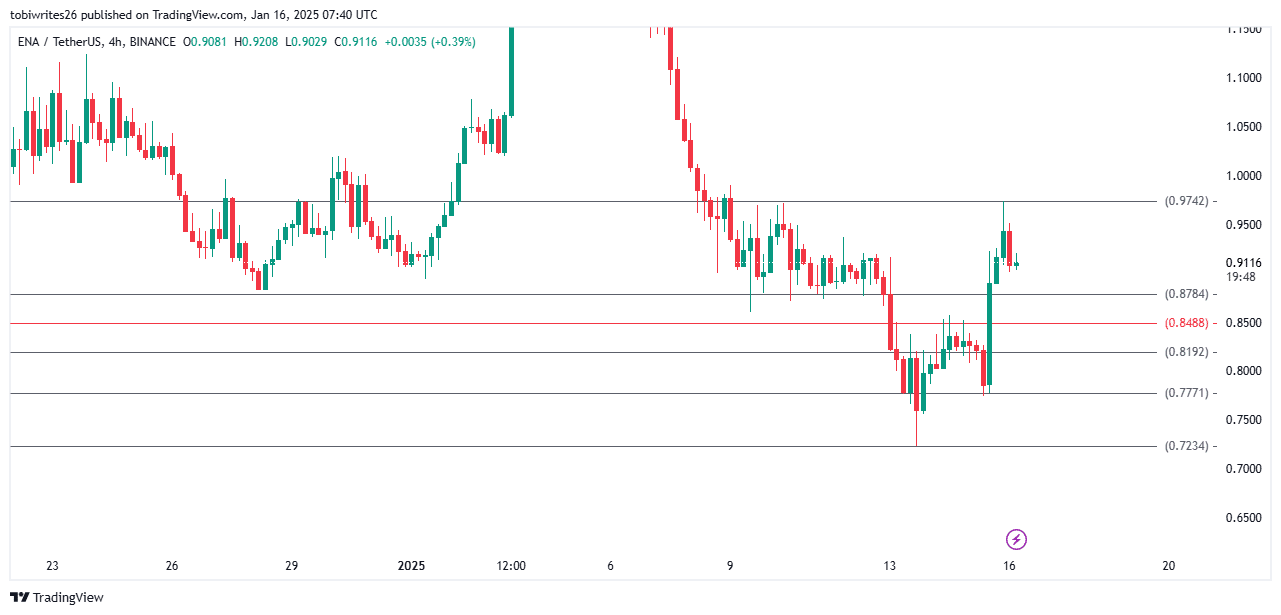

The ENA finds itself in a precarious position on the chart. Its rally from the previous day stalled after reaching the resistance level of $0.9742, identified by the Fibonacci retracement.

From this point on, ENA’s trajectory depends on its reaction to the $0.8784 support level, which it is currently approaching.

Source: TradingView

Failure to sustain or rebound from this level would indicate a significant loss of trader confidence, which could push the price down to support levels below $0.7771, or even $0.7234, thus leading to additional losses for investors.

Read Ethena (ENA) Price Prediction 2025-26

If whale sales persist, alongside retail and a continued decline in new address adoption, ENA could face further downward pressure, putting it at risk of deeper price erosion.