- A whale recently moved over $1 billion worth of BTC to Coinbase, a move that highlights increased institutional demand for the asset.

- Bitcoin could experience a slight retracement before resuming its upward trajectory in the coming days

Bitcoin has surpassed the psychological threshold of $100,000 for the fifth time, recording gains of 3.39% over the past 24 hours. This follows a week of accumulation by buyers, totaling a 7.93% rise on the weekly charts.

The price of the cryptocurrency could soon climb further, as growing institutional demand and whale activity appear to align.

Massive whale movement responds to US institutional demand

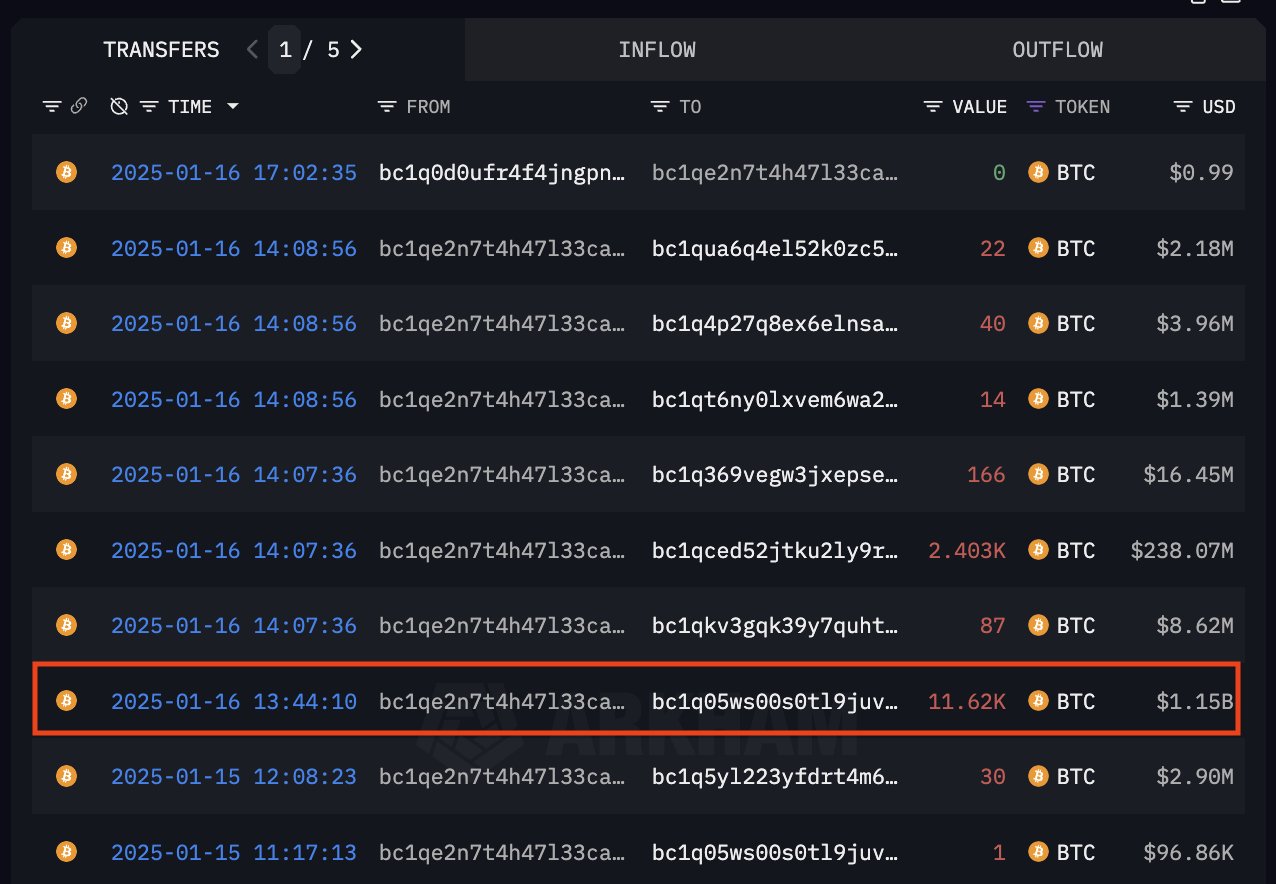

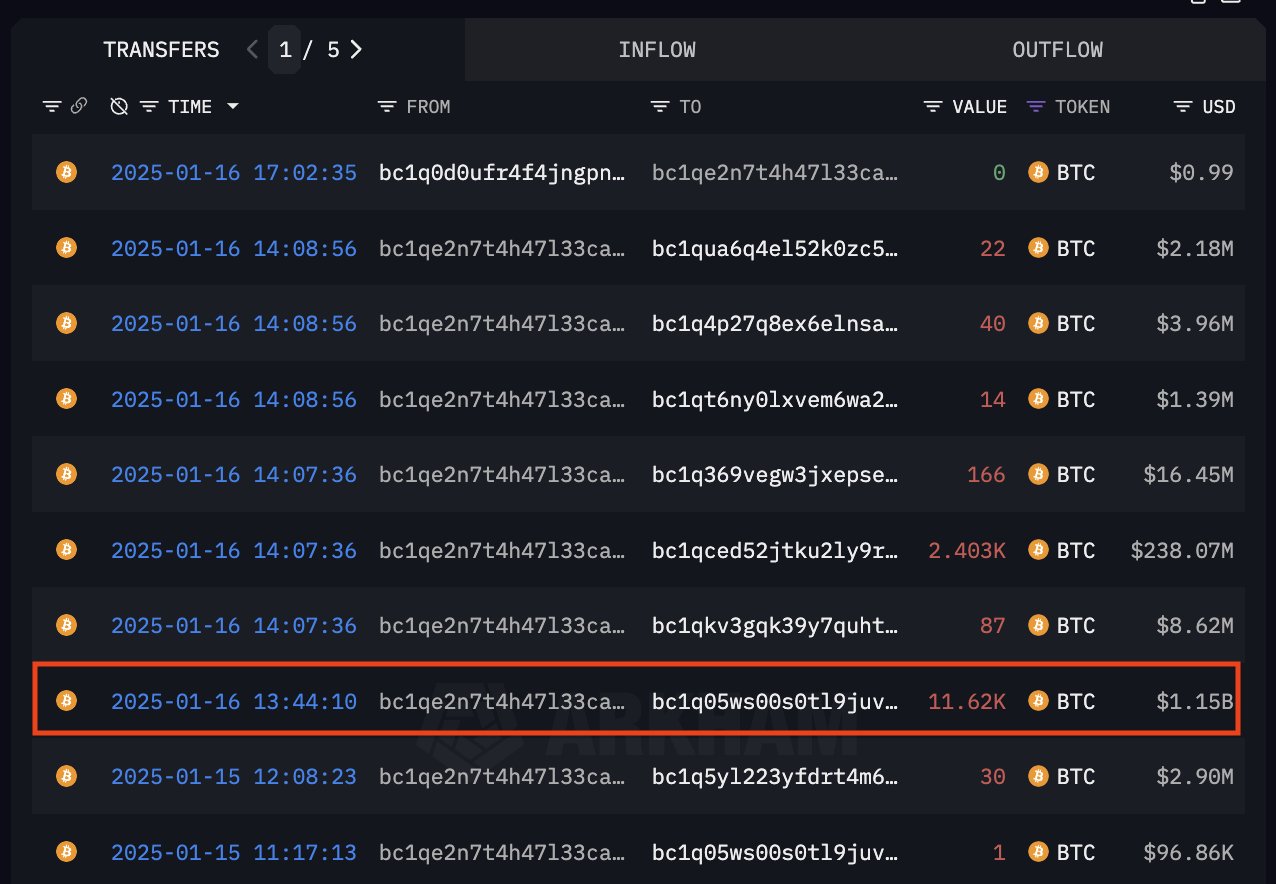

A significant increase in whale activity – addresses holding significant assets – has been observed over the past 24 hours. Notably, a whale holding around $2.7 billion worth of BTC moved around $1.05 billion into Coinbase Prime.

Source:

This whale accumulated most of its BTC between September 9 and 11, 2024, when the price ranged between $54,000 and $56,000. This was just a few months before the cryptocurrency surpassed the $100,000 threshold.

In most scenarios, large asset transfers from private wallets to exchanges are considered bearish, as they often indicate plans to sell. However, in this case, the move likely highlights strong demand for BTC, as evidenced by the recent price trajectory.

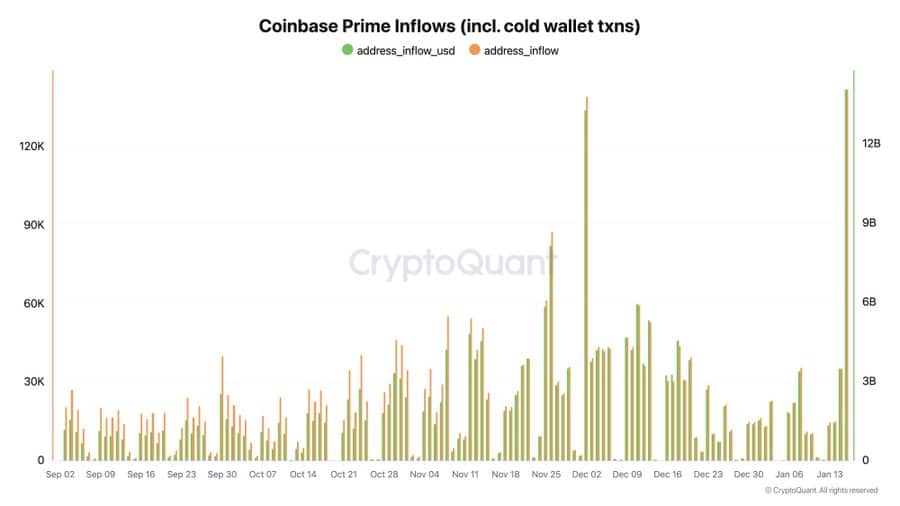

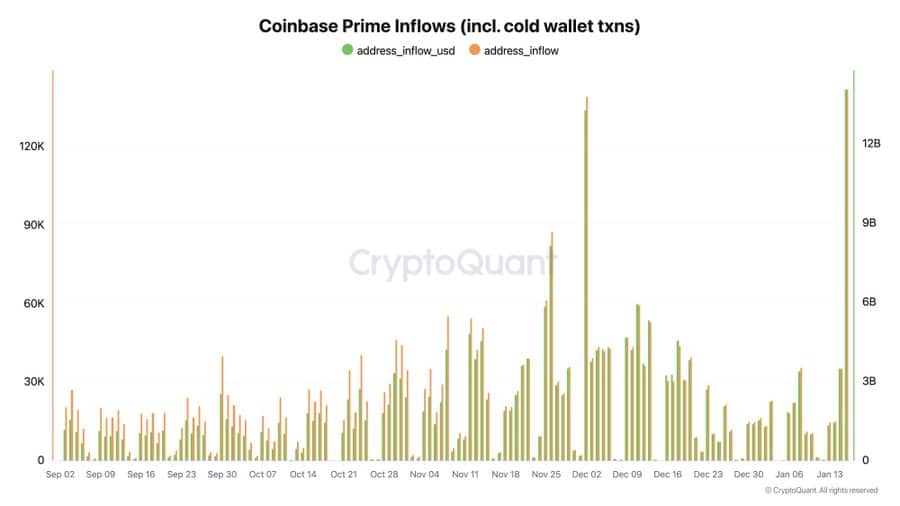

In fact, according to CryptoQuant, when large inflows occur in Coinbase Prime Brokerage, it often signals increased demand for the asset among institutional investors.

Crypto analyst Ki Young Ju commented:

“US institutions’ preferred Bitcoin buying channel suggests several over-the-counter (OTC) transactions are currently underway.”

Over-the-counter transactions involve private transactions between buyers and sellers, bypassing public exchanges to avoid slippage or significant market impact.

Source: CryptoQuant

As the chart above shows, inflows into Coinbase Prime have increased significantly over the past week, reaching levels last seen in December 2024, just before BTC hit its all-time high of 108,135 $ on December 17. If this trend continues, Bitcoin could reach a new all-time high in the coming weeks.

Although market sentiment remains optimistic, a short-term pullback is possible before BTC resumes its upward trajectory.

Local peak, slight decline

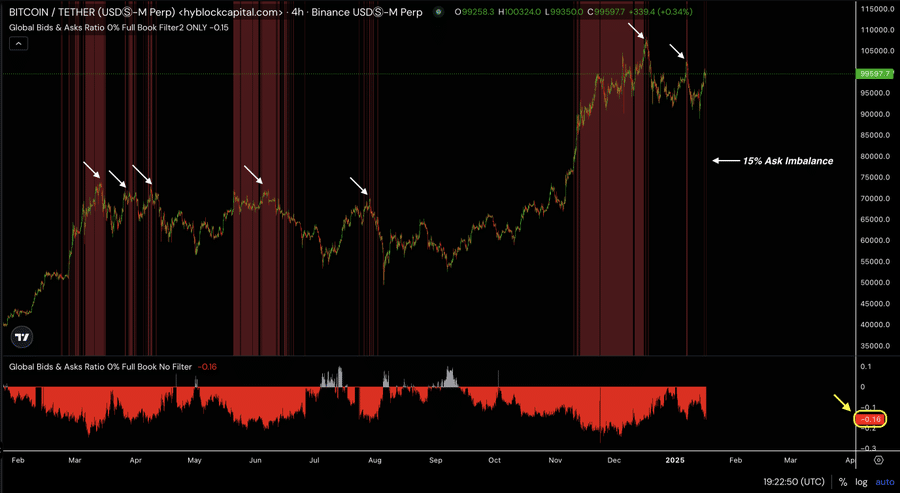

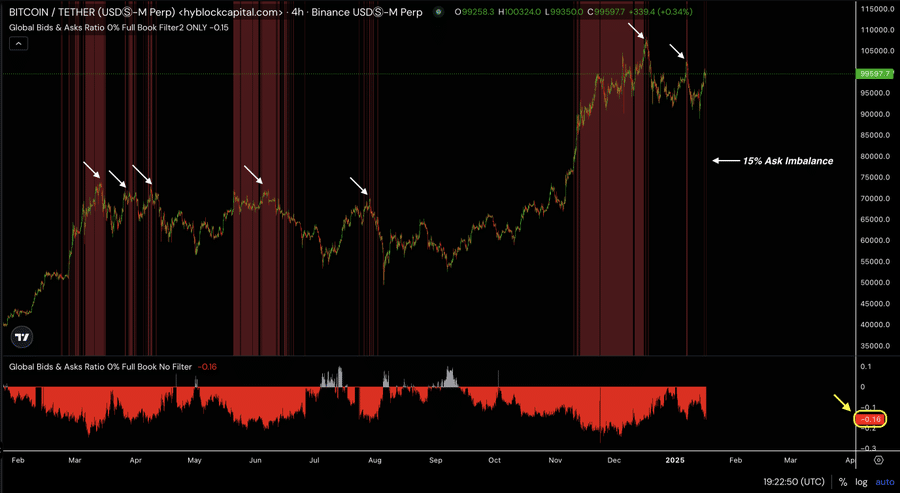

According to Hyblock Capital, there is a requested imbalance of 15% on BTC. This implies that the asset has likely reached a local high, with an increase in sell orders as well.

Source: HyblockCapital

Historically, this trend has occurred seven times, as reflected in the chart. In each case, Bitcoin experienced a slight retracement down before resuming an upward movement.

If history repeats itself, BTC could see a slight pullback before continuing its upward trajectory and potentially hitting a new all-time high.