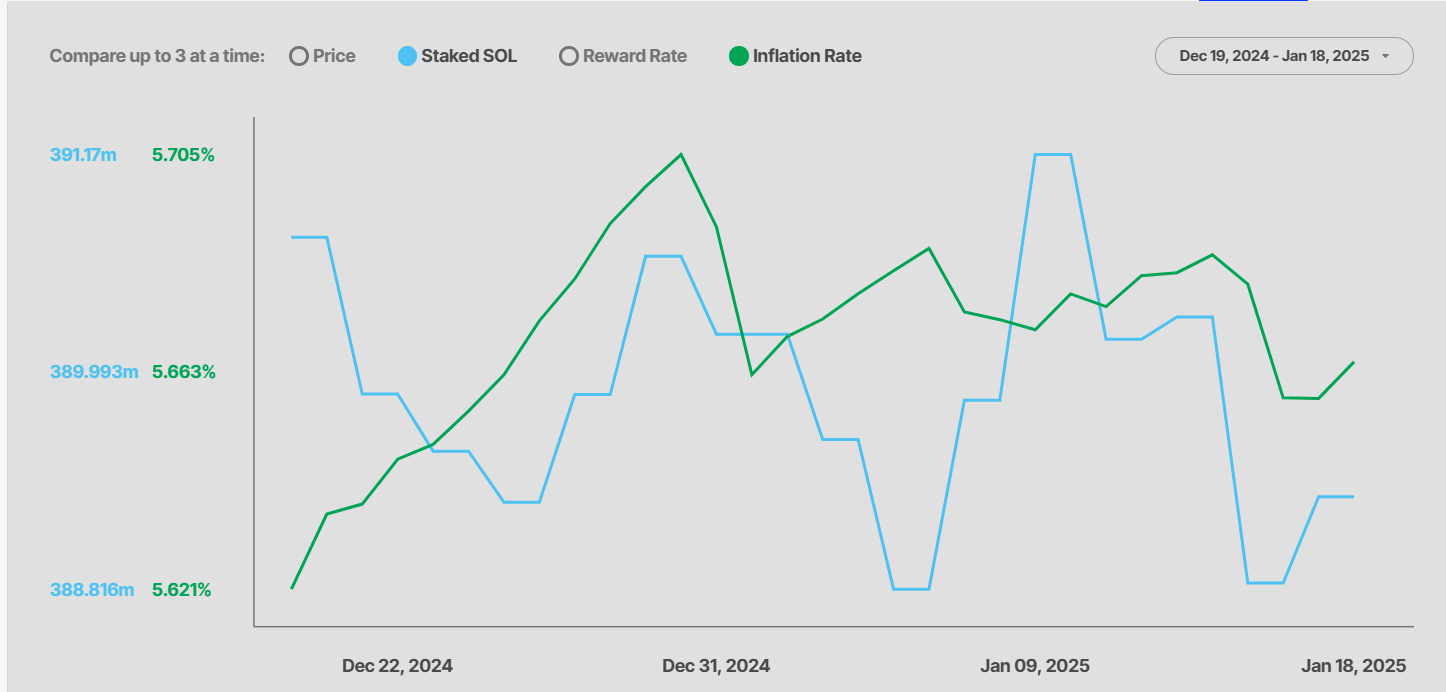

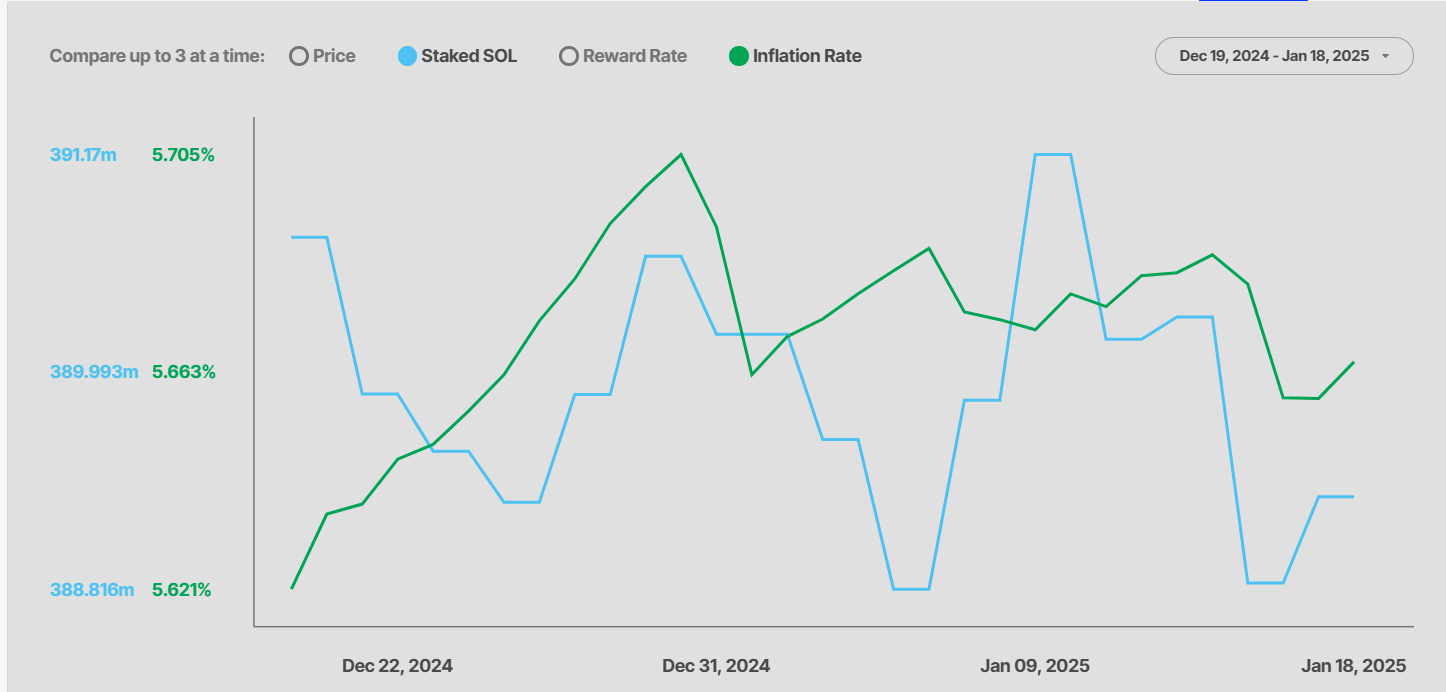

- Solana proposed reducing the inflation rate from 5.7% to 1.5%

- Investors fear the proposal will reduce their returns

THE Solana (SOL) The community proposed reducing the network’s annual inflation rate (token issuance) to 1.5%, depending on market conditions. Tushar Jain, Managing Partner of Multicoin Capital, made the proposal and criticized the current inflation model.

In a recent interview on the Lightspeed podcast, Jain summary the proposition like,

“Our idea is to have the emission rate determined by market forces. Currently, we issue the same amount of SOL tokens regardless of market conditions. We propose a smart issuance schedule that would dynamically encourage participation/staking. “

Jain added that the current model issues SOL tokens “more than necessary” to secure the network. He believes this should be kept to a minimum.

More reasons to fight SOL inflation

For context, the main inflation pressure comes from validator staking or locking users’ SOL to secure and execute network operations. In return, punters earn a commission in the form of SOL tokens, which is added to the supply.

Jain said that approximately 100 million SOL have been added to the supply since 2021. Of the total supply of 592.4 million, 391 million tokens are locked in staking, representing 66% of the supply overall.

Source: Staking Rewards

THE proposal looks at 50-66% of SOL staked, claiming that over 67% does not help with network security.

“Beyond 67% additional stake, SOL adds no additional security guarantees, because a large majority of all SOLs voted on a given block and a long-range attack is impossible.”

However, anything below 33% could put the Solana network at security risk. It should be emphasized, however, that the benefits of the proposal go beyond market efficiency. This would also reduce selling pressure, as validators may be forced to sell their tokens to pay their tax obligations.

Additionally, this would improve the optics of SOL, as high inflation would deter others from holding the tokens until devaluation.

It should be noted, however, that not all members seem satisfied with the proposal. A pseudonymous DeFi analyst, Ignas, noted that SOL’s staking yield would drop if the proposal passed. He said,

“To be honest, I don’t want the $SOL Inflation Reduction Act to pass. I know it will, but I was really happy with my 20%-30% APY on the $SOL multiplier pools at Kamino.

According to MC, the current model only benefits diluted stakeholders and non-participants. If inflation is reduced, even non-participants could benefit since their reserves would not be devalued. Additionally, Multicoin Capital believes that this could boost DeFi activity in the ecosystem.