The crypto market recorded its highest weekly inflow this year, reaching an impressive $2.2 billion.

According to the latest report from CoinShares, this influx of capital was fueled by the growing enthusiasm for Donald Trump’s inauguration on January 20. The company noted that the sharp rise brought total year-to-date inflows to $2.8 billion.

This influx also pushed assets under management (AUM) to a record high of $171 billion. This rise coincided with Bitcoin’s impressive performance, with the flagship crypto climbing nearly 20% over the past week to reach an all-time high near the $110,000 mark.

Meanwhile, the market also saw a corresponding rise in exchange-traded product (ETP) trading volumes, which reached $21 billion last week.

James Butterfill, head of research at CoinShares, pointed out that this figure represents 34% of Bitcoin trading activity on major exchanges. This robust figure highlights the growing institutional interest and growing adoption of crypto.

Bitcoin and XRP shine

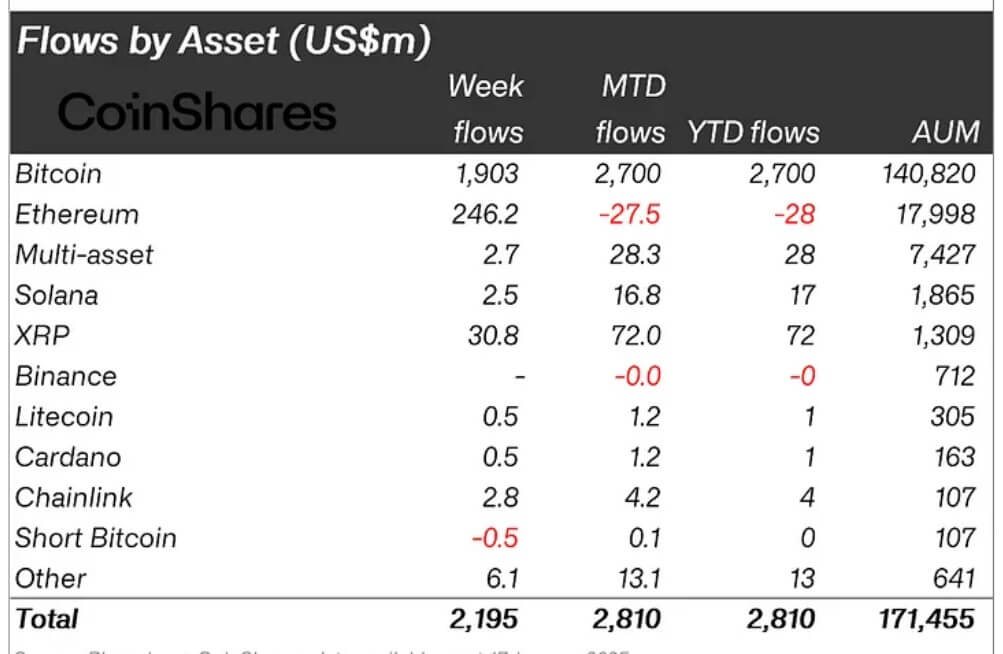

Bitcoin continued its dominance, securing $1.9 billion in inflows last week and bringing its total for the year to $2.7 billion.

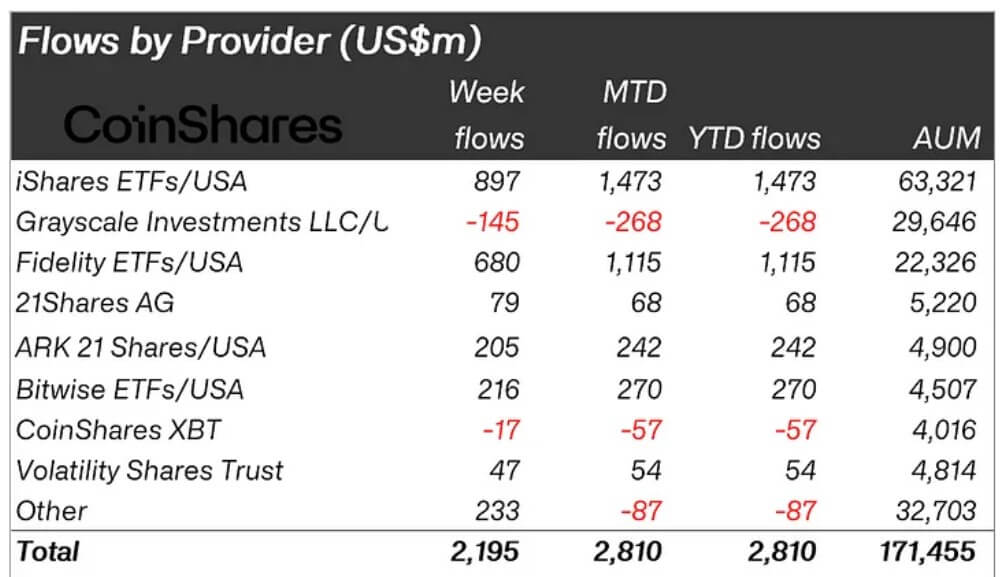

The report highlights that spot Bitcoin ETFs, offered by key players such as BlackRock, Fidelity, Ark Invest and Bitwise, have collectively attracted over $2.1 billion in inflows. These flows are seen as a positive response to market optimism over supportive regulatory policies expected under the new administration.

Interestingly, short Bitcoin products saw modest inflows of $500,000, a surprising departure from typical bearish behavior during an uptrend.

Meanwhile, Ethereum attracted $246 million in inflows, marking a reversal of its previous outflows this year. However, the second largest cryptocurrency continues to underperform its peers.

Butterfill noted that Ethereum remains the worst performer this year in terms of inflows, although it has far surpassed Solana, which brought in $2.5 million last week.

On the other hand, XRP has proven to be a remarkable performer, attracting $31 million in inflows last week. Since mid-November 2024, XRP’s total inflows have reached an impressive $484 million, highlighting its growing appeal to investors.

Stellar followed with more modest inflows of $2.1 million, while other altcoins showed little activity during the period.