- Arthur Hayes projected a 30% BTC correction to $ 70,000 at $ 75,000 in the short term.

- He linked the potential decline to the increase in yields of the US Treasury and sticky inflation.

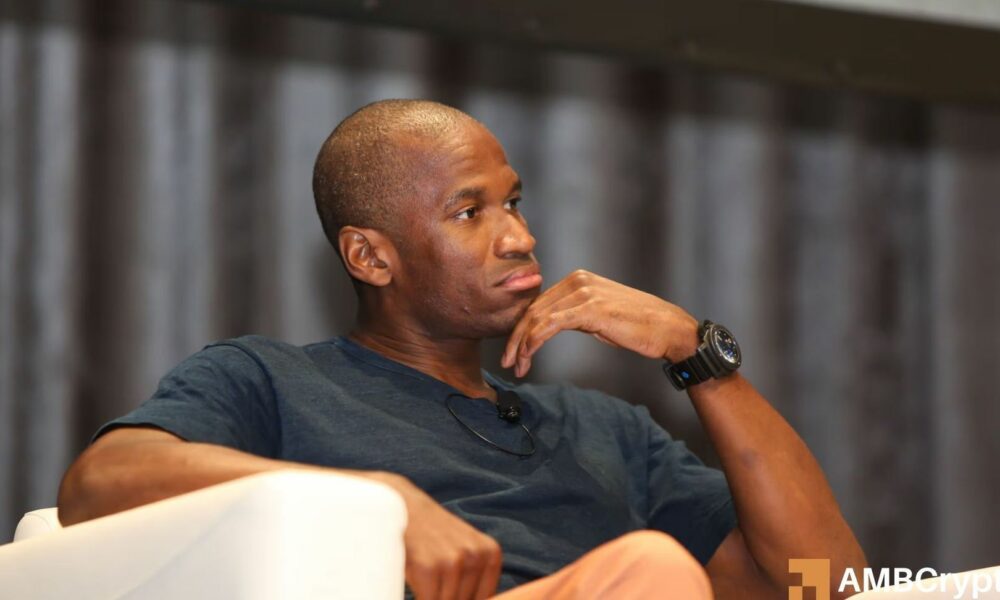

Arthur Hayes, co-founder of The Bitmex Exchange, warned that Bitcoin (BTC) The price could drop to $ 70,000 to $ 75,000 in the short term before moving to $ 250,000 by the end of the year. Part of his recent blog read,

“I think we are more likely to drop from $ 70,000 to $ 75,000 Bitcoin, then increase to $ 250,000 by the end of the year than to continue to cure equipment tight.”

Hayes linked its short -term correction forecasts of 30% of the BTC upwards to the treasury yields at 10 years and its probable impact on actions and the crypto.

Is the BTC due for prolonged correction?

For the context, a hike in the treasure performance always indicates tighter liquidity, which makes assets at risk such as shares and crypto less attractive than obligations. Thus, an increasing yield is a net negative for the cryptography market, in particular the BTC.

Hayes added,

“Inflation is always high and probably higher in the near future while the world is hate itself economically. This is why I expect the 10 -year yields to increase … the actions will be poured. »»

Given the close correlation between American actions and the BTC (increased to a recent 0.70 summit, by correlation of 30 days of Pearson), such a drop could also cause the King Coin room.

Source: the block

Hayes noted that the BTC could drop in front of American stocks in a short -term liquidity compression scenario.

“The BTC is extremely sensitive to the global conditions of liquidity Fiat; Consequently, if a Fiat liquidity crisis is coming, its price will decompose before that of shares and will be the main indicator of financial stress. »»

However, the investor stressed that such distress would force the United States, China and Japan to react by printing money and QE (quantitative relaxation). It has planned 60% of a probable QE pivot in the first quarter or first quarter.

“A financial mini-crise in the United States would provide the monetary mana crypto. It would also be politically opportune for Trump. »»

Since the QE leads to American liquidity and risk assets, it could feed the BTC rally at a new summit of $ 250,000, by Hayes.

That said, “any indicator” of the BTC, a collective profitability gauge of minors, money supply and network growth, showed that BTC was midway in the bull.

Historically, reading more than 80 (red zone) marked the previous cycle in 2017 and 2021. Current reading was greater than 50, suggesting a place for growth.

Source: BM Pro