Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The cryptocurrency market continues to evolve, presenting investors of opportunities and risks. With recent price movements and technological developments, digital assets such as Litecoin, Mantle and Decentraland draws attention to the cryptography market.

Recent market changes have aroused renewed interest in specific projects, each with separate use cases and network activities. This review examines part of the The best cryptocurrencies in which invest now Based on market trends and project fundamentals.

The best cryptocurrencies in which invest now

Solaxy has obtained more than $ 16 million in its in progress, highlighting a strong interest in investors in blockchain scalability solutions. The decentraland price reached $ 0.44,457, marking an increase of 4.82% in the last 24 hours. Meanwhile, BGB is negotiated well above its simple 200-day mobile average (SMA), with 1,372% higher than the $ 0.458 threshold.

1. Litecoin (LTC)

Litecoin is designed for fast and low cost transactions using blockchain technology. He shares similarities with Bitcoin but has key differences, such as a different chopping algorithm, higher total diet and faster blocking times. These changes aim to make transactions faster and more effective.

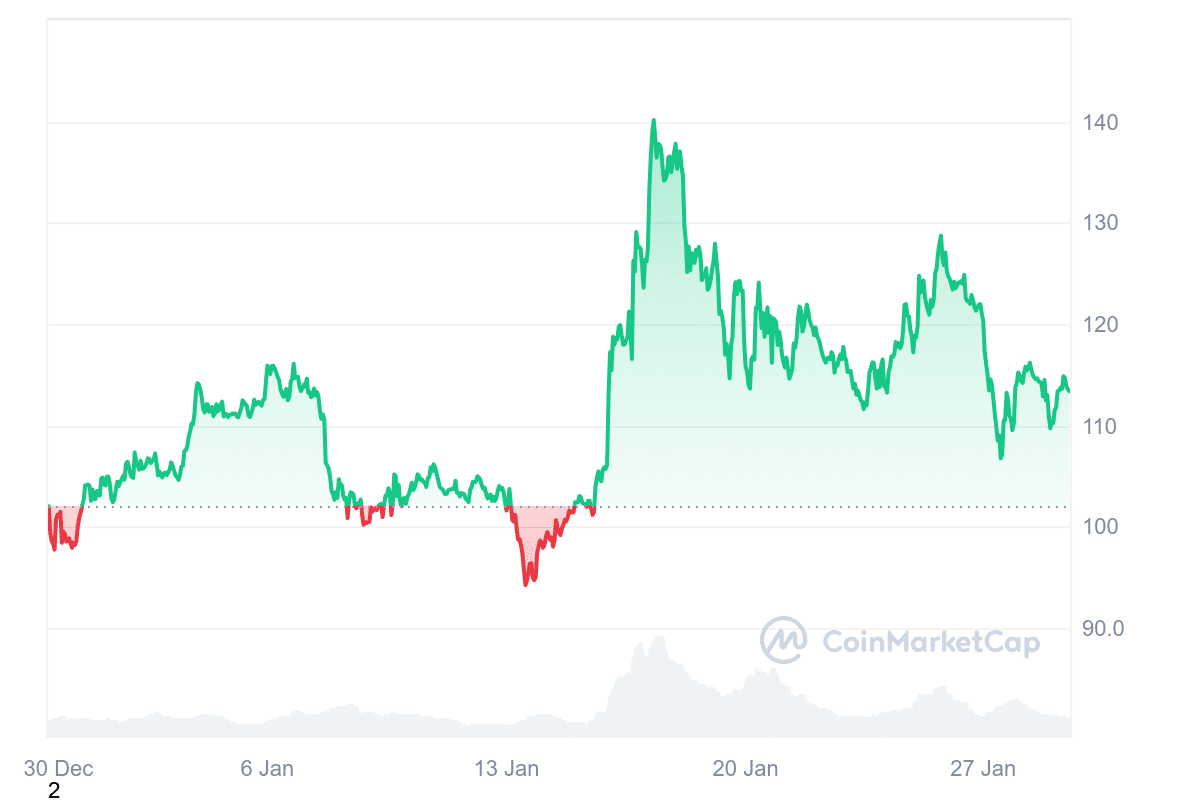

Currently, Litecoin is at a price of $ 113.40, showing a 1.15% drop in the last 24 hours. Despite this short -term drop, the feeling of the market remains optimistic. The Fear & Greed index, which measures the emotions of the market, amounts to 72, indicating greed.

Litecoin is negotiated well above its simple 200-day mobile average (SMA), a long-term trend indicator. It is 25.30% higher than the SMA value of $ 90.58. During the last month, Litecoin closed in the green for 18 days out of 30, which suggests a constant dynamic. The liquidity is high, which means that buyers and sellers can exchange without significant price fluctuations.

The relative resistance index of 14 days (RSI), a measure of the question of whether an asset is exaggerated or occurred, is currently at 44.72. This indicates neutral conditions, which suggests that Litecoin can continue to exchange laterally.

While Litecoin remains a widely used cryptocurrency, price movements depend on global market trends, the feeling of investors and adoption. Its position above key technical levels suggest stability, but short-term fluctuations remain possible.

2. Bitget Token (BGB)

Bitget Token (BGB) is the native token for the exchange of Bitget and its decentralized portfolio ecosystem. It works as a utility token, allowing users to negotiate, pay transaction costs and access to the advantages of the platform.

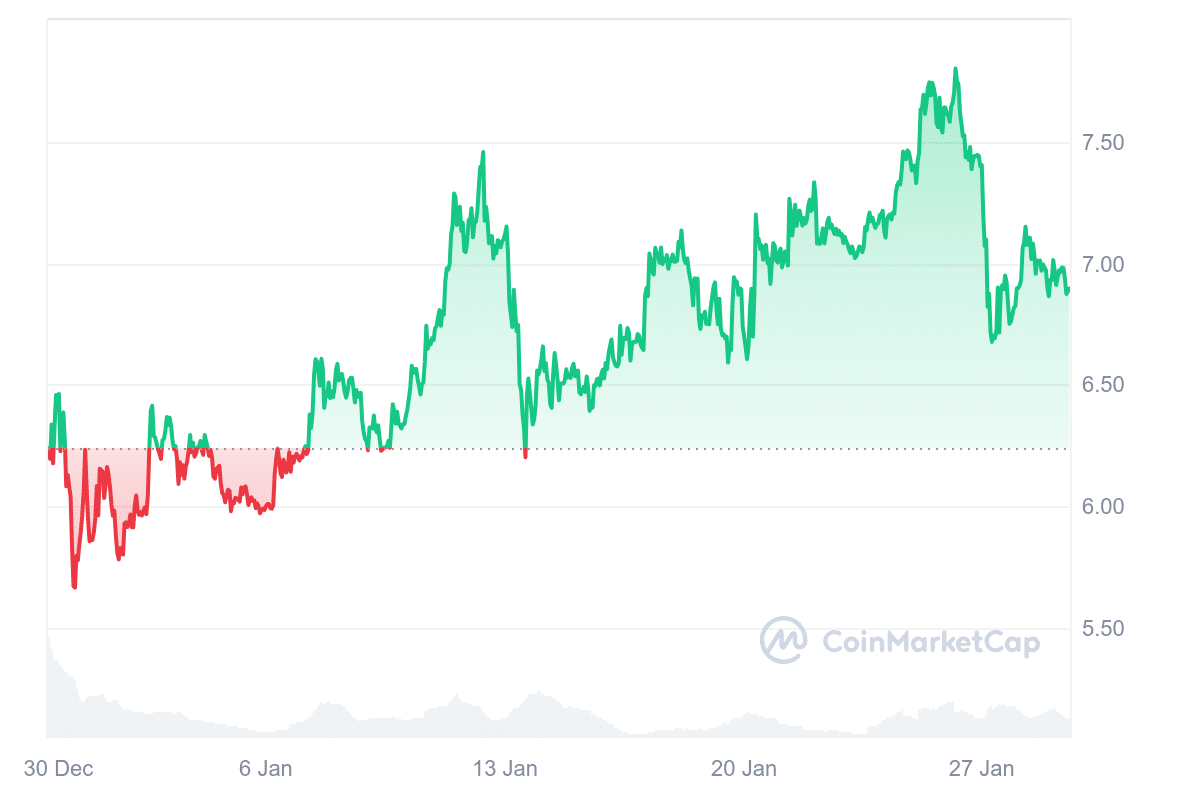

Currently, BGB has $ 6.75, with a 24 -hour negotiation volume of $ 699.31 million and a market capitalization of $ 8.10 billion. During the last day, the price of the token dropped 3.58%, but it earned 8.25% in the last 30 days. The feeling of the market remains neutral, while the index of fear and greed indicates 72, signaling greed on the market.

In addition, the BGB is negotiated considerably above its simple 200-day mobile average (SMA), located at 1,372.39% higher than the level of $ 0.458. This suggests a strong long -term trend. The token has shown positive performance in 17 of the last 30 days, indicating a stable price action. Its liquidity remains high compared to its market capitalization, which can help facilitate smooth trading.

Myth: chain trading is always expensive due to high gas costs. ⛽️

Do: #BitGetSeed eliminates this barrier by allowing transparent transactions, using $ USDT As a gas token, making chain exchanges more affordable and without hassle. 💡 pic.twitter.com/cxmz8ovhih

– bitget (@bitgetglobal) January 29, 2025

The relative resistance index of 14 days (RSI) is 37.70, reflecting neutral conditions. This metric makes it possible to assess whether an asset is exaggerated or exceeded. With a negative annual inflation rate of -14.29%, the BGB shows signs of deflationary pressure, which means that its diet can decrease.

Short -term projections estimate a modest increase of 0.95%, now the stable price around $ 6.75 in February. Although BGB has demonstrated resilience, its future performance will depend on wider market conditions and platform developments.

3. Mantle (MNT)

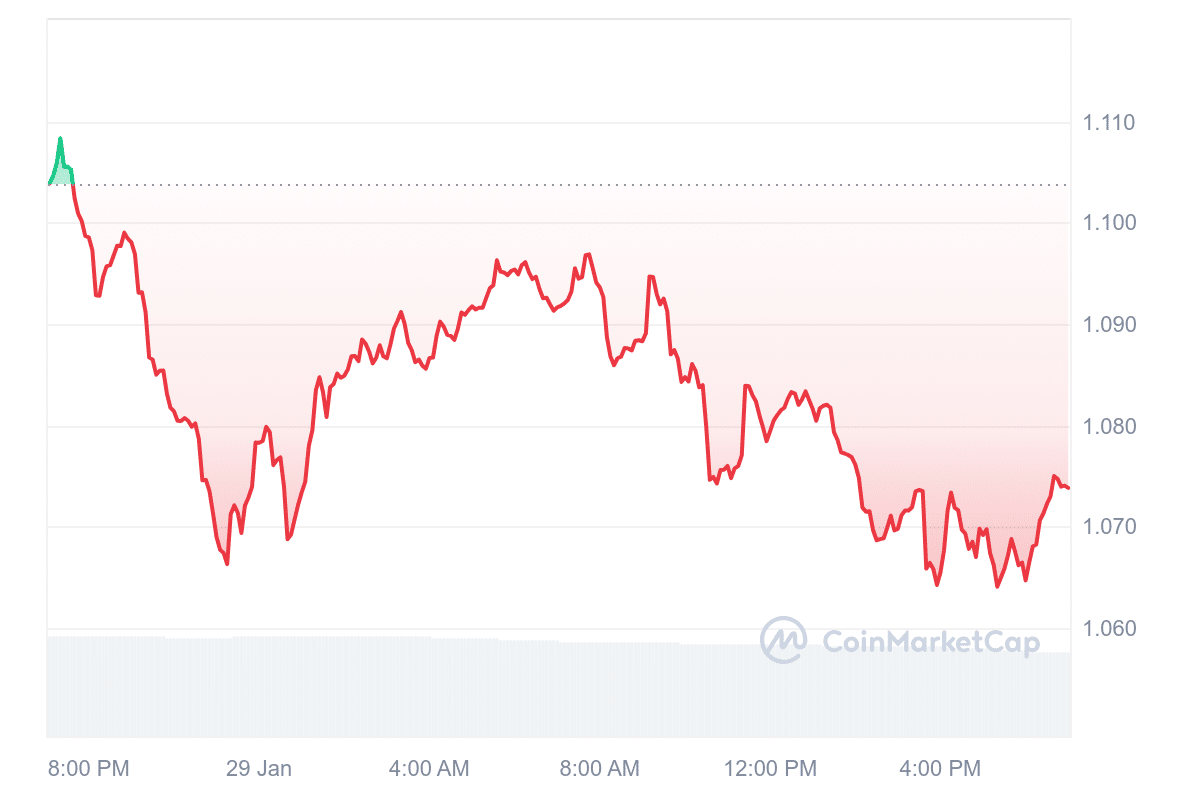

Mantle (MNT) is negotiated at $ 1.07, reflecting a decrease of 3.05% in the last 24 hours. Despite this short -term drop, MNT has won 104% in the past year. Its market capitalization is around 3.6 billion dollars, which placing it as the 38th largest cryptocurrency.

The network has focused on expanding its ecosystem, with plans to introduce six major products in 2025. These include methamphetamine, a liquid implementation solution and ignition FBC, which supports the Blockchain projects at an early stage.

The developers also work on an improved index fund, an Blockchain-based banking platform, and Mantlex, a project based on AI. These updates suggest improving the usefulness of the coat and attracting more users.

Recent data show an increase in network activity. Active addresses increased by 50% in a week, while the creation of new addresses increased by 16%. There has also been a significant increase in MNT withdrawals of exchanges, which could indicate an increase in long -term interest in the token.

The Mantle network builds the liquidity chain of the future.

Ready to combine the transformative power of the blockchain with deep liquidity, sustainable performance offers and an enriched user experience 👇

1. Our new technical roadmap is centered on two planned criticism upgrades … pic.twitter.com/minrbkod

– mantle (@mantle_official) January 28, 2025

Mantle continues to improve its infrastructure, focusing on liquidity solutions and zero knowledge withdrawal technology (ZK). These developments aim to improve the efficiency and safety of transactions, in particular for high -value asset transfers.

The growth of the network reflects increased adoption and continuous innovation. Although price fluctuations are common on the cryptography market, projects in the course of mantle and growing commitment suggest that it is working to establish a stronger presence in the sector.

4. SOLAXY (Solx)

Solaxy (Solx) is a new blockchain project aimed at improving the Solana network by introducing a layer of layer 2. The project has lifted more than $ 16 million in its current presale, reflecting interest Investors in the scalability of blockchain. Solaxy is designed to solve congestion problems on Solana, offering a modular infrastructure that allows developers to create decentralized applications (DAPP) requiring high -speed performance.

This could benefit from decentralized financial platforms (DEFI), NFT and blockchain games. Currently, the Prix de la Prévente de Solaxy is $ 0.00162 per solx. The project promotes its ability to effectively manage high transactions volumes, which makes it relevant for assets such as parts that are based on rapid transactions.

In addition, Solaxy aims to prevent network slowdowns by discharging the activity of the main Solana chain. Solaxy also offers an implementation program with a dynamic annual percentage (APY) up to 243%. Participation allows users to win a passive income while supporting the network. Until now, 4.7 billion solx tokens have been punctuated, suggesting early confidence in investors.

As a layer 2 solution, Solaxy seeks to improve the efficiency of blockchain, but its real performance will depend on adoption and execution. While prevente has aroused significant interest, the success of the project will depend on its ability to effectively integrate into Solana and offer tangible advantages to users and developers.

Visit Solaxy’s presale

5. DECENTRALAND (Mana)

DECENTRALAND (Mana) is a virtual reality platform built on Ethereum blockchain. It allows users to create, explore and monetize digital content. In this virtual world, users buy field graphics in the form of NFT using Mana tokens. The platform works as a decentralized ecosystem, where property and governance rest with its participants through the decentral and DAO.

Users can design unique experiences, create interactive environments and exchange digital assets. The platform promotes creativity and self-expression, with dependent progress entirely of individual effort and imagination. The ability to own and sell virtual land offers economic opportunities within the metavese.

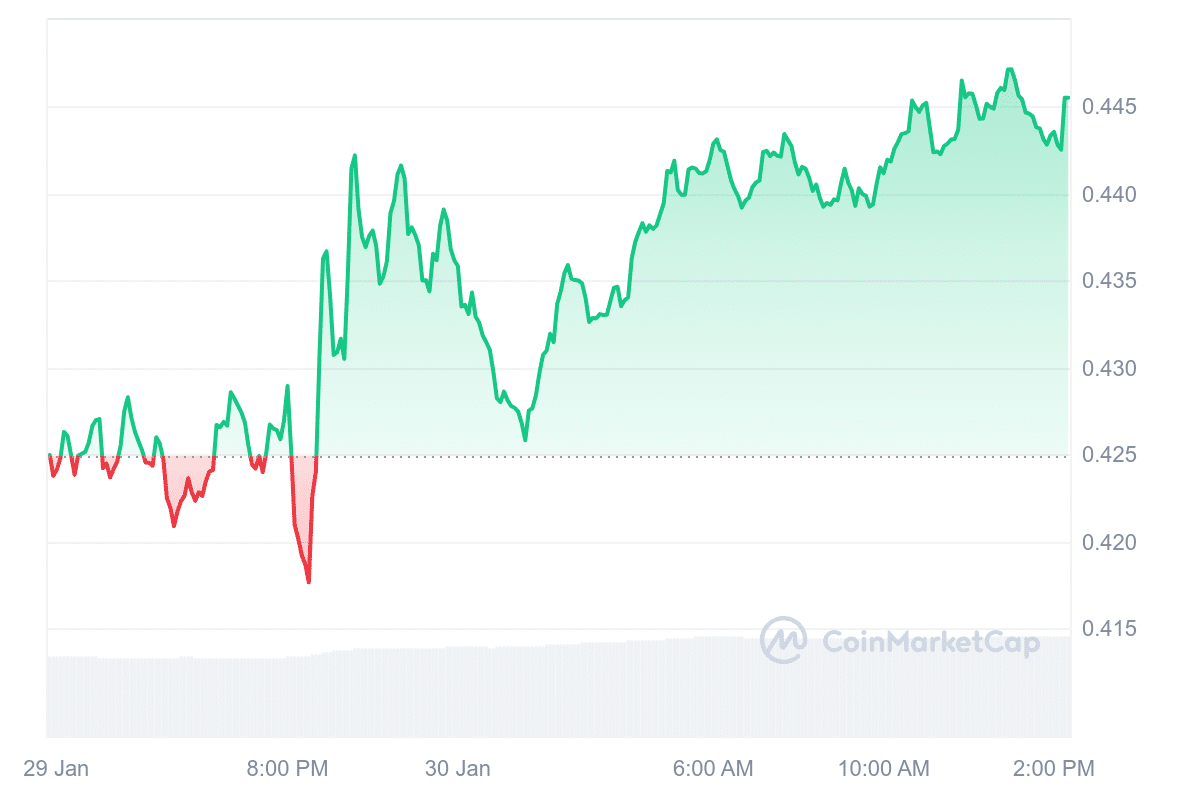

Currently, the decentraland price is $ 0.44,45736, reflecting an increase of 4.82% in the last 24 hours. Despite this short -term gain, the feeling of the market remains lower. However, the Fear & Greed index is 70, indicating a favorable investment climate.

2025 is our chance to amplify everything that makes the decentral and creativity, collaboration and connection 🤝

We are shaping an autonomous and vibrating virtual world. Let’s push the steering wheel forward!

– decentraland (@decentraland) January 23, 2025

The cryptocurrency is negotiated at 0.72% above its simple mobile average (SMA) of 200 days of 0.442325 $, which suggests stability. With an RSI of 47.50, the asset is in a neutral area, which means that it is neither overbound nor occurring. This could indicate a short -term lateral movement.

Market analysis predicts a price increase of 10.65% by March, potentially reaching $ 0.488,8642. DECENTRALAND also benefits from high liquidity compared to its market capitalization, which allows merchants to buy and sell more easily without prices.

Learn more

New same corner ICO – Wall Street Pepe

- AUTIDENCE by COINSULT

- Early access presale round

- Alpha Tradie Privé for the army $ Wepe

- High dynamic pool – Apy Dynamic

Join our Telegram Channel to stay up to date on the coverage of information on the breakup