- The market experienced an intense liquidation activity, the highest concentration occurring between $ 101,500 and $ 99,800.

- The current distribution of Bitcoin holders gives an overview of potential market trends.

The recent Bitcoin (BTC) price fluctuations have drawn the attention of traders as volatility intensifies, leading to an increase in liquidations.

While market players sail on these rapid price changes, several critical factors shape the Bitcoin trajectory.

Bitcoin price performance and key levels

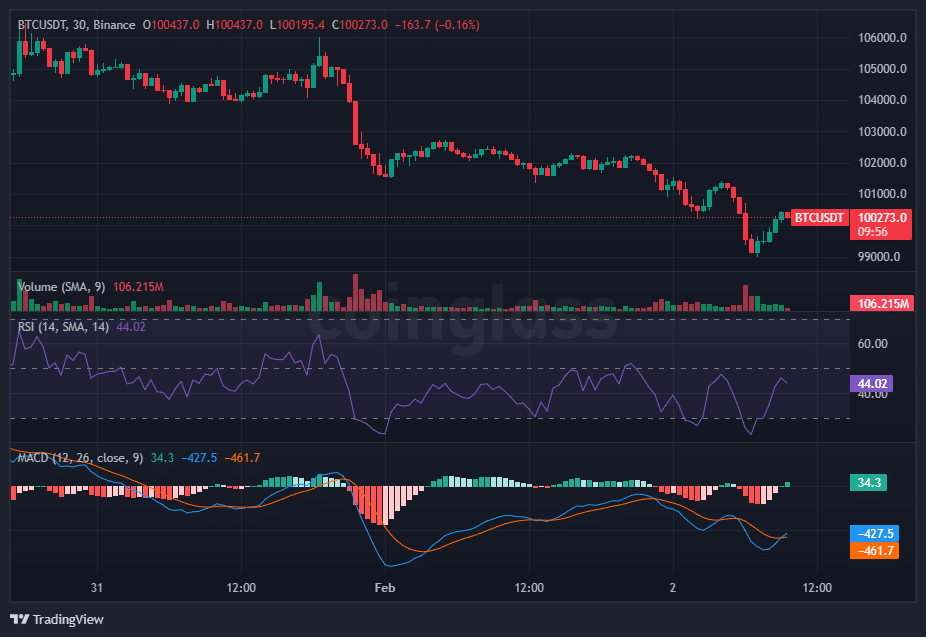

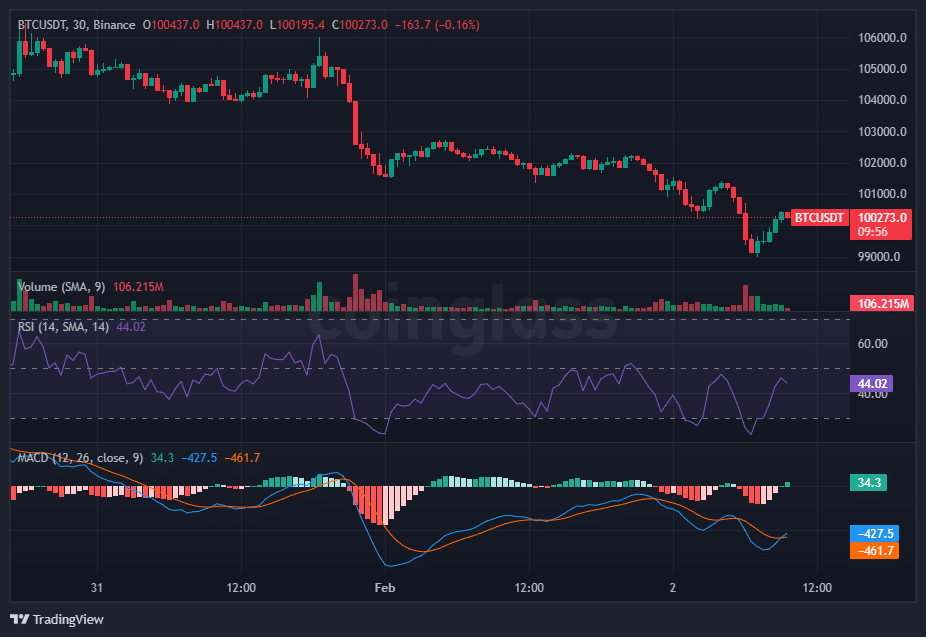

Ambcrypto’s gaze on the BTC price has shown a recent downward trend followed by a small recovery. The price fell considerably, but was trying a rebound in the level of $ 99,000, trading at $ 100,273 at the time of the press.

Source: Coringlass

In addition, the RSI was 44.02, indicating neutral impulse but approaching the levels of occurrence.

The MacD histogram, on the other hand, became less negative, suggesting a potential bullish crossing, but the signal line remained below the zero line, which means that the downward trend was not yet completely reversed.

The volume has increased during the sale but remains relatively lower on the rebound. Overall, although there is a slight recovery, the trend is always down

Feeling of traffic and market reactions

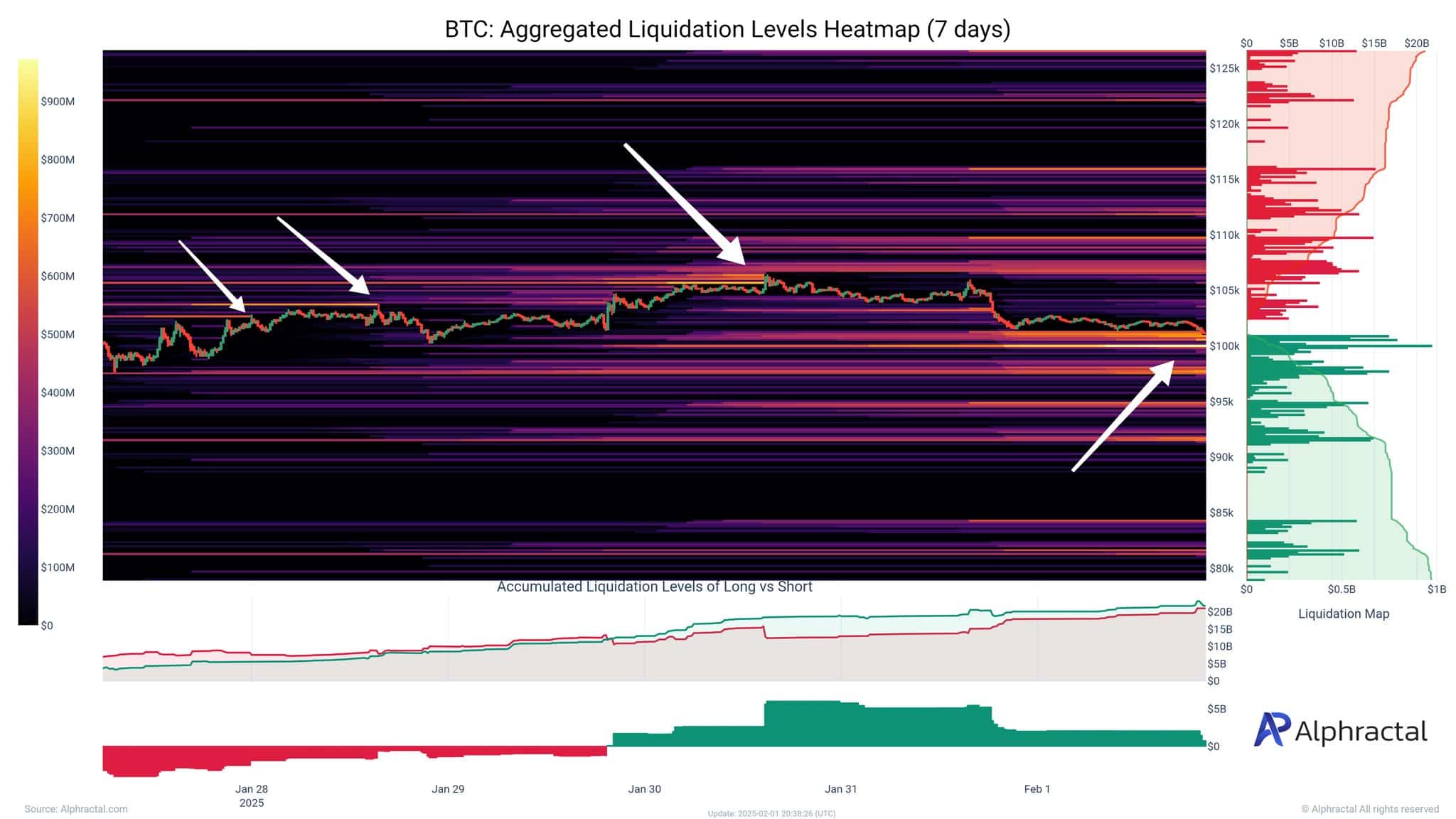

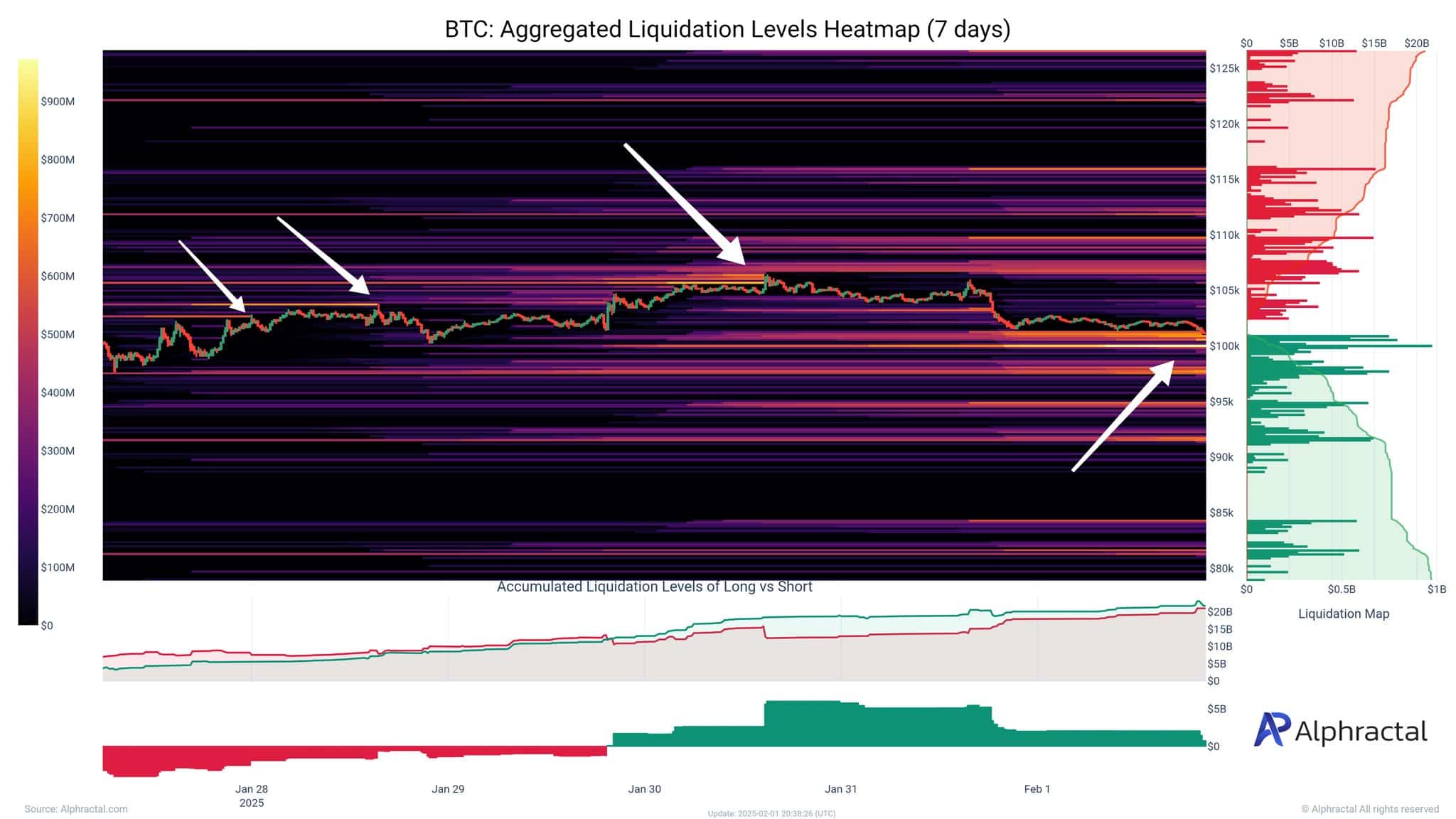

The market experienced an intense liquidation activity, the highest concentration occurring between $ 101,500 and $ 99,800.

This area represents the maximum point of pain, where long and short positions have been liquidated at an accelerated rate.

Source: APHRATTAL

The rapid development of positions has amplified price instability, forcing traders to reassess their strategies.

As liquidity is absorbed during these liquidation events, unexpected price swings become more frequent, strengthening the importance of risk management in such volatile conditions.

Positioning of investors and market influence

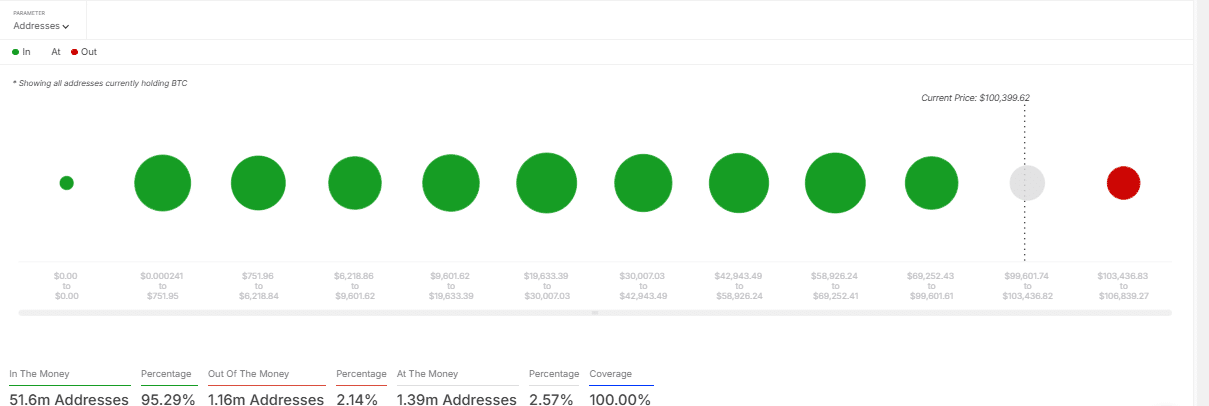

The current distribution of Bitcoin holders has provided information on potential market trends. At the time of the press, 95.29% of Bitcoin addresses, or 51.6 million, remained for profit.

Meanwhile, 1.16 million speeches were “out of money”, while 1.39 million were “to money”.

Source: intotheblock

Most investors sitting on unrealized gains, the feeling of the market has remained stable, but taking advantage could introduce sales pressure.

Read the Bitcoin Price Provision (BTC) 2025-2026

If an important part of profitable holders decides to leave their positions, Bitcoin could face an additional downward movement, which makes the support levels even more critical in future sessions.

Bitcoin price movements remain very reactive to market conditions, with liquidation models, volatility levels and positioning of investors playing a crucial role.