XRP delivered remarkable performance in January, gathering more than 50% and leaving the wider market of cryptocurrencies in its wake. What is Ripple’s next play that could?

The XRP overvoltage has stimulated optimism between traders and analysts, some providing that the token could reach $ 4 in the coming weeks. But what exactly motivates the ascent of XRP, and is $ 4 really at hand?

Ripple regulatory boost and increasing institutional adoption

The escape of XRP can be widely attributed to a series of positive developments for its parent company, Ripple Labs. One of the most important catalysts occurred in December when Ripple received approval from the New York Department of Financial Services (NYDFS) for its stablecoin Rlusd. The upward movement managed to restore investors’ confidence and was a key step for Ripple’s ambitions in the regulated financial world.

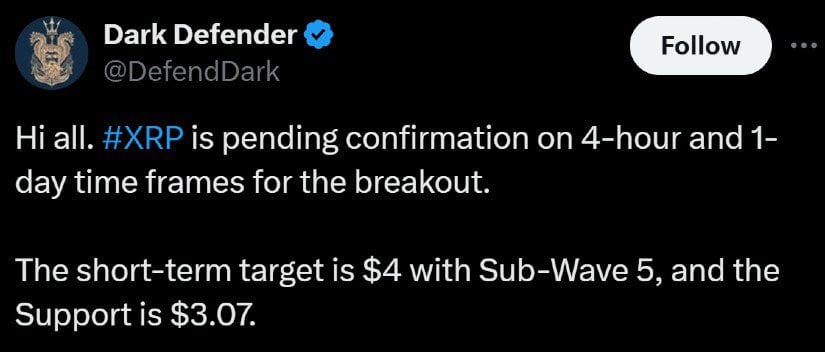

XRP awaits a breakup confirmation over 4 hours and 1 day, with a short -term lens of $ 4. Source: Dark defender via x

In addition, the XRP rally was still stretched by the growing Ripple exhibition in the financial sector. The company recently received money issuer licenses in Texas and New York, thus strengthening its operating capacity on the main markets in the United States. It is true that the increase in the permeation of the XRP cryptocurrency in institutional payment systems induces the request for a token, thus strengthening its bullish cycle.

According to Santiment, XRP recently received wider recognition from the main financial institutions. While its adoption as a payment solution is accelerating, for example, the partnership between Ripple and Ondo Finance to make titles of the American Treasury in possible token on the large XRP book has opened new avenues for XRP integrations on traditional financial markets.

A technical break on the horizon?

XRP’s technical table also points to a potential break. According to renowned analyst Dark Defender, XRP shows signs of preparation for a movement up. “The short -term objective is $ 4 with support at $ 3.07,” said Dark Defender while stressing that XRP was just waiting for confirmation on shorter deadlines to trigger its next ascending leg.

XRP is approaching the escape confirmation on short -term graphics, considering $ 4 with a support at $ 3.07. Source: Dark defender via x

Meanwhile, Bollinger strips – an extremely popular volatility indicator – reports that XRP is ready for an explosive movement. As the crypto investor Armando Pantoja pointed out, the tightening of these bands was a sign of an imminent escape: “compression of volatility indicates that XRP could see a significant price change in the near future.”.

Merchants are however warned to remain cautious because the recent XRP rebound from the lowest $ 2.70 has created liquidity pockets which could be targeted by a drop -down action if market conditions change. With 3 $ serving as a level of critical support, it remains to be seen if XRP can hold the ground or cope with a retracement.

Watch XRP prices analysis

Target of $ 4 in sight, but the challenges persist

Continuous fluctuations in the cryptocurrency market had the Strong Rally Place XRP as one of the best in January. XRP jumped 50% and outperformed the 13% bitcoin rally and a slight drop in ether. XRP has even surpassed the performance of other high capitalization cryptocurrencies such as Polkadot, Solana and Binance Coin.

Ripple’s XRP price is expected to bounce for $ 3 to reach the Haussier rally targeting $ 4. Source: R2CDING R2 on tradingView

One of the main contributors to XRP resilience was Ripple’s Stablecoin game. The Rlusd Stablecoin, which has exceeded other leading floors in the volume of exchanges, provided a new liquidity avenue and a wider adoption of the market. As of January 30, the daily volume of Rlusd reached $ 62 million, exceeding the Stablecoin USD of Paypal, Pyusd, by a considerable margin.

The resignation of the President of the SEC, Gary Gensler, also played a central role in the rise of XRP. Under a new leadership, the SEC reported a more favorable position towards the cryptographic industry, potentially benefiting in Ripple in its current legal battle with the Commission. With speculation around a possible ETF XRP spot gaining momentum, JPMorgan analysts predict that such a fund could attract significant entries, which potentially increases the price of XRP.

Lowering signals: profit and correction of the market

Despite optimism surrounding the potential of XRP, caution is justified. Certain measures on the chain slightly indicate the overvaluation of the XRP and the likely cases of taking advantage. Currently, the MVRV report for XRP is in positive territory, which means that many holders could seek to take advantage of recent gains. According to Santiment, the addresses holding between 10 million and 100 million XRPs have recently sold large pieces of their accumulation and could exert downward pressure on its price.

Despite bullish optimism, the XRP price still has room for a decline nearly $ 2.13. Source: Jyoon012 on tradingView

If this configuration continues, XRP could undergo a retirement, and according to some analysts, it could return to $ 2.13 when the Bears increase their sales pressure. If the purchase pressure goes back again and the beneficiaries are retreating, XRP could explode higher thanks to its current resistance levels for new peaks of all time.

What is the next step for XRP in February?

For the future, the immediate future of XRP remains uncertain but promising. The token has shown resilience to navigate both bullish and lowering forces, and its technical table indicates that the next main target could be $ 4, a level that many traders are considering in the short term. Although challenges such as taking advantage and whale activity can weigh on the price of XRP, its growing adoption and the changing regulatory landscape suggest that the token could continue to surpass its peers in the coming weeks.

Ripple price board (XRP). Source:XRP liquid index (XRPLX) via Brave new room

In the end, the question of whether XRP reaches $ 4 or faces a correction will depend on a combination of market dynamics, the feeling of investors and external factors, in particular potential regulatory decisions and institutional adoption . As always, caution is notified, but XRP’s prospects in February remain that of prudent optimism.