Bitcoin and Altcoins were faced with steep drawbacks, stimulating increased liquidation while the global market reacted to an intense macroeconomic headwind.

It is barely three days in February and Bitcoin corrected by 9%. The largest cryptocurrency by market capitalization participated in the current assault on the world market, because fears of a border war between the United States and large countries such as Canada, Mexico and China have increased .

For the context, Donald Trump imposed A 25% price on Canada and Mexico, China receiving a 10% softer. The executive decree, which will be fully implemented on February 4, experienced an increase in the US dollar to a record peak against the Chinese Yuan and a 22 -year -old summit against the Canadian dollar and the Mexican peso, respectively.

Risk active ingredients and cryptocurrencies have felt the heat enormously, bitcoin spilling to an intra-day hollow of $ 91,281 today. The drop of 4% provided a greater capitulation for altcoins, the global market for crisp reduction from 10.28% to 3.04 dollars.

Market merchants become victims

Meanwhile, the traders in fact endured the strong market correction as the liquidation data increased. As expected, the bulls have undergone the most important losses, with Rinsing showing that the slowdown wiped $ 2.2 billion dollars on the cryptography market, with long positions representing $ 1.88 billion.

The correction of more than 20% of Ethereum assured that its traders have endured the highest liquidation in position. The drop has enabled almost $ 600 million in market ether exchanges in the last 24 hours, with $ 474 million in long and 125.75 million dollars in shorts.

In addition, Bitcoin position liquidations also increased in the last day, with $ 406 million deleted from the market. After the 4%correction, long positions worth $ 341 million was dissolved, while the bears suffered a minute of $ 65.5 million.

Other active ingredients such as XRP and Solana have also seen increased thermal marshes. The first recorded $ 155 million, while the second experienced $ 85 million. In total, the market market liquidated 726,831 positions, the largest erased trade being a position of $ 25.64 million on the Binance ETH / BTC pair.

A rebound on the horizon?

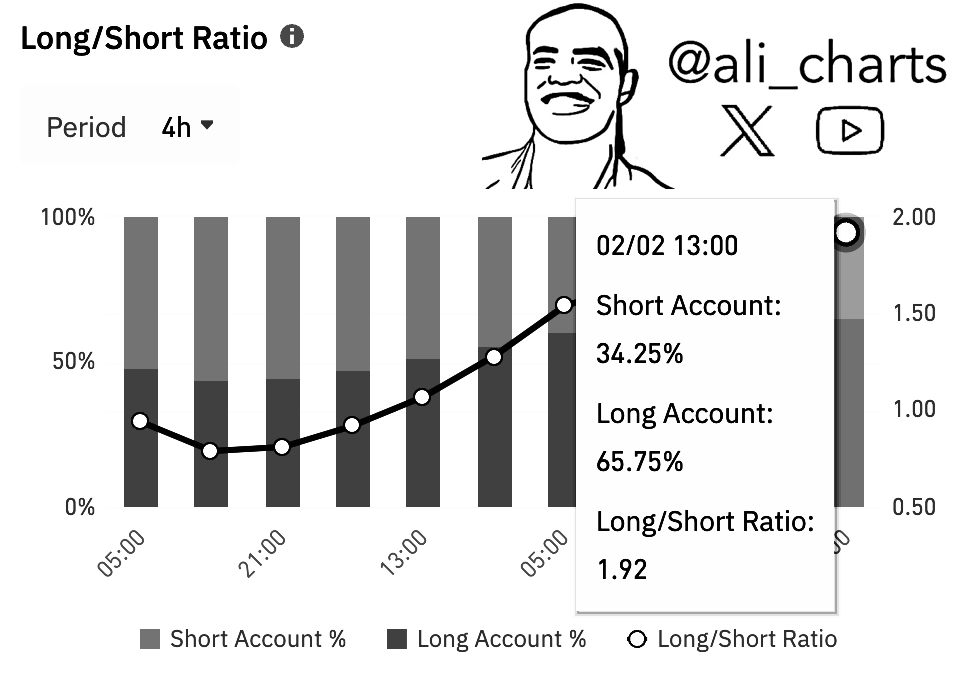

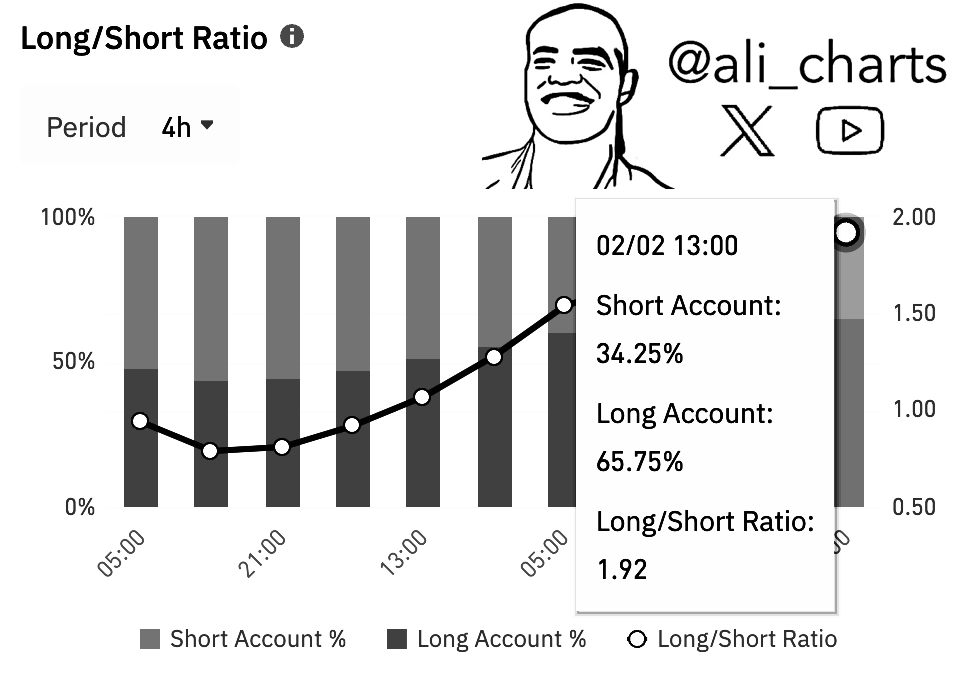

Interestingly, the bulls are still betting on a price rebound in the middle of skepticism on the world market. Eminent analyst Ali Martinez sharp To this surprising confidence, obvious in the position of position on Binance, the main exchange of crypto by commercial volume.

According to disclosure, 65.75% of Binance traders bet on a price rebound, with the long / short ratio at 1.92. Do these traders know what we don’t know?

Meanwhile, Bitcoin and Altcoins have bounced for such a drop in countless times, ensuring market enthusiasts from their ability to dispel down pressure and target the advantages. Meanwhile, Bitcoin is negotiated at $ 94,136, bouncing 3% compared to his lower intraday of $ 91,281.

Difles: This content is informative and should not be considered financial advice. The opinions expressed in this article may include the author’s personal opinions and do not reflect the basic opinion of cryptography. Readers are encouraged to do in -depth research before making investment decisions. The Crypto Basic is not responsible for financial losses.