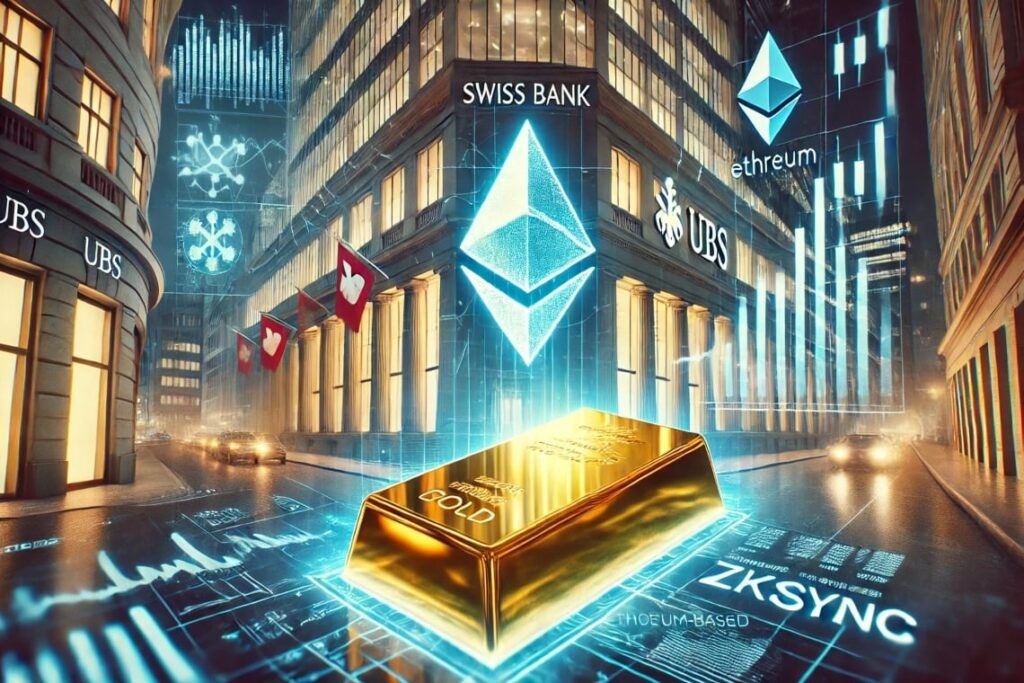

The Swiss Bank UBS, a world leader in the financial sector, is experimenting Innovative blockchain solution To simplify and make investments in digital gold more effective.

This project uses ZKSYNC technology, a Layer 2 platform based on Ethereum, to offer greater transparency and security in transactions.

The initiative represents an important step in the integration between traditional finance and blockchain technology, with potential implications for the global investment market.

UBS and adoption of blockchain: a step towards the digitization of assets in Switzerland

The choice of UBS to explore the blockchain reflects a strategic change towards the digitization of assets and the adoption of emerging technologies.

The bank tests indeed a platform which allows investors to buy, hold and transfer digital gold in a secure and transparent manner.

Digital goldRepresented on blockchain, offers investors a modern alternative to traditional investment methods in precious metals, eliminating the need for intermediaries or additional costs.

This initiative is based on ZKSYNC technology, a layer 2 protocol designed to improve the scalability of Ethereum.

Thanks to the use of Zero knowledge rollupsZKSYNC allows rapid and profitable transactions without compromising security or decentralization.

UBS therefore explores how this technology can be used to ensure traceability and integrity of investments in digital gold.

As mentioned, Zksync is one of the most promising layer 2 solutions of the Ethereum ecosystem.

Thanks to its zero knowledge rolls, the protocol makes it possible to treat a large number of transactions on the main blockchain, recording only a summary on Ethereum to maintain security.

This approach not only reduces transaction costs, but also also improves speedThis makes it ideal for complex financial applications such as those offered by UBS.

The adoption of ZKSYNC by a traditional bank like UBS shows that blockchain technologies can be used in regulated and institutional contexts.

In addition, the choice of Ethereum as a technological basis highlights the growing maturity of its ecosystem and the confidence that important financial institutions place there.

Why digital gold? UBS and the strategic value of this choice

Gold has always been considered as an asset of refuge, appreciated for its stability and its intrinsic value. However, the traditional gold physical market has logistical challenges, childcare costs and transport risks.

Digital gold, represented on blockchain, eliminates many of these obstacles, offering a more practical and accessible alternative.

UBS is experimenting with this solution to meet the growing demand for digital investments from its customers. The tokenization of gold on the blockchain makes it possible to divide the asset into smaller units, which makes it accessible to a wider audience.

In addition, the intrinsic transparency of the blockchain ensures that each transaction is verifiable and secure, increasing the confidence of investors.

The UBS initiative could have significant implications for the financial sector. The use of blockchain to digitize traditional assets like gold shows how institutions can take advantage of this technology to innovate their services.

THE Tokenizazione degli asset Reduces not only operational costs, but also opens up new investment opportunities for customers.

In addition, the adoption of ZKSYNC highlights the importance of evolutionary and sustainable solutions to ensure that blockchain applications can be integrated into existing financial systems without compromising security or efficiency.

If the UBS pilot project succeeds, it could serve as a model for other financial institutions interested in exploring the blockchain.