Crypto analyst followed closely, Benjamin Cowen, said that a change in monetary policy will most likely be what triggers an “allusivity season”, or a period when altcoins largely surpass Bitcoin (BTC).

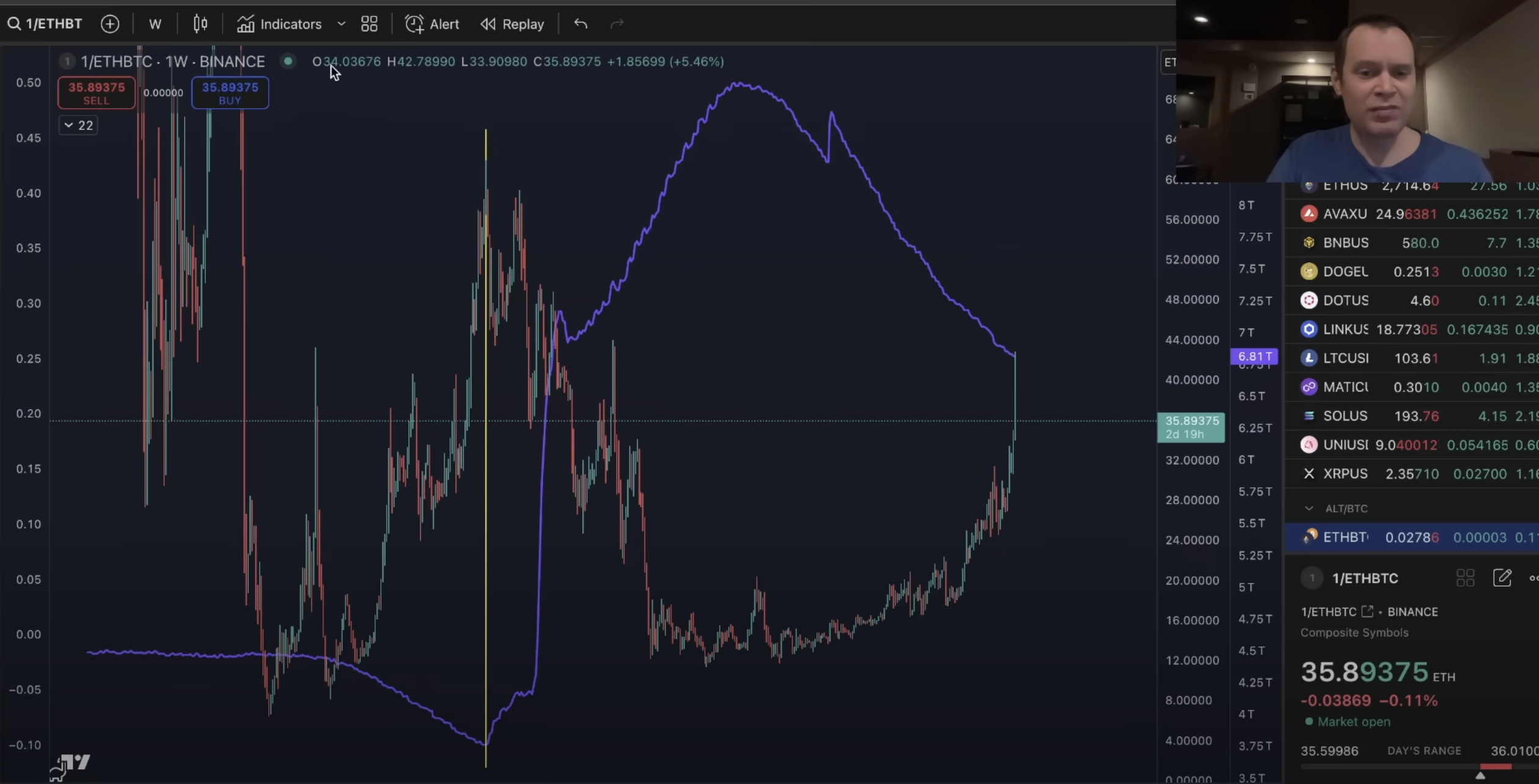

In a new strategy session, Cowen superimposes the Fed balance sheet with Ethereum (ETH) against Bitcoin (ETH / BTC) and notes that in previous market cycles, the Seasons Alts have not launched until the Fed ended the quantitative tightening (QT) and increased the active in its balance sheet.

“What made it possible (the forecasts) was just understanding of the stricter monetary policy, and knowing that the last cycle, we did not see the bottom of the Eth / BTC or the reverse of this summit, We did not see the top of the BTC / ETH evaluation before the Fed ended the quantitative tightening …

And so, you can see that the Fed did the same thing exactly this cycle and throughout this process, just like the last cycle, ETH has lost value against Bitcoin. Now, the same goes for many altcoins …

And in fact, if you look at an alts basket, you can see that in fact, they have put new stockings this week, and my argument has always been, that they will probably end up going to the beach before There is really a great hope that all season in Allusatory could occur. You can also look at others / BTC, and see that it has just fallen since the beginning of 2022.

There are a lot of people who call it the “SUPERCYCLE MEMECOIN” and they try to make you pump for Alteason and to say that these same will outperform, but in the end, they continue to bleed in Bitcoin. »»

https://www.youtube.com/watch?

Do not miss a beat-Subscribe to obtain alerts by e-mail delivered directly in your reception box

Check price action

Follow us XFacebook and telegram

Surf the daily Hodl mixture

& nbsp

Warning: Opinions expressed at Daily Hodl are not investment advice. Investors should make their reasonable diligence before making high-risk investments in bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and that all the losses you may undergo are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, and the Daily Hodl is an investment advisor. Please note that the Daily Hodl is participating in affiliation marketing.

Featured image: Shutterstock / Tithi Luadthong / Natalia Siiatovskaia