The North Korean pirates and broken chain projects have left several decentralized financial blockchains in difficulty, with tens of millions of user asset outings.

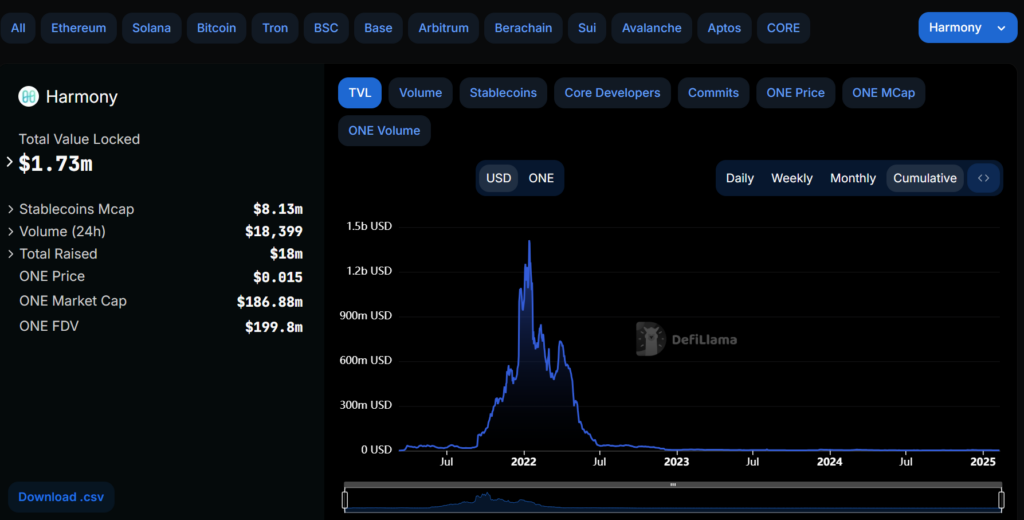

Defillama’s data show that several DEFI channels have lost approximately 90% of the total user deposits over the years, in particular from the last cryptographic cycle. The 0xthoor chain analyst has identified the Ethereum Virtual Machine Compatible Blockchain Harmony as the greatest drop regarding the total locked value.

Harmony launched his Mainnet Layer-1 in 2019, two years before the previous Bull Run and its 2021 peak. In January 2022, Harmony TVL reached a summit of all time, exceeding $ 1.4 billion.

Six months later, in June, the North Korean pirate group Lazarus stole $ 100 million at the Harmony Horizon bridge in one of the biggest DEFI hacks to date. Harmony user deposits have regularly decreased from this point. The protocol held $ 1.7 million on TVL by publishing a publication time, down 99% compared to its 2022 ATH.

DEFI TVL for projects like Aurora, Moonrise, Canto and Evmos also dropped at least 90%. Even Polygon, a popular scaling solution based on Ethereum, has lost 92% of its TVL. Crypto deposited on the L2 of $ 9.9 billion in 2021 to $ 700 million at the beginning of 2025. “Many more TVL graphics will look like this in the coming years,” tweeted 0xthoor on February 10.

Total DEFI TVL currently oscillates above $ 106 billion, compared to $ 175 billion in 2025. Despite the collapse of the major protocol, projects such as the Incubated Coinbase base and the emerging operability of Bitcoin Defi can propel the Ecosystem on the chain to new heights as adoption acceleration.