Este Artículo También is respondable in Español.

In her testimony on Tuesday, the president of the federal reserve Jerome Powell attenuated the hopes for another quantitative relaxation cycle (QE), reiterating that “QE is a tool that we only use when the rates are already zero “And that the FED remains” far from the end of the QT. “This position calls into question the idea that a rapid pivot in aggressive relaxation could move bitcoin and the entire cryptography market as in past cycles.

End of bull for Bitcoin and Altcoins?

Macro analyst Alex Krüger posted on X that “we are at the age of Qe”, stressing that some market players needed to hear Powell’s position clearly. Another commentator, Tagoo, noted that there is “no need for QE, only for QT stopping”, which has encouraged Krüger to answer that he can take “a few more months” for QT ends.

Felix JAUVIN, the host of the Podcast on the Margin, commented via X: “Because the Qe arrives soon, I hope you have just heard what Powell said” Qe is a tool that we only use when when The prices are already zero ”. You don’t want zero prices and qe. This means that a lot of pain should occur in the meantime. Qe does not come to save your alt bags overfacted anytime soon. »»

JAUVIN thinks that the American economy went from a period of stagnation to a more fundamental growth phase. According to him, “we can always see the bull markets and an offer in risk assets without these monetary plumbing tips”, because he considers this as a healthier environment led by productivity – he calls “a golden age economic”.

Dan Mcardle reminded followers that markets can remain at risk “with a decent economy and a certain expansion of credit”. He warned the cryptographic community against the anchoring of expectations only to policies and qe at zero interest rate, suggesting that a regular economy could always support the increase in bitcoin.

Julien Bittel, responsible for macro-research at Global Macro Investor (GMI), supervised Powell’s comments in “The Everything Code”, affirming that QE is only part of the global image of liquidity. Although the FED may not soon rotate QE, Bittel stressed that other factors, such as the actions of the Banque Populaire de China, the creation of private credit or changes in the General Treasury Account, can also inject liquidity on the markets. “The Fed has other tools, and they work with the treasure from Covid to smooth the impact of QT by the TGA and the RRP,” said Bittel.

He reminded traders that “it is not only the Fed in this equation” and noted that the Chinese rates towards zero increase the possibility that China deploys a form of QE. “In 2017, the Fed was a little player in the liquidity game. In fact, the Fed made QT and hiking rates all year round, but assets at risk have always prospered and Bitcoin made a 23x after the net but 28% short in January, “he Added.

Crypto Kevin analyst also argues that Bitcoin may not strictly require qe to prosper. However, he stressed that “we have also never seen a macro cycle in the domination of the BTC” during the active QT, throwing doubt on the probability of a robust Altcoin season as soon as. “I always believe that my analysis tells me in the second trimester, it will end, but if we take Powell at its nominal value, the Altcooin seasonal appellants every day in the past 2 years will continue to appear more lost and bad, then They are and have already been “, Kevin indicated.

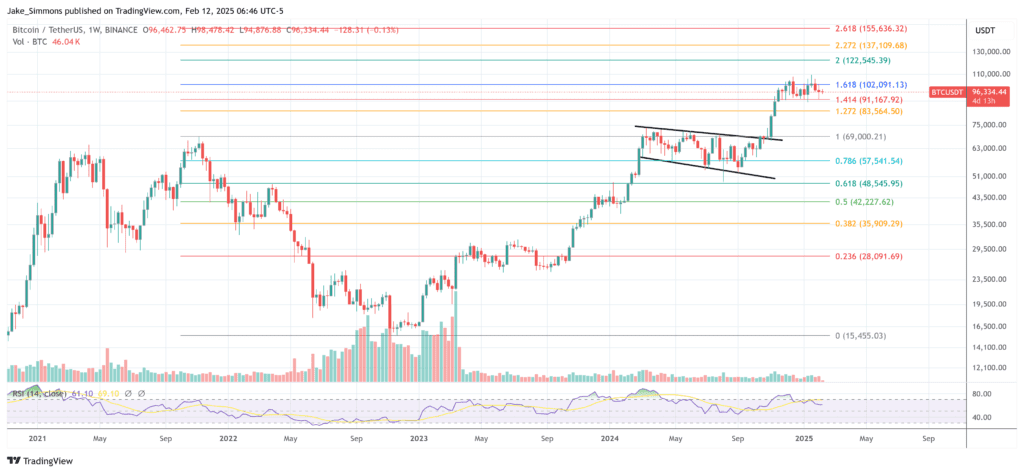

At the time of the press, BTC exchanged $ 96,334.

Shutterstock star image, tradingView.com graphic