- The average directional index (ADX) of the IP (ADX) was 59, at the time of the press, indicating a strong dynamic.

- Channel metrics revealed that exchanges have experienced $ 2.15 million in IP tokens.

The Crypto project AI recently launched, Story (IP), makes waves on the cryptocurrency market with its impressive upward momentum.

With the massive overvoltage of 32%, traders and investors are betting strongly on the assets and accumulating it, as reported by the Coiginglass chain analysis company.

The current price of the IP

Not only that, but he also obtained a place among the ten toppoises Crypto AI by going beyond the virtual (virtual) protocol. At the time of writing the editorial staff, IP was negotiated nearly $ 3.42 and experienced a 97% increase in the negotiation volume.

Since the launch of the project, the exchanges have experienced a coherent exit of IP tokens, suggesting that long -term investors and holders have accumulated the active.

The influx / spot outlet data reveal that, in the last 24 hours, the exchanges have recorded an IP tokens out of $ 2.15 million.

Source: Coringlass

This significant exit from exchanges could create a purchase pressure and lead to the rise up. This could explain today’s substantial rally.

Following this accumulation and prices overvoltage, intraday traders entered the market. This led to a 70% increase in the open interest of the IP (OI).

The increase in the OI indicates that traders have increased their positions on the long and short sides.

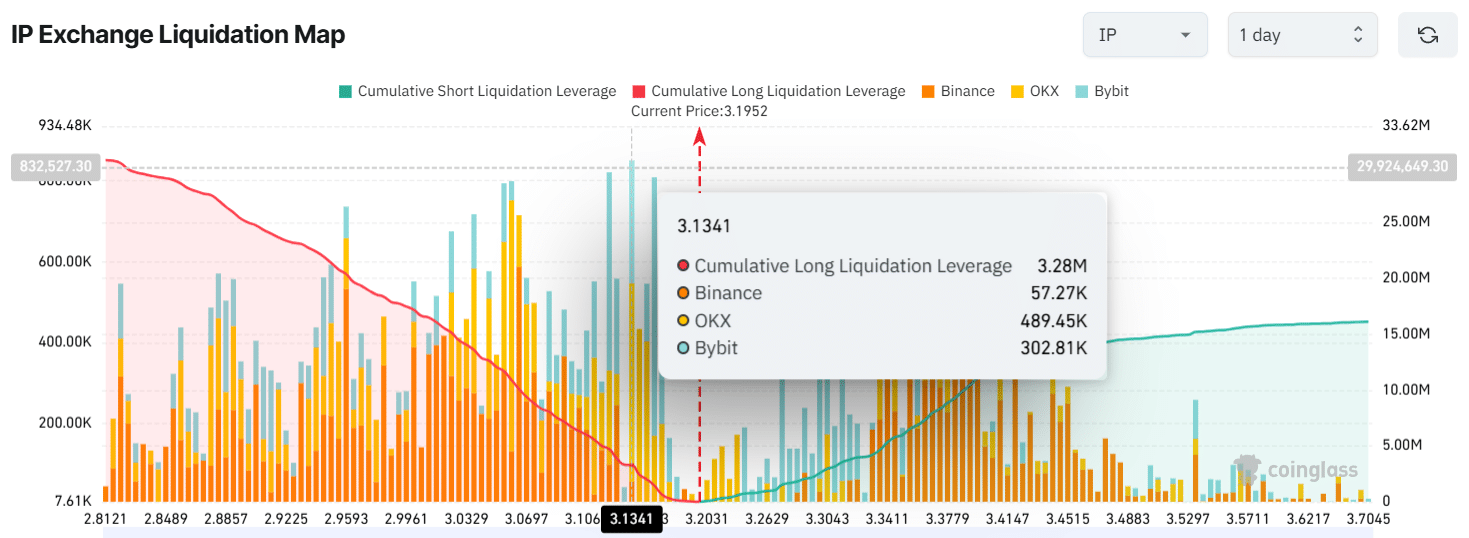

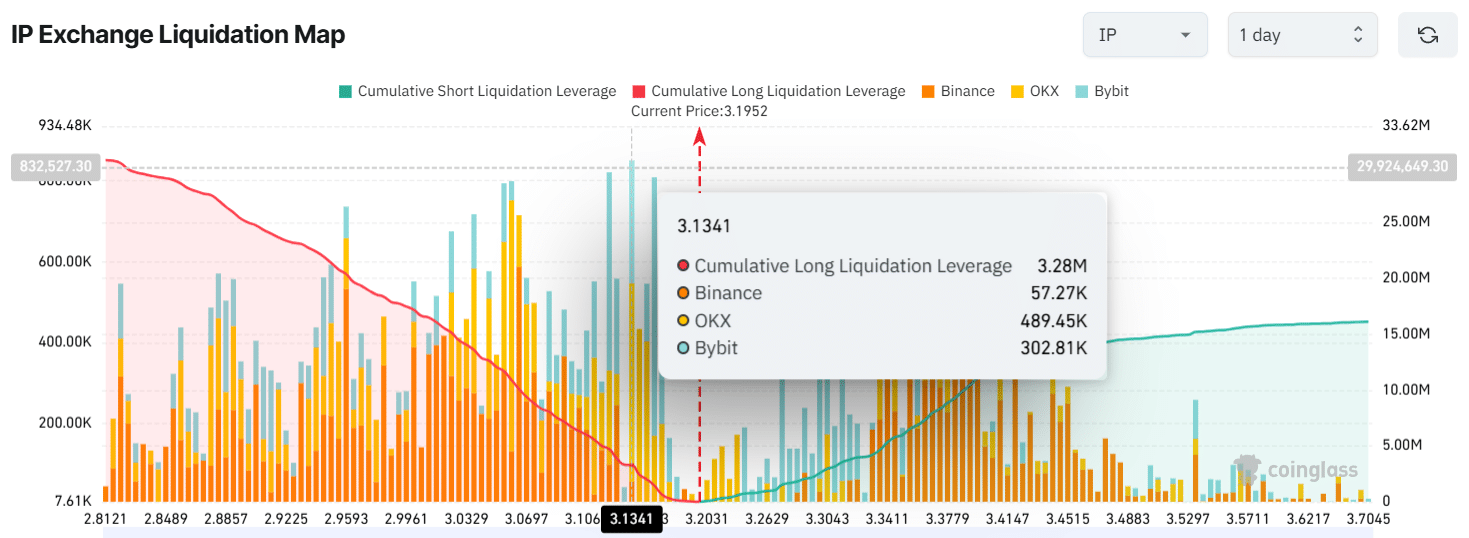

Main liquidation zones

Coinglass data has revealed that traders are betting on the long side currently dominate the assets and are over-leveled at $ 3.134, holding $ 3.28 million in long positions.

On the other hand, open sellers seem to be exhausted because they are overexploited at $ 3.276, with $ 1.54 million in short positions.

Source: Coringlass

These chain parameters indicate that the bulls strongly support the assets, which could help maintain its momentum.

Technical IP analysis and key levels

According to Ambcrypto’s technical analysis, the IP seems bullied as the average directional index (ADX) is currently being 59, indicating a strong dynamic.

The ADX line with the ascending pressure suggests that the ip momentum accelerates.

Source: tradingView

However, despite the upward trend of ADX, the four -hour graph indicates that the assets could undergo a short -term price correction.

Based on the recent momentum, IP could see a price drop of 15%, potentially reaching the level of $ 2.61 in the coming days.