- The greatest winners: History (IP), Sonic (s), Maker (MKR).

- The biggest losers: Raydium (Ray), Jupiter (JUP), official Trump (Trump).

The cryptocurrency market continues to present net price movements, some tokens reaching remarkable gains while others are undergoing significant slowdowns.

This week has experienced explosive rallies among the most efficient tokens, while some assets were faced with incessant sales pressure. You will find below a deep dive in the biggest winners and losers of the last seven days.

The greatest winners

History (IP)

History (IP) has dominated cryptographic markets this week, soar 205% from $ 1.50 to $ 4.40.

The meteoric increase in the token started on February 20, when a sustained wave of purchase brought the prices of $ 2.50 to an amazing peak of $ 5.80 on February 21.

The rally was powered by an exceptional volume of trading, especially during the above -mentioned explosive session, when IP reached its weekly summit.

However, taking advantage of profit above the $ 5.50 mark, triggering a withdrawal that stabilized around $ 4.40.

Despite the retirement of peak levels, IP maintains robust support at $ 4.20, buyers constantly working at this price.

The activation of token prices is a bullish consolidation model, suggesting potential for another step.

This week’s overvoltage places the IP among the best artists on the cryptography market, with technical indicators firmly in Haussier territory.

SONIC (s)

Sonic (s) drew significant attention this week, from $ 0.52 to $ 0.81. The former FTM token posted a remarkable momentum, especially during its mid -week rally which pushed the prices to a peak of $ 0.95.

The ramp -up started on February 19, with a strong purchase pressure leading a series of green candles that led to a summit on February 21.

The negotiation volume has notably increased during this period, reflecting a substantial interest in the market in the token.

While taking profits emerged above $ 0.90, causing a decline at current levels, Sonic maintains its upward structure. The token found solid support at around $ 0.80, buyers constantly defending this area.

The technical indicators suggest that the upward trend remains intact despite the consolidation phase. The level of $ 0.85 now represents a key resistance, with a break above the potentially renewal of purchasing interests.

Maker (MKR)

Maker (MKR) presented an exceptional force this week, going from $ 58% to $ 1,585.

The truck DEFI took a significant momentum after hitting key resistance levels, in particular the $ 1,200 mark.

The bullish momentum accelerated on February 21, when MKR recorded a substantial green candle, bringing prices from $ 1,200 to $ 1,400 in a single session.

The volume of trading has increased spectacularly, the MacD indicator confirming a strong bullish momentum while it crossed the signal line.

Source: tradingView

Technical analysis reveals that the action of MKR prices has formed a powerful upward trend, each demotion finding solid support at higher levels.

The token managed to violate its 200 -day mobile average at $ 1,487, transforming it into a level of support.

Recent sessions, at the time of the press, have shown that MKR consolidating itself over $ 1,500, which suggests that buyers remain in control. The MacD histogram continues to print higher peaks, indicating sustained bullish momentum.

For merchants who envisage entry points, the newly established support for $ 1,500 has a key level to monitor.

A successful defense of this area could set up MKR for another higher leg, potentially targeting the resistance level of $ 1,700. However, any break below $ 1,400 could report a short -term decline.

Top 1,000 winners

Beyond the most efficient, the wider market has seen notable overvoltages.

Scotcoin (Scot) led the 1,000 best tokens with a 742%gain, while Undeads (UDS) and Solana Social Explorer (SSE) games displayed gains of 295%and 266%, respectively.

Biggest losers

Raydium (Ray)

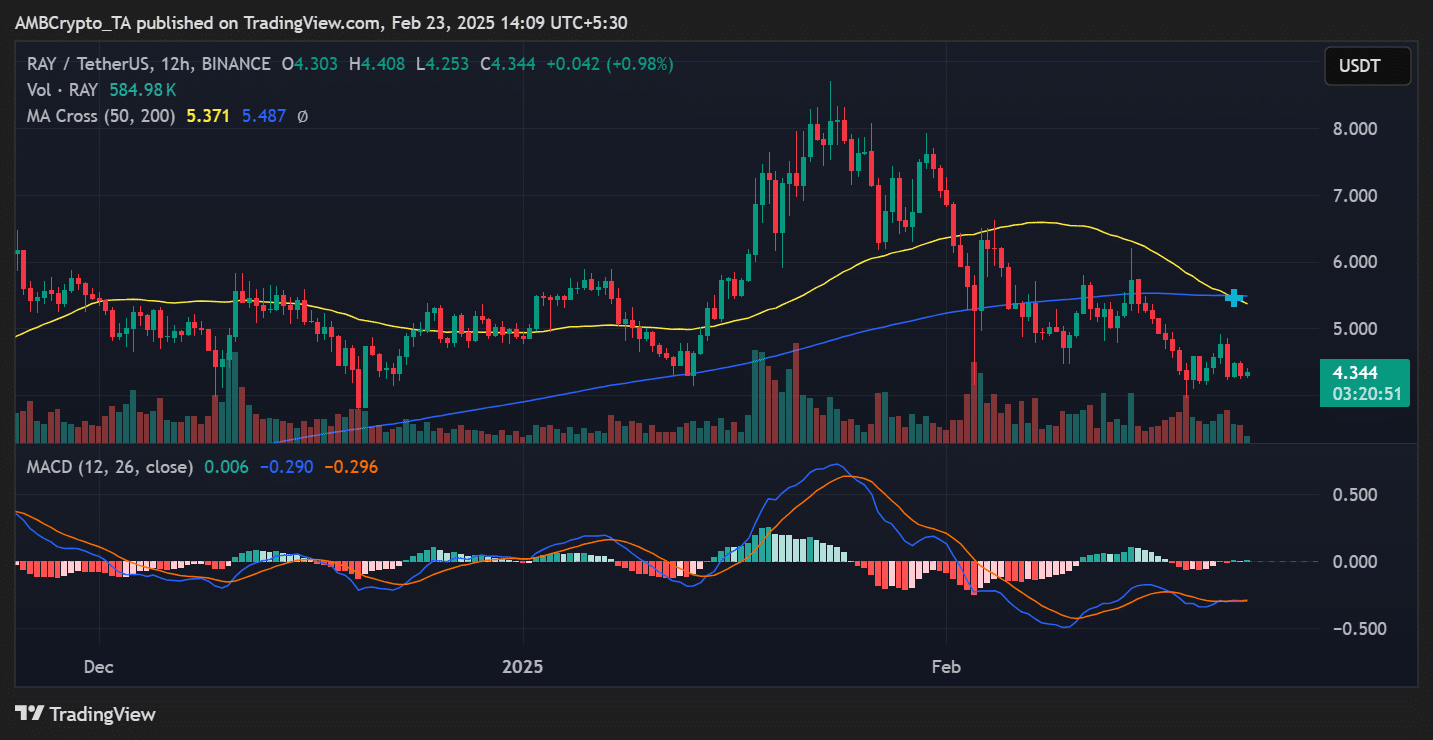

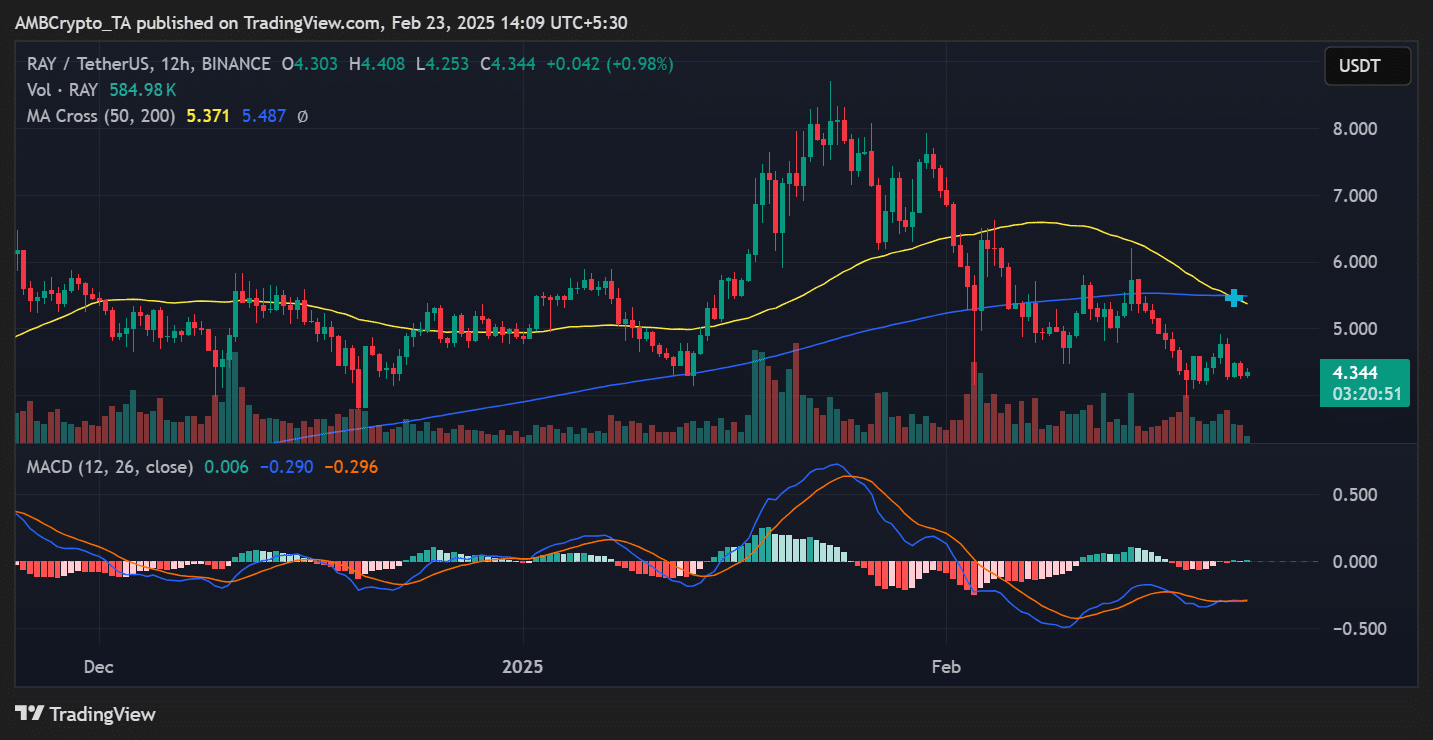

Raydium (Ray) has become the biggest loser this week, from $ 5.15 to $ 4.34.

The Token Dex based in Solana has been faced with incessant sales pressure, the bears dominating almost all negotiation sessions since February 17.

The sharp drop started with a series of large red candles that have crossed several levels of support.

The largest drop occurred in the first two days of the week, when Ray went from $ 5.15 to $ 4.20, bouncing briefly in this support area.

Source: tradingView

Despite an attempt to recover the middle of the week which pushed prices to $ 4.80 on February 21, the sellers quickly regained control.

The MacD indicator remains negative and a skull model has formed, signaling prolonged drop pressure.

For any significant recovery, Ray must recover $ 4.50, followed by a resistance level rupture of $ 4.80. However, the current technical configuration suggests that bears remain in control.

Jupiter (JUP)

Jupiter (JUP) could not escape a larger pressure on the market, from $ 0.92 to $ 0.78. The DEX aggregator based in Solana was faced with significant sales pressure, especially during the start of the week.

The most steep drop occurred between February 17 to 19, when JUP went from $ 0.92 to $ 0.70, marking a local background. While buyers emerged at this level of support, the rebound was not durable.

JUP was consolidated between $ 0.77 and $ 0.80 to date, with lower ups and lower stockings defining the trend.

The level of $ 0.75 now represents crucial support, with any rupture below probably triggering another wave of sales.

Official Trump (Trump)

The official Trump token (Trump) even had trouble this week, going from $ 0.35 to $ 0.31. The political theme was faced with persistent sales pressure, continuing its downward trend.

The decline accelerated in the middle of the week, briefly affecting $ 0.29 before seeing a minor rebound. Despite stabilization attempts of about $ 0.32, the sales pressure remained dominant.

For any significant recovery, Trump must recover and maintain above the resistance level of $ 0.33. However, the support level of $ 0.30 remains a critical test for the token.

Top 1,000 losers

In the wider market, Unchain X (UNX) led the drops with a drop of 62%, followed by balance (balance) and griffin (griffin), which dropped by 61%and 44%, respectively.

Conclusion

Here is the weekly summary of the greatest winners and losers. It is crucial to keep the volatile nature of the market in mind, where prices can change quickly.

Thus, doing your own research (Dyor) before making investment decisions is the best.