- Litecoin has surpassed Bitcoin, driven by liquidations, but the risks remain due to market volatility

- Analysts encourage caution because SLD faces key support challenges and current price fluctuations

Litecoin (LTC) recently shown a light edge on Bitcoin (BTC) in the short term, certain lowering positions being liquidated in the process. This increase in the LTC price has triggered optimism among traders, but analysts urge prudence.

Despite the rally, the market remains volatile, which makes risk management essential.

Short -term LTC performance – liquidations fuel the rally, but caution is required

Litecoin has dropped 5.54% in the last 24 hours, negotiating $ 119.74 on graphics after a summit of $ 127.30. Despite this withdrawal, the LTC has outperformed Bitcoin in the short term. The liquidation of lowering positions has probably contributed to a temporary increase in prices before retrace.

Source: tradingView

The data indicated that, even if the SLC recorded a solid rally in mid-February, the rejection to key resistance alluded to the profit taking and the uncertainty of the market.

Meanwhile, BTC saw a drop of 20.51%, before recovering, reflecting a broader weakness of the market. Analysts have thus highlighted the importance of stop-loss levels, because volatility remains high with the key LTC at $ 114 and $ 110.

Litecoin market analysis

A recent analysis also highlighted a dynamic market landscape.

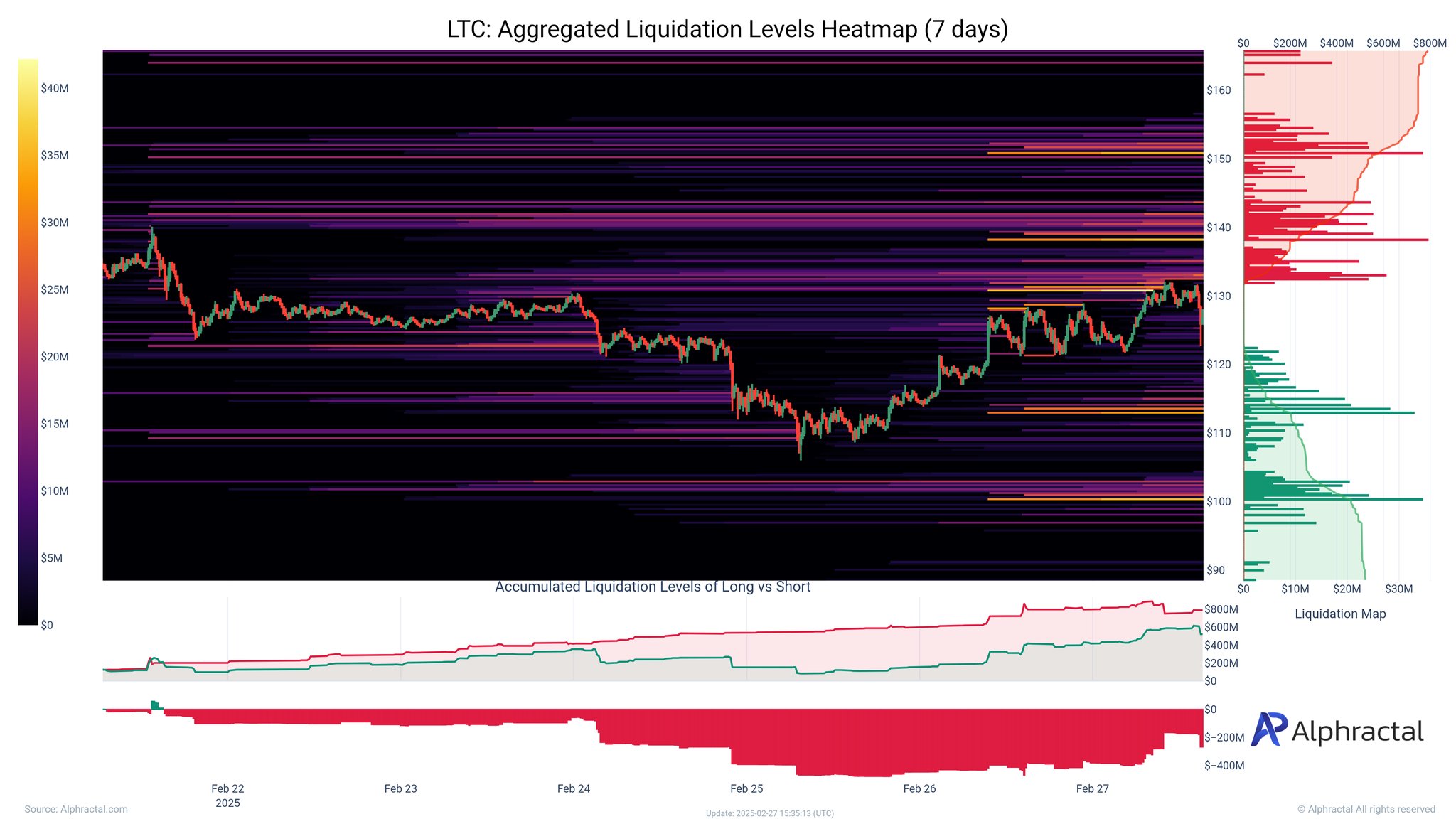

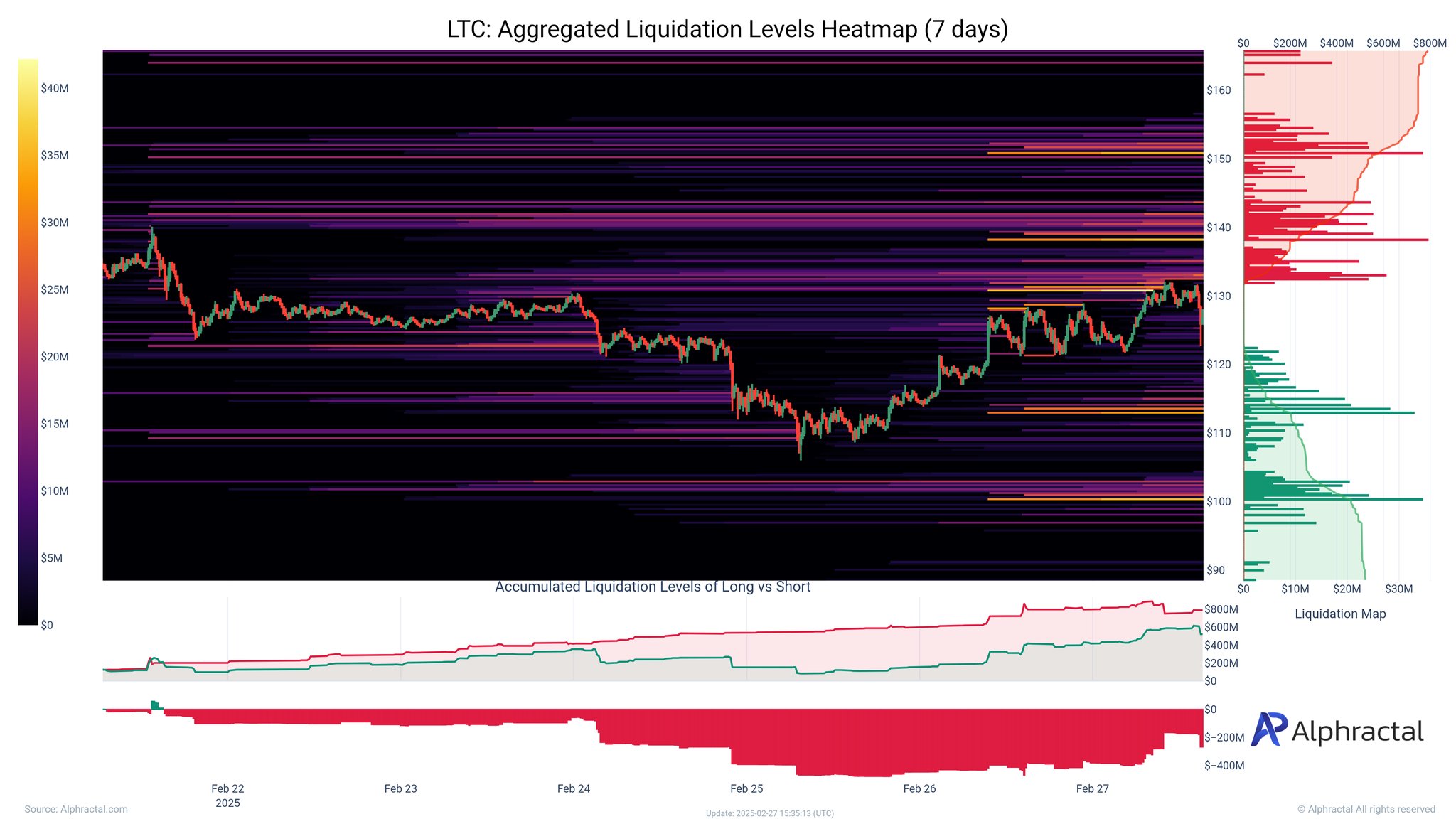

A seven -day liquidation thermal card has revealed a significant activity at key levels – large short liquidations nearly $ 130 of resistance and long liquidations close to $ 110. The short liquidation group greater than $ 130 suggested that the lowering positions have been in a hurry while the LTC tried to rally on the graphics.

Source: Alphractal

This rally was largely driven by short liquidations.

However, as the LTC approaches, long liquidations of $ 110 will become more pronounced, signaling the risk of drop in potential if the sales pressure increases. The global trend has also highlighted more short liquidations than long – the strengthening that bears were forced to go out during the upward movement.

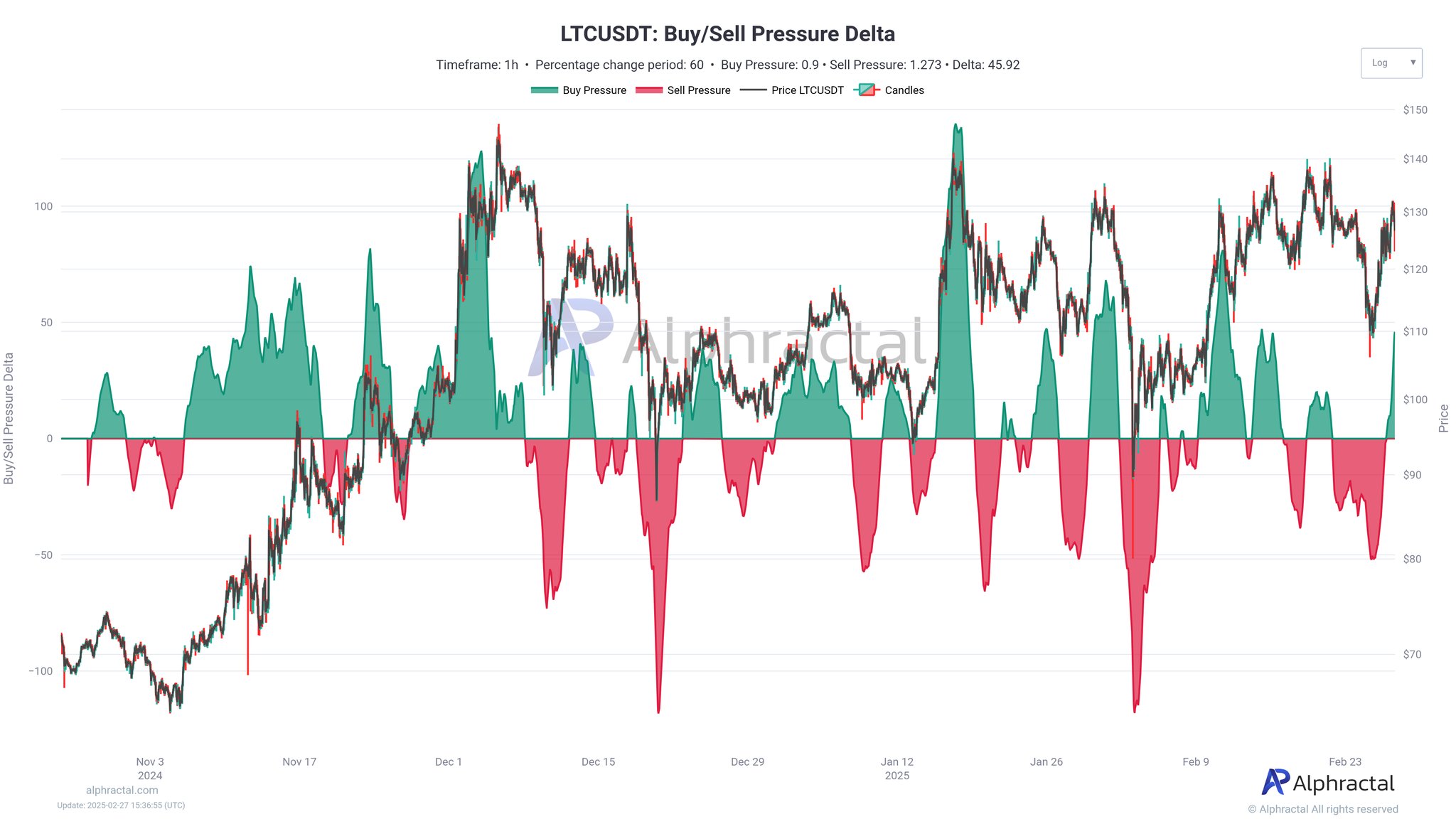

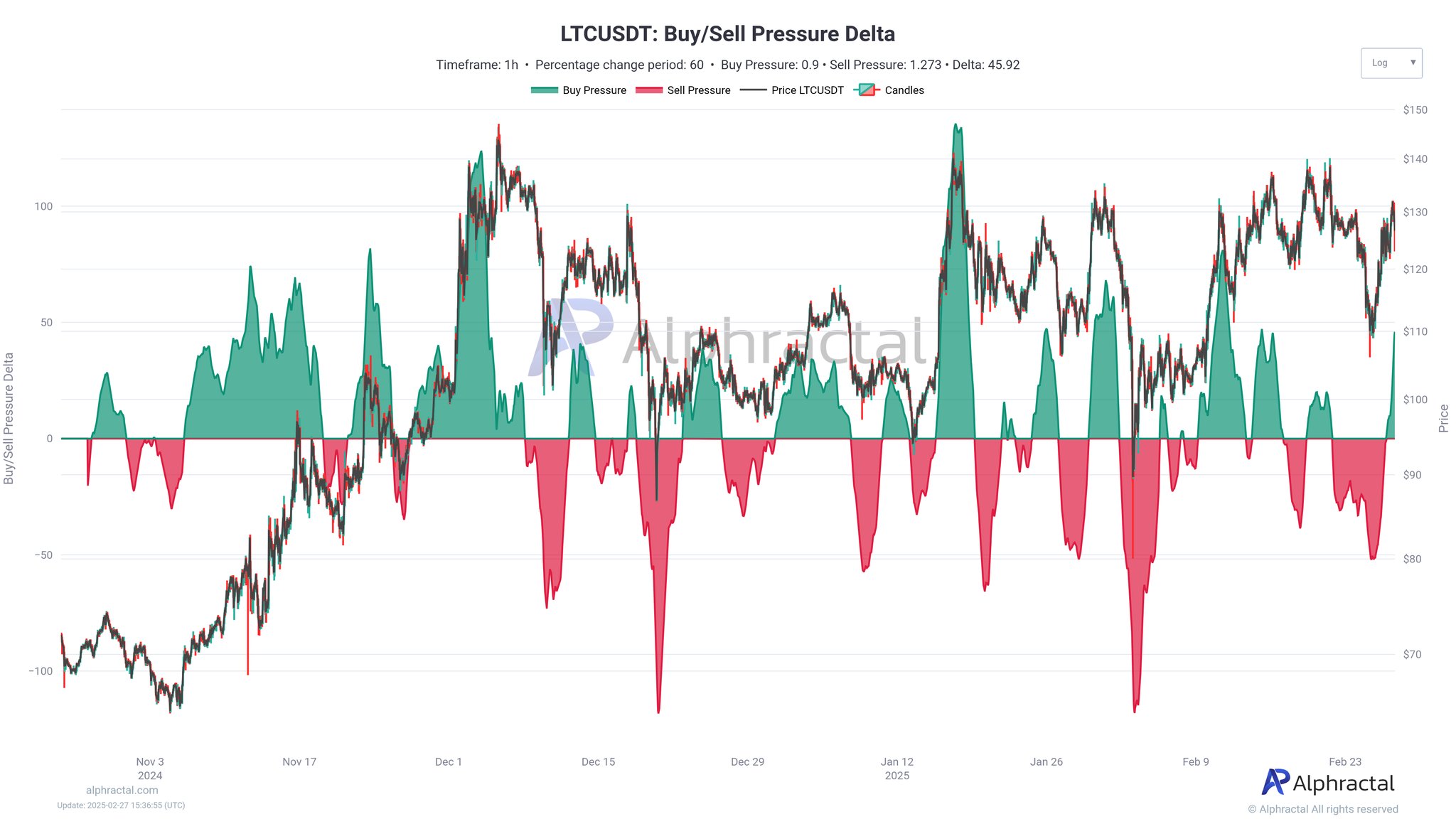

Source: Alphractal

The purchase and sale pressure table highlighted the key moments of accumulation and distribution.

During the LTC rally, domination on the purchase side increased the higher price. As the momentum slowed down, the sale pressure increased, suggesting a profit or a change of feeling. Despite this, the demand remained solid near the support, referring to a potential rebound if the SLD stabilizes.

Source: Alphractal

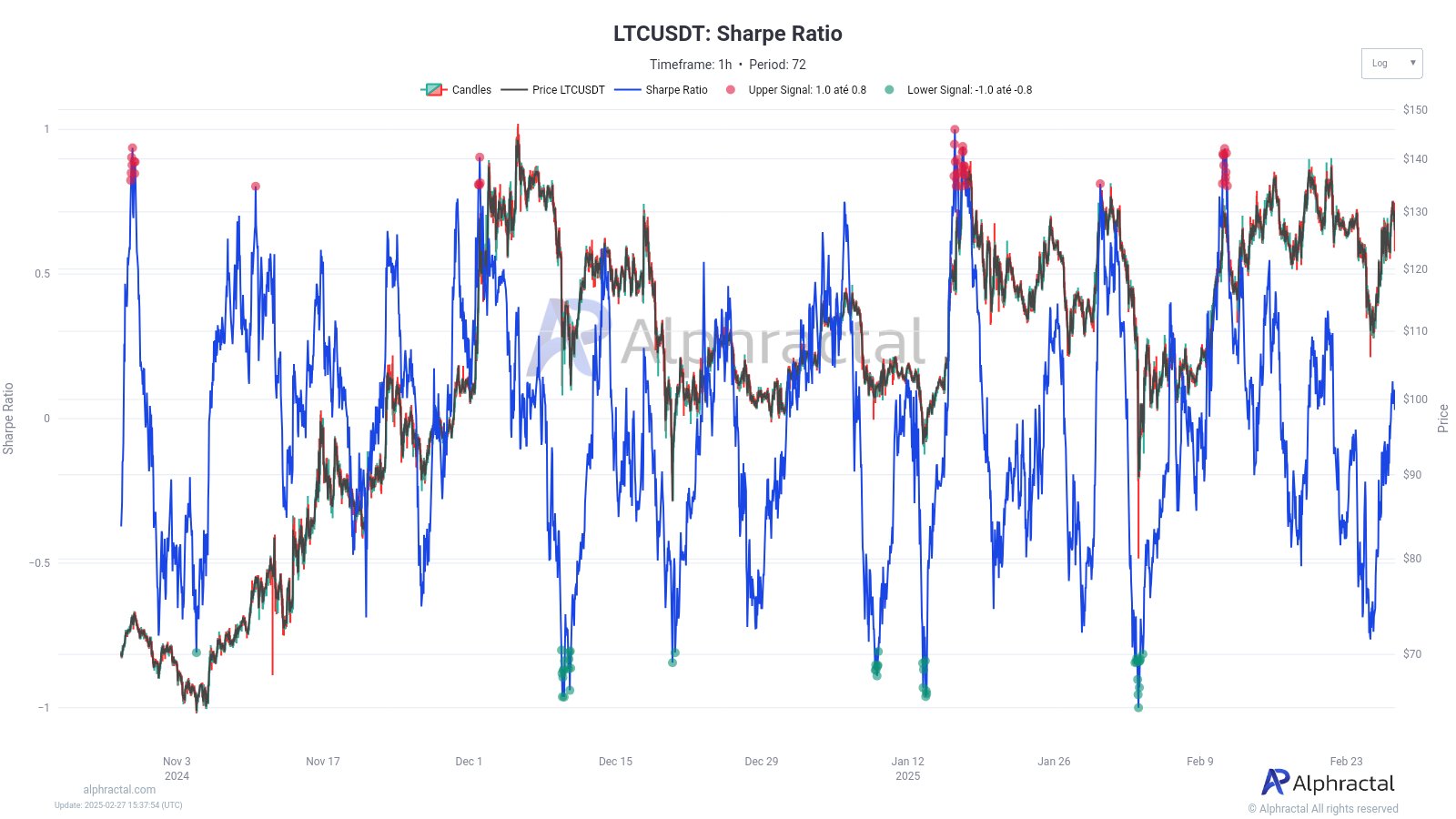

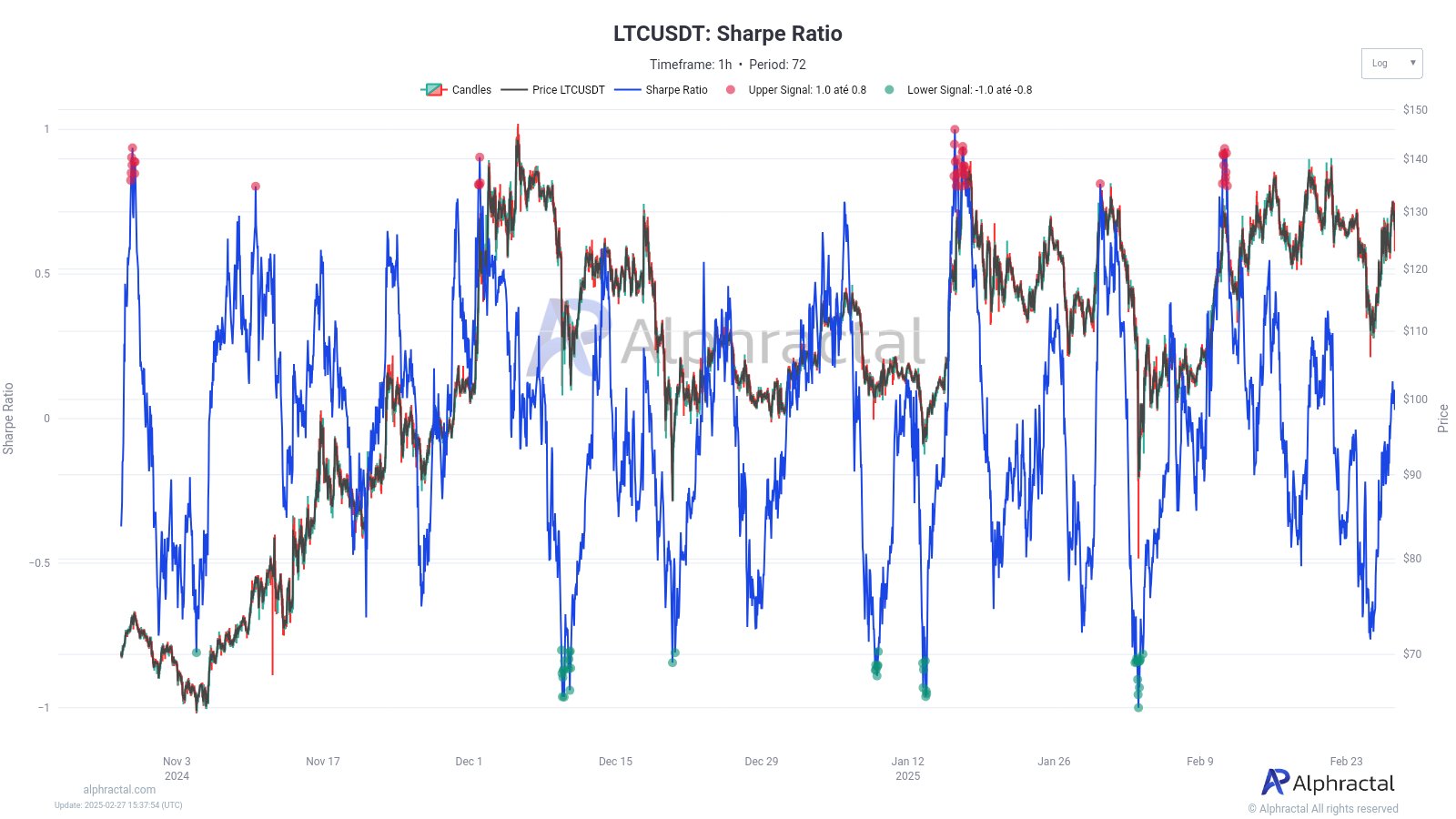

Finally, the Sharpe ratio, with points above 0.8, signals excessive conditions where yields exceed the risk, often leading to corrections. Conversely, drops below -0.8 indicate an undervaluation, where the risk prevails over potential yields.

At the time of writing the editorial staff, the Sharpe de LTC ratio seemed to bounce back from a recent hollow – a sign that, although volatility persists, yields adjusted to risk can improve in the near future.