Este Artículo También is respondable in Español.

Cryptographic analyst Tony Severino has established similarities between the action of Ethereum prices in 2024 and this year. More specifically, the analyst has highlighted important technical indicators and what they say about the future eth trajectory.

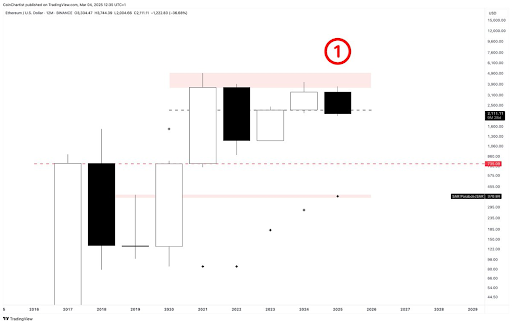

The action of Ethereum prices in 2024 vs. 2025 on the basis of important technical indicators

In a X postTony Severino provided a Japanese candlestick, a sequential and parabolic Sar analysis of 2024 and 2025 Ethereum price action. He noted that ETH’s candle in 2024 had made a lower top at a candle and high wick. On the other hand, he revealed that the 2025 candlestick is currently a downward swallowing with the body of candles fully engulfing the chandelier of 2024 and entered the body of the candles of 2023.

Related reading

Meanwhile, Severino said the annual support was fired at $ 735, while the parabolic SAR is $ 370. He also noticed that the TD sequential account is now on a red 1, potentially indicating the start of the very first annual decline in Ethereum. The analyst assured that it was still very early to worry about an annual candlestick which has another ten months to close.

Ethereum is currently in a downward trend, having dropped below $ 2,000 yesterday for the first time since December 2023. Although ETH has recovered above this psychological level, concerns remain concerning its current price action. As Severino noted, the Ethereum price could be faced with its first annual decline trend.

Ethereum started the year unusually, recording a negative monthly fence in January and February, the first time that happened. Cryptographic analyst Ali Martinez warned that the Ethereum price could still fall at as low as $ 1,600, or even $ 1,200, having broken below the lower limit of a parallel channel.

ETH’s background could be in

In a post X, crypto analyst Crypto titan said the bottom of Ethereum was in place. He revealed that the Bas 2024 had been swept away on the perpetual daily graphic of ETH, explaining what the analyst thinks is the most important point of interest for a potential reversal. The analyst’s support graph suggested that the Ethereum price could still approach or even reach its top of all current time (ATH).

Related reading

In the short term, the Ethereum price should always bounce back. The analyst revealed that two eTh CME Futures GAPS Stay not full above $ 2,500. The first is between $ 2,540 and $ 2,620, while the second is between $ 2,900 and $ 3,300. He noted that these ETH CME gaps have traditionally tended to fill, indicating that crypto could soon bounce back at these price levels.

At the time of writing writing, the Ethereum price is negotiated at around $ 2,176, up more than 3% in the past 24 hours, according to data from CoinMarketCap.

Felash star image, tradingView.com graphic