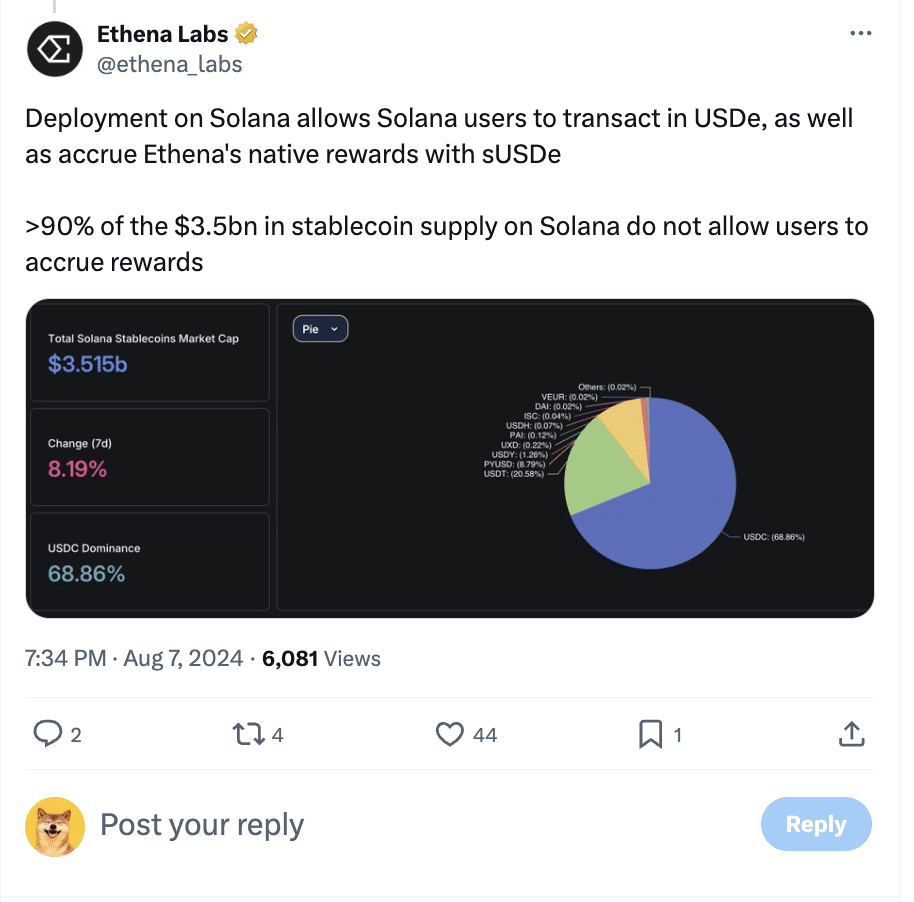

Ethena Labs, the team behind the USDe stablecoin, is making headlines today after integrating with the Solana blockchain on August 7. This strategic move allows USDe to leverage Solana’s high-throughput, low-cost infrastructure, significantly enhancing the stablecoin’s capabilities.

But that’s not all, as Solana’s native token, SOL, will now be used as a backing asset for USDe, pending approval of governance proposals.

Source: X

According to the DeFi project,

“The inclusion of SOL as a supporting asset is expected to unlock an additional $2-3 billion in open interest.”

This increase in scalability is crucial for the stablecoin market as it provides more liquidity and stability, making USDe a more robust and reliable option for users.

USDe’s integration with Solana also means it can now be used across multiple decentralized finance (DeFi) applications on the Solana network. These include Kamino Finance, Orca, Drift, and Jito. Users can provide liquidity to these platforms or use USDe as collateral for margin trades.

In doing so, they can earn Ethena Sats, which are convertible into ENA tokens at the end of each campaign. This feature provides users with more ways to interact with the DeFi ecosystem, improving their earning potential and participation in the growing DeFi market.

What does this mean for DeFi?

Kamino Finance, for example, is a platform that allows users to automate their DeFi strategies, making it easier for them to maximize their returns. Orca is a decentralized exchange that offers a user-friendly interface and efficient trading options.

On the contrary, Drift provides a decentralized derivatives trading platform, while Jito focuses on providing advanced trading tools and analytics.

The inclusion of USDe in these platforms will provide users with more robust and diverse options to use their stablecoins in the DeFi space.

The integration of USDe with Solana marks a significant milestone for Ethena Labs and the stablecoin market. By leveraging Solana’s capabilities, USDe aims to provide its users with a more scalable, efficient, and versatile stablecoin solution.

The additional liquidity and supporting assets will improve the stability and utility of USDe, making it an attractive option for users looking to engage in DeFi applications on Solana.