- WIF climbs 21% on weekly charts.

- Dogwifhat’s open interest has increased by 51.5% over the past week.

Over the past two weeks, cryptocurrency markets have experienced extreme volatility. Since the market crash a week ago, most cryptocurrencies are recovering.

Amidst this rally, meme coins have taken the lead, with WIF leading the way. Solana-based memecoin dogwifhat (WIF) is outperforming other memecoins, posting significant gains.

Dogwifhat is the leader in the memecoin market

WIF has outperformed most memecoins on the weekly charts with substantial gains.

For starters, SHIB has registered 3.17% over the past seven days while DOGE has reported small gains of 3.47% on the weekly charts, and PEPE has enjoyed a 5.41% surge.

As cryptocurrency markets saw a significant recovery, most memecoins gained on the daily and weekly charts, with WIF leading the way.

This surge has led analysts to bet on WIF to lead the memecoin industry. On Page X, Platinum Capital shared that,

“If the market holds and #wif can hold 1.8, we are ready for a move on #dogwifhat. $wif could lead the next leg of this #memecoin.”

What the price charts suggest

At the time of writing, WIF was trading at $1.86 after registering a 21.34% increase over the past week. Similarly, the memecoin increased its market cap by 3.17% to $1.8 billion.

However, although the altcoin has seen a price surge, its trading volume has decreased by 37.51% in the last 24 hours to $255.5 million.

Source: Tradingview

Looking at the Altcoin Price Drawdown Ratio (ADR), which is 1.15, suggests that the asset is experiencing more gains in value than losses. This indicates a bullish market sentiment.

Additionally, RVGI has been trending upwards from -0.4 to -0.12 over the past week. While still below zero, the upward trend shows that the upward move is gaining momentum as market sentiment evolves.

Source: TradingView

Additionally, the Relative Strength Index (RSI) has been trending upwards from 29.6 to 47.14 over the past week. This shows that WIF has been experiencing sustained buying pressure over the past week, which has pushed prices higher.

Source: Coinglass

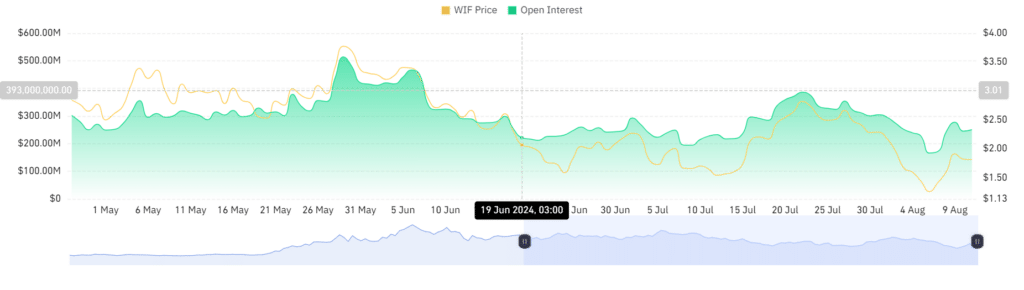

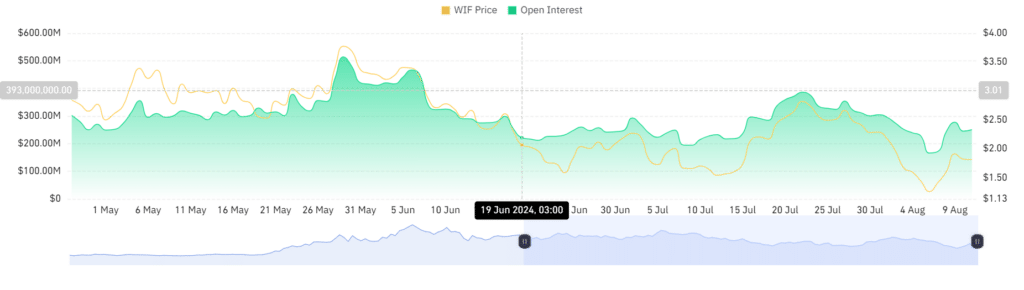

Digging deeper, AMBCrypto’s analysis on Coinglass shows that WIF’s open interest has increased by 51.1% over the past week. Open interest has increased by 51.5% over the past week, from $165 million to $250 million.

This shows that investors are opening more new positions while maintaining existing ones.

Source: CoinGlass

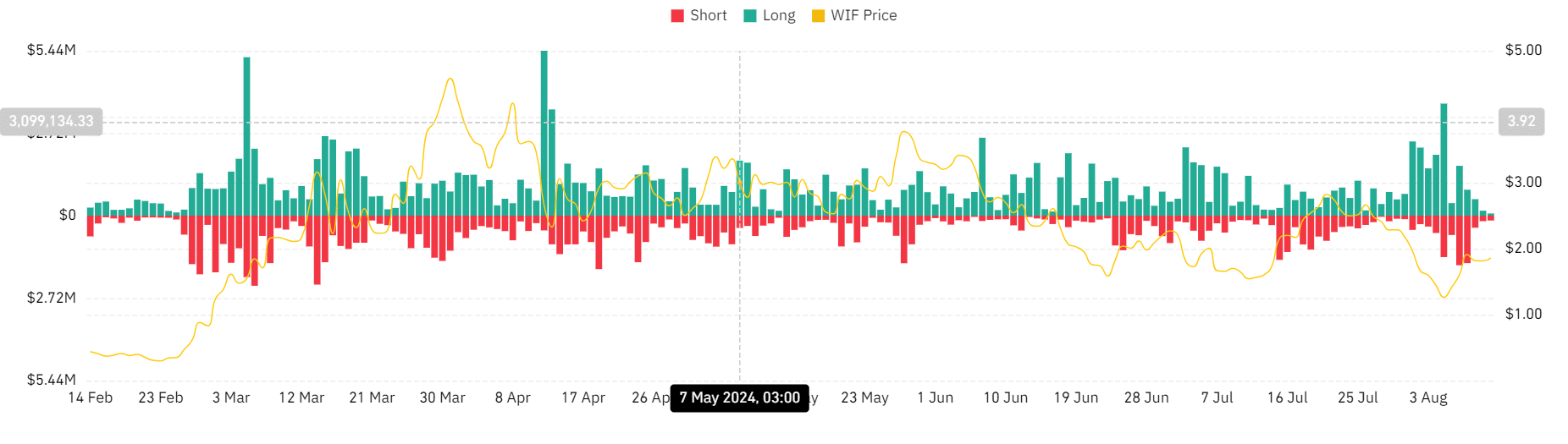

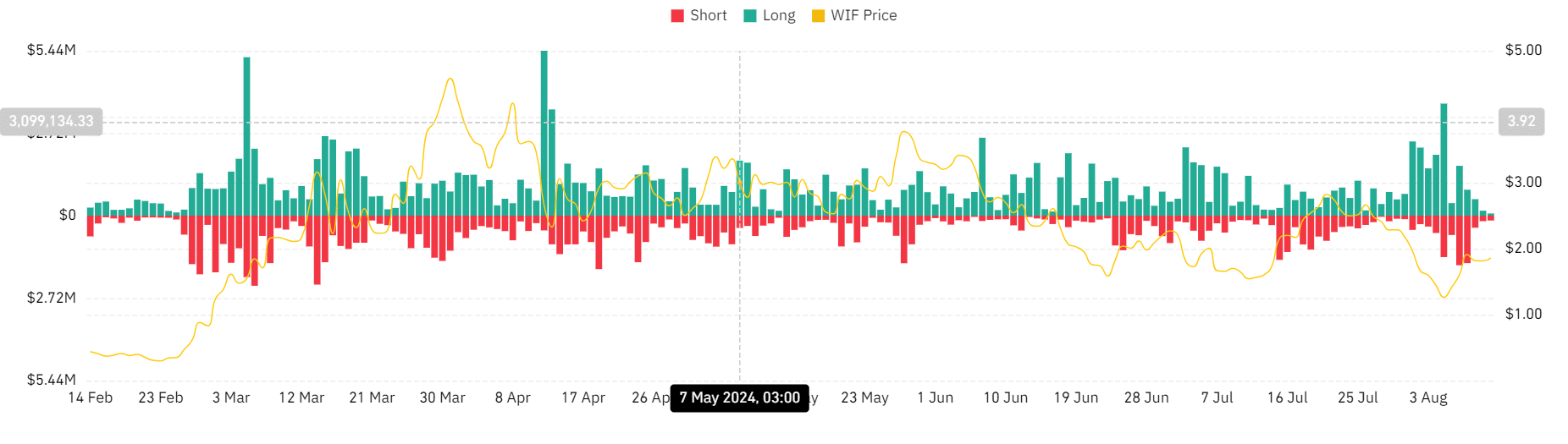

These phenomena are further proven by the low liquidation of long positions over the last 48 hours. Liquidation of WIF long positions has dropped from a peak of $3.7 million to $71,800 over the last week.

Realistic or not, here is the market capitalization of WIF in terms of BTC

This shows that long position holders are willing to pay a premium to hold their positions.

Therefore, if current market conditions and sentiment continue, WIF could challenge the next significant level at $2.3. Especially if the daily candlestick closes above $1.89.