Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Bitcoin strikes again at the door to discovery of prices, but the researchers of the asset management Bit during their week 24 Crypto Market Compass circulated on Tuesday evening, Dr. André Dragosch, the manager of Bitwise for Europe, and the analyst Ayush Tripathi calculate that “the quantitative models consider that the” fair value “of Bitcoin Bitcoin in the middle of the probabilities current sovereign defect at around $ 230,000 today. ” The figure implies a bonus of just over 110% at the price of the market, which oscillated nearly $ 109,600 at the time of the press on June 11, 2025.

Bitcoin’s “true value” is explosive

Dragosch links this evaluation to the rally in hedges at sovereign risks. United -States The decomposition differences from one year to one year are negotiated near the half -pourrying territory – the levels seen for the last time during the fear of the debt ceiling in 2023 – reflecting “wider concerns concerning the American budget deficit”, reported Reuters last week. “Bitcoin can provide an alternative” portfolio insurance “against generalized sovereign defects as a rare and decentralized intake which is free from counterpart risks,” says the ticket, adding that the net expenses of the interests projected by the Office Budget of the Congressal are the tricotment point for revenue costs at around $ 3 billion per $ 2030.

Related reading

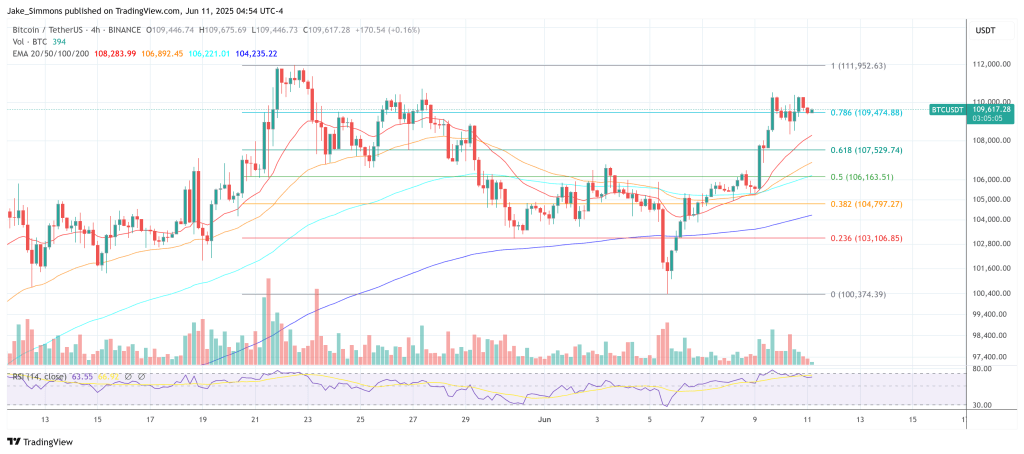

The macro backdrop, however, is not the only pillar supporting the equitable value call of Bitwise. The company’s internal cryptocurrency feeling index shows that twelve of the fifteen market control gauges are higher, while the cross risk index (CAR) compiled from actions, credit, prices and basic products has reached a five-year level. “The cryptoast and the crossed feeling are now decisively optimistic,” writes Dragosch, noting that Bitcoin goes back above $ 110,000 place it less than 2% of the top of all time almost $ 112,000 in May.

The chain data remains constructive. The exchange reserves dropped to 2.91 million BTC – approximately 14.6% of the supply in circulation – after the whales withdrew around 390,632 BTC last week. At the same time, net spot releases slowed down for around $ 0.53 billion, compared to $ 1.78 billion in the previous week, which suggests lighter lucrative pressure.

The derived positioning echoes the resilience of the market to the meter. Aggregate Bitcoin Futures Open Interest added 2,200 BTC on the sites, while the CME leg won 6.4 k BTC. The funding rates on perpetual exchanges remained positive as a whole despite the negative reversal for certain parts of the weekend, and the annualized base of three months held approximately 6.3%. In the options, the open interest was extended from 27,300 BTC, the Put-to-Adppel ratio at 0.55; The 25 -month -old month’s bias has remained modestly negative, which implies continuous demand for downward covers, even if volatility made fell to 28.2%.

Institutional flows strengthen the bullish tone. Global Crypto ETPS absorbed $ 488.5 million last week, of which $ 254.9 million went to Bitcoin products. US SPOT Bitcoin ETF led the charge with $ 525 million in entries, offset by a weekly leak of 24.1 million dollars from Bitcoin Trust de Grayscale. Bitwise’s Bitwise vehicle attracted $ 78.1 million, while its European Bitcoin ETP (BTCE) has only experienced marginal outings. Ethereum Products also benefited from 260.9 million dollars in net entries, maintaining the large risk of risk supply.

Related reading

Bitwise concedes that the risk of the head can still cause net and short -term samples – the ship of the week between Elon Musk and President Donald Trump briefly reduced to $ 100,000 – but sees structural forces firmly inclined upwards. “The uncertainty of American economic policy has already exceeded its zenith and continues to decrease at the margins,” writes Dragosch, stressing that the growth of May 139,000 May and moderation of recession ratings.

Bitcoin already surpassing traditional assets of the year and the feeling of reducing assets now confirmed by Bitwise indicators, analysts maintain that the market begins to assess less the asset as a speculative vehicle and more as a macro hedge. The question of whether traders adopt the complements of the equitable value marker of $ 230,000 on the same variables underlined in the note – sovereign risk premiums, political uncertainty and the rhythm of institutional adoption – but the bases, they say, is visible in mind, on desks and in flow data.

“Bitcoin has also recovered 110K USD and is close to its top of all time,” said the relationship to readers. For the bit, this proximity is not a final point but a staging area: the intrinsic value of the monetary asset, they conclude, resides “considerably further north”.

At the time of the press, BTC exchanged $ 109,617.

Star image created with dall.e, tradingView.com graphic