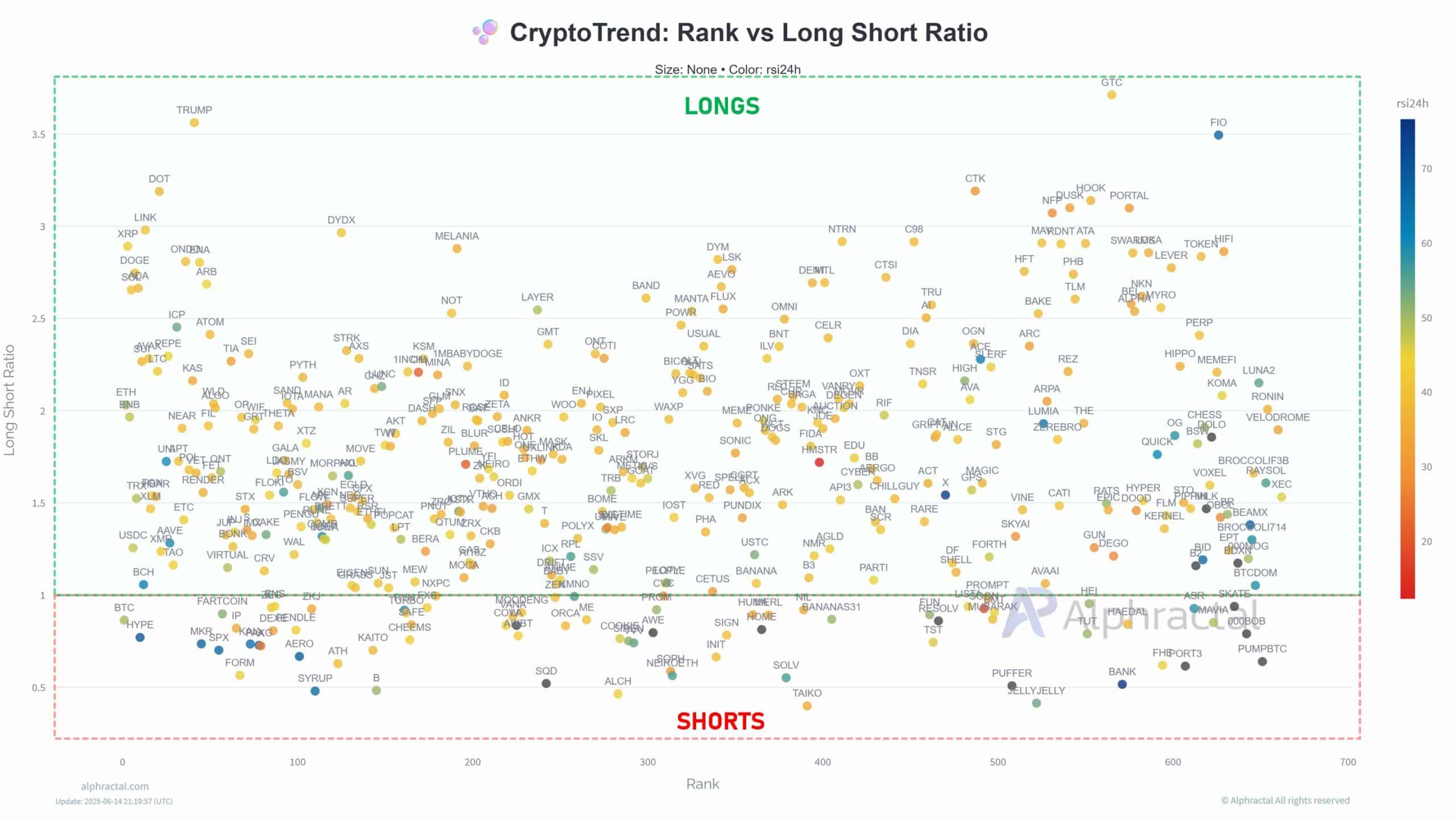

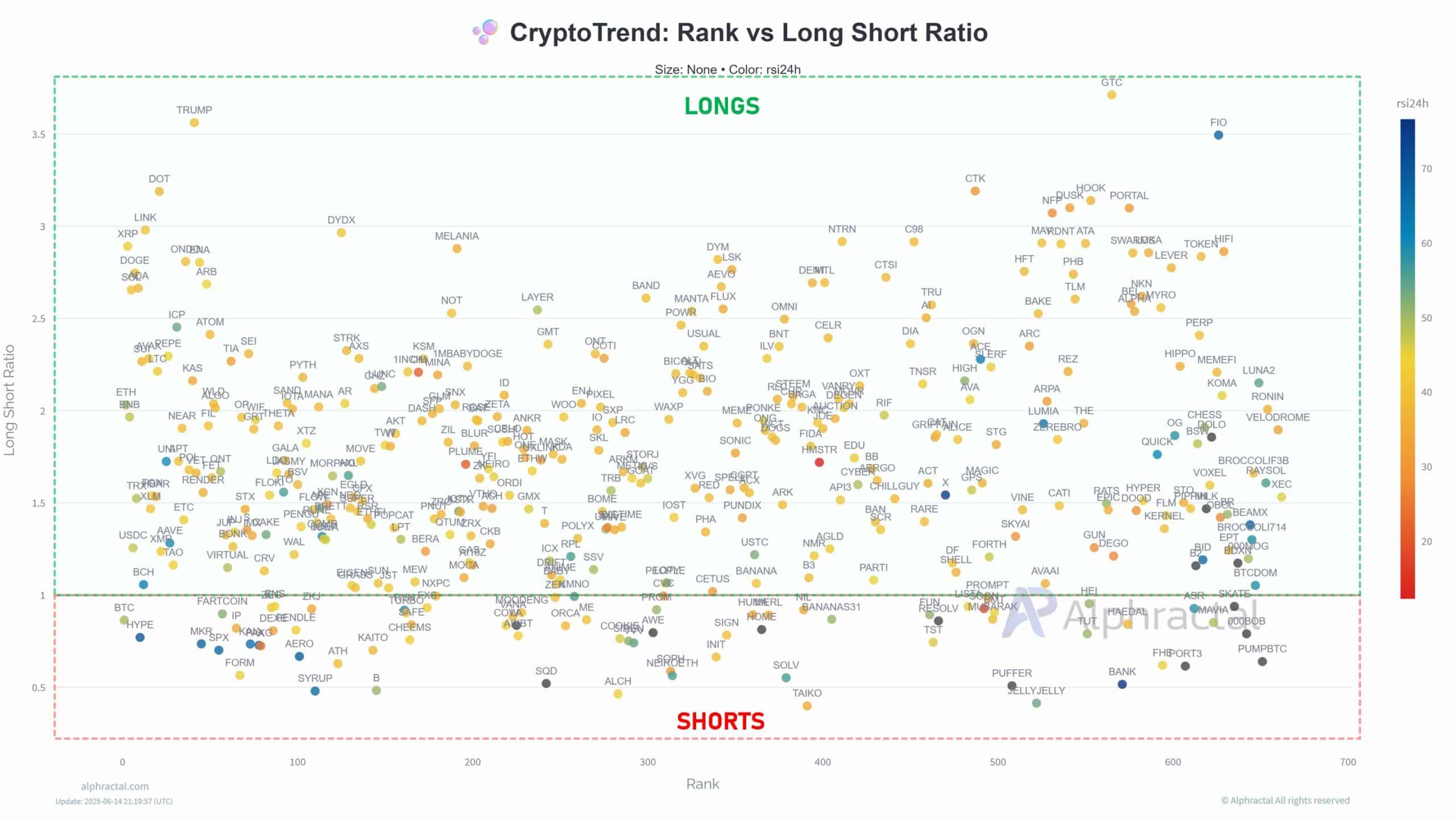

- Altcoins show a long, strong bias, with more than 70% bullish inclination.

- Is market bracing for pressure or slide?

Two weeks after marking his record level, Bitcoin (BTC) is back by teasing the $ 105,000 bar. It is a level that has become a pressure point for the feeling of the market. The last time he cracked, the BTC slipped directly to $ 100,000, and without a confirmed background, the merchants are on the edge.

Historically, this type of indecision triggers alt rotations while the capital research in the short term outside the shadow of BTC. However, while the configuration is there, many alts are always stuck in the red, displaying two -digit losses each week.

According to Ambcrypto, a season in Alts-season is not yet there, but with the BTC in the limbo and the structure of the market, there could be just enough space so that the bulls with sharp eyes begin to position for the next reversal.

Long bondus indicate the rebalancing of the imminent market

While cash prices remain moderate, the perpetual market is preparing as if something big happens.

Overall, more than 70% of altcoins see a long, strong bias, and in Binance, the big players do not hold back. High capitalization assets have, on average 60% + merchants leaning for a long time.

However, it is not only random optimism. Instead, it looks more like strategic risk taking.

In simple terms, after the sudden liquidation cascade last week, the traders seem to bet on a short -term rebalancing of the market, looking at a short potential pressure.

Source: Alphractal

It is a daring decision given recent volatility. What if Bitcoin breaks down to $ 100,000? This is the scenario that the open sellers are probably positioned, opening the door to late shorts to press the drawbacks.

However, if the market is stable and increases the shoulders of the chop, these late shorts could tighten hard. This is exactly what the Bulls seem to bet with all this long exposure through the alts.

Given the circumstances, it is a piece of room at this stage, and whatever the side, it is smarter will set the tone for the next movement.

Market positions for a strategic altcoin rally

With the domination of bitcoin over 65%, it is clear that altcoins are still inspired by the BTC. If Bitcoin is falling at $ 100,000, there is a good chance that the alts will follow.

The last withdrawal proved it. While BTC fell 9.6% compared to its ATH, Ethereum (ETH) displayed a clearer correction of 10.25%.

The reason? – A long high exposure through altcoins has amplified the downward pressure.

Source: TradingView (ETH / USDT)

However, Ambcrypto recently pointed out a key structural change in the current cycle which makes Bitcoin’s complete retrace at $ 100,000 less likely.

If BTC stabilizes, altcoins could not only stage a rally of relief, but potentially drive the rebound, especially if a short pressure accelerates the momentum.

This is why this “dip” may not be something to fear. Instead, it could be an intelligent entry point for those who seek to take the next movement early.