- Besides staking, MATIC price also dropped by double digits last month

- Buying pressure on the token has increased slightly, hinting at a possible price increase

Polygon (MATIC) has lost a substantial portion of its market cap in the past few months. But that’s not all, with the latest data revealing that things aren’t looking good in the staking ecosystem either. Is this happening because investors are losing faith in the token?

Betting on decline

Polygoninans, a popular X handle that shares updates related to the Polygon ecosystem, recently posted a tweet highlighting the state of the blockchain staking ecosystem. According to the same report, the total MATIC staked this week reached a figure of 3.4 billion, a decrease of 35% compared to the previous week.

AMBCrypto checked Staking Rewards data to get a better understanding of MATIC staking. We found that the number of MATIC staked increased until July 3. However, since then, its numbers have started to decline, signaling a decline in investor interest.

Source: Staking Rewards

Do investors not have confidence in MATIC?

CoinMarketCap data revealed that, similar to staking, the price of MATIC also saw a drop of over 27%.

At the time of writing, MATIC was trading at $0.4035 with a market cap of over $4 billion, making it the 22nd largest cryptocurrency. And, due to the massive price drop, only 2% of MATIC investors remained profitable, according to data from IntoTheBlock.

Source: IntoTheBlock

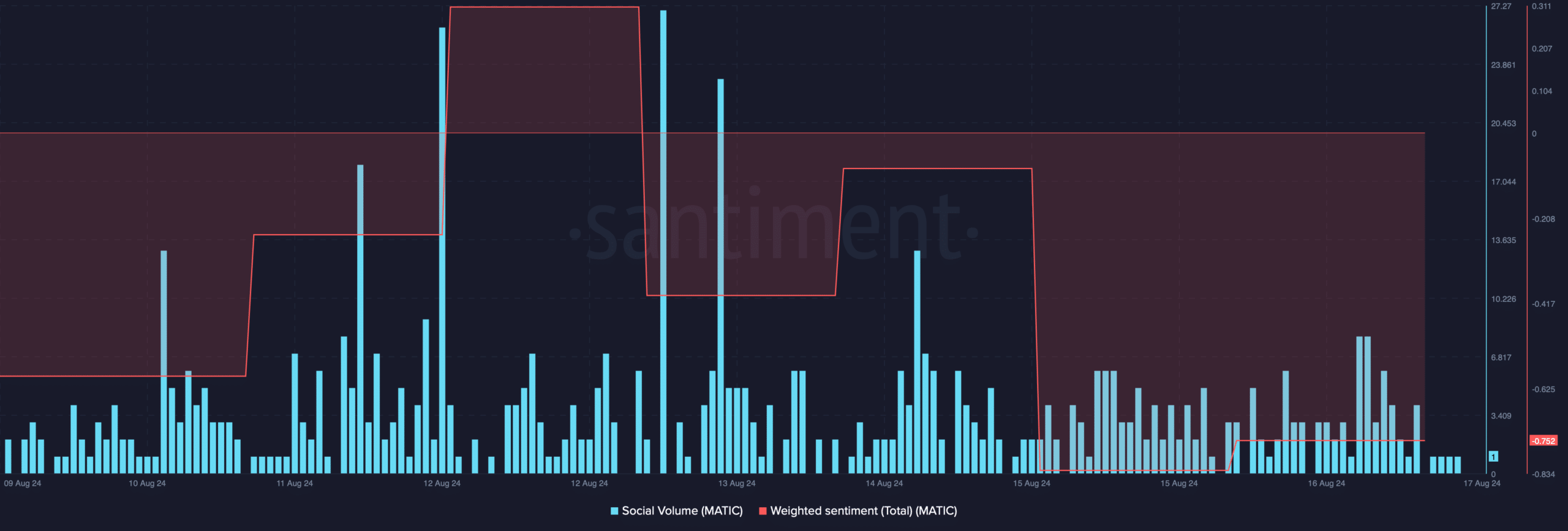

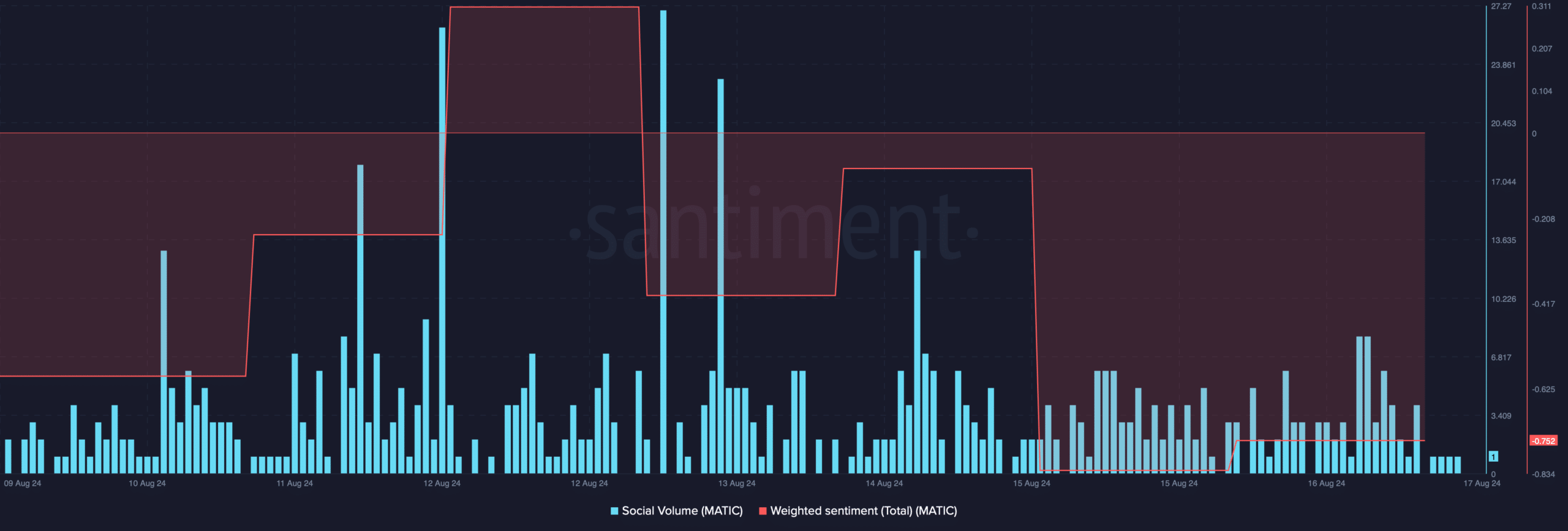

AMBCrypto then evaluated MATIC’s on-chain data to better understand investor sentiment around the token. According to our analysis, the altcoin’s weighted sentiment was in the negative zone.

This means that the bearish sentiment around the token has remained dominant in the market. After a spike, its social volume has also registered a decline, reflecting a decline in its popularity.

Source: Santiment

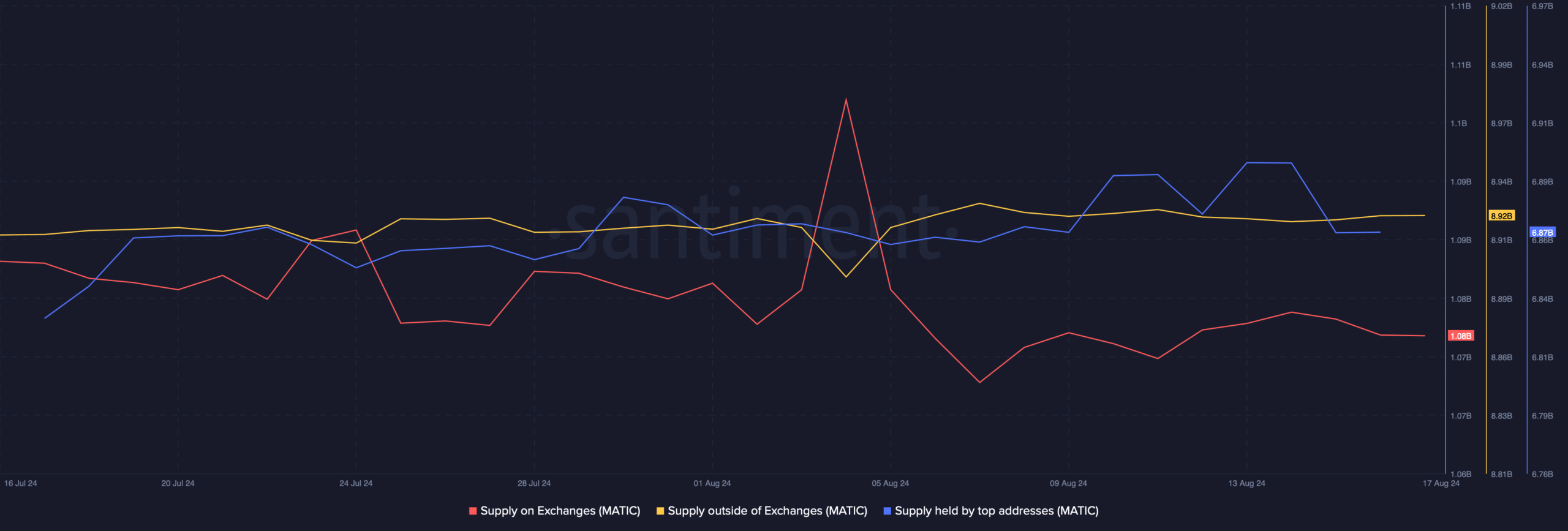

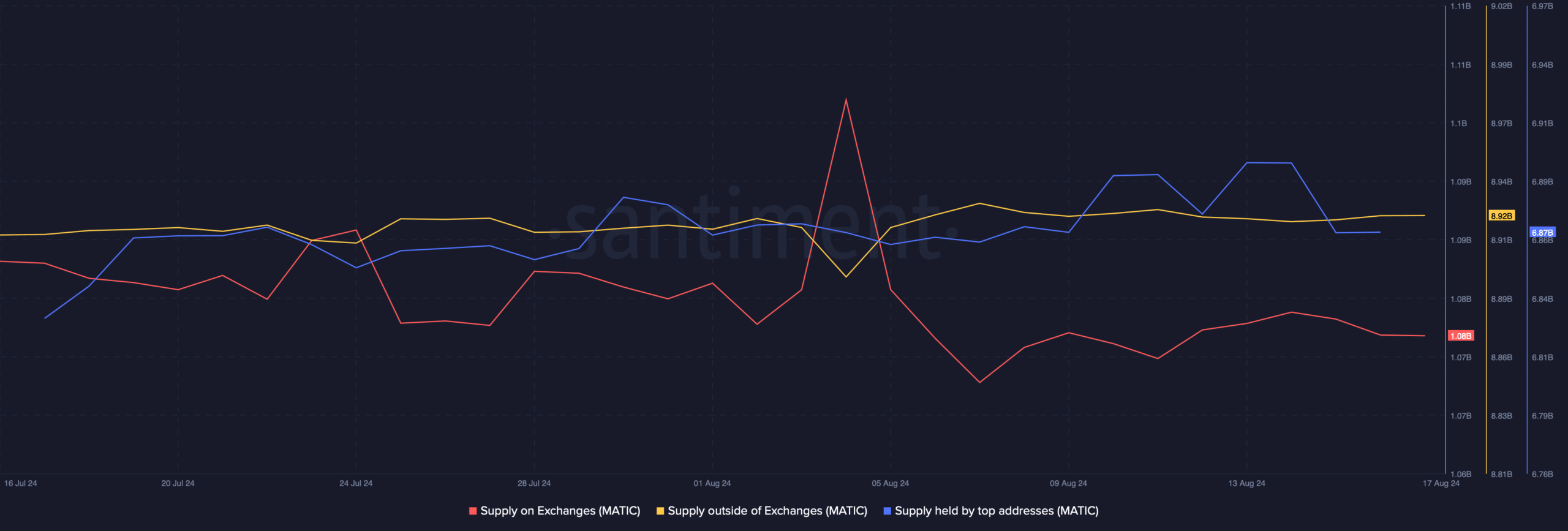

Alas, upon closer inspection, a different story was revealed. Over the past 30 days, MATIC’s supply on exchanges has decreased slightly.

Meanwhile, off-exchange supply has increased, suggesting that some investors are considering accumulating MATIC.

The supply held by major addresses also increased slightly, a sign that whales were putting buying pressure on the altcoin. By extension, this also means that many expected the price of MATIC to increase in the coming days.

Source: Santiment

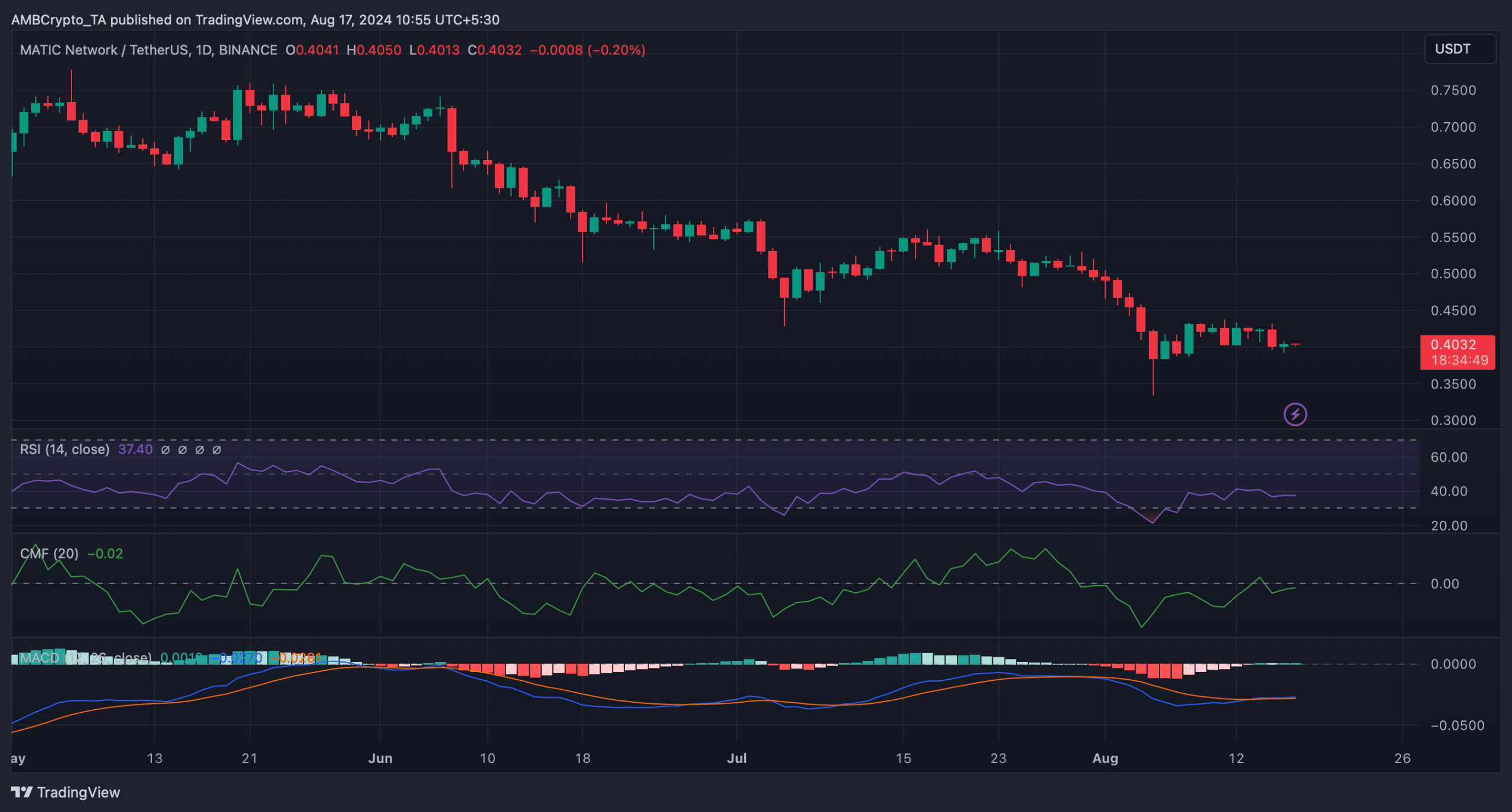

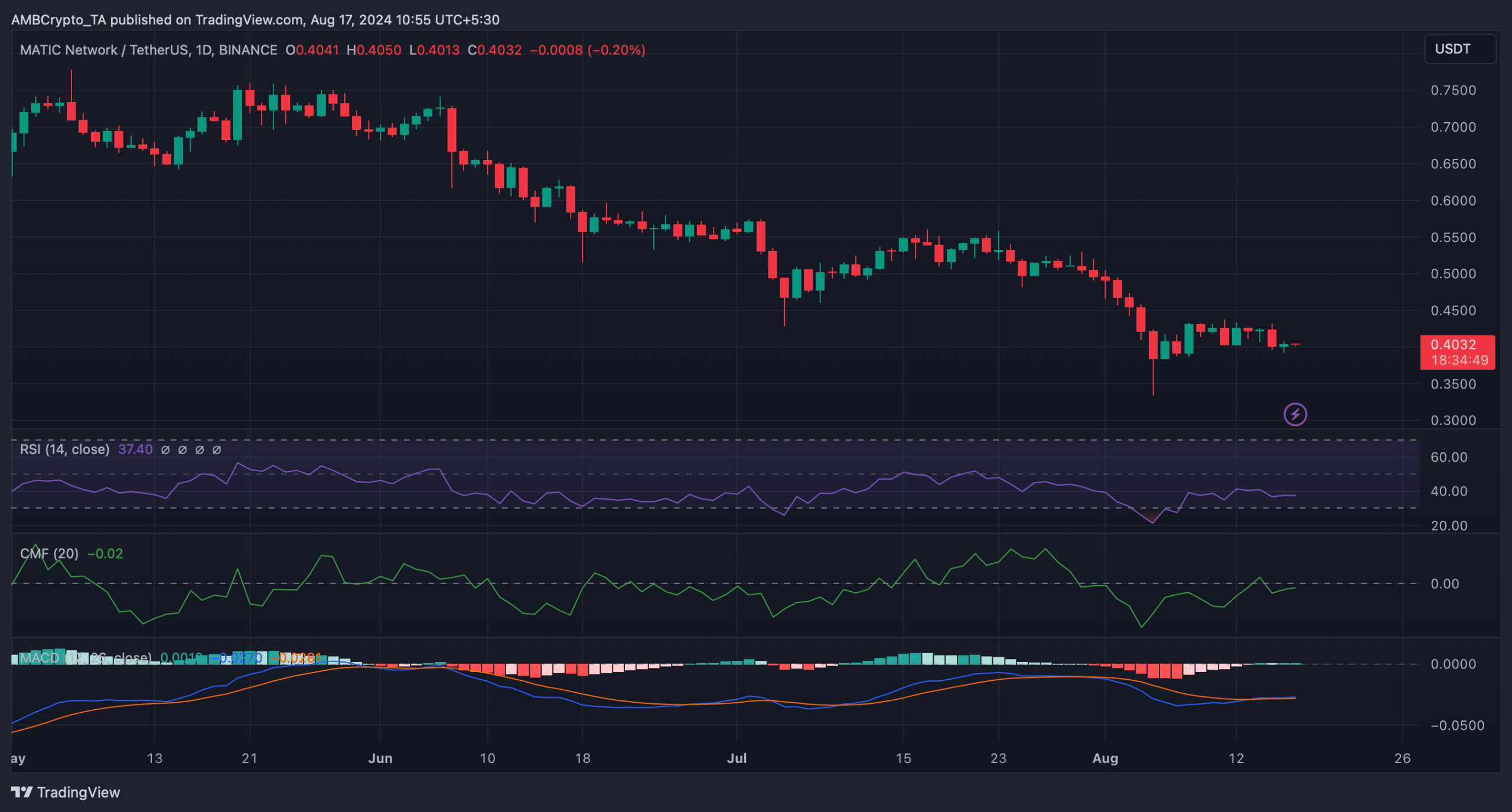

Therefore, AMBCrypto looked at the token’s daily chart to see what the market indicators were suggesting. The MACD technical indicator posted a bullish crossover. MATIC’s Chaikin Money Flow (CMF) also registered an uptick and was heading towards the neutral mark at press time.

Both of these indicators highlighted that there were chances for MATIC to gain bullish momentum on the charts.

Read Polygon (MATIC) Price Prediction 2024-25

However, it may take a little longer for MATIC to turn bullish as the Relative Strength Index (RSI) is also moving sideways.

Source: TradingView