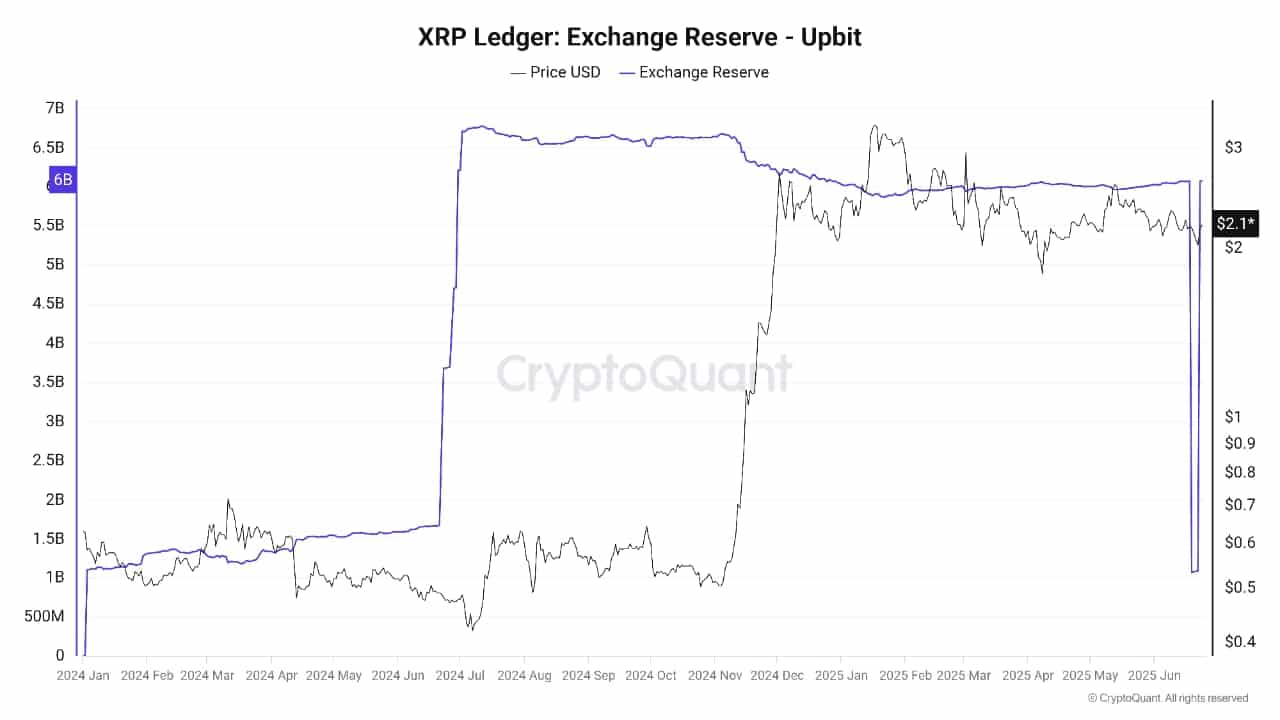

- The XRP offer suddenly abandoned on several exchanges, Upbit seeing the largest withdrawal of around 5.5 billion XRP.

- The activity was heating up, suggesting a potential for an XRP ETF supported by MVDApp from Vaneck live.

Ripple’s reserves (XRP) have recorded significant reductions in major exchanges, by cryptocurrency. Upbit saw the highest level of decline because it fell to almost 1.1 billion.

Upbit dropped by 5.5 billion XRP but had a sudden overthrow, which increases the uncertainty around Ripple’s play.

Binance also flowed in more than 2.86 billion at around 2.23 billion with a lack of around 630 m XRP. In Bébit, the reserves decreased by 110 million XRP.

This was equivalent to a fall in reserves of 340 m to 229.7 m of tokens. Bitfinex also initiated a drop in the level of XRP, where a drop of 6 m of tokens took place between 64.5 m to 58.5 m.

Source: cryptocurrency

These decreases suggested the withdrawal of XRP by institutions such as ETFs, dividend funds and payment companies. They probably intend to store funds with childcare services or use them in settlement operations.

Obviously, the reserves of the Upbit who plunged have already started to fulfill certain measures, indicating that it could suffer a realignment.

Although these actions can indicate an institutional accumulation, they indicate liquidity in short -term exchange, but this can increase volatility.

Why approval of XRP ETF could be close

In addition to the withdrawal, the launch of MVDApp by Vaneck increased the possibility of an XRP ETF, indicating a more intensive institutional activity.

The stage was considered a plumbing before the plumbing linked to the FNB, potentially setting the bases to introduce the undulation into the regulated asset club.

In addition, future XRP and micro XRP became active because they were launched on May 19.

The CME group observed that Altcoin had on the course that has become one of the best -monitored cryptographic assets during this period.

The growing interest of institutional and detail merchants highlighted the increase in regulated derivative needs with structured exposure.

However, there were still feelings divided according to the data of market prophecy. The gauge has shown that the crowd was optimistic with 1.94 because the score reflecting an upward perspective.

The intelligent monetary feeling, on the other hand, was always on the negative side with the number of -1.30. This indicated a conservative mood among informed investors.

Source: Market Prophit

This disconnection highlighted the imprecision of the way Ripple can get away in the short term, although the history of the ETF continues to build with an increase in institutional clues and increased demand in term contracts.

According to: 250 billion dollars in stablecoins: the history of the Alts of the Altes season of what concerns this change of capital!

Source link