Main to remember

- Galaxy Digital raised $ 175 million for its first venture capital funds, externally targeting cryptography startups at an early stage.

- The fund focuses on stable blockchain applications, deffi and practices, reflecting a passage to cases of use of tangible crypto.

Share this article

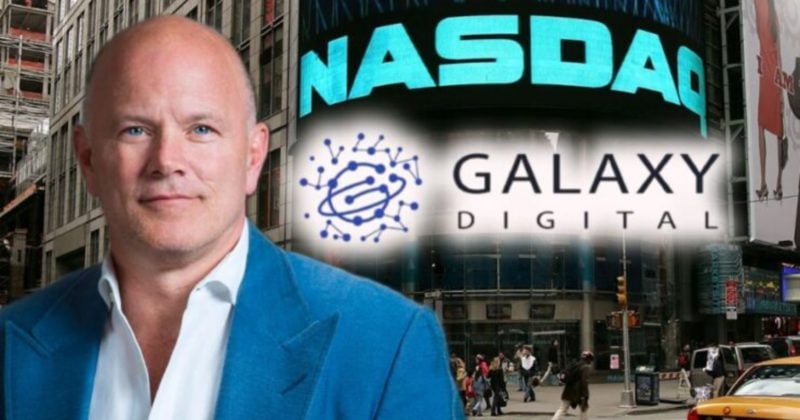

Galaxy Digital, which recently made its debut on the NASDAQ, obtained $ 175 million for its first venture capital fund which includes external capital, according to a new makeshift report.

The new capital, which exceeds the target of $ 150 million in Galaxy, will be used to invest in cryptographic startups at an early stage, in particular those focused on Stablecoin infrastructure, DEFI applications and the practical use of blockchain, said Mike Giampapa, general partner of Galaxy.

Galaxy has long supported cryptographic startups using its own assessment. With this new fund, it brings out external investors for the first time to extend its footprint in companies that bridge crypto and traditional finance.

Galaxy occupies both roles of general partner and limited partners in the fund. The other participants include institutional investors, family offices and funds related to their asset management activity.

The fund reached an initial closure of $ 113 million in July 2024 and already deployed $ 50 million in companies such as Monad and Ethena.

Mike Novogratz’s company participates in the fund as a general partner and limited partner, with additional institutional LPS commitments, including family offices and funds related to the Galaxy asset management division.

Since its initial fence of $ 113 million in July 2024, around $ 50 million have been allocated to start -up projects such as Monad and Ethena, as indicated in the report.

Founded in 2018, Galaxy’s mission is to fill traditional finance and the economy of emerging cryptography. Over the years, the company has extended to the management of assets, the proprietary trade, the exploitation of crypto and the ETF.

At the beginning of 2024, Galaxy joined Investco to launch an ETF Bitcoin Spot, and he now explores an ETF Solara Spot.

Despite the previous setbacks, including a huge loss of exposure to the Luna Stablecoin failure project and a net loss of $ 295 million in the first quarter of 2025 due to the drop in the prices of cryptography and mining closures, Galaxy remains one of the most influential American cryptoms.

In May 2025, the company said about $ 7 billion in management assets.

The company began to be negotiated on the Nasdaq under the Ticker Gunxius in mid-May, the actions increasing by more than 15% during its first day.

Novogratz considers the expansion of the American market as a strategic priority. Beyond the crypto, Galaxy also invests in artificial intelligence, identifying the two sectors as the most promising fields for the growth of the long-term market.

The company explores the tokenization of its own equity more, engaging with the dry to potentially allow the integration of the galaxy stock in the DEFI applications.

Share this article