Cryptocurrency markets are paying attention to several US macroeconomic events this week that could influence Bitcoin’s price. In 2024, macroeconomic developments have regained their effect on crypto assets, marking a shift from 2023, when their impact had largely faded.

Bitcoin (BTC) remains below $60,000, a worrying price drop considering the daily chart’s low highs. This drop is due to the market sentiment shifting from fear to extreme fear.

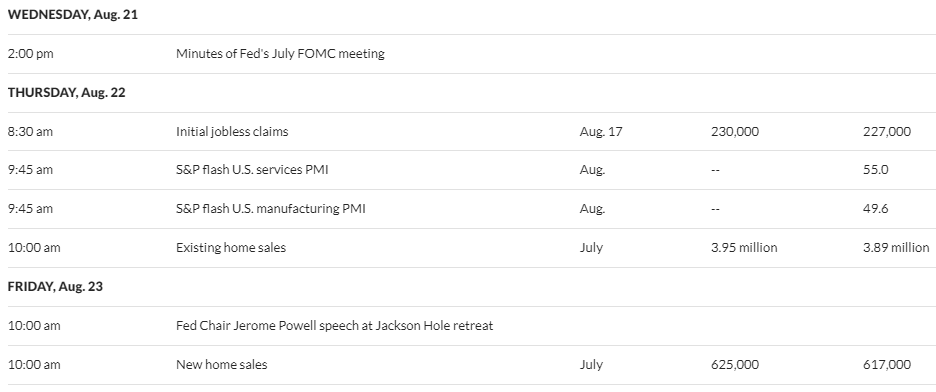

US Macroeconomic Events This Week

Against this backdrop, investors are paying close attention to upcoming data releases and policy announcements that could impact market sentiment and trigger some volatility. Several events are scheduled for this week in the U.S. economic calendar, including three that stand out as key triggers for potential price swings in Bitcoin and other cryptocurrencies.

Fed July FOMC Meeting Minutes

The Federal Reserve (Fed) will release the minutes of its July meeting of the Federal Open Market Committee (FOMC) on Wednesday, August 21. The release will provide an overview of the central bank’s thinking regarding interest rates and monetary policy.

Any hint of a more dovish or aggressive stance could send ripples through financial markets, including cryptocurrencies. A dovish tone suggesting a potential rate cut could increase risk on assets like Bitcoin, while a more aggressive tone could lead to a selloff.

Data from 10x Research has revealed a strong correlation between Bitcoin price and inflation trends as macroeconomic influence on crypto resumes. As BeInCrypto reported, the Fed has kept interest rates steady between 5.25% and 5.50%, in line with market expectations.

Learn more: How to protect yourself from inflation with cryptocurrencies

Following last week’s release of U.S. consumer price index (CPI) inflation data, traders have fully priced in a 25 basis point rate cut in September. They are also pricing in a 24.5% chance of a 50 basis point (bps) hike, with futures indicating a cut of more than 90 bps by the end of 2024.

Initial job applications

Cryptocurrency markets are also eagerly awaiting Thursday’s weekly report on initial jobless claims. The U.S. Bureau of Labor Statistics (BLS) will use the data to provide insight into the health of the labor market and could influence investor sentiment.

A lower-than-expected number of jobless claims could indicate a strong economy, potentially pushing investors into riskier assets like cryptocurrencies. Conversely, a higher number of claims could raise concerns about a slowing economy, leading to a flight to safety and a possible decline in Bitcoin and cryptocurrency prices.

Looking back, crypto and financial markets in general had a rocky start to the month, largely due to weaker-than-expected US economic data, particularly a disappointing July jobs report. This triggered significant market volatility, fueled by growing concerns about a potential recession.

Those concerns have started to ease, as evidenced by traditional safe-haven assets like the Japanese yen, which have given back some of their early August gains. If economic data released on Thursday, August 22, comes in below expectations, bitcoin could benefit as investors shift back to risk assets.

Jerome Powell’s Speech at the Jackson Hole Retreat

Traders and investors are also looking forward to Friday’s speech by Fed Chairman Jerome Powell at the annual Jackson Hole policy conference. Markets will be focused on what Powell has to say on the sidelines.

The title of his speech at last year’s Jackson Hole economic symposium was “Inflation: Progress and the Way Forward.” He went on to say that policymakers were prepared to keep rates tight until they were confident that inflation would be sustainably below 2 percent.

As in 2023, Friday’s event will be of interest to traders and investors. Powell will either endorse or push back market pricing as policymakers vow to decide the next rate move based on the data.

Powell’s comments on the state of the economy, inflation and monetary policy could therefore set the tone for market expectations. Traders will be listening for any clues on future interest rate decisions, which could influence the direction of Bitcoin and cryptocurrency prices.

Bitcoin Price Outlook Ahead of US Macroeconomic Events

Bitcoin is consolidating within a symmetrical triangle. This means that the next directional bias will only be revealed once the price breaks out of this technical formation. Based on the outlook of the relative strength index (RSI), which measures momentum, BTC could continue to trade in a range in the short term. Indeed, the RSI remains below 50, suggesting a lack of conviction among the bulls.

Volume profiles reinforce the same assumption, with bullish and bearish peaks (orange and gray, respectively) showing some wariness on both sides. Similarly, the position of the Awesome Oscillator (AO) in negative territory with red histogram bars accentuates this thesis.

A break and close below the lower trendline on the daily time frame could see Bitcoin make a foray into the demand zone. This would provide remaining bulls and pullback traders with another buying opportunity between $53,485 and $57,050.

However, if such a move occurs and BTC closes below the $53,313 midline, the downside potential could extrapolate Bitcoin’s ability to collect liquidity from the sell side.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Conversely, a break and close above the upper trendline could encourage more buy orders. Based on the orange spikes in the volume profile, several bulls are waiting to interact with BTC prices above $63,000. Buying pressure above this level could boost the upside potential.

However, only a decisive close of the candlestick above $67,000, the middle line of the supply zone, would confirm the continuation of the uptrend.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent news. This news article aims to provide accurate and current information. However, readers are advised to independently verify the facts and seek professional advice before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.